Africa's Critical Minerals Opportunity: Powering Global Transition and Continental Growth

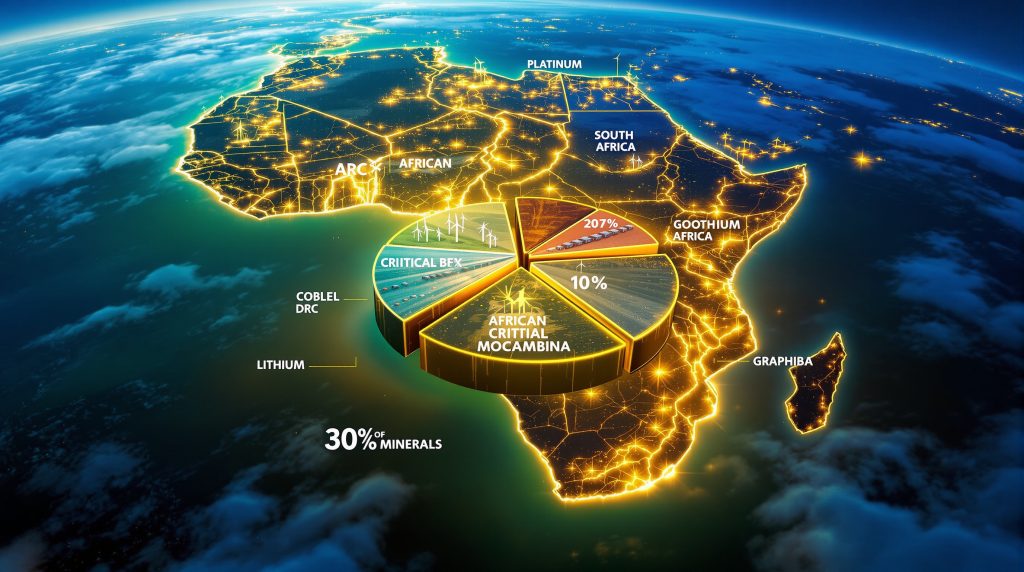

Africa stands at a pivotal moment in history, possessing approximately 30% of the world's critical mineral reserves at a time when global critical minerals demand is surging. These minerals—essential for clean energy technologies, digital infrastructure, and advanced manufacturing—position the continent to become a cornerstone of the global transition to sustainable economies. However, transforming this geological advantage into lasting economic development requires strategic approaches that move beyond traditional extraction models.

The Strategic Importance of Africa's Critical Minerals

Africa's mineral wealth spans numerous resources crucial to modern technologies:

-

The Democratic Republic of Congo produces 70% of global cobalt

-

South Africa holds over 80% of global platinum group metals reserves

-

Zimbabwe, Mali, and Namibia possess significant lithium deposits

-

Mozambique and Tanzania have substantial graphite resources

-

Guinea contains approximately 25% of global bauxite reserves

-

Gabon and South Africa lead in manganese production

These minerals form the foundation of technologies driving global decarbonization efforts, including electric vehicle batteries, renewable energy systems, and digital infrastructure. As countries worldwide accelerate their energy transitions, demand for these minerals is projected to increase 4-6 times by 2040, according to the International Energy Agency.

What Critical Minerals Does Africa Possess?

Battery Minerals: Powering Electrification

Africa's battery mineral reserves position the continent as essential to global electrification efforts:

| Mineral | Key African Countries | Global Position | Primary Applications |

|---|---|---|---|

| Cobalt | DR Congo, Zambia, Morocco | 70% of global production | EV batteries, aerospace alloys |

| Lithium | Zimbabwe, Mali, Namibia | Emerging producer | Batteries, ceramics, lubricants |

| Graphite | Mozambique, Tanzania, Madagascar | 20% of global reserves | Battery anodes, industrial applications |

| Manganese | South Africa, Gabon, Ghana | 40% of global reserves | Battery cathodes, steel production |

Cobalt: Congo's Crucial Resource

The Democratic Republic of Congo dominates global cobalt production, with approximately 70% of world supply. This mineral is critical for lithium-ion battery cathodes, particularly in applications requiring high energy density and performance. Despite its abundance, only a fraction of Congo's cobalt undergoes local processing, with most value addition occurring overseas.

