BHP's Copper Dominance: How the Mining Giant Became the World's Largest Producer

BHP has strategically transformed its business model to focus on copper production, resulting in significant growth and positioning itself as a global leader in the red metal. The company's deliberate shift toward copper has yielded impressive financial results and established a strong foundation for future growth in this essential commodity.

How Has BHP Transformed Its Copper Portfolio?

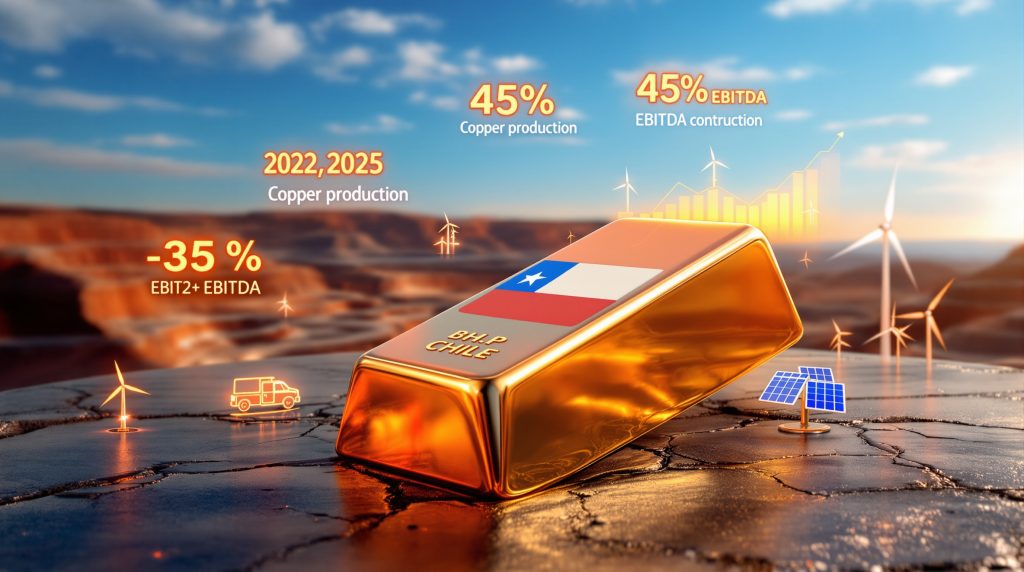

BHP's strategic pivot toward copper production has dramatically transformed its business model. Through strategic acquisitions and operational investments, the company has increased copper production by 28% over the past three years, reaching a record 2,017 kilotonnes in FY25. This expansion has positioned copper as the dominant contributor to BHP's earnings, representing 45% of total underlying EBITDA—up significantly from just 29% one year prior.

The company's copper EBITDA reached an unprecedented US$12.3 billion in FY25, marking a 44% increase compared to the previous year. With impressive EBITDA margins of 59% for copper operations, this strategic shift has proven financially rewarding despite fluctuations in other commodity markets.

Key Copper Production Milestones

-

Record 2,017 kt copper production in FY25 (8% increase year-over-year)

-

28% increase in copper production since FY22

-

Escondida mine achieved highest output in 17 years (16% increase)

-

Spence mine reached record production levels

-

Copper now contributes 45% of BHP's total EBITDA (up from 29% in FY24)

What Copper Assets Does BHP Currently Operate?

BHP's copper portfolio spans multiple continents and includes some of the world's most significant copper market trends. The company has strategically assembled these assets through a combination of long-term investments and strategic acquisitions.

Chilean Operations

-

Escondida: BHP holds a 57.5% ownership stake and operates the world's largest copper producer. The operation delivered its highest output in 17 years during FY25.

-

Pampa Norte: This operation consists of two sites:

- Spence: Currently operational and achieving record production levels

- Cerro Colorado: Currently in care and maintenance

South Australian Operations

Following the 2023 acquisition of OZ Minerals, BHP created its Copper South Australia division, which includes:

-

Olympic Dam: BHP's long-standing copper-uranium-gold operation

-

Prominent Hill: Copper-gold mine acquired through OZ Minerals

-

Carrapateena: Copper-gold mine acquired through OZ Minerals

-

Oak Dam: An exploratory deposit with future potential

Global Joint Ventures and Development Projects

-

Antamina (Peru): BHP holds a 33.75% stake in this copper and zinc mine

-

Resolution Copper Project (Arizona, USA): BHP owns 45% of this undeveloped project, considered one of the world's largest untapped copper resources

-

Vicuña Project (Argentina): In FY25, BHP invested US$2.1 billion to acquire a 50% interest in this pre-construction project, which includes the Filo del Sol deposit—described as one of the largest greenfield copper discoveries in three decades

Why Is Copper Central to BHP's Future Strategy?

