Understanding Brazil's Newest Energy Frontier

The Bumerangue oil discovery represents a transformative milestone in Brazil's offshore energy landscape, establishing new benchmarks for deepwater exploration success in the strategically important Santos Basin. Located 404 kilometers offshore from Rio de Janeiro, this massive hydrocarbon find sits beneath 2,372 meters of water depth, demonstrating the technological sophistication required for modern deepwater operations. The exploration well, designated 1-BP-13-SPS, penetrated to a remarkable 5,855 meters total depth, revealing what BP characterizes as its largest exploration success in 25 years.

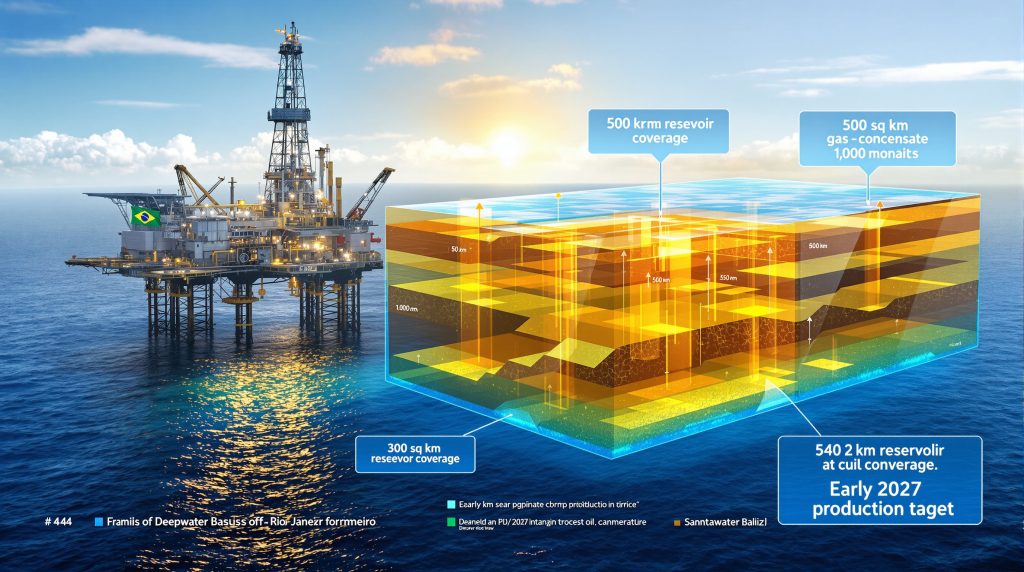

Laboratory analysis has revealed a gross hydrocarbon column of approximately 1,000 meters, significantly exceeding initial estimates of 500 meters. This substantial column comprises distinct zones: a 100-meter gross oil layer and an extensive 900-meter liquids-rich gas-condensate section. The discovery spans an areal extent exceeding 300 square kilometers, indicating substantial lateral distribution across high-quality pre-salt carbonate formations that typically exhibit superior reservoir characteristics compared to conventional sandstone sequences.

Geographic Location and Strategic Positioning

The Santos Basin has emerged as Brazil's premier petroleum province, with the Bumerangue discovery positioned within the pre-salt play that has revolutionized South American energy production. Pre-salt formations, characterized by their position beneath thick salt layers deposited millions of years ago, contain some of the world's highest-quality reservoir rocks. These carbonate formations demonstrate exceptional porosity and permeability properties, enabling efficient hydrocarbon extraction despite extreme water depths and technical complexity.

The specific positioning 404 kilometers from Rio de Janeiro places Bumerangue within established shipping lanes and potential pipeline corridors, offering logistical advantages for future development. The 2,372-meter water depth represents the sweet spot for deepwater technology applications, deep enough to access premium pre-salt reservoirs while remaining within proven operational capabilities for floating production systems and subsea infrastructure.

