Why Are Canadian Natural Gas Prices Hitting Historic Lows?

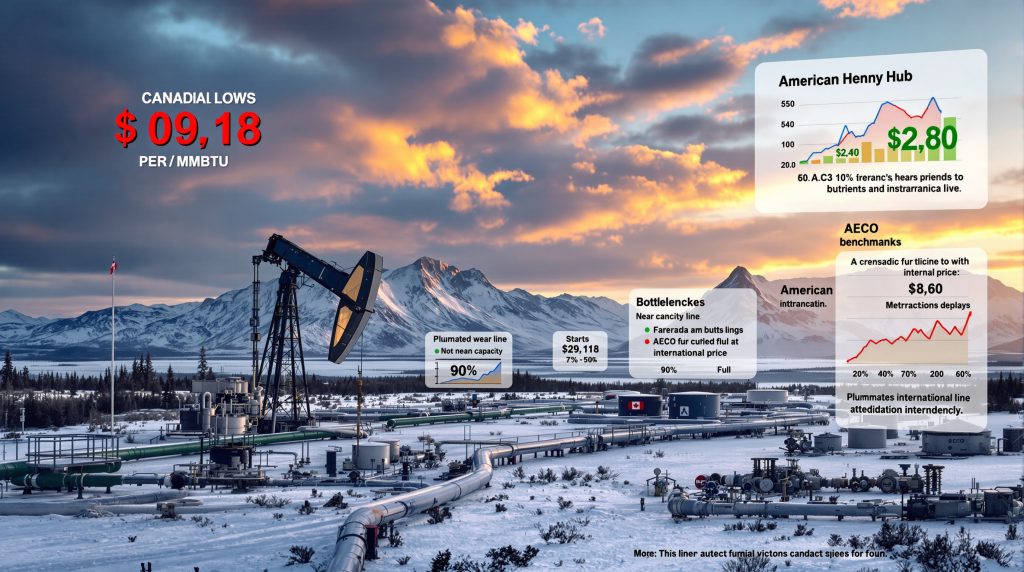

Canadian natural gas prices have plummeted to unprecedented levels, creating significant challenges for producers across the country. The AECO hub, which serves as Canada's primary natural gas pricing benchmark, has recorded spot prices falling as low as 18 cents per MMBtu in recent months—a figure that represents the lowest levels in history.

This price collapse has forced companies to implement substantial production cuts as they grapple with financial viability in an increasingly oversupplied market. Record-low Canadian natural gas prices have emerged from a perfect storm of structural issues, weather patterns, and shifting global market dynamics.

Key Factors Behind the Price Collapse

Several interconnected factors have contributed to this severe price depression:

Pipeline capacity constraints have severely limited export potential, essentially trapping Canadian production within domestic markets. These infrastructure bottlenecks prevent producers from accessing higher-priced markets in the United States and beyond.

Record-high production levels continue to flood the domestic market, outpacing local demand growth and exacerbating the oversupply situation. Canadian producers have increased efficiency and output despite price signals suggesting restraint.

Seasonal demand fluctuations are creating additional challenges, particularly during shoulder seasons when heating and cooling needs naturally decrease. These transitional periods expose the market's structural imbalances.

Regional infrastructure limitations have created bottlenecks in key production areas, preventing efficient movement of gas to storage facilities and demand centers. These constraints are particularly problematic during maintenance periods.

The result is a staggering discount compared to Henry Hub prices in the United States, which have generally maintained above $2.80 per MMBtu even during periods of weakness. This price disparity highlights the severity of Canada's localized market challenges.

How Severe Is the Canadian Natural Gas Price Crisis?

The current price crisis represents an extraordinary departure from historical norms, both in absolute terms and relative to other North American markets. What makes this situation particularly concerning is the widening gap between Canadian and US natural gas forecasts, which has created unprecedented regional disparities.

Price Comparison: Canadian vs. U.S. Natural Gas

| Benchmark | Recent Price (per MMBtu) | Historical Average | % Below 5-Year Average |

|---|---|---|---|

| AECO (Alberta) | $0.18-1.50 | $2.35 | -68% to -92% |

| Dawn (Ontario) | $1.85-2.25 | $2.80 | -34% to -19% |

| Henry Hub (U.S.) | $2.80-3.20 | $3.15 | -11% to +1.6% |

This extraordinary price disparity has created an unsustainable economic environment for many Canadian producers. Companies without diversified market access or effective hedging strategies are particularly vulnerable to the continuing price weakness.

