Balancing Act: Vedanta's Coal Dependency Amid Renewable Energy Transition

Vedanta, the Indian mining and metals conglomerate, maintains a strategic dual approach to energy management, with coal forming its operational foundation while gradually expanding its renewable energy portfolio. This balancing act reflects the practical challenges faced by resource-intensive companies navigating the Energy Transition Insights while ensuring operational stability and energy security.

Current Energy Mix and Dependency

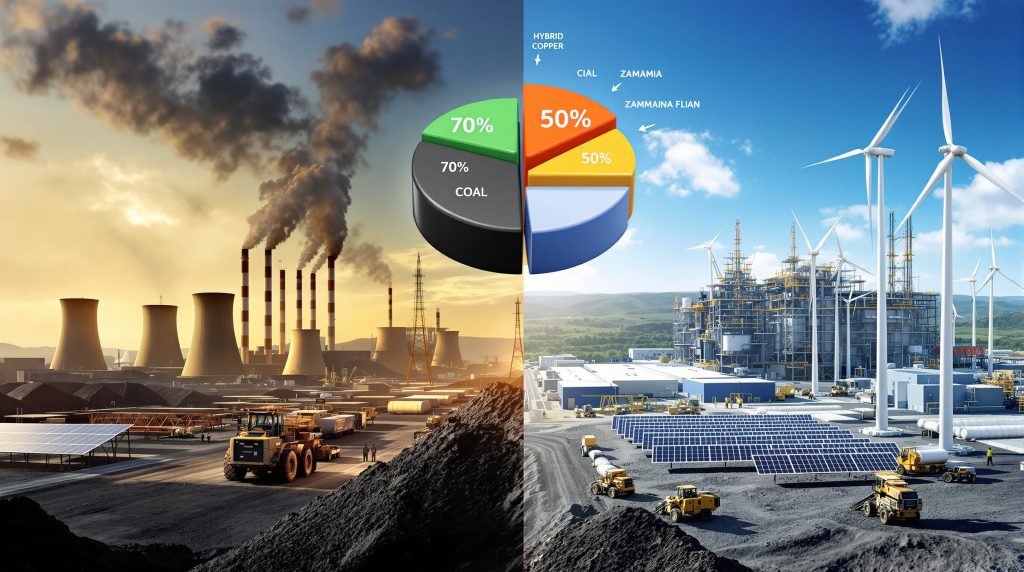

Coal currently accounts for approximately 70% of Vedanta's total energy consumption, serving as the dominant power source for its energy-intensive aluminum, copper, and zinc operations. This heavy reliance on coal-fired power stems from the need for consistent baseload energy that can meet the demanding requirements of mineral processing and metallurgical operations.

The company's energy security concerns and operational stability requirements continue to drive this coal dependency, particularly in regions with unreliable power infrastructure. For mining and metals production, interruptions in power supply can result in significant operational disruptions and financial losses, making reliable baseload power a critical business necessity.

Industry analysts note that this dependency reflects broader patterns across the mining sector, where the technical requirements of continuous, high-energy operations have made rapid transitions away from fossil fuels particularly challenging.

Renewable Energy Transition Timeline

Despite its continued reliance on coal, Vedanta has established a clear timeline for reducing its dependency. The company aims to decrease coal's share in its energy mix from the current 70% to approximately 50-60% within the next 3-4 years, representing a significant but measured transition.

This progressive shift toward a more diversified energy portfolio demonstrates Vedanta's recognition of the changing energy landscape while acknowledging the practical limitations of an immediate transition. The company's approach focuses on balancing immediate operational needs with long-term sustainability transformation goals, allowing for the gradual integration of renewable alternatives without compromising production capabilities.

Industry experts view this timeline as realistic given the technical constraints of replacing coal-fired power in energy-intensive mining operations, where reliability, cost, and energy density requirements present significant challenges for alternative energy sources.

What Renewable Energy Initiatives Is Vedanta Implementing?

Vedanta is pursuing multiple pathways to incorporate clean energy into its operations while acknowledging the current limitations of renewable technologies for heavy industrial applications. The company's approach combines immediate implementation of proven technologies with longer-term research into emerging solutions.

Solar and Wind Power Integration

The company is expanding investments in solar and wind energy projects to supplement its energy mix and reduce its carbon footprint. These developments include both on-site installations at mining and processing facilities and power purchase agreements with dedicated renewable energy providers.

Vedanta is developing hybrid renewable models that combine multiple clean energy sources to improve reliability and address the intermittency issues that can affect solar and wind power generation. These hybrid systems integrate energy storage components to provide more consistent power delivery, making renewable energy more viable for industrial applications.

