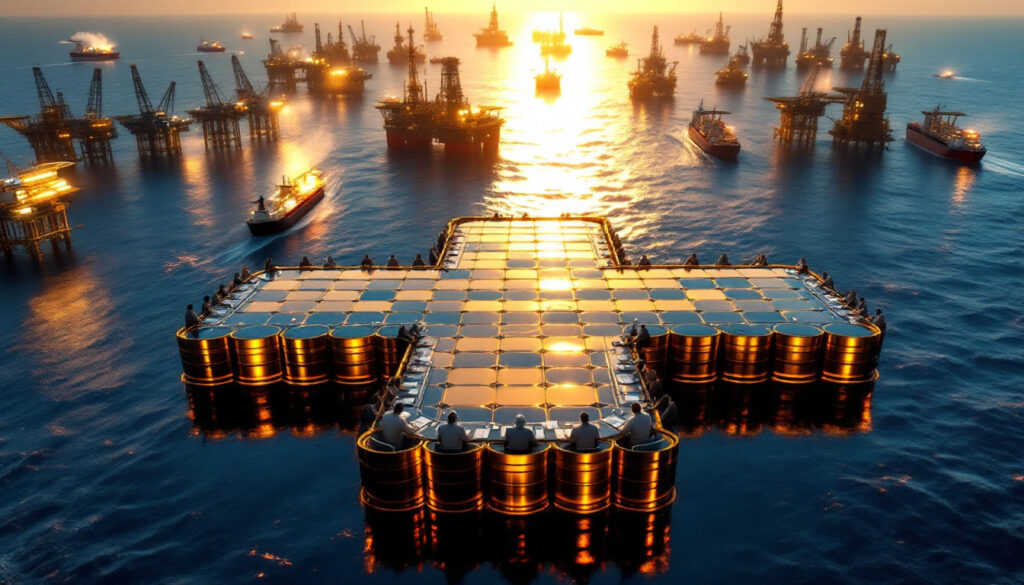

What is the OPEC+ Meeting and How Will It Impact Oil Production?

OPEC+ is scheduled to meet online on Thursday to discuss oil production plans, with sources indicating the group will likely maintain its current strategy of gradual output increases. The meeting represents a critical juncture for global commodities market insights as participants navigate complex geopolitical tensions and fluctuating demand forecasts. Industry analysts will be watching closely for any signals about future production adjustments that could influence crude prices worldwide.

The alliance, comprising OPEC members and their allies led by Russia, continues to exert significant influence over global oil supply dynamics. Their collective decisions directly impact energy costs for consumers and businesses globally, with ripple effects throughout the economy. This upcoming meeting occurs against a backdrop of relatively stable but uncertain oil prices, with Brent crude hovering around $85 per barrel.

How Does OPEC+ Control Global Oil Supply?

OPEC+ effectively functions as the world's oil production regulator, implementing coordinated policies to influence global supply levels. This control mechanism allows the group to respond to market conditions with remarkable agility, though internal disagreements occasionally surface regarding production quotas and compliance.

Current Production Cut Framework

OPEC+ has been cutting output by 5.85 million barrels per day (bpd), equivalent to approximately 5.7% of global supply. This substantial reduction represents one of the largest coordinated cuts in the group's history, reflecting their determination to maintain price stability amid fluctuating demand conditions.

The group has implemented a series of coordinated cuts since 2022 to support oil prices, with the most recent adjustments occurring in a phased approach. These strategic reductions began as a response to pandemic-related demand destruction and have evolved into a more nuanced framework designed to balance market stability with member revenue requirements.

Eight OPEC+ members are gradually unwinding these cuts through planned monthly increases. This measured approach reflects the group's cautious outlook on global economic recovery and oil demand growth projections. According to industry analysts, this gradual unwinding strategy aims to prevent price volatility while slowly returning production capacity to the market.

Planned Production Increases

Eight OPEC+ members are scheduled to increase oil output by 135,000 bpd in May. This relatively modest increase represents approximately 2.3% of their total production cut commitments, indicating the alliance's cautious approach to market rebalancing.

This marks the second monthly increase under the current unwinding plan, following a similar adjustment in April. The sequential nature of these increases allows OPEC+ to monitor market reactions before committing to further supply additions.