The crisis has evolved beyond a temporary market adjustment into a sustained structural challenge requiring industry-wide responses and potentially regulatory intervention.

What Production Cuts Have Been Implemented?

In response to the prolonged price crisis, several leading Canadian natural gas producers have announced significant production curtailments aimed at reducing market oversupply and supporting price recovery.

Major Producer Responses to Price Collapse

The industry's collective response has included multiple strategies:

Voluntary shutdowns of non-essential wells have been implemented across multiple production regions. Producers have strategically identified lower-productivity assets for temporary closure to minimize financial impact while reducing output.

Deferred completions of drilled but uncompleted wells (DUCs) have become increasingly common. Companies are postponing the final stages of bringing new wells online, effectively creating a backlog of potential production that can be activated when market conditions improve.

Reduced drilling programs for the remainder of the year have been announced by numerous operators. Capital expenditure cuts have been implemented across the board, with some companies reducing planned drilling activity by 20-30%.

Temporary facility maintenance has been strategically scheduled during low-price periods, allowing companies to justify production cuts while performing necessary upkeep on processing infrastructure.

These production cuts represent a market-driven attempt to rebalance supply with available demand and transportation capacity. While individual companies have acted independently based on their unique financial positions and asset portfolios, the collective industry response aims to reduce the oversupply situation and potentially support price recovery.

Why Is Canadian Storage Approaching Capacity?

The natural gas storage situation in Canada has become increasingly problematic, with facilities approaching maximum capacity levels much earlier than usual in the seasonal cycle. This storage congestion has further depressed spot prices as producers compete for limited injection capacity.

Storage Utilization and Capacity Challenges

Current storage levels in Western Canada have reached nearly 90% of working capacity, significantly above the five-year average for this time of year. This elevated storage situation reflects multiple converging factors:

Mild weather patterns have reduced heating demand during traditional consumption periods, leaving more gas in storage than anticipated. Warmer-than-normal winter temperatures have dampened the typical seasonal drawdown.

Continued strong production despite price signals has contributed to persistent oversupply. The industry's response to price weakness has been slower than market conditions would typically dictate.

Limited export capacity has prevented the efficient relief of domestic oversupply through sales to external markets. Pipeline constraints have effectively trapped gas within the Canadian market.

Seasonal injection cycle approaching its natural conclusion has created timing pressure for producers. As winter approaches, storage operators become increasingly selective about additional volumes they're willing to accept.

This storage situation creates a negative feedback loop—high storage levels depress prices, which should theoretically reduce production. However, infrastructure constraints, contractual obligations, and fixed operational costs have delayed the market's self-correcting mechanisms from taking full effect.

Some producers face the possibility of having no available storage options as facilities reach maximum capacity, potentially forcing additional production curtailments regardless of economic considerations.

How Do Oil Sands Operations Impact Gas Demand?

A significant factor in the Canadian natural gas market is the substantial demand from oil sands operations, which typically consume approximately 25% of Western Canadian natural gas production. Recent disruptions in this demand have contributed to the market imbalance.

The Critical Relationship Between Oil Sands and Natural Gas

Oil sands facilities require enormous volumes of natural gas for steam generation, hydrogen production, and power generation—creating a vital demand source for Canadian gas producers. However, several recent developments have disrupted this traditionally stable consumption pattern:

Wildfires near Fort McMurray forced temporary production shutdowns at major oil sands facilities, rapidly reducing gas demand during critical periods. These operational interruptions removed significant gas consumption from the market with little warning.

Scheduled maintenance at upgrader facilities has reduced gas consumption during key periods. Maintenance timing has unfortunately coincided with periods of already-weak gas demand from other sectors.

Operational efficiency improvements have decreased gas intensity per barrel of oil sands production. Technological advances and optimization efforts have progressively reduced the amount of gas required for each unit of bitumen processed.

Price-responsive industrial users have adjusted consumption patterns when possible, taking advantage of low gas prices for certain operations while curtailing usage during brief price spikes.

The temporary reduction in oil sands natural gas consumption has removed a critical demand source precisely when the market was already oversupplied, exacerbating the price decline. This highlights the interconnected nature of Canada's energy system and the vulnerability of gas prices to disruptions in crude supply.

What Role Do Weather Patterns Play in Price Volatility?

Weather patterns have played a significant role in the current price environment, with several climate factors combining to reduce natural gas demand and contribute to market volatility.