Technical Specifications That Define the Discovery

The reservoir quality encountered at Bumerangue demonstrates characteristics that support BP's confidence in development feasibility. High-grade pre-salt carbonate formations typically exhibit:

• Porosity values ranging from 15-25 percent, enabling substantial hydrocarbon storage capacity

• Permeability measurements often exceeding 100 millidarcies, facilitating efficient production rates

• Structural integrity supporting horizontal drilling and enhanced recovery techniques

• Minimal water encroachment due to favorable geological positioning

The presence of liquids throughout the entire hydrocarbon column provides operational flexibility, allowing for diversified product streams including crude oil, natural gas liquids, and gas condensate. This compositional diversity typically enhances project economics by providing multiple revenue streams and market exposure options.

How Significant Is This Discovery in Global Context?

The Bumerangue oil discovery establishes unprecedented benchmarks within BP's exploration portfolio, representing the company's largest find across 25 years of global operations. This achievement arrives within a remarkable year for BP's exploration division, which announced 12 separate discoveries across multiple basins in 2025 alone. However, Bumerangue's scale distinguishes it significantly from these other finds, positioning it as a cornerstone asset for BP's upstream growth strategy.

Industry analysis suggests the discovery's 1,000-meter hydrocarbon column with substantial liquids content places it among the most significant deepwater finds in recent years. The combination of oil and gas-condensate zones provides revenue diversification advantages rarely achieved in single discoveries, particularly given the 300+ square kilometer areal extent that suggests substantial recoverable volumes.

Historical Perspective on BP's Exploration Success

BP's exploration achievements in 2025 demonstrate systematic success across diverse geological settings. Beyond Bumerangue, the company's Volans-1X discovery in Namibia's Orange Basin encountered 26 meters of net pay in gas condensate-bearing reservoirs with a condensate-to-gas ratio exceeding 140 barrels per million standard cubic feet. This parallel success reinforces BP's technical capabilities in deepwater exploration while highlighting Bumerangue's exceptional characteristics.

The company's strategic positioning includes plans to grow global upstream production to 2.3-2.5 million barrels per day by 2030, with capacity for further increases through 2035. Bumerangue represents a material component of this production growth strategy, supported by BP's commitment of approximately $10 billion annually through 2027 for upstream investments.

| Development Milestone | Timeline | Strategic Impact |

|---|---|---|

| Discovery Announcement | August 2025 | Largest BP find in 25 years |

| Laboratory Analysis | 2025-2026 | Fluid characterization completion |

| Appraisal Planning | 2026-2027 | Regulatory approvals and well design |

| Production Target Integration | 2030+ | Contribution to 2.3-2.5 million bpd goal |

Brazil's Energy Landscape Transformation

The Santos Basin has undergone dramatic transformation since pre-salt discoveries began reshaping Brazil's energy profile in the mid-2000s. These geological formations, positioned beneath ancient salt deposits, contain reservoir rocks with exceptional quality characteristics that enable high production rates and substantial recovery factors. The Bumerangue oil discovery adds significant scale to this already productive basin, potentially extending Brazil's position as a major global petroleum exporter.

Brazil's pre-salt province has demonstrated consistent ability to support large-scale developments despite technical complexity. Previous discoveries in the region have achieved production rates exceeding 100,000 barrels per day from individual fields, establishing proof-of-concept for deepwater pre-salt commercialisation. Furthermore, global oil price movements significantly influence the commercial viability of such large-scale deepwater projects. Bumerangue's scale suggests potential for similar or greater production capacity, contingent upon successful appraisal results and development execution.

What Are the Technical Challenges Facing Development?

Carbon Dioxide Management Requirements

Laboratory analysis confirmed the presence of elevated carbon dioxide levels within Bumerangue's reservoir fluids, representing the primary technical challenge for commercial development. While specific CO₂ concentration percentages remain undisclosed, industry experience demonstrates that elevated carbon dioxide content typically ranges from 5-30 percent in similar deepwater discoveries, requiring specialised processing infrastructure.

"Elevated CO₂ levels historically represent a significant constraint on commercial viability for similar prospects, necessitating enhanced processing technologies and operational procedures that impose both capital and operational cost implications."

