Explore China’s projected 1.27 billion ton iron-ore imports in 2025, adapting to market complexities, strategic maneuvers, and economic challenges for a dynamic future.

China’s 2025 Iron-Ore Imports: Major Transformation and Challenges Ahead

Explore China’s projected 1.27 billion ton iron-ore imports in 2025, adapting to market complexities, strategic maneuvers, and economic challenges for a dynamic future.

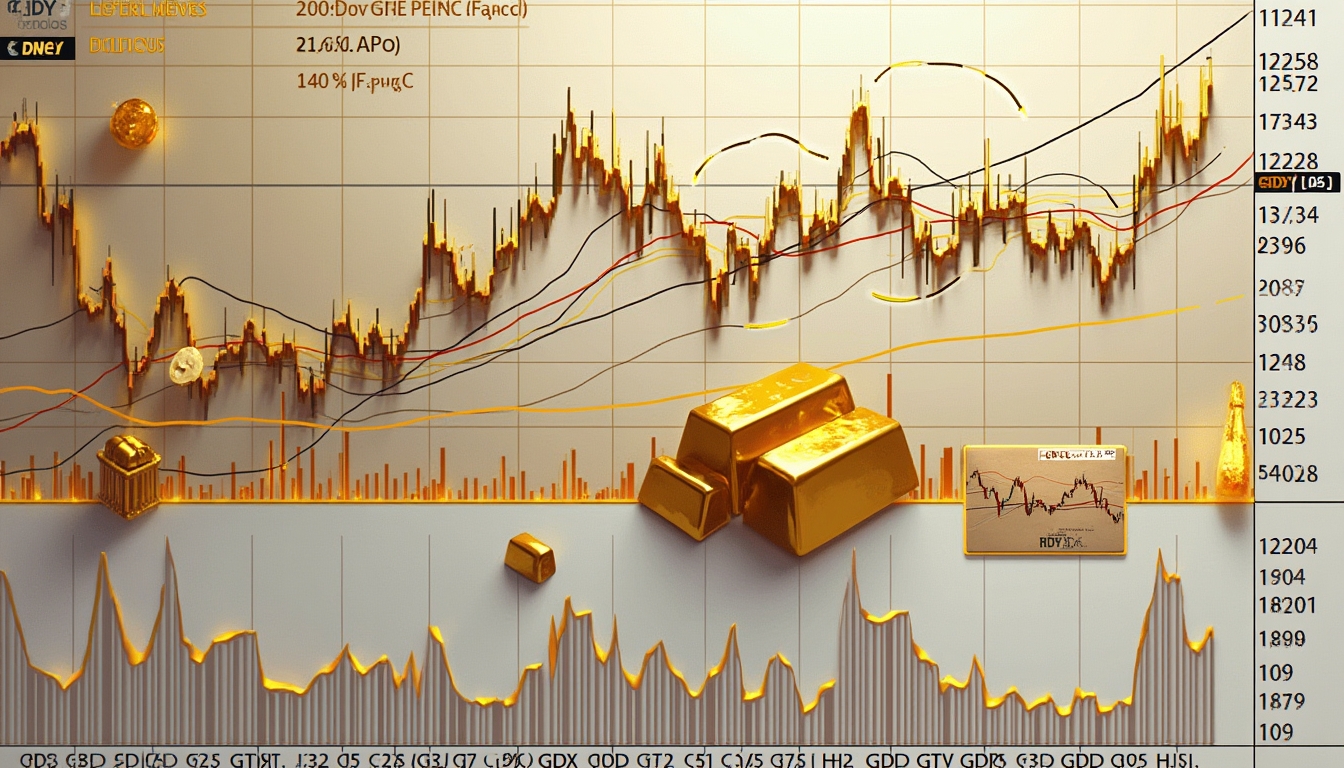

Discover the key insights behind Goldman Sachs’ revised gold price forecast, now targeting $2,910 by year-end 2026, influenced by global economic trends and central bank dynamics.