Seasonal Impacts and Climate Factors

The natural gas market's inherent weather sensitivity has been particularly evident in recent market movements:

Warmer-than-normal winter forecasts have reduced heating expectations and dampened traditional seasonal price support. Long-range forecasts suggesting mild conditions have discouraged storage withdrawals and winter premium pricing.

Moderate summer temperatures have limited cooling demand in key regions, reducing gas consumption for electricity generation during what would typically be peak demand periods. The absence of prolonged heat waves has prevented meaningful demand increases.

Precipitation patterns have affected hydroelectric generation alternatives in key regions. Above-average rainfall in certain areas has increased hydro output, displacing potential natural gas-fired electricity generation.

Seasonal transition periods have created temporary demand gaps as heating requirements fade before cooling needs emerge. These shoulder seasons expose the market's structural oversupply issues more dramatically.

The natural gas market is inherently seasonal, with weather-driven demand fluctuations creating predictable cycles. However, the current situation has been exacerbated by weather patterns that have consistently reduced demand during critical balancing periods. Climate variability has added another layer of uncertainty to an already challenging market environment.

How Does Pipeline Infrastructure Affect Canadian Gas Prices?

The Canadian natural gas infrastructure network faces several structural challenges that have contributed significantly to the current price environment. These transportation limitations effectively trap natural gas within producing regions, creating localized oversupply situations that dramatically impact regional pricing benchmarks like AECO.

Transportation Constraints and Market Access

Several specific infrastructure challenges have emerged as key price factors:

Limited export capacity to U.S. markets during maintenance periods has created severe bottlenecks at key interconnection points. When cross-border pipeline capacity is reduced for scheduled work, the immediate impact on AECO prices can be dramatic.

Intra-provincial bottlenecks between production and consumption regions have prevented efficient market balancing. Within Alberta itself, certain pipeline segments operate at capacity, creating congestion points that impede market efficiency.

Seasonal capacity constraints during peak demand periods have become more problematic as production has increased. The infrastructure was not designed to handle current production volumes during high-demand periods.

Regulatory delays for new infrastructure development have prevented timely capacity additions. Proposed pipeline expansions have faced lengthy approval processes, postponing much-needed relief for constrained regions.

The TC Energy (formerly TransCanada) NOVA Gas Transmission Ltd. (NGTL) system plays a crucial role in Western Canadian gas transportation, but maintenance on this system can create significant pricing disruptions. When capacity is restricted, particularly at key junction points, the impact on regional gas prices can be immediate and severe.

These transportation limitations highlight the critical importance of infrastructure in determining regional gas prices. Without adequate pipeline capacity to move supply to demand centers or export points, localized pricing will continue to disconnect from broader North American benchmarks.

What Are the Economic Impacts on Canadian Gas Producers?

The sustained low-price environment has created significant financial challenges for Canadian natural gas producers, with varying impacts based on company size, operational flexibility, and market access.

Financial Implications for Industry Participants

The economic consequences of the price collapse include:

Negative cash flow for pure-play gas producers without hedges has become a widespread reality. Companies focused exclusively on natural gas production with limited price protection have faced severe financial strain.

Deferred capital investment in new drilling and completion activities has reduced future production potential. Capital expenditure cuts of 20-40% have become common as companies preserve financial resources.

Asset impairment considerations for reserves valuation have emerged as a significant accounting challenge. Prolonged low prices may require companies to revalue their proven reserves, potentially triggering balance sheet adjustments.

Credit facility pressures have increased as borrowing bases are redetermined based on lower commodity prices. Banks have become more conservative in their lending criteria, reducing available capital for many producers.

Many producers have responded by implementing aggressive cost-cutting measures, focusing on only the highest-productivity assets, and exploring alternative market arrangements to mitigate pricing exposure. Operational efficiency has become paramount, with companies scrutinizing every aspect of their business for potential savings.

The divergent impact on different types of producers is notable. Larger, diversified companies with strong balance sheets have generally weathered the crisis more effectively, while smaller, debt-laden producers focused primarily on dry gas production have faced more severe challenges.

How Do Canadian Gas Prices Compare Globally?

The Canadian natural gas price crisis is particularly striking when viewed in a global context, where other major consuming regions have maintained significantly higher price levels. This disparity highlights the disconnected nature of natural gas markets and the critical importance of transportation infrastructure to access premium international markets.

International Price Benchmarks and Market Dynamics

Global natural gas pricing reveals dramatic regional variations:

European TTF prices have averaged $8-10/MMBtu, supported by consistent industrial demand and competition with Russian pipeline gas. European markets remain heavily influenced by geopolitical factors and supply security concerns.

