What Makes Canada a Prime Uranium Exploration Destination?

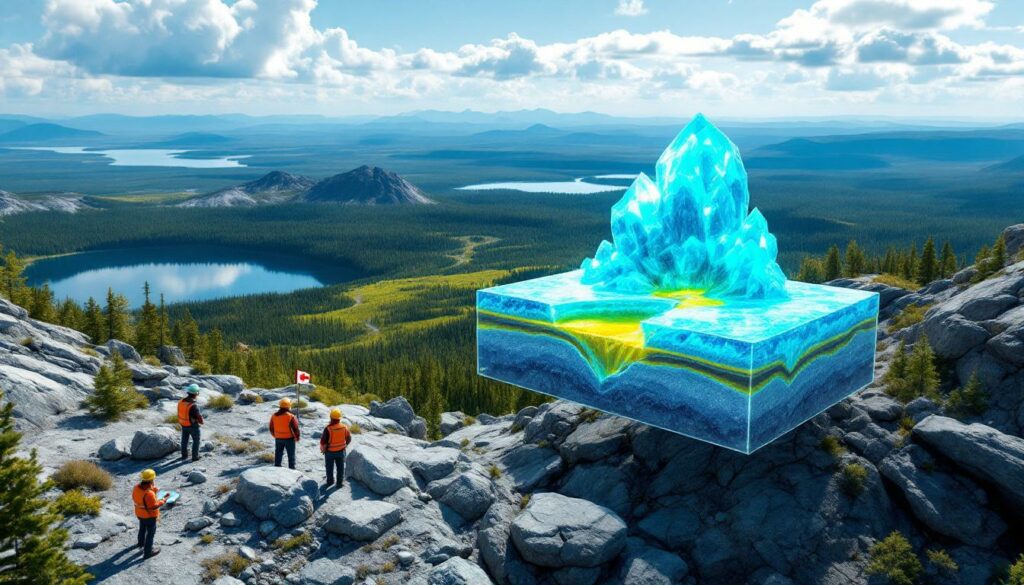

Canada stands as a global powerhouse in uranium exploration and production, controlling approximately 15% of worldwide uranium output primarily from Saskatchewan's Athabasca Basin (World Nuclear Association, 2024). The country's geological bounty offers exceptional opportunities for companies seeking high-grade uranium deposits across several key regions.

Key Canadian Uranium Districts

-

Athabasca Basin (Saskatchewan): The crown jewel of global uranium exploration, hosting deposits with grades 10-100 times higher than global averages of 0.1-0.2% U₃O₈. Cigar Lake, for example, boasts an extraordinary 14.8% U₃O₈ grade (Cameco Corp., 2023 Annual Report).

-

Thelon Basin: A geological formation sharing structural similarities with the Athabasca Basin, spanning parts of Nunavut and the Northwest Territories.

-

Anjukuni Basin (Nunavut): An emerging exploration frontier with compelling geological characteristics matching productive uranium-bearing basins.

-

Other Sub-basins: Various interconnected geological formations across northern Canada that share favorable conditions for uranium mineralization.

Geological Advantages of Canadian Uranium Deposits

Canadian uranium deposits offer several distinct advantages that attract global exploration investment:

"Canada has the best uranium jurisdictions… Our Angilak Project covers the Anjukuni Basin, a sub-basin with the same geological traits as the Athabasca." – Troy Boisvert, CEO of AHA Energy Corp.

The country's deposits typically feature:

-

Exceptional grades: While global uranium deposits average 0.1-0.2% U₃O₈, Canadian deposits frequently reach multi-percentage grades. McArthur River in Saskatchewan averages an astonishing 20.7% grade across its 324 million pound resource (Cameco Technical Report, 2022).

-

Well-defined geological structures: Unconformity-related deposits form where Proterozoic sandstone meets older basement rocks, creating ideal fluid pathways for uranium concentration.

-

Graphitic fault zones: These structures act as reductants for uranium mineralization, a critical factor in forming high-grade deposits (Jefferson et al., Economic Geology, 2007).

-

Proven production history: Saskatchewan ranks #2 globally for mining investment attractiveness (Fraser Institute, 2023 Annual Survey), offering regulatory certainty alongside geological potential.

While Saskatchewan dominates current production, Nunavut represents the next frontier for uranium exploration and development in Canada. Though producing zero uranium in 2023, the territory hosts five advanced uranium projects in permitting (Nunavut Impact Review Board, 2024), including AHA Energy's Lac 50 deposit with its historic resource of 43 million pounds at 0.69% U₃O₈ (Latitude Uranium NI 43-101, 2019).

