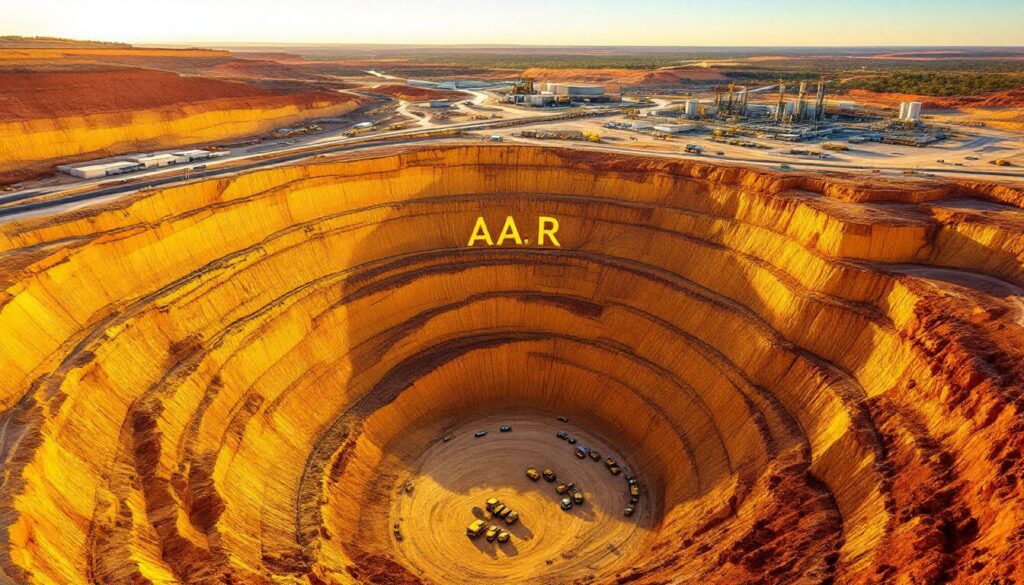

Astral Resources: Pioneering a 100,000oz Per Annum Gold Mine in Western Australia's Premier Mining Hub

Multi-Decade Gold Production on Horizon with Impressive PFS Results

Astral Resources (ASX: AAR) is rapidly advancing its flagship Astral Resources Mandilla Gold Project toward becoming a significant gold production hub in Western Australia's premier Kalgoorlie goldfields. The recently completed Pre-Feasibility Study (PFS) has delivered exceptional results, positioning Astral as the only ASX-listed aspiring gold developer with a project of this scale in the strategically important Kalgoorlie/Kambalda region.

The PFS has demonstrated the project's potential to produce 95,000 ounces of gold annually for the first 12 years, with a total mine life spanning 18.5 years. Based on a gold price of A$4,250/oz, the project boasts a pre-tax NPV8 of A$1.4 billion and anticipated pre-tax free cash flow of A$2.8 billion with a remarkably short payback period of approximately 12 months.

"The Mandilla Gold Project represents a rare opportunity in the Australian gold sector – a large-scale, long-life development with robust economics in the heart of one of the world's premier gold mining districts," commented Managing Director Marc Ducler.

Strategic Location With Excellent Infrastructure

The Mandilla Project's location provides significant operational advantages that further enhance its economic appeal. Situated just 70km south of Kalgoorlie and less than 25km from the well-serviced town of Kambalda, the project benefits from:

- Infrastructure less than 500m from the Coolgardie-Esperance Highway

- Readily available potable water and gas pipelines

- Proximity to established mining communities and services

- Access to skilled workforce and support services

This strategic position in Western Australia's goldfields significantly de-risks the development pathway and reduces infrastructure costs compared to more remote project locations.

Growing Resource Base With High Conversion Rate

Astral has established an impressive mineral resource inventory of 1.8 million ounces, underpinned by a robust 1.1 million ounce Probable Reserve. What's particularly noteworthy is the high conversion rate from resources to reserves:

- 95% of the Mandilla Mineral Resource Estimate (MRE) has been converted into the PFS production target

- 86% of the Feysville MRE has been converted into the PFS production target

| Project | Mineral Resource | Probable Reserve | Conversion Rate |

|---|---|---|---|

| Mandilla | 1.43Moz | 1.0Moz | 95% |

| Feysville | 196,000oz | 88,000oz | 86% |

| Spargoville | 139,000oz | – | – |

| Total | 1.76Moz | 1.08Moz | High |

The cornerstone of the project is the Theia deposit, which represents 81% of the Mandilla MRE with 33Mt at 1.1g/t Au for 1.2Moz of contained gold in one large open pit. Recent diamond drilling at Theia has returned exceptional high-grade intercepts, including 1m at 223.3g/t Au and 9.55m at 27.6g/t Au.