Asian LNG spot prices have ranged from $9-14/MMBtu, reflecting strong demand growth in key markets like China, Japan, and South Korea. Asian premium pricing has traditionally incentivized LNG shipments from other regions.

UK NBP prices have stabilized around $7-9/MMBtu, influenced by European market dynamics but with unique local factors affecting price movements. Britain's declining domestic production has increased import dependency.

Canadian AECO prices have struggled below $2/MMBtu, and frequently below $1/MMBtu, creating an extraordinary disconnect from global markets. Without direct access to international markets, Canadian producers cannot capture global price premiums.

This global price disparity underscores the importance of LNG export prospects for Canadian producers to reach higher-priced international markets. The lack of operational LNG export terminals on Canada's coast has prevented producers from capturing global pricing opportunities.

Several LNG projects are under development in Canada, including LNG Canada on the west coast, but these facilities will not provide immediate relief for current price challenges. The long lead time for LNG infrastructure development means that Canadian producers will likely face continued disconnection from global pricing in the near term.

What's the Outlook for Canadian Natural Gas Prices?

The outlook for Canadian natural gas prices depends on several key variables that will influence the supply-demand balance. While challenges persist, several potential developments could support price recovery in the medium to long term.

Future Market Scenarios and Recovery Potential

Market recovery hinges on multiple factors:

Effectiveness of current production cuts in reducing oversupply will determine near-term price movements. If voluntary curtailments expand and persist, market balance could improve more rapidly than currently expected.

Winter weather patterns and resulting heating demand remain critical variables. A colder-than-normal winter could significantly reduce storage levels and provide price support heading into 2026.

Infrastructure developments, including potential new export capacity, will shape long-term market access. Several pipeline expansion projects could alleviate some transportation constraints if completed on schedule.

Industrial demand recovery, particularly from oil sands operations, could provide crucial consumption support. As disruptions from wildfires and maintenance subside, this key demand source should stabilize.

LNG export developments on both East and West coasts represent transformational opportunities for Canadian producers. The LNG Canada project, currently under construction, will eventually provide access to premium Asian markets.

Market analysts project a gradual recovery in Canadian natural gas prices, but the timing and magnitude remain uncertain given the structural challenges facing the market. The potential for price improvement exists, but producers should prepare for continued volatility and regional pricing disconnects in the near term.

Industry participants are increasingly focused on securing firm transportation commitments, exploring market diversification strategies, and implementing financial hedging programs to mitigate exposure to AECO price weakness. These risk management approaches will be essential for navigating the challenging market environment ahead, especially considering Canada's energy challenges and the potential US tariffs impact on cross-border energy trade. Additionally, policy changes related to Alaska drilling policy could further influence North American gas market dynamics.

FAQ: Canadian Natural Gas Price Crisis

What caused Canadian natural gas prices to fall to record lows?

The primary factors include pipeline capacity constraints limiting export potential, record-high production levels flooding the domestic market, reduced demand from oil sands operations due to wildfires, and storage facilities approaching maximum capacity. These factors created a perfect storm of oversupply in a market with limited export options.

How do Canadian natural gas prices compare to U.S. prices?

Canadian AECO hub prices have fallen as low as 18 cents per MMBtu, representing a discount of more than 90% compared to U.S. Henry Hub prices, which have generally remained above $2.80 per MMBtu. This price disparity reflects the severe regional imbalance between supply and demand.

Will production cuts help stabilize the market?

Production curtailments by major Canadian producers are expected to help reduce the current oversupply situation. However, the effectiveness of these cuts depends on their scale, duration, and coordination across the industry. Weather patterns and infrastructure constraints will also influence market recovery.

How does natural gas storage affect pricing?

Storage facilities in Western Canada have reached nearly 90% of capacity, significantly above the five-year average. This high storage level creates downward pressure on prices as producers compete for limited injection capacity and face the prospect of forced production shut-ins if storage completely fills.

What is the long-term solution to Canadian natural gas price volatility?

Long-term solutions include developing additional export infrastructure (particularly LNG terminals), expanding pipeline capacity to reach new markets, diversifying the domestic demand base, and implementing more flexible storage options. Regulatory certainty would also support investment in necessary infrastructure development.

Are You Interested in Staying Ahead in the Mining Market?

Discover significant ASX mineral announcements in real-time with Discovery Alert's proprietary Discovery IQ model, giving you immediate insights into actionable trading opportunities before the market catches up. Learn why major mineral discoveries lead to exceptional returns by exploring Discovery Alert's dedicated discoveries page.