Sources indicate the group is expected to approve this planned hike during Thursday's meeting. The technical committee monitoring market conditions has reportedly found sufficient demand growth to justify the increase, though some members have expressed concerns about potential market oversupply if all planned increases materialize simultaneously.

Who Are the Key Players in OPEC+?

Understanding the complex dynamics within OPEC+ requires recognizing the diverse interests and production capabilities of its member nations. The alliance represents approximately 40% of global oil production, giving it unprecedented influence over energy markets.

Core OPEC Members

The Organization of Petroleum Exporting Countries (OPEC) forms the foundation of the alliance, with thirteen member nations collectively holding about 80% of the world's proven oil reserves. This concentration of resources gives OPEC significant structural power in global energy markets.

Led by major producers like Saudi Arabia and other Middle Eastern oil powers, OPEC's core membership includes nations whose economies depend heavily on oil export revenues. Saudi Arabia, with production capacity exceeding 12 million bpd, serves as the group's de facto leader and often functions as the "swing producer" capable of rapidly adjusting output to influence prices.

Historically coordinated production policies to influence global oil markets, OPEC has evolved significantly since its founding in 1960. The group's cohesion has faced challenges during price crashes and geopolitical shift in global markets, but its fundamental purpose of protecting member economic interests through market management remains unchanged.

Non-OPEC Allies

Russia leads the non-OPEC contingent within the OPEC+ alliance, contributing production capacity of approximately 10 million bpd. The Russian Federation's participation, which began formally in 2016, significantly enhanced the group's market influence and transformed global oil politics.

The "+" in OPEC+ represents these additional oil-producing nations that coordinate with OPEC, including significant producers like Kazakhstan, Malaysia, Mexico, Bahrain, Brunei, and Sudan. This expanded membership has increased the alliance's share of global production to nearly 50% when operating at full capacity.

Together they form a powerful bloc controlling a significant portion of global oil supply, though maintaining discipline among such diverse members presents ongoing challenges. Production capacity varies widely among the non-OPEC allies, with compliance rates historically lower than core OPEC members.

What Issues Will Be Addressed at the OPEC+ Meeting?

The upcoming meeting agenda reflects both short-term market management priorities and longer-term strategic considerations. Delegates must balance immediate price support mechanisms with preparation for evolving clean energy transition challenges.

Quota Compliance Enforcement

Two sources indicated the meeting will review plans for members exceeding their quotas, a persistent challenge for the alliance. Internal monitoring has reportedly identified several members whose production has exceeded agreed limits, potentially undermining collective efforts to manage global supply.

Some producers will be required to make additional output cuts to compensate for overproduction, implementing a policy known as "compensation cuts" within the alliance. This mechanism requires non-compliant members to reduce production below their quotas for specified periods to offset previous excess output.

These compensatory cuts are designed to ensure overall group compliance with agreed targets, though enforcement mechanisms remain limited to peer pressure and diplomatic negotiations. Historical compliance data shows significant variation among members, with some consistently producing above quotas while others maintain strict adherence to agreed limits.

Market Monitoring Mechanisms

The OPEC+ ministerial committee, which has authority to recommend policy changes, may meet Thursday to evaluate current market conditions. This Joint Ministerial Monitoring Committee (JMMC) includes key members from both OPEC and non-OPEC contingents, serving as the alliance's primary technical advisory body.

This committee was previously scheduled to meet on April 5 but may adjust its timetable to coincide with the broader ministerial meeting. The JMMC analyzes extensive market data, including inventory levels, demand projections, and production compliance statistics before making recommendations.

Their assessments of market conditions influence broader OPEC+ production decisions, with technical analyses forming the foundation for ministerial-level policy choices. Recent JMMC reports have highlighted improving demand indicators in major economies, though concerns about Chinese consumption growth persist.

How Have Oil Markets Responded to OPEC+ Policies?

Market reactions to OPEC+ decisions reflect both immediate price impacts and longer-term structural adjustments. Trading patterns reveal sophisticated anticipation of production announcements, often pricing in expected changes before formal decisions are announced.

Price Stabilization Efforts

OPEC+ production cuts have been implemented to support oil prices, with varying degrees of success depending on broader economic conditions. Recent cuts have maintained Brent crude prices between $80-90 per barrel, a range generally considered acceptable to both producers and consumers.