The strategic shift toward copper aligns with BHP's long-term vision of positioning itself at the center of global energy transition efforts. Copper's unique properties make it essential for electrification and renewable energy infrastructure, creating strong demand fundamentals.

Copper's Role in the Energy Transition

Copper is fundamental to:

-

Renewable energy infrastructure (wind turbines, solar panels)

-

Electric vehicle production (3-4 times more copper than conventional vehicles)

-

Power grid expansion and modernization

-

Energy storage systems

-

Data centers and AI infrastructure

Market Growth Projections

BHP forecasts global copper demand to increase from approximately 33 million tonnes annually today to more than 50 million tonnes by 2050—a growth of over 50%. This projection is driven by three key factors:

-

Traditional economic growth: Home building, electrical equipment, and household appliances

-

Energy transition demand: Renewables and electric vehicles

-

Digital infrastructure expansion: Artificial intelligence and data centers

Supply Constraints

While demand continues to grow, copper faces significant supply challenges:

-

Declining ore grades at existing mines

-

Limited new discoveries

-

Long development timelines for new projects

-

Geopolitical complications in key mining regions

These supply constraints, combined with surging copper demand, create favorable long-term pricing fundamentals for copper producers with established operations.

How Is BHP Investing in Its Copper Future?

BHP allocated US$4.5 billion of its US$9.8 billion capital and investment costs to copper in FY25, demonstrating the company's commitment to expanding its copper footprint. The company has stated it expects to invest approximately 70% of its medium-term capital expenditure in copper and potash to position itself for anticipated higher long-term demand.

Strategic Acquisition Approach

BHP's copper strategy has been characterized by:

-

Targeted acquisitions: The OZ Minerals acquisition added significant Australian copper assets to BHP's portfolio

-

Joint venture investments: The US$2.1 billion investment in the Vicuña project with Lundin Mining

-

Operational excellence: Driving production improvements at existing operations like Escondida

-

Early-stage exploration: Maintaining a pipeline of future development opportunities

Production Growth Targets

BHP's copper production has increased by 28% since FY22, and the company continues to pursue growth opportunities. With global copper demand expected to increase by approximately 17 million tonnes annually over the next 25 years, BHP is positioning itself to capture an increasing share of this growing market.

What Market Conditions Are Driving BHP's Copper Focus?

Several market factors support BHP's strategic emphasis on copper:

Favorable Pricing Environment

-

Average realized copper price in FY25: US$4.25 per pound (up 7% from FY24)

-

Strong EBITDA margins of 59% for copper operations

Chinese Demand Strength

BHP noted that Chinese copper demand exceeded expectations during FY25, driven by:

-

Increased power infrastructure investment

-

Policy support for domestic consumer durables

-

Sharp rise in exports of manufactured goods

Shifting Investment Priorities

BHP's investment strategy reflects a broader shift in focus:

-

Approximately 70% of medium-term capital expenditure allocated to copper and potash

-

Anticipation of higher long-term demand as China's economy transitions from construction-focused to consumer-focused

How Does Copper Compare to BHP's Traditional Iron Ore Business?

While BHP remains the world's lowest-cost major iron ore producer, the relative contribution of iron ore to the company's earnings has declined as copper has grown in importance.

Production Comparison

-

Iron ore production: 263 Mt in FY25 (up 1% year-over-year)

-

Copper production: 2,017 kt in FY25 (up 8% year-over-year)

Price Performance

-

Average realized iron ore price: US$82.13 per wet metric tonne (down 19% from FY24)

-

Average realized copper price: US$4.25 per pound (up 7% from FY24)

Margin Comparison

-

Iron ore EBITDA margin: 63% in FY25

-

Copper EBITDA margin: 59% in FY25

Despite iron ore maintaining slightly higher margins, copper's growing contribution to overall earnings reflects both increased production volumes and more favorable price performance.

What Challenges Does BHP Face in Copper Production?