How Do Companies Identify Promising Uranium Targets?

Successful uranium exploration requires specialized techniques and expertise that differ significantly from other mineral commodities. The technical approach combines multiple disciplines to identify the most promising drilling targets in vast exploration areas.

Modern Exploration Techniques

-

Geophysical Surveys: Gravity and electromagnetic studies identify basement structures and potential fluid pathways. These non-invasive methods allow companies to "see" beneath the surface before committing to expensive drilling programs.

-

Structural Geology Analysis: Detailed mapping of fault systems helps identify potential uranium traps, particularly where graphitic structures intersect with brittle faults.

-

Radiometric Surveys: Ground and airborne measurements of natural radioactivity provide direct detection of uranium mineralization. Readings exceeding 10,000 counts per second (CPS) typically indicate high-grade mineralization potential (IAEA, Guidelines for Radioelement Mapping, 2020).

-

Geochemical Sampling: Analysis of soil, rock, and water samples for uranium and pathfinder elements like boron and nickel, which correlate with uranium deposition in graphitic faults (Hoeve & Sibbald, Mineralium Deposita, 1978).

-

Historical Data Integration: Leveraging past exploration to build comprehensive geological models that guide new targeting.

"We used gravity/EM surveys, structural modeling, and geochemistry to derisk our 31km trend. The first drill hole hit mineralization—extremely uncommon." – Troy Boisvert, CEO of AHA Energy Corp.

The Role of Technical Expertise in Uranium Exploration

The uranium sector demands highly specialized knowledge:

-

Basin-Specific Experience: Understanding the unique characteristics of different uranium-hosting basins is crucial. Exploration methods effective in the Athabasca Basin may require modification in Nunavut's geological settings.

-

Radiometric Interpretation: Specialized training is required to interpret radioactivity measurements accurately. Site-specific calibration (using instruments like the RS-120 probe) translates CPS readings to uranium grade estimates, though chemical assays remain essential for validation (Cameco, Exploration Methodology Handbook, 2021).

-

Structural Analysis: Identifying the complex fault systems that control mineralization requires advanced geological modeling capabilities.

-

Cost Management: Exploration costs vary significantly by region—Athabasca drilling averages $800/meter versus Nunavut's $1,200/meter (Natural Resources Canada, 2024)—requiring efficient targeting to maximize return on exploration investment.

AHA Energy's approach demonstrates this technical rigor, integrating historical drilling data, geophysics, and basin-scale fault mapping at their Angilak Project, resulting in their Patterson Corridor project discovery (AHA Corporate Presentation, 2025).

What Are the Characteristics of High-Potential Uranium Systems?

When evaluating uranium exploration projects, geologists look for specific geological signatures that correlate with significant uranium deposits. These indicators help prioritize drilling targets and assess project potential.

Critical Geological Indicators

-

Graphitic Fault Zones: These carbon-rich structures serve as critical reductants in the uranium mineralization process. Graphite chemically reduces uranium from its soluble U⁶⁺ state to insoluble U⁴⁺, causing precipitation of uraninite minerals (Hoeve & Quirt, Mineralium Deposita, 1984). Approximately 70% of Athabasca Basin uranium reserves are hosted within graphitic fault structures (Jefferson et al., 2007).

-

Unconformity Offsets: Displacements at the contact between basin and basement rocks create fluid pathways and traps. Research shows 90% of Athabasca's uranium resources sit within 300 meters of these unconformities (Cameco Technical Report, 2023).

-

Brittle Structures: These fracture zones enable fluid movement through otherwise impermeable rock, facilitating uranium precipitation. Brittle fracturing is particularly important in basement-hosted deposits where structurally-controlled fluid flow concentrates mineralization (Hiatt & Kyser, Precambrian Research, 2007).

-

Sandstone-Hosted Systems: These typically form above the unconformity in basin environments, creating distinctive deposit geometries.

-

Vein-Hosted Mineralization: Often containing high-grade uranium minerals in basement rock settings below unconformities.

Case Study: Unconformity-Related Deposits

Unconformity-related deposits represent some of the most valuable uranium resources globally:

| Feature | Significance | Example |

|---|---|---|

| Unconformity Offset | Creates pathways for mineralizing fluids | P2 Fault at McArthur River (90m offset) |

| Graphitic Structures | Provides reductant for uranium precipitation | Common feature in high-grade deposits |

| Brittle Faulting | Allows fluid movement through rock | Essential for deposit formation |

| Sandstone-Basement Contact | Primary location for mineralization | Key exploration target |

"We intersected a 23m-wide graphitic fault with 90m unconformity offset—identical to the P2 Fault hosting McArthur River." – Troy Boisvert, CEO of AHA Energy Corp.