Lithium: Emerging Opportunity

While historically underexplored, Africa's lithium deposits are gaining attention. Zimbabwe's Bikita and Arcadia mines represent significant resources, while exploration projects in Mali, Namibia, and Ghana show promising potential. As battery manufacturers seek supply chain diversification, African lithium presents a substantial growth opportunity.

Rare Earth Elements and Technology Minerals

Africa possesses substantial deposits of rare earth elements (REEs) and other technology minerals:

-

Burundi and Malawi have emerging rare earth production

-

South Africa contains monazite sands with significant REE content

-

Tanzania has niobium and tantalum deposits crucial for electronics

-

Rwanda produces approximately 50% of global tantalum

These minerals are essential components in permanent magnets for wind turbines, electric motors, and various high-tech applications including semiconductors, defense systems, and medical technologies.

Why Is Africa's Position Uniquely Advantageous?

Geological Diversity and Abundance

Africa's geological formation has created exceptional mineral diversity within relatively concentrated geographic areas. This enables potential development of integrated mining and processing hubs that can achieve economies of scale while reducing infrastructure requirements.

The continent's mineral wealth extends beyond traditional resources to include:

-

Platinum group metals (PGMs) for hydrogen technologies and emissions control

-

Vanadium for grid-scale energy storage

-

Bauxite for aluminum production

-

Chromium for stainless steel manufacturing

Geopolitical Significance

As nations worldwide seek to secure resilient supply chains, Africa's critical minerals have become central to geopolitical strategies:

-

The European Union's Critical Raw Materials Act specifically targets African partnerships

-

The United States' Inflation Reduction Act incentivizes minerals from countries with free trade agreements

-

China has established significant mining investment strategies across the continent

This competitive landscape creates leverage for African nations to negotiate more advantageous terms and partnerships that extend beyond simple extraction.

What Challenges Limit Africa's Mineral Development?

Despite abundant resources, several interlocking challenges have limited Africa's ability to fully capitalize on its mineral wealth:

Infrastructure Deficits

Inadequate power, water, transportation, and logistics infrastructure significantly increases development costs and timelines:

-

Approximately 600 million Africans lack reliable electricity access

-

Rail capacity constraints limit mineral transportation in many regions

-

Port congestion and inefficiencies increase export costs

-

Limited water resources in many mining regions create operational constraints

These infrastructure gaps not only impede new project development but also make downstream processing economically challenging.

Regulatory Fragmentation

Inconsistent policies across African nations create barriers to regional integration and investor confidence:

-

Varying mining codes and fiscal regimes

-

Unpredictable policy changes and contract enforcement

-

Limited harmonization of standards and regulations

-

Bureaucratic inefficiencies that delay project approvals

This regulatory patchwork increases complexity and risk for investors while limiting opportunities for regional value chain development.

Capital Constraints

Despite global interest, financing remains a significant barrier:

-

Less than 10% of critical mineral projects in Southern Africa have secured financing

-

Risk perceptions increase capital costs for African projects

-

Limited local capital markets restrict domestic investment options

-

Traditional mining finance often excludes smaller-scale projects

These capital constraints particularly impact early-stage exploration and development, creating a pipeline bottleneck for new projects.

How Can Africa Transform Its Mineral Potential?

Moving Beyond Extraction to Value Addition

To maximize economic benefits, African nations must advance beyond raw material exports to capture more of the value chain:

-

Developing midstream processing capabilities (concentrates, precursors)

-

Establishing regional manufacturing hubs for components and products

-

Building technical capabilities and specialized workforces

-

Creating innovation ecosystems around mineral resources

South Africa's platinum industry demonstrates this potential, having developed capabilities ranging from mining to catalyst manufacturing and recycling.