Despite the strategic advantages of focusing on copper, BHP faces several challenges:

Operational Complexities

-

Managing declining ore grades at mature operations

-

Water management in drought-prone regions

-

Energy costs and decarbonization efforts

Geopolitical Considerations

-

Regulatory changes in Chile, where BHP operates its largest copper assets

-

Community relations and social license to operate

-

Potential resource nationalism in copper-producing countries

Competition for Resources

-

Increasing competition for high-quality copper assets

-

Rising acquisition costs for copper projects

-

Technical challenges in developing lower-grade deposits

How Does BHP's Copper Strategy Align with Investor Expectations?

BHP's strategic pivot toward copper appears to be resonating with investors. Despite reporting a 26% decrease in underlying profit in its FY25 results, BHP shares rose by 1.57% on the day of the announcement. This positive reaction suggests investors recognize the long-term value of the company's copper-focused strategy.

Investment Thesis

For investors, BHP's copper strategy offers:

-

Exposure to energy transition metals: Positioning in a high-demand commodity with strong long-term fundamentals

-

Portfolio diversification: Reduced reliance on iron ore, which has historically been more volatile

-

Growth potential: Opportunities for production expansion through existing assets and new projects

-

Margin resilience: Strong EBITDA margins of 59% for copper operations

Financial Performance Indicators

-

Record copper EBITDA of US$12.3 billion in FY25 (up 44% year-over-year)

-

Copper contributing 45% of total underlying EBITDA

-

Strong operational cash flow supporting dividend payments despite overall profit decline

What Is the Future Outlook for BHP's Copper Business?

BHP's future in copper looks promising based on market fundamentals and the company's strategic positioning.

Market Growth Projections

The company forecasts global copper demand to increase from approximately 33 million tonnes annually today to more than 50 million tonnes by 2050, driven by:

-

Urbanization and industrialization: Particularly in China and India

-

Electrification trends: Increasing copper intensity in modern economies

-

Renewable energy expansion: Higher copper requirements for green infrastructure

BHP's Competitive Advantages

As the world's largest BHP copper producer with the largest copper resource base (by equity share), BHP is well-positioned to benefit from these trends through:

-

Scale efficiencies: Operating some of the world's largest copper mines

-

Technical expertise: Demonstrated ability to improve production at existing operations

-

Financial strength: Capacity to invest in expansion and development projects

-

Diversified portfolio: Operations across multiple jurisdictions reducing country-specific risks

Development Pipeline

BHP's future copper growth will be supported by:

-

Continued optimization of existing operations

-

Development of the Resolution Copper Project in Arizona

-

Advancement of the Vicuña project in Argentina

-

Potential new discoveries and acquisitions

FAQ: BHP's Copper Strategy

How much copper does BHP currently produce?

BHP produced 2,017 kilotonnes of copper in FY25, an 8% increase from the previous year and a 28% increase since FY22.

What percentage of BHP's earnings comes from copper?

Copper contributed 45% of BHP's total underlying EBITDA in FY25, up from 29% in FY24.

Where are BHP's main copper operations located?

BHP's main copper operations are in Chile (Escondida and Pampa Norte) and South Australia (Olympic Dam, Prominent Hill, and Carrapateena). The company also has joint venture interests in Peru (Antamina) and development projects in the United States (Resolution) and Argentina (Vicuña).

How does BHP's copper strategy align with global energy transition goals?

Copper is essential for renewable energy infrastructure, electric vehicles, and grid modernization—all key components of the global energy transition. BHP's increased focus on copper positions the company to benefit from growing demand for these applications.

What is BHP's competitive position in the global copper market?

BHP claims to be the world's largest copper producer based on 2024 calendar year production data compared to competitors. The company also states it owns the world's largest copper resource base on a contained metal basis by equity share. Furthermore, investors looking for insights into future copper price prediction and global copper supply outlook may find BHP's positioning particularly relevant, especially considering the copper-uranium investment insights from their South Australian operations.

Looking for the Next Major Mineral Discovery?

Stay ahead of the market with Discovery Alert's proprietary Discovery IQ model, which instantly notifies investors of significant ASX mineral discoveries through real-time alerts. Explore historic examples of exceptional investment returns from major discoveries by visiting Discovery Alert's dedicated discoveries page and begin your 30-day free trial today.