Carbon dioxide separation technologies applicable to offshore operations include:

• Amine-based chemical absorption systems utilising monoethanolamine (MEA) or diethanolamine (DEA) solvents

• Physical separation technologies including membrane systems designed for high-pressure applications

• Cryogenic separation processes enabling precise component separation at extremely low temperatures

• Hybrid processing systems combining multiple technologies for optimal separation efficiency

BP has expressed confidence that the CO₂ challenge can be managed through proven technologies, citing the company's extensive deepwater development experience and the presence of liquids across the entire hydrocarbon column. However, the company acknowledges that specialised processing approaches will be required, potentially including carbon capture and storage considerations for separated CO₂ streams.

Structural Complexity and Drilling Considerations

Pre-salt formations in the Santos Basin frequently exhibit structural compartmentalisation resulting from complex geological history including faulting, folding, and depositional architecture variations. These characteristics can create isolated reservoir compartments that affect:

• Pressure regime distribution across the field, influencing well placement and production optimisation

• Fluid communication patterns between reservoir sections, impacting recovery efficiency estimates

• Drilling risk profiles requiring precise well positioning to avoid structural boundaries

• Development well spacing optimisation to maximise reservoir contact and production rates

The 5,855-meter total depth achieved at Bumerangue demonstrates successful navigation of these complex geological conditions. The reservoir penetration approximately 500 meters below the structural crest indicates favourable positioning for gravity drainage and pressure maintenance, supporting enhanced recovery potential through the field's productive life.

When Will Commercial Production Begin?

Appraisal Timeline and Regulatory Pathway

BP has announced that appraisal well activities are expected to commence in early 2027, representing approximately 18-24 months from the August 2025 initial discovery announcement. This timeline reflects the complexity of planning deepwater appraisal operations while navigating Brazilian regulatory requirements administered by ANP (Agência Nacional do Petróleo).

The appraisal programme will focus on:

- Reservoir delineation through additional exploration and appraisal wells

- Fluid characterisation completion including gas-to-oil and condensate-to-gas ratio determinations

- Volumetric assessment for in-place hydrocarbon estimates and recovery factor calculations

- Development concept optimisation including well placement and production system design

Laboratory analysis continues for comprehensive fluid characterisation, with results expected to provide critical data supporting commercial viability assessments. These analyses will determine specific hydrocarbon compositions, CO₂ concentration levels, and processing requirements necessary for development planning.

Development Concepts Under Consideration

BP has indicated consideration of potential early production system implementation, suggesting accelerated development pathways rather than extended appraisal phases. Early production systems enable hydrocarbon production prior to full field development, providing several strategic advantages:

• Cash flow generation during extended development phases, improving project economics

• Reservoir performance validation through actual production data rather than modelling alone

• Market position establishment securing crude oil and gas sales agreements

• Technical risk mitigation by proving production concepts before major capital commitment

The development timeline positions potential first production within BP's strategic timeframe for achieving 2.3-2.5 million barrels per day by 2030, assuming successful appraisal results and regulatory approvals proceed as planned. However, current oil price trends could influence the timing and scale of investment decisions for such significant offshore developments.

| Phase | Timeline Estimate | Key Activities |

|---|---|---|

| Regulatory Approval | 2026-2027 | ANP submissions and environmental permits |

| Appraisal Drilling | Early 2027+ | Additional wells and reservoir evaluation |

| Development Decision | 2027-2028 | Commercial viability determination |

| Early Production | 2029-2030 | Potential fast-track production system |

Who Controls the Bumerangue Block and Operations?

Ownership Structure and Partnership Details

BP maintains 100 percent working interest in the Bumerangue exploration block, providing exclusive operational control and decision-making authority over all development activities. This ownership structure eliminates joint venture complexities common in many deepwater projects, enabling streamlined decision-making and capital allocation processes.

Pré-Sal Petróleo S.A. serves as the Production Sharing Contract manager, representing the Brazilian government's interests in pre-salt resource development. This entity functions as the contractual intermediary between BP and Brazilian regulatory authorities, ensuring compliance with national petroleum policies and revenue sharing agreements.

