Understanding Sedimentary Lithium Deposits

Sedimentary lithium deposits represent the third major type of lithium resource, alongside brine and hard rock deposits. These unconventional resources have been under investigation since the 1970s by the US Geological Survey and various research entities, yet they remain in pre-commercial stages as of 2025. Despite their current developmental status, these deposits are positioned to play a crucial role in meeting the projected 500% increase in global lithium demand by 2030, which will significantly impact the lithium market in 2025 and beyond.

What Are Sedimentary Lithium Deposits?

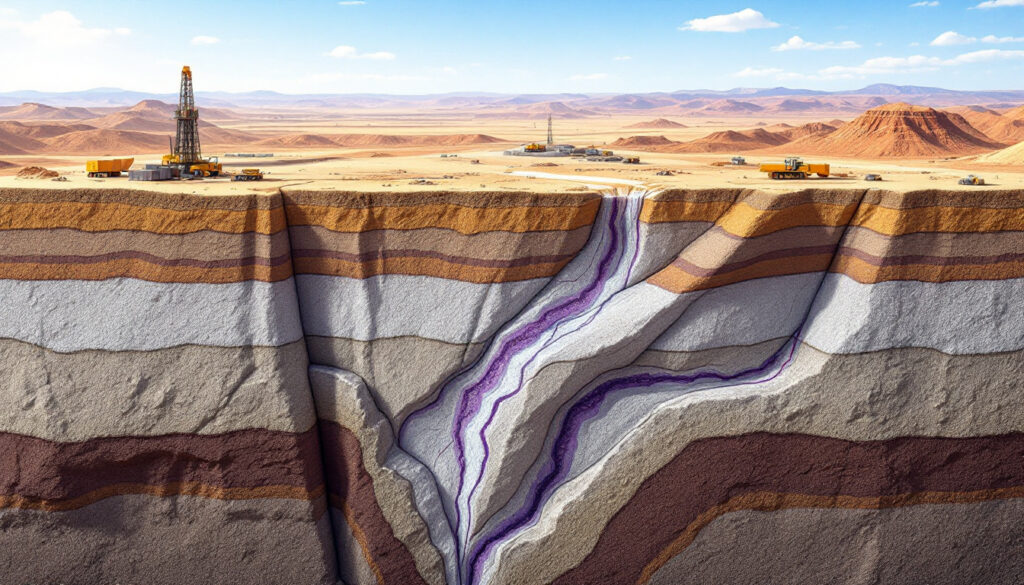

Sedimentary lithium deposits form when lithium-rich solutions accumulate in closed basin environments, primarily in arid regions where evaporation concentrates lithium in clay minerals. While conventional sources like salt brines and pegmatites have dominated commercial production, sedimentary deposits offer unique advantages that position them as increasingly important in the evolving lithium supply landscape.

The US Geological Survey's research timeline shows continuous investigation of these resources since the 1970s, with significant acceleration in the past decade as electric vehicle adoption drives unprecedented demand for battery materials. According to recent USGS data, sedimentary deposits could provide up to 30% of global lithium supply by 2035 if current development projects reach commercial production.

How Do Sedimentary Lithium Deposits Compare to Other Lithium Sources?

Sedimentary lithium deposits occupy a strategic middle ground in the lithium supply spectrum, offering several technical and economic advantages:

- Recovery Efficiency: Average recovery rates reach approximately 80%, significantly outperforming hard rock (60%) and conventional brine operations (40%)

- Production Costs: Operating costs typically range between $2,510-$8,000 per tonne lithium carbonate equivalent (LCE), positioning them between low-cost brines ($1,500-$2,500/tonne) and higher-cost hard rock operations ($4,000-$6,000/tonne)

- Mining Simplicity: Most deposits feature shallow, flat-lying mineralization with simple stratigraphy, requiring minimal drilling and blasting due to the unconsolidated nature of sediments

- By-product Potential: Many projects generate valuable by-products that enhance economics by 15-30%, including magnesium sulfate ($800-$1,200/tonne in added value), sodium hydroxide, potassium sulfate, and boric acid

As geologist Matt Vitale notes, "Sedimentary deposits bridge the gap between low-cost brine and high-recovery hard rock, but metallurgical complexity remains a barrier to widespread commercial development."

Where Are Sedimentary Lithium Deposits Located?