The economic implications of deposit style are significant. Basement-hosted vein deposits (like Lac 50) average 40% lower stripping ratios than sandstone-hosted deposits, potentially offering cost advantages during mining (WNA, Uranium Mining Handbook, 2022). This distinction becomes crucial when evaluating the economic potential of early-stage uranium discoveries.

How Is Uranium Mineralization Measured and Evaluated?

Uranium exploration employs specialized measurement techniques that differ substantially from those used in other mineral commodities, requiring specific expertise and equipment.

Radiometric Measurement Protocols

-

Counts Per Second (CPS): Field instruments measure natural gamma radiation emitted by uranium and its decay products. Readings above 10,000 CPS typically indicate high-grade potential, while measurements exceeding 20,000 CPS suggest percentage-grade uranium may be present (IAEA, Guidelines for Radioelement Mapping, 2020).

-

Downhole Probing: Specialized tools like the RS-120 probe measure radioactivity in drill holes, providing immediate feedback on potential mineralization. AHA Energy's peak downhole radiometry of 24,000 CPS at Ribbon Ridge correlates to approximately 2-3% U₃O₈ grades in Athabasca analogs (Cameco Internal Data, 2020).

-

Conversion Factors: Site-specific "K-factors" translate CPS readings to equivalent uranium grades. These factors must be calibrated using matched pairs of radiometric measurements and chemical assays from the same location.

-

Laboratory Assays: ICP-MS (Inductively Coupled Plasma Mass Spectrometry) provides definitive uranium content confirmation through chemical analysis at ISO 17025-certified laboratories.

Interpreting Radiometric Results

Radiometric measurements offer valuable real-time guidance during drilling programs:

"Counts per second in the 24,000 range? We're confident that's percentage-grade mineralization. But assays are non-negotiable for validation." – Troy Boisvert, CEO of AHA Energy Corp.

Important considerations when interpreting radiometric data include:

-

Geological Context: CPS readings must be interpreted within the specific geological environment. The same reading might indicate different grades in different deposit types.

-

Equilibrium Factors: Uranium and its decay products can become separated over geological time, affecting the accuracy of radiometric measurements.

-

Lithological Interference: CPS accuracy decreases in clay-rich zones due to gamma-ray absorption (IAEA, 2020), requiring adjustment factors based on host rock type.

-

Regulatory Compliance: The Canadian Nuclear Safety Commission (CNSC) requires specialized radiation safety training for drilling personnel working on uranium projects (CNSC RD/GD-326, 2022).

The historic Lac 50 resource of 43 million pounds at 0.69% U₃O₈ required validation through 1,200 chemical assays (Latitude Uranium 43-101, 2019), demonstrating the rigorous confirmation process needed to establish reliable uranium resources.

What Are the Stages of Uranium Project Development?

Advancing a uranium project from initial discovery to potential production involves several distinct phases, each with specific objectives and milestones. This progression typically spans a longer timeline than other mining commodities due to uranium's unique regulatory requirements.

The Exploration-to-Development Pathway

-

Generative Exploration: Identifying and prioritizing target areas based on geological, geophysical, and geochemical criteria. This phase establishes the foundation for all subsequent work.

-

Target Testing: Initial drilling to confirm mineralization presence. Success at this stage—as with AHA Energy's Ribbon Ridge discovery—warrants expanded exploration.

-

Resource Expansion: Defining the extent of mineralized zones through systematic step-out drilling. AHA's 2025 program includes 10,000 meters of drilling to expand the Lac 50 deposit and test Ribbon Ridge (AHA MD&A, Q1 2025).

-

Resource Delineation: Comprehensive drilling at tighter spacing to establish resource dimensions and grade distribution, leading to formal resource estimation.

-

Economic Assessment: Evaluating project viability through increasingly detailed studies—Preliminary Economic Assessment (PEA), Pre-Feasibility Study (PFS), and Feasibility Study (FS)—as defined by CIM Definition Standards (2014).

Technical De-Risking Milestones

For uranium projects to advance toward development, several key technical aspects must be addressed:

-

Mineralization Continuity: Demonstrating consistent uranium presence between drill holes is essential for resource classification. This requires systematic drilling patterns governed by geostatistical principles.

-

Grade Distribution: Understanding how uranium concentrations vary throughout the deposit impacts mine planning and economic projections.

-

Deposit Geometry: Defining the three-dimensional shape of the mineralized body informs extraction methods and infrastructure requirements.