Understanding Strip Ratio and Its Impact on Mining Economics

What is a strip ratio?

The strip ratio is a crucial mining metric that represents the amount of waste material that must be removed to extract one unit of ore. For Astral's Mandilla Gold Project, the Theia deposit has a strip ratio of 5.5:1, while the overall life-of-mine strip ratio is 6.4:1.

Why it matters to investors:

Strip ratios directly affect mining costs and project economics. Although Mandilla's strip ratio is moderate for an open-pit gold operation, the high-grade nature of portions of the deposit, combined with the project's scale and long life, more than compensate for the waste removal costs. The impressive financial returns from the PFS confirm that the economics remain robust despite this level of waste stripping.

Development Timeline and Next Steps

Astral is advancing toward development with a clear timeline:

- Environmental permitting submissions planned for Q4 2025

- Definitive Feasibility Study (DFS) completion expected in Q2 2026

- Final Investment Decision targeted for July 2026

- Construction commencing Q3 2026

- First gold production anticipated in Q4 2027

The company is well-funded to progress through these development stages, with approximately A$22.3 million in cash as of March 2025.

Investment Thesis: Why Astral Resources Stands Out

Astral Resources presents a compelling investment opportunity in the gold sector for several key reasons:

-

Scale and Longevity: The 18.5-year mine life with production of 95,000oz annually for the first 12 years places Mandilla among the more significant gold developments in Australia.

-

Strong Economics: With an AISC of A$2,085/oz against the current gold price environment of approximately A$5,150/oz, the project offers substantial margins.

-

De-Risked Development: Located in a Tier-1 jurisdiction with excellent infrastructure and a clear permitting pathway.

-

Growth Potential: Continued exploration success across three project hubs (Mandilla, Feysville, and Spargoville) provides opportunities to further expand resources.

-

Experienced Leadership: A management team with a track record in gold project development and operations.

| Key Financial Metrics | Base Case (A$4,250/oz) | Current Gold Price (A$5,150/oz) |

|---|---|---|

| Pre-tax NPV8 | A$1.4B | A$2.0B |

| Pre-tax Free Cash Flow | A$2.8B | A$3.9B |

| Payback Period | ~12 months | ~9 months |

| AISC | A$2,085/oz | A$2,085/oz |

| Initial Capital Cost | A$180.4M | A$180.4M |

Why Investors Should Follow Astral Resources

Astral Resources represents a rare opportunity to invest in a gold developer with a large-scale, long-life project located in one of the world's premier gold mining districts. The company has systematically de-risked the Mandilla Gold Project through detailed technical studies and exploration, resulting in a robust development opportunity.

With gold prices remaining strong and global economic uncertainties supporting the precious metals sector, Astral is well-positioned to capitalise on favourable market conditions. The company's three-hub strategy centred on Mandilla provides multiple pathways for growth and value creation.

As one of the few ASX-listed gold developers with a clear path to becoming a significant producer in the next 2-3 years, Astral Resources merits close attention from investors seeking exposure to the gold sector with a balance of near-term catalysts and long-term production potential.

"Astral Resources has positioned itself as an emerging player in Australia's gold sector, with significant upside potential due to its strategic location, robust project economics, and exploration upside. With upcoming milestones in 2025-2027, investors should keep a close eye on developments as the company advances toward production."

Want to Invest in Australia's Next Major Gold Producer?

Discover why Astral Resources is rapidly advancing towards becoming a 100,000oz per annum gold producer in Western Australia's premier mining district. With an impressive 18.5-year mine life, robust economics including a pre-tax NPV8 of A$1.4 billion, and strategic location in the Kalgoorlie goldfields, Astral represents a compelling investment opportunity in the gold sector. For more information about this emerging ASX-listed gold developer and its flagship Mandilla Gold Project, visit Astral Resources' website today.