Sedimentary lithium deposits occur in specific geological environments worldwide, with the most economically viable projects concentrated in several regions:

- Western United States: The Great Basin region, particularly Nevada, hosts numerous projects including Thacker Pass (Lithium Americas), Rhyolite Ridge (Ioneer), and Bonnie Claire (Nevada Lithium Resources)

- Mexico: Sonora Project (Ganfeng Lithium Group), currently facing challenges due to Mexico's 2021 lithium nationalization

- Serbia: Rio Tinto's Jadar Project, containing the unique lithium-boron mineral jadarite

- China: Substantial resources in Yunnan Province remain largely untapped due to complex mineralogy, though they form part of China's 2,800 km lithium belt discovery that is transforming global resources

- Additional Regions: Emerging projects in India, Peru, and various African nations show exploration potential but remain early-stage

These deposits typically form in endorheic basins—closed hydrological systems where evaporation exceeds precipitation, creating ideal conditions for lithium concentration in lacustrine sediments.

Geological Formation and Characteristics

How Do Sedimentary Lithium Deposits Form?

The formation of sedimentary lithium deposits requires three critical elements working in geological concert:

-

Lithium Source: Primary lithium contributions (>60%) come from rhyolitic magmatic fluids and pyroclastic materials. Secondary sources include high-silica vitric volcanic rock, ignimbrites, and existing lithium-containing clay minerals, predominantly from the Cenozoic Era.

-

Transport Mechanism: Hydrothermal fluids serve as the primary transport medium, facilitated by geological structures like faults and fractures. As Benson et al. (2023) note, "Hydrothermal processes enhance lithium mobility in illite structures by altering cation exchange capacity," explaining why some deposits show enrichment patterns independent of surface weathering.

-

Natural Trap: Accumulation occurs in arid, endorheic basins where evaporation concentrates lithium-rich solutions. These hydrologically closed regions create ideal conditions for lithium fixation in clay minerals through cation exchange and adsorption processes.

The interplay between these elements explains why sedimentary lithium deposits show such variable characteristics across different geological settings. For a comprehensive global perspective on these environments, the favorability of sedimentary lithium accumulation has been analyzed using various geological parameters.

What Are the Key Geological Settings for These Deposits?

Sedimentary lithium deposits typically form in specific geological environments with distinctive characteristics:

- Subsiding Valley Floors: Areas that undergo subsidence through caldera formation or extensional basin tectonics, creating accommodation space for sediment accumulation

- Closed Basins: Endorheic environments conducive to lithium-rich sediment concentration and minimal outflow

- Volcanic Proximity: Regions with volcanic activity or ongoing extensional tectonics active up to the Quaternary Period, providing lithium sources and heat

- Substantial Sediment Packages: Basins filled with sediments reaching remarkable thicknesses—up to five kilometers in Nevada's Clayton Valley

These geological settings create ideal conditions for lithium enrichment through both primary depositional processes and secondary enrichment mechanisms.

What Minerals Host Lithium in Sedimentary Deposits?

Lithium mineralization in sedimentary deposits occurs within several host materials:

- Tuffs: Volcanic deposits containing >75% ash content

- Evaporites: Minerals precipitated from solution during water evaporation

- Marls: Mixed clay and calcite sediments

- Volcanic Clays: Altered volcanic materials

Clay minerals represent particularly important hosts, with varying lithium capacities:

- Smectite: Dominates approximately 70% of deposits and usually contains the most abundant lithium

- Illite: At Thacker Pass, hydrothermally altered illite contains approximately twice the lithium of smectites

- Chlorite: Common secondary mineral in altered volcanic rocks

- Mica: Includes lithium-bearing varieties such as lepidolite

- Kaolinite: Generally contains less lithium than other clay types

The distribution of these minerals significantly impacts extraction methods and processing requirements. As noted by Tourtelot & Brenner-Tourtelot (1978), "Flint clay weathering profiles are critical for identifying lithium-rich layers," highlighting the importance of detailed mineralogical characterization.

Exploration and Mining Methods

How Are Sedimentary Lithium Deposits Explored?