-

Metallurgical Characteristics: Testing confirms that uranium can be effectively recovered. Uraninite and pitchblende extraction via alkaline leaching typically achieves greater than 95% recovery (WNA, 2022).

-

Scale Potential: Establishing sufficient size for economic viability is crucial. Troy Boisvert notes that "tier-one" uranium projects require 80-100 million pounds of U₃O₈—a benchmark consistent with industry standards.

The development timeline varies by jurisdiction. Cameco's McArthur River took 7 years from discovery to production (1997-2003) (Cameco Annual Report, 2004), while Nunavut projects average 10-15 years due to permitting complexity (Nunavut Impact Review Board, 2023).

What Economic Factors Drive Uranium Project Advancement?

The uranium sector operates under unique economic considerations that influence project development decisions. Understanding these factors helps investors and stakeholders evaluate the potential of exploration projects.

Scale Requirements for Economic Viability

-

Resource Threshold: Projects typically need substantial scale to justify development costs. Mines generally require 5-10 million pounds of annual production capacity sustained over 10+ years to be economical (WNA, Supply and Demand, 2023).

-

Grade Considerations: Higher grades dramatically enhance economic potential. Deposits exceeding 1% U₃O₈ can generate positive net present value (NPV) at uranium prices around $60/lb, whereas deposits below 0.3% might require $90/lb for similar returns (BMO Mining Research, 2024).

-

Depth Factors: Shallow mineralization reduces development and mining costs. This advantage is particularly relevant when comparing basement-hosted versus deeper unconformity deposits.

-

Metallurgical Simplicity: Well-understood uranium minerals like uraninite and pitchblende typically allow for conventional processing methods with predictable recovery rates.

-

Operating Cost Variations: All-in sustaining costs in Nunavut average $40/lb versus Saskatchewan's $25/lb (CRU Group, 2024), reflecting the challenges of remote Arctic operations.

Market Dynamics and Project Economics

The uranium market presents distinct characteristics that affect development decisions:

-

Supply-Demand Gap: Current production falls significantly short of reactor requirements. The global uranium market volatility created a deficit that reached 25 million pounds in 2024 and is projected to widen to 50 million pounds by 2030 (WNA, 2024).

-

Price Recovery: The uranium spot price reached $105/lb in July 2025, representing a 400% increase since 2020 (UxC Weekly Report). This dramatic recovery improves the economic potential of development projects.

"Today's market needs pounds that don't exist. Projects like ours with scalable, high-grade resources are critical." – Troy Boisvert, CEO of AHA Energy Corp.

-

Development Timeline: The multi-year pathway from discovery to potential production means current exploration projects address medium to long-term supply needs rather than immediate shortfalls.

-

Capital Requirements: Significant investment is needed to advance projects to production readiness. NexGen's Arrow project in Saskatchewan (287 million pounds at 2.4% U₃O₈) represents one of the most advanced uranium development projects globally, with a construction decision pending (NexGen 43-101, 2023).

The current uranium market structure creates a favorable environment for advancing quality projects, particularly those with the potential to achieve significant scale and manage the unique costs associated with uranium development in Canada.

What Regulatory and Community Considerations Apply to Canadian Uranium Projects?

Uranium development in Canada involves specialized regulatory frameworks and essential community relationships that differ substantially from other mining commodities.

The Canadian Regulatory Framework

-

Canadian Nuclear Safety Commission (CNSC): This federal agency serves as the life-cycle regulator for all uranium projects in Canada. The licensing process follows a structured progression: Environmental Assessment → License to Prepare Site → Construction License → Operating License (CNSC REGDOC-3.5.1).

-

Territorial/Provincial Oversight: Additional jurisdiction-specific requirements apply. Saskatchewan projects follow provincial environmental assessment processes, while Nunavut projects operate under co-management arrangements with Inuit organizations as mandated by the Nunavut Land Claims Agreement (NLCA, 1993).

-

Environmental Assessment: Uranium projects undergo rigorous evaluation of potential environmental impacts, typically requiring 5-7 years for approval in Nunavut (Nunavut Planning Commission, 2023).

-

Permitting Process: While well-established, the pathway to development approval for uranium

Looking to Capitalise on the Next Major Uranium Discovery?

Stay ahead of the market with Discovery Alert's proprietary Discovery IQ model that delivers real-time notifications on significant ASX uranium discoveries, transforming complex geological data into actionable investment insights. Explore historic examples of exceptional market returns from major mineral discoveries by visiting our dedicated discoveries page and begin your 30-day free trial today.