Regional Integration and Cooperation

The fragmented nature of Africa's mineral resources and markets necessitates regional approaches:

-

Harmonizing policies and standards across regional economic communities

-

Developing shared infrastructure to reduce costs and improve efficiency

-

Creating complementary specializations based on comparative advantages

-

Establishing regional centers of excellence for skills development

The African Continental Free Trade Area (AfCFTA) provides a framework for this integration, potentially creating a unified market of 1.3 billion people.

Innovative Financing Models

Addressing capital constraints requires new approaches to project financing:

-

Blended finance instruments that combine public and private capital

-

Development finance institutions providing catalytic funding

-

Resource-backed infrastructure arrangements with appropriate safeguards

-

Special purpose vehicles for shared infrastructure development

These innovative approaches can reduce risk perceptions and mobilize capital for critical projects.

What Economic Impact Could Critical Minerals Create?

Job Creation and Economic Diversification

According to a Boston Consulting Group analysis, for every $1 billion invested in mining and processing:

-

3,000 to 6,000 direct, indirect, and induced jobs are created

-

$210-280 million is contributed annually to GDP

-

$70-100 million in yearly government revenue is generated

-

$100 million in regional infrastructure development occurs

These benefits extend beyond direct mining operations to include:

-

Manufacturing jobs in downstream industries

-

Services sector growth supporting mineral value chains

-

Knowledge economy development through research and innovation

-

Small and medium enterprise opportunities in supply chains

Sustainable Development Alignment

Critical minerals align with broader sustainable development objectives:

-

Enabling global decarbonization through clean energy technologies

-

Creating high-quality employment opportunities

-

Developing technical skills transferable to other sectors

-

Generating government revenue for public services and infrastructure

With appropriate governance frameworks, these minerals can support inclusive growth rather than reinforcing extractive economic models.

How Should Stakeholders Approach Africa's Critical Mineral Opportunity?

For African Governments

African governments must establish enabling environments while ensuring appropriate value capture:

-

Develop stable, transparent regulatory frameworks

-

Invest in foundational infrastructure and education

-

Implement regional harmonization of policies and standards

-

Balance investment attraction with appropriate local content requirements

-

Establish sovereign wealth funds to manage resource revenues sustainably

These actions can transform the traditional boom-bust cycle of resource extraction into sustainable development.

For International Partners

Countries and companies seeking access to Africa's minerals should:

-

Develop genuine partnerships focused on mutual benefit

-

Support infrastructure development with fair financing terms

-

Facilitate technology transfer and skills development

-

Respect sovereignty and democratic processes

-

Align with national development priorities

This approach builds sustainable relationships rather than perpetuating extractive models.

For Investors and Mining Companies

The private sector plays a crucial role in responsible development:

-

Embrace sustainable mining practices

-

Develop inclusive local supply chains

-

Invest in workforce development beyond immediate needs

-

Consider shared infrastructure models to reduce costs

-

Engage transparently with communities and governments

Companies that adopt these approaches can secure social license while creating sustainable operations.

What Does Success Look Like?

A transformed approach to Africa's critical minerals would create:

-

Integrated regional value chains capturing greater economic value

-

Diversified economies less vulnerable to commodity price fluctuations

-

High-skill employment opportunities across the continent

-

Sustainable infrastructure serving both mining and broader development

-

Improved governance and transparent resource management

This vision represents a fundamental shift from resource extraction to industrial transformation—creating high-quality jobs, building technological capabilities, and positioning African nations as essential minerals energy security partners in global clean energy and digital infrastructure development.

Furthermore, as the industry evolves, we can expect to see increased mining consolidation trends that may reshape how African nations engage with international mining companies, according to the Africa Center for Strategic Studies.

Disclaimer: The market analyses and economic projections in this article are based on current information and represent possibilities rather than certainties. Readers should conduct their own research before making investment or policy decisions related to Africa's critical minerals sector.

Want to Stay Ahead of Major Mineral Discoveries?

Discovery Alert's proprietary Discovery IQ model delivers instant notifications when significant ASX mineral discoveries are announced, empowering investors with actionable insights before the broader market reacts. Visit the Discovery Alert discoveries page to understand how identifying these opportunities early can lead to exceptional investment returns.