Exploration for sedimentary lithium employs a multidisciplinary approach utilizing various techniques:

- Remote Sensing: Aerial photography, topographic analysis, and airborne magnetics reduce exploration costs by approximately $500 per hectare compared to conventional methods

- Geophysical Methods: Magnetotellurics, gravity surveys, and ground-penetrating radar help identify basin structures and lithium-bearing horizons

- Spectral Analysis: Hyperspectral imaging differentiates between octahedral (Al-OH) and tetrahedral (Si-O-Si) clay structures, enabling targeted drilling

- Surface Sampling: Handheld laser-induced breakdown spectrometer (LIBS) tools provide real-time lithium assays with ±5% accuracy

- Laboratory Confirmation: Four-acid digestion tests by certified assay labs establish definitive grades and mineralogy

These techniques work synergistically to identify promising targets while minimizing exploration costs and environmental impacts.

What Drilling Methods Are Used?

Selecting appropriate drilling methods for unconsolidated sedimentary material presents unique challenges:

- Reverse Circulation: Cost-effective for preliminary exploration but may suffer from sample contamination

- Air Core: Suitable for shallow deposits with minimal water content

- Diamond Core: Provides intact core samples for detailed analysis but at higher cost

- Sonic Drilling: Achieves 95% core recovery in unconsolidated sediments compared to 70% for RC drilling, preserving stratigraphic relationships

Downhole measurements include resistivity, conductivity, acoustic, spectral, and gamma ray logs that complement physical core analysis and provide continuous data on formation characteristics.

How Are Sedimentary Lithium Deposits Mined?

Mining methods for sedimentary lithium deposits typically leverage their favorable physical characteristics:

- Open Pit Mining: Most common approach due to the large, shallow, flat-lying nature of deposits

- Low Waste-to-Ore Ratios: Minimal overburden removal with high ore tonnage accessibility

- Minimal Processing Requirements: As noted in a Nevada Lithium report, "Open-pit mining at Bonnie Claire requires zero blasting due to natural comminution," significantly reducing energy requirements

- Special Cases: Some deposits employ alternative methods, such as Bonnie Claire's proposed in-situ leaching system (reducing water usage by 60% versus conventional methods) or Jadar's planned underground mine (increasing safety but raising costs by 25%)

Coffey et al. (2021) highlight an important consideration: "Lacustrine sediment porosity (>30%) complicates solid-liquid separation during processing," necessitating specialized handling protocols from extraction through processing.

Processing and Production

How Is Lithium Extracted from Sedimentary Deposits?

The extraction of lithium from sedimentary deposits involves several innovative processes:

-

Sulfuric Acid Leaching: The predominant method, utilizing vats, heaps, or in-situ techniques. Modern approaches incorporate acid recycling systems to reduce costs and minimize waste generation. Recovery rates typically reach 80-85% with optimized conditions.

-

Alternative Leaching Media: Several companies have developed proprietary approaches including:

- Hydrochloric acid leaching (higher cost but cleaner residues)

- Chlor-alkali processes (Century Lithium's approach achieving 85% water recycling in closed-loop systems)

- Sulfate-based methods (reduced acid consumption but slower kinetics)

-

Emerging Technologies: Innovative extraction methods under development include:

- Water disaggregation (minimizing chemical usage)

- Hydrothermal treatment (accelerating reaction kinetics)

- Electrical separation (reducing water requirements)

- Mechanochemistry (Tesla's patented high-energy milling with sodium chloride catalyst, reducing acid consumption by 35%)

These varied approaches reflect the diversity of sedimentary lithium deposits and the ongoing optimization efforts to improve efficiency and sustainability, with some companies integrating innovative lithium ore processing techniques to enhance efficiency.

What Factors Affect Processing Efficiency?

Clay structure emerges as a critical factor in determining project feasibility and processing requirements:

- Tetrahedral Structure: Typically destroyed by acid leaching, releasing lithium but potentially creating processing challenges

- Octahedral Structure: May require increased acid consumption or roasting/calcination steps

- Cation Positioning: The structural position of magnesium and potassium ions significantly affects lithium leachability, with isomorphic substitution potentially reducing recovery by 20-40%

- Interlayer Lithium: Deposits with lithium concentrated in clay interlayers are rare but potentially more valuable due to simplified extraction

These mineralogical characteristics explain why seemingly similar deposits may require substantially different processing approaches.

What Are the Final Products?

Processing typically yields several high-value lithium products:

- Lithium Carbonate: Precipitated using soda ash (sodium carbonate) in a multi-stage process

- Lithium Hydroxide: Converted from lithium carbonate through various processes, commanding premium pricing due to its suitability for high-nickel cathode materials

- Purification Steps: Deleterious elements removal using calcium and sodium carbonate, evaporation, crystallization, and ion exchange to meet battery-grade specifications

By-products often enhance project economics substantially, with magnesium sulfate, boron compounds, and potassium sulfate providing additional revenue streams that can offset processing costs.

