ArcelorMittal South Africa's Massive Job Cuts Signal Deeper Steel Industry Crisis

ArcelorMittal South Africa (AMSA) is implementing a workforce reduction affecting approximately 4,000 employees—nearly half of its total South African workforce. This significant escalation from the initially announced 3,500 job cuts signals a deepening crisis within South Africa's steel manufacturing sector, with implications extending far beyond the company itself.

Scale and Timeline of the Workforce Reduction

The job cuts now represent close to 50% of AMSA's South African operations, marking one of the most substantial industrial downsizings in the country's recent history. According to Reuters reporting from September 2025, the Solidarity union confirmed AMSA's communication about "mass retrenchments involving more than 4,000 jobs."

Key details of this workforce reduction include:

- Nearly half of AMSA's South African workforce to be eliminated

- Implementation expected to be completed by end of September 2025

- Financial context includes a half-year headline loss of 1 billion rand (approximately $56 million)

- Company has been reporting consecutive losses since 2023

The expanded job cuts reflect the gravity of AMSA's financial situation and suggest that previous attempts to stem losses have proven insufficient.

Understanding the Perfect Storm Facing ArcelorMittal South Africa

AMSA's decision to cut such a substantial portion of its workforce stems from a convergence of persistent challenges that have created an unsustainable business environment.

Multiple Economic Challenges Converging

The steel manufacturer has faced compounding difficulties that have eroded its competitive position:

- Prolonged period of weak domestic steel demand within South Africa

- Declining steel prices in both local and international markets

- Significant operational cost pressures, particularly from energy

- Twice-deferred closure of struggling long steel operations that are now "buckling under pressure"

These factors have created a vicious cycle where reduced demand leads to lower capacity utilization, increasing per-unit production costs and further undermining competitiveness.

External Market Pressures Intensifying

AMSA's position in the market has been increasingly compromised by both global and local factors:

- Surging steel imports, particularly from China, which can produce at significantly lower costs

- Growing competition from local scrap metal recycling operations that operate with different cost structures

- Structural economic challenges within South Africa affecting industrial demand

- Global steel industry overcapacity continuing to suppress international prices

Industry analysts note that South Africa's steel industry is particularly vulnerable to import competition due to its distance from major global shipping routes, adding freight costs to domestically produced steel that imports from major producing nations don't face to the same degree.

Infrastructure and Operational Hurdles

Beyond market conditions, AMSA faces significant operational challenges:

- Escalating electricity costs from Eskom that exceed global averages for steel production

- Unreliable power supply causing production disruptions and quality issues

- Logistical bottlenecks in rail and port infrastructure increasing both input and output costs

- High transportation costs affecting both raw materials and finished products

These infrastructure challenges have a disproportionate impact on heavy industry like steel manufacturing, where energy intensity and logistical requirements are significantly higher than in other sectors.