BP acquired the Bumerangue block in December 2022 through ANP's 1st Cycle of Open Acreage competitive bidding process. This acquisition represents strategic positioning within Brazil's petroleum sector, supporting BP's stated ambition to "explore the potential of establishing a material and advantaged production hub in the country."

Strategic Positioning Within BP's Portfolio

The Bumerangue oil discovery integrates directly into BP's upstream production growth strategy, contributing toward the company's 2.3-2.5 million barrels per day target by 2030. This discovery supports BP's broader strategic reset announced in February 2025, emphasising increased oil and gas investment allocation and improved upstream performance.

BP's commitment includes:

• $10 billion annual investment through 2027 for upstream oil and gas development

• 10 major project startups planned by end of 2027 across global portfolio

• Production capacity increases extending through 2035 based on resource base expansion

• Strategic geographic diversification with Brazil representing a key growth region

What Economic Impact Could This Discovery Generate?

Production Potential and Market Implications

The Bumerangue oil discovery presents substantial economic potential based on its exceptional scale and reservoir characteristics. The 1,000-meter gross hydrocarbon column with 300+ square kilometer areal extent suggests recoverable volumes potentially ranking among the largest deepwater discoveries in recent years.

"Initial reservoir analysis indicates substantial hydrocarbon volumes, though precise commercial quantities require comprehensive appraisal results to establish definitive recovery estimates and production profiles."

Revenue potential depends on several critical factors:

• Hydrocarbon composition including oil, natural gas liquids, and gas condensate ratios

• Production rate capabilities based on reservoir quality and well performance

• Development cost structures influenced by CO₂ processing requirements and deepwater complexity

• Commodity price environments for crude oil and natural gas over the field's productive life

The presence of liquids throughout the entire hydrocarbon column provides revenue diversification advantages, enabling multiple product streams that can optimise returns based on market conditions. Meanwhile, the broader implications of US oil production decline could create additional market opportunities for Brazilian offshore developments. Oil and gas condensate typically command premium pricing compared to dry gas, enhancing overall project economics.

Infrastructure and Investment Requirements

Deepwater development at 2,372-meter water depth requires substantial infrastructure investment including:

Subsea Infrastructure:

• Subsea production systems rated for extreme water depths and pressures

• Umbilicals, risers, and flowlines connecting wells to surface facilities

• Manifolds and processing equipment for multiple well tie-ins

• Pipeline systems for hydrocarbon transportation to shore or floating facilities

Surface Processing Facilities:

• Floating Production Storage and Offloading (FPSO) vessels or fixed platforms

• CO₂ separation and processing equipment designed for elevated concentrations

• Export systems including tanker loading or pipeline connections

• Power generation and utilities supporting offshore operations

Specialised CO₂ Management:

• Enhanced processing trains for carbon dioxide separation from production streams

• Potential carbon capture and storage systems for separated CO₂

• Environmental compliance systems meeting Brazilian offshore regulations

• Monitoring and safety systems for high-CO₂ operations

Employment generation potential includes direct operational positions, specialised technical roles, and extensive supply chain opportunities throughout Brazil's energy sector. Deepwater projects typically generate 500-2,000 direct jobs during development phases, with ongoing operational employment supporting hundreds of positions over field life.

How Does Bumerangue Compare to Other Major Discoveries?

Regional Discovery Benchmarking

Within the Santos Basin context, the Bumerangue oil discovery establishes new scale benchmarks for recent deepwater finds. The 1,000-meter hydrocarbon column significantly exceeds typical Santos Basin discoveries, which commonly range from 100-400 meters gross thickness. This exceptional column height, combined with 300+ square kilometer areal extent, positions Bumerangue among the basin's largest prospects.