Investment Considerations and Future Outlook

What Are the Economic Factors to Consider?

Sedimentary lithium projects present a distinct economic profile with several key considerations:

- Operating Costs: Ranging from $2,510-$17,000 per tonne LCE, with most viable projects targeting costs under $8,000—positioning them between brine operations ($1,500-$2,500/tonne) and hard rock mines ($4,000-$6,000/tonne)

- By-product Value: Secondary products enhance economics by 15-30%, with magnesium sulfate alone adding $800-$1,200 per tonne in value

- Grade Correlations: Higher lithium grades generally correlate with more efficient processing and lower acid consumption

- Capital Expenditures: According to a Goldman Sachs report, "Sedimentary projects require $10,000-$15,000/tonne CAPEX versus $5,000/tonne for brine operations," reflecting the more complex processing infrastructure required

These economic parameters vary considerably between projects, highlighting the importance of detailed feasibility studies and pilot plant testing before full-scale development decisions.

What Risks Should Investors Be Aware Of?

Potential investors must consider several categories of risk:

- Market Volatility: Lithium carbonate spot prices have demonstrated extreme fluctuations, ranging from $70,000 to $18,000 per tonne between 2022 and 2024

- Regulatory Uncertainty: Government policies on decarbonization significantly impact demand forecasts, while resource nationalism poses supply risks—exemplified by Mexico's 2021 lithium nationalization that froze over $2 billion in investments

- Technology Risk: Commercial-scale production remains unproven for most sedimentary lithium extraction methods

- Jurisdictional Challenges: Political opposition has created hurdles for projects like Rio Tinto's Jadar development in Serbia, where environmental concerns have sparked heated debate. Similar challenges are evident in Bolivia's lithium mining sector, where social and environmental considerations complicate development.

These risk factors necessitate careful due diligence and strategic planning when evaluating investment opportunities in this emerging sector.

What Is the Future Outlook for Sedimentary Lithium?

Despite challenges, sedimentary lithium deposits appear increasingly crucial to meeting future demand:

- Global lithium demand projections show growth exceeding 500% by 2030, driven primarily by electric vehicle adoption and grid-scale energy storage systems

- Meeting these ambitious forecasts will likely require all available lithium sources, including sedimentary deposits

- The most viable projects are concentrated in favorable mining jurisdictions in the western United States, benefiting from regulatory support such as the Inflation Reduction Act's tax credits (offsetting approximately 30% of processing plant costs)

- Technological advancements continue to improve extraction efficiency and reduce environmental impacts, with several projects nearing commercial production

The US geological advantage in sedimentary lithium resources—combined with supportive policies and ongoing innovation—positions this deposit type as an increasingly important component of future supply chains, particularly for North American and European markets seeking to reduce dependency on foreign sources. Furthermore, countries like Australia are actively developing their lithium ambitions and future prospects to secure a position in this growing market.

FAQs About Sedimentary Lithium Deposits

What Makes Sedimentary Lithium Different from Other Lithium Sources?

Sedimentary lithium deposits differ fundamentally from traditional sources in their formation, mining methods, and processing requirements. They typically offer superior recovery rates (approximately 80%) compared to hard rock (60%) and conventional brine operations (40%), with operating costs that position them between these established alternatives. Their relatively simple mining requirements and valuable by-products create a distinctive economic profile that is particularly attractive in stable mining jurisdictions.

Why Haven't Sedimentary Lithium Deposits Reached Commercial Production Yet?

Despite decades of research, sedimentary lithium deposits face persistent challenges including complex metallurgy, the need for bespoke processing flowsheets, and technological hurdles in scaling laboratory successes to commercial operations. The price volatility of lithium markets has also complicated investment decisions, with projects advancing during price spikes but often slowing during downturns. However, the combination of rising demand projections and improving extraction technologies is accelerating development timelines for the most promising deposits.

Ready to Stay Ahead of the Next Major Lithium Discovery?

Discover high-potential lithium opportunities before the market catches on with Discovery Alert's proprietary Discovery IQ model, which delivers real-time alerts on significant ASX mineral discoveries. Visit our discoveries page to understand how major mineral discoveries like lithium can lead to substantial investment returns.