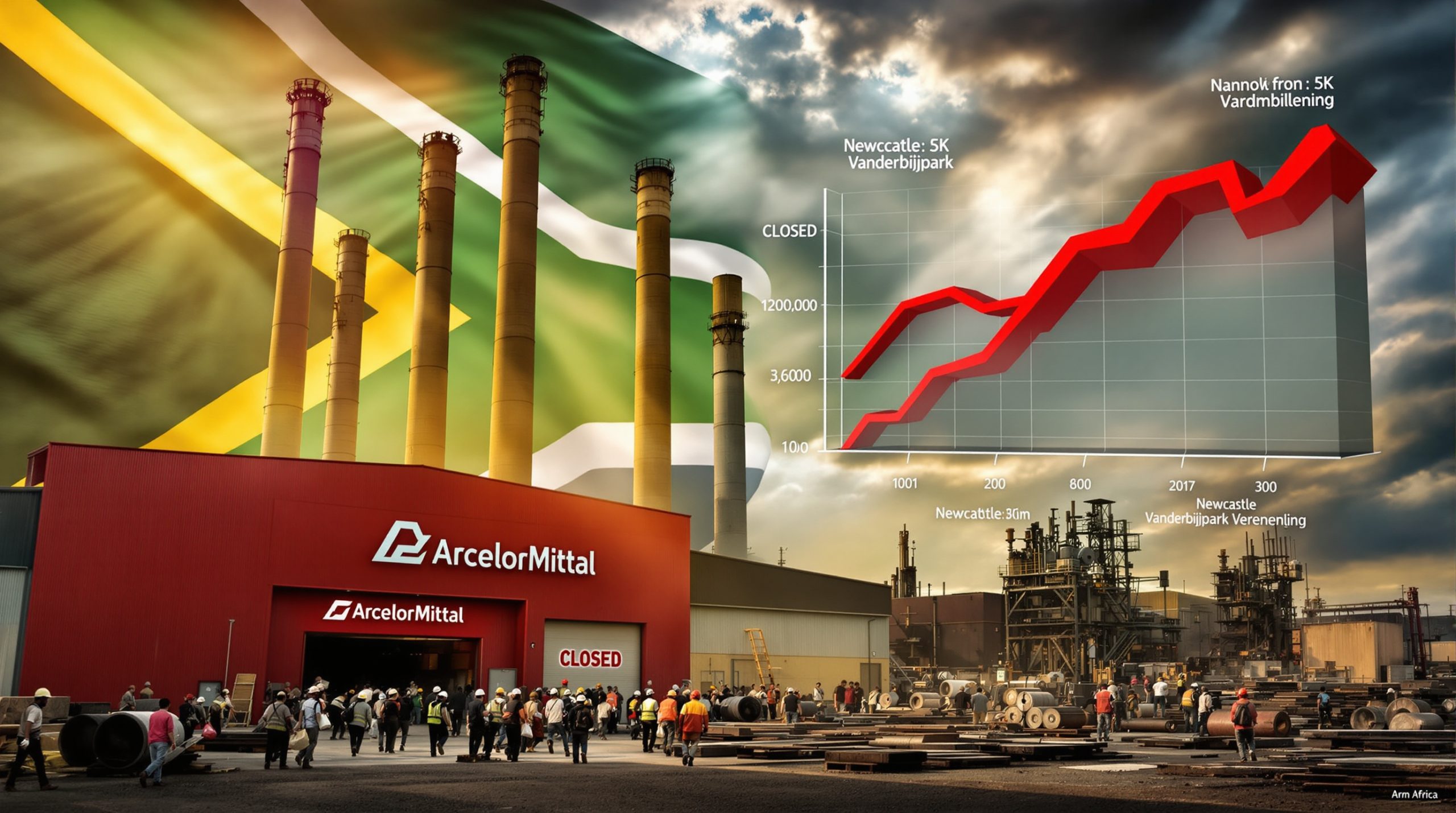

Facilities Affected by the Expanded Job Cuts

The restructuring plan has grown substantially beyond the initial closure announcements, now affecting AMSA's core production capabilities in South Africa.

From Targeted Closures to Comprehensive Restructuring

The job reduction plan has expanded significantly:

Original Closure Announcements

- Newcastle plant (specialized in long steel products)

- Vereeniging operations (also focused on long steel products)

- Combined workforce impact: Approximately 3,500 employees

New Additions to Restructuring Plan

- Vanderbijlpark operations (the company's flagship facility)

- Produces flat steel products for automotive, construction, and appliance industries

- Represents AMSA's core production capability in South Africa

- Additional 500+ jobs now at risk at this critical facility

The inclusion of Vanderbijlpark in the restructuring plan is particularly significant as it represents the company's most modern and strategically important operation in South Africa.

Production Impact Assessment

| Facility | Product Type | Annual Capacity | Strategic Importance |

|---|---|---|---|

| Vanderbijlpark | Flat steel | Major portion of 2.4M tons | Flagship operation, core to SA industrial supply |

| Newcastle | Long steel | Significant portion of production | Major regional employer in KwaZulu-Natal |

| Vereeniging | Long steel | Smaller operation | Historical facility with specialized capabilities |

Industry experts note that flat steel production at Vanderbijlpark serves critical industries including automotive manufacturing, construction, and consumer goods—sectors deemed essential for South Africa's industrial development.

Failed Interventions: What Solutions Were Explored Before Job Cuts?

Before resorting to massive workforce reductions, AMSA engaged in extensive efforts to secure policy interventions that might have improved its competitive position.

Government Negotiations and Intervention Requests

According to Reuters reporting, AMSA engaged with South African government officials seeking several policy interventions:

- Requested reduction in scrap metal export duties, which AMSA claims give recyclers an unfair competitive advantage

- Sought implementation of protective tariff market effects on imported steel, particularly from China

- Advocated for preferential electricity pricing from Eskom to offset high energy costs

- Pushed for improved freight logistics solutions through state-owned transportation infrastructure

These requests reflect the company's assessment that structural issues in South Africa's industrial policy environment were significantly contributing to its competitive disadvantages.