Historical Santos Basin developments provide comparative context:

| Field Name | Discovery Year | Column Height | Development Status |

|---|---|---|---|

| Lula (Tupi) | 2006 | ~400 meters | Producing 1M+ bpd |

| Libra | 2010 | ~350 meters | Development phase |

| Buzios | 2010 | ~300 meters | Producing 600K+ bpd |

| Bumerangue | 2025 | ~1,000 meters | Appraisal planned |

The reservoir quality indicators at Bumerangue suggest potential for production rates comparable to or exceeding existing Santos Basin champions. However, the elevated CO₂ content represents a differentiating factor requiring specialised processing approaches not commonly employed in regional developments.

Global Deepwater Discovery Context

Internationally, the Bumerangue oil discovery ranks among 2025's most significant offshore finds. The combination of scale, reservoir quality, and hydrocarbon diversity positions it favourably against other major deepwater discoveries worldwide. Furthermore, the trade war impact on oil markets continues to shape global investment priorities and development schedules for major offshore projects. BP's parallel success at Namibia's Volans-1X discovery, with 26 meters of net pay and 140+ barrel per million cubic feet condensate ratios, demonstrates the company's systematic exploration success across multiple basins.

Global deepwater exploration trends emphasise high-impact prospects capable of supporting large-scale developments. Bumerangue's characteristics align perfectly with industry preferences for:

• Substantial resource volumes supporting extended field lives and significant production rates

• High-quality reservoir properties enabling efficient recovery and attractive economics

• Diversified hydrocarbon compositions providing market flexibility and revenue optimisation

• Established basin infrastructure supporting accelerated development and reduced costs

What Are the Environmental and Sustainability Considerations?

Carbon Management and Climate Impact

The presence of elevated CO₂ levels in Bumerangue reservoir fluids creates both environmental challenges and potential sustainability opportunities. While carbon dioxide separation requires additional processing infrastructure and energy consumption, the captured CO₂ streams present options for beneficial utilisation or permanent storage.

Carbon Capture and Storage Applications:

• Geological sequestration in depleted reservoirs or saline aquifers offshore Brazil

• Enhanced oil recovery applications in mature Santos Basin fields

• Carbon utilisation for chemical manufacturing or other industrial applications

• Regulatory compliance with Brazil's evolving carbon management policies

According to Rigzone, BP has described the initial results at Bumerangue as "extremely encouraging," while acknowledging the need for sophisticated environmental management approaches. The company's extensive deepwater experience includes successful management of high-CO₂ reservoirs in other global locations, providing proven technical foundations for Bumerangue development.

Marine Environment Protection Measures

Deepwater operations at 2,372-meter water depth require comprehensive environmental protection protocols addressing:

Marine Ecosystem Safeguards:

• Baseline environmental surveys documenting existing marine life and habitat conditions

• Real-time monitoring systems tracking potential environmental impacts during operations

• Spill prevention and response capabilities sized for deepwater operational requirements

• Waste management systems minimising environmental discharge and contamination risks

Regulatory Compliance Framework:

• Brazilian environmental regulations governing offshore petroleum operations

• International maritime standards for deepwater drilling and production activities

• Environmental impact assessments addressing all phases from exploration through decommissioning

• Community consultation processes engaging local stakeholders and indigenous groups

"Modern deepwater developments incorporate advanced environmental protection technologies and monitoring systems that significantly exceed historical industry standards, reflecting both regulatory requirements and corporate sustainability commitments."

What's Next for the Bumerangue Development?

Short-term Milestones and Objectives

The Bumerangue oil discovery development pathway focuses on systematic progression through critical technical and regulatory milestones over the next 24 months. Laboratory analysis continuation aims to complete comprehensive fluid characterisation, determining precise hydrocarbon compositions, CO₂ concentration levels, and processing requirements essential for development planning.

Critical Near-term Activities:

• Gas-to-oil ratio determination establishing production stream compositions and processing requirements

• Condensate-to-gas ratio calculations optimising product mix and revenue potential

• In-place volume estimations supporting reserve calculations and commercial assessments

• Regulatory approval processes for appraisal activities planned to commence in early 2027

ANP regulatory engagement represents a critical pathway component, requiring detailed technical submissions demonstrating environmental compliance, operational safety protocols, and development concepts. Additionally, offshore energy industry analysis highlights that this represents BP's largest deepwater oil and gas find offshore Brazil in 25 years. Brazilian regulatory processes typically span 12-18 months for major deepwater projects, necessitating early and comprehensive preparation.