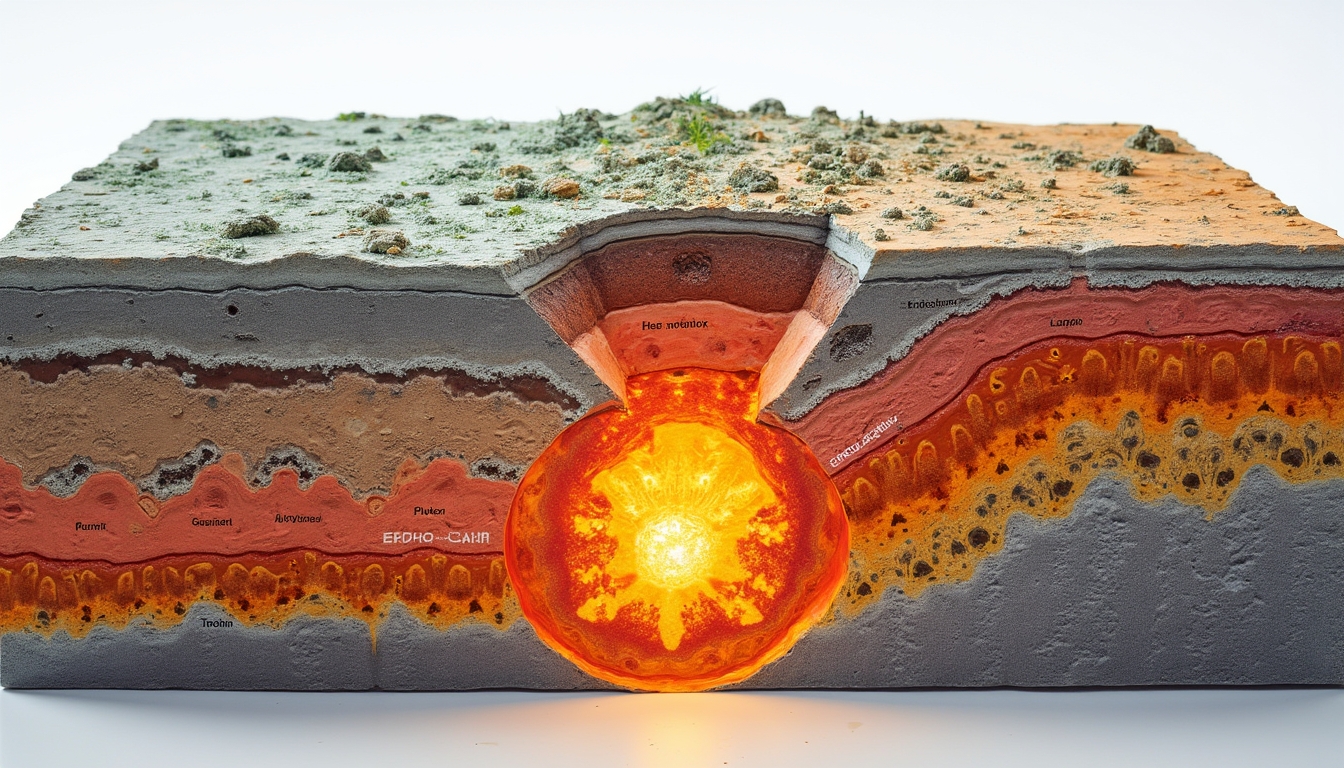

Discover the fascinating world of scarn zones, unique geological formations created by metasomatism, and learn about their mineral diversity and economic significance in mineral exploration.

Explore how the global lithium market is dealing with price volatility and policy changes in 2025, pushing Australian producers towards strategic innovations and resilience.

Explore the pivotal recovery and strategic shifts in the global lithium market for 2024, highlighting key production regions, market challenges, and future growth opportunities.

Discover how Direct Lithium Extraction is transforming the battery metal industry with its eco-friendly, efficient methods, responding to the surging global demand for lithium.

Discover expert insights on the most promising investment sectors for 2025, including gold, energy, copper, and data centers, with strategies for navigating market challenges and opportunities.

Discover crucial gold and silver market trends for 2025, including technical indicators, gold-silver ratio analysis, and potential breakout opportunities in precious metals investments.

Explore the unexpected halt in uranium production at Kazakhstan’s JV Inkai, its regulatory challenges, and the anticipated minimal market impact as Kazatomprom and Cameco navigate this complex mining landscape.

Explore PT Freeport Indonesia’s strategic maneuvers to extend its copper export permit amid operational setbacks at the Manyar smelter and the implications for Indonesia’s mining sector.

Discover why central banks are amassing gold reserves as a strategic asset since the 2007-2008 crisis, driven by economic resilience and global uncertainties.

Explore China’s strategic export restrictions on battery and mineral technologies, aimed at maintaining global dominance and reshaping international supply chains with significant economic and geopolitical implications.