Why Intervention Efforts Failed

The Solidarity union has "accused the government of dragging its heels in seeking solutions," according to Reuters reporting. Several factors appear to have limited the effectiveness of potential interventions:

- Slow governmental response to industry challenges amid competing national priorities

- Limited policy flexibility within existing trade frameworks and international obligations

- Competing priorities within South Africa's economic strategy

- Insufficient scale of proposed interventions relative to the magnitude of challenges

Industrial policy experts note that steel industry support presents particular challenges for governments, as protective measures for upstream producers can negatively impact downstream manufacturers who use steel as an input.

Union Response to the Expanding Crisis

Labor organizations representing AMSA workers have been vocal about the expanding job cuts and their implications for South Africa's industrial base.

Union Statements and Actions

The Solidarity union has taken a prominent role in responding to the job cut announcements:

- Publicly confirmed AMSA's communication about expanded mass retrenchments

- Criticized government for insufficient action to protect South Africa's steel industry

- Highlighted broader implications for South Africa's manufacturing sector

- Raised concerns about the social impact in affected communities

Union representatives have emphasized that the job losses at AMSA represent not just individual hardships but a significant blow to South Africa's industrial capabilities and manufacturing base.

Worker Representation Challenges

The unions face significant challenges in addressing this crisis:

- Limited leverage given AMSA's deteriorating financial situation

- Difficult negotiating position amid industry-wide challenges

- Competing priorities between job preservation and company viability

- Broader concerns about deindustrialization in South Africa

Labor analysts note that the steel industry's capital-intensive nature and global overcapacity create particularly difficult conditions for labor negotiations, as companies have limited ability to maintain employment levels when facing persistent financial losses.

Broader Economic Impact on South Africa

The contraction of AMSA's operations represents far more than a single company's difficulties—it signals potential structural changes in South Africa's industrial landscape.

Industrial Sector Implications

The reduction in AMSA's operations represents a significant blow to South Africa's industrial capacity:

- Reduction in domestic steel production capability at a time when industrialization remains a national priority

- Increased dependence on imported steel products, affecting trade balance

- Loss of manufacturing expertise and specialized industrial knowledge

- Potential downstream effects on steel-consuming industries including automotive, construction, and mining industry innovation

Industrial policy experts note that steel production has historically been viewed as a strategic industry for developing economies seeking to build manufacturing capacity, making its contraction particularly significant.

Regional Economic Consequences

Communities hosting AMSA facilities will experience significant economic impacts:

- Newcastle: Major employer in KwaZulu-Natal province with limited alternative employment opportunities

- Vanderbijlpark: Critical economic anchor in Gauteng province supporting numerous supplier businesses

- Vereeniging: Historical industrial center facing further decline after decades of manufacturing contraction

- Multiplier effects on local businesses, service providers, and municipal tax bases

Economic development specialists highlight that the concentration of job losses in specific communities creates particularly severe impacts, as affected regions often lack the economic diversity to absorb displaced workers.

National Economic Considerations

The restructuring raises broader questions about South Africa's industrial policy:

- Challenge to mineral beneficiation in SA strategy for mineral resources, as steel represents a key value-adding process

- Implications for manufacturing competitiveness when a major input producer contracts

- Concerns about deindustrialization trends in a country already facing high unemployment

- Impact on trade balance as steel imports potentially increase to replace domestic production

Policy analysts note that South Africa's rich iron ore and coal resources theoretically provide natural advantages for steel production, making the industry's struggles particularly concerning from a resource utilization perspective.

Long-Term Prospects for ArcelorMittal in South Africa

The extensive restructuring raises fundamental questions about AMSA's future in the country and the viability of large-scale integrated steel production under current conditions.

Company's Strategic Outlook

AMSA's future in South Africa appears increasingly uncertain:

- Significant reduction in production capacity suggests a fundamental reassessment of market viability

- Focus potentially shifting to more specialized, higher-margin product segments

- Reassessment of long-term viability in current market conditions

- Potential for further restructuring depending on market developments

According to Kitco News, the company has stated it is "limited in what we can say in the public domain given the complexities of the matters under discussion and a cautionary announcement we issued recently," suggesting that additional strategic changes may be forthcoming.

Industry Transformation Scenarios

The steel industry in South Africa may undergo fundamental changes:

- Shift toward smaller, more specialized producers focusing on niche markets

- Increased role for scrap-based mini-mills with different cost structures

- Greater import dependence for certain steel products, particularly commodity grades

- Potential for new business models focused on higher-value, specialized products

Steel industry experts note that similar transformations have occurred in other markets, where large integrated producers have given way to more specialized operations targeting specific market segments with higher barriers to entry.

Global Context: How This Compares to International Steel Industry Trends

AMSA's challenges reflect broader dynamics reshaping the global steel industry, though with specific South African dimensions.