Long-term Development Scenarios

Full Field Development Considerations:

The ultimate development approach for Bumerangue will balance technical requirements, economic optimisation, and environmental sustainability. Key decision factors include:

• Processing technology selection for optimal CO₂ management and hydrocarbon recovery

• Production system design including FPSO specifications, well count, and subsea infrastructure

• Market integration strategy for crude oil, natural gas liquids, and gas condensate sales

• Phased development sequencing potentially including early production systems followed by full field expansion

Integration with Brazilian Infrastructure:

Bumerangue's 404-kilometre offshore location positions the discovery within established shipping corridors and potential pipeline networks serving Brazilian and export markets. Integration opportunities include:

• Existing FPSO hub concepts enabling shared infrastructure and reduced development costs

• Pipeline corridor utilisation connecting to onshore processing and distribution facilities

• Port facility integration at established Brazilian petroleum export terminals

• Supply chain optimisation leveraging existing Santos Basin service and logistics networks

Industry Knowledge and Investment Implications

Technical Expertise and Market Dynamics

The Bumerangue oil discovery represents convergence of several critical industry trends that define modern deepwater petroleum development. Pre-salt carbonate reservoirs demand specialised technical approaches significantly different from conventional sandstone developments, requiring enhanced drilling technologies, advanced completion designs, and sophisticated production optimisation strategies.

Specialised Technical Requirements:

• Horizontal drilling capabilities with extended reach and precise directional control

• Intelligent completion systems enabling real-time production optimisation and reservoir management

• High-pressure, high-temperature equipment rated for extreme deepwater conditions

• Corrosion-resistant materials designed for long-term exposure to CO₂-rich environments

The presence of elevated CO₂ concentrations necessitates specialised metallurgy and processing equipment not commonly employed in conventional offshore developments. These requirements typically increase capital costs by 15-25 percent compared to standard deepwater projects, while also extending engineering and procurement timelines.

Investment Strategy Considerations

From an investment perspective, the Bumerangue oil discovery presents both exceptional opportunities and significant risk factors that require careful evaluation. The discovery's scale suggests potential for substantial cash flow generation, while technical complexity and regulatory requirements create execution risks that could impact project economics.

Investment Attractiveness Factors:

• Resource scale indicating potential for long-term, high-rate production

• Operator expertise with BP's proven deepwater development capabilities

• Geographic positioning within established petroleum province with existing infrastructure

• Product diversification through oil and gas condensate production streams

Risk Considerations:

• CO₂ management complexity potentially impacting project costs and timelines

• Regulatory approval timeline affecting development schedule and cash flow timing

• Commodity price exposure influencing long-term project economics

• Technical execution risks inherent in deepwater development complexity

Moreover, recent trends of oil prices easing due to various geopolitical factors could influence the timing and economics of major offshore developments like Bumerangue.

"While the Bumerangue discovery demonstrates exceptional resource potential, successful commercialisation depends on effective management of elevated CO₂ levels, regulatory approvals, and technical execution across multiple complex development phases."

The discovery's integration into BP's 2.3-2.5 million barrel per day production target by 2030 provides strategic context for investment timing and scale. Early production system implementation could accelerate cash flow generation, though full field development economics ultimately determine long-term investment returns.

Disclaimer: This analysis involves forecasts, speculation, and assumptions regarding future commodity prices, regulatory approvals, technical execution, and commercial development timelines. Actual results may differ significantly from projected scenarios due to various technical, commercial, and regulatory factors beyond current knowledge or control.

Ready to Capitalise on Major Energy Discoveries?

Discovery Alert's proprietary Discovery IQ model delivers instant notifications on significant ASX energy and mineral discoveries, empowering subscribers to identify actionable opportunities ahead of the broader market. Explore historic examples of exceptional discovery returns and begin your 30-day free trial today at Discovery Alert to position yourself advantageously for the next major breakthrough.