The gradual unwinding approach aims to prevent market disruption by avoiding sudden supply increases that could trigger price volatility. This measured strategy reflects lessons learned from previous rapid production adjustments that led to market instability.

Oil markets closely monitor OPEC+ decisions for signals about future supply levels, with price movements often preceding official announcements as traders position themselves based on expected outcomes. Trading volumes typically increase significantly in the days surrounding OPEC+ meetings, reflecting their central importance to market dynamics.

Supply-Demand Balance

OPEC+ adjusts production in response to global supply-demand dynamics, using sophisticated modeling to forecast market conditions. Their internal analysis reportedly shows global oil demand growing by approximately 2.2 million bpd in 2024, though this forecast is slightly more optimistic than those from the International Energy Agency.

The group's policies significantly impact global oil inventories, which serve as a key metric for market balance assessment. Current OECD commercial inventories remain slightly below five-year average levels, supporting the case for continued cautious production increases.

Production decisions consider both short-term price stability and long-term market share, with growing concern about competition from non-OPEC+ producers. U.S. shale output has stabilized around 13 million bpd, representing a significant competitive challenge to OPEC+ market dominance.

What Are the Implications for Global Oil Prices?

Price implications extend beyond immediate market reactions to include broader economic impacts and potential policy impact on global commodity markets. Energy market participants must consider both technical factors and fundamental supply-demand balances when interpreting OPEC+ decisions.

Short-Term Price Impact

Confirmation of the planned 135,000 bpd increase would signal continuity in OPEC+ strategy, likely resulting in relatively stable price action. Market psychology currently reflects expectation of this outcome, with limited volatility priced into near-term futures contracts.

Markets have likely already priced in the expected production increase, with current futures curves showing minimal backwardation through the next several months. This market structure indicates trader expectations of adequate near-term supply relative to demand.

Any unexpected changes to the plan could trigger price volatility, particularly if the group announces larger-than-anticipated production increases or delays in the unwinding schedule. Historical analysis shows that surprise announcements typically generate price movements of 3-5% within 48 hours of OPEC+ meetings.

Long-Term Market Outlook

OPEC+ is gradually returning production capacity to the market, balancing revenue requirements against market share considerations. The deliberate pace reflects concerns about potential demand destruction if prices rise too rapidly amid persistent inflationary pressures in major economies.

The pace of unwinding cuts reflects the group's assessment of global demand recovery, which remains uneven across regions. North American and European consumption has largely stabilized, while Asian demand growth projections continue to face downward revisions.

Compliance with production quotas remains critical to maintaining price stability, with market participants closely monitoring actual production data versus announced targets. Satellite monitoring technology has increased transparency, making it increasingly difficult for members to exceed quotas without detection.

Frequently Asked Questions About OPEC+ and Oil Production

What is the total volume of OPEC+ production cuts?

OPEC+ has been cutting output by 5.85 million barrels per day, representing about 5.7% of global supply. This substantial reduction demonstrates the alliance's commitment to market management during periods of demand uncertainty.

How much will oil production increase in May?

Eight OPEC+ members are scheduled to increase oil output by 135,000 barrels per day in May. This modest increase represents a carefully calibrated response to improving demand indicators while maintaining overall supply discipline.

Why does OPEC+ cut oil production?

OPEC+ implements production cuts to stabilize oil prices by reducing supply when demand weakens or when prices fall below desired levels. This market management approach aims to ensure sustainable revenue streams for member nations while preventing extreme price volatility.

How does OPEC+ enforce production quotas?

Members exceeding their quotas are required to implement compensatory cuts, producing below their targets for a period to make up for previous overproduction. This self-regulation mechanism relies primarily on peer pressure and diplomatic negotiations rather than formal penalties.

When will OPEC+ completely unwind its production cuts?

The group has not announced a specific timeline for fully unwinding all production cuts, instead opting for a gradual approach based on market conditions. Current projections suggest the unwinding process could continue through 2024, though this timeline remains subject to adjustment based on demand developments and inventory levels, potentially contributing to a new commodity super-cycle.

Want to Stay Ahead of the Next Major Mineral Discovery?

Discovery Alert's proprietary Discovery IQ model delivers real-time notifications on significant ASX mineral discoveries, helping investors identify actionable opportunities before the broader market. Explore historic returns from major discoveries and position yourself for success by visiting the Discovery Alert discoveries page.