International Steel Industry Dynamics

AMSA's difficulties mirror several global steel industry trends:

- Worldwide overcapacity in steel production creating persistent pricing pressure

- Chinese dominance in global steel markets reshaping competitive landscapes

- Shift toward electric arc furnace technology and mini-mills in many markets

- Growing emphasis on green steel production as carbon policies evolve

Industry analysts note that global steel production capacity significantly exceeds demand, creating structural challenges for higher-cost producers regardless of location.

Regional Comparisons and Distinctions

Other African steel producers face similar challenges, though with important variations:

- Competition from imported products affecting producers across the continent

- High energy and logistics costs common to many African industrial operations

- Limited domestic market size constraining economies of scale

- Challenges in accessing export markets due to logistical costs and trade barriers

Steel industry observers point out that South Africa's relatively developed industrial base provides potential advantages compared to other African producers, making AMSA's struggles particularly noteworthy.

Limited Options for Affected Workers

The thousands of workers facing job losses at AMSA confront a challenging employment landscape with limited comparable opportunities.

Employment Transition Support

Workers facing job losses may have access to various support mechanisms, though their adequacy remains uncertain:

- Potential severance packages (specific details not publicly disclosed)

- Government unemployment benefits through the Unemployment Insurance Fund

- Possible retraining programs through sector education and training authorities

- Limited relocation assistance for specialized roles

Labor market specialists note that the specialized nature of many steel industry jobs creates particular challenges for worker transitions, as skills may not transfer readily to other sectors.

Alternative Employment Prospects

The affected workforce faces significant reemployment challenges:

- Limited comparable manufacturing opportunities in a contracting industrial sector

- Potential need for geographic relocation in a country with significant regional economic disparities

- Skills transfer challenges to other industries requiring substantial retraining

- Competition from other job seekers in an economy with over 30% unemployment

Economic development experts emphasize that the concentration of job losses in specific communities and the specialized nature of many affected positions create particularly difficult reemployment prospects for displaced workers.

FAQs About ArcelorMittal South Africa's Job Cuts

Why is ArcelorMittal cutting jobs in South Africa?

ArcelorMittal South Africa is cutting jobs due to persistent financial losses, weak domestic demand, high operational costs (particularly energy), poor logistics infrastructure, and intense competition from both imports and local scrap metal recyclers.

How many jobs will be lost at ArcelorMittal South Africa?

Approximately 4,000 jobs are at risk, representing nearly half of ArcelorMittal's South African workforce, according to September 2025 Reuters reporting citing union confirmation.

Which ArcelorMittal facilities in South Africa are affected?

The job cuts will affect operations at Newcastle and Vereeniging (long steel plants) as well as the flagship Vanderbijlpark facility (flat steel production), representing a comprehensive restructuring of AMSA's South African operations.

What is the financial situation at ArcelorMittal South Africa?

The company has been reporting losses since 2023 and recently posted a half-year headline loss of approximately 1 billion rand ($56 million), reflecting persistent challenges in market conditions and operational costs.

What solutions were attempted before announcing job cuts?

ArcelorMittal sought government interventions including reduced scrap export duties, import tariffs on steel, preferential electricity rates from Eskom, and improved freight logistics solutions, but according to Reuters reporting, these efforts "failed to provide an alternative solution."

The Uncertain Future of South Africa's Steel Industry

The extensive job cuts at ArcelorMittal South Africa represent more than just a corporate restructuring—they signal fundamental challenges within South Africa's industrial economy. With nearly half the workforce being eliminated and major facilities affected, the company's contraction raises serious questions about the viability of large-scale steel manufacturing in the country under current conditions.

The combination of high energy costs, logistical challenges, weak domestic demand, and intense international competition has created a perfect storm for AMSA. Despite attempts to secure government interventions, the company has proceeded with dramatic workforce reductions that will have lasting impacts on affected communities and South Africa's industrial capacity.

As the restructuring unfolds, stakeholders across government, labor, and industry will need to confront difficult questions about South Africa's industrial policy, energy strategy, and industry consolidation trends in manufacturing. The outcome will have significant implications not just for the steel sector but for the country's broader economic development trajectory and industrialization ambitions, particularly as global iron ore trends continue to evolve.

Looking for the Next Significant Mineral Discovery?

Discovery Alert's proprietary Discovery IQ model provides instant notifications when major ASX mineral discoveries are announced, delivering actionable insights before the broader market reacts. Visit our dedicated discoveries page to see how historic mineral finds have generated exceptional returns for early investors.