The company has strategically focused these renewable deployments in regions with favorable conditions for solar and wind generation, maximizing the efficiency and cost-effectiveness of these investments while building internal expertise in renewable energy management.

Strategic Energy Partnerships

To accelerate its renewable energy transition, Vedanta is forming strategic collaborations with established renewable energy providers who bring specialized expertise and capabilities. These partnerships extend beyond simple power purchase agreements to include joint development of innovative energy solutions tailored to the unique requirements of mining and metals processing.

The company is securing long-term power purchase agreements for clean energy, providing both price stability and a foundation for expanding the share of renewables in its energy mix. These agreements enable renewable energy developers to secure financing for new projects while giving Vedanta access to clean energy without the full capital burden of developing these resources independently.

Through these partnerships, Vedanta is building internal expertise in renewable energy management, creating the organizational capabilities needed to effectively integrate diverse energy sources into its operations while maintaining reliability and cost competitiveness.

Technology Innovation Focus

Recognizing that current renewable technologies alone cannot fully replace coal for all industrial applications, Vedanta is exploring energy storage solutions to address the intermittency issues that limit renewable energy reliability. These include both battery storage systems and mechanical storage alternatives that can provide power during periods when renewable generation is unavailable.

The company is investigating hydrogen applications for manufacturing processes, particularly in its aluminum and zinc operations where hydrogen could potentially replace fossil fuels in certain production steps. While industrial-scale green hydrogen remains in early development stages, Vedanta's research positions it to capitalize on advancements in this promising technology.

Energy efficiency improvements across operations represent another key focus area, with the company implementing comprehensive audits and upgrades to reduce overall energy requirements. These efficiency initiatives create immediate emissions benefits while reducing the scale of renewable capacity needed for future operations.

How Does Vedanta's Strategy Compare to Industry Peers?

Vedanta's approach to energy transition reflects broader industry evolution trends where mining companies are gradually shifting away from fossil fuels while acknowledging the practical limitations of current renewable technologies for energy-intensive operations.

Mining Industry Energy Transition Landscape

Major mining companies globally are maintaining fossil fuel baseload generation while expanding renewable energy capacity, recognizing that energy-intensive operations require reliable, consistent power that current renewable technologies cannot fully provide without significant storage or backup systems.

The pace of transition varies significantly based on operational locations and energy access, with companies operating in regions with developed renewable infrastructure generally moving faster than those in areas with limited grid reliability or renewable resources.

The industry demonstrates widespread recognition of the technical challenges in fully eliminating coal dependency, particularly for energy-intensive processes like smelting and refining. Most major miners have adopted staged transition plans that balance immediate operational requirements with longer-term decarbonization goals.

Competitive Positioning

Vedanta's transition pace aligns with industry averages, positioning the company neither as a leading edge innovator nor as a laggard in the mining sector's movement toward cleaner energy. This middle-path approach reflects a pragmatic assessment of both the opportunities and challenges presented by the energy transition.

Some industry competitors are pursuing more aggressive renewable targets, particularly those operating primarily in regions with well-developed renewable infrastructure and strong policy support for clean energy. These companies often highlight their renewable commitments as part of broader mining decarbonisation benefits and ESG performance.

Other mining operations maintain higher fossil fuel dependence due to operational constraints, particularly those in regions with limited renewable resources or unreliable grid infrastructure. These constraints highlight the uneven global landscape for energy transition, where geographical and infrastructure factors can significantly impact decarbonization timelines.

What Are Vedanta's International Energy Strategies?

Vedanta's global operations face varying energy challenges across different regions, requiring tailored approaches that account for local infrastructure conditions, regulatory environments, and renewable resource availability.

Zambian Operations Energy Solutions

In Zambia, where Vedanta faces critical power shortages of up to 20 hours daily, the company is planning a 300-megawatt power facility with capacity split equally between coal and renewable sources. This balanced approach reflects the immediate need for reliable power while still advancing clean energy goals.

The severe power challenges in Zambia exemplify the infrastructure constraints that mining companies face in many developing regions, where grid reliability issues can make operations nearly impossible without dedicated power generation capacity.

This power facility will support Vedanta's copper production expansion goals in Zambia, demonstrating the direct link between energy security and production capabilities in mining operations. The company's willingness to invest in significant power infrastructure highlights the strategic importance of its Zambian copper assets.

Regional Energy Approach Variations

Across its global operations, Vedanta tailors energy strategies to local grid reliability and renewable potential, recognizing that a one-size-fits-all approach would fail to address the diverse challenges across its operational footprint.

The company implements location-specific solutions for energy security, ranging from fully grid-connected operations in regions with reliable infrastructure to self-generation in areas with poor grid reliability. This flexible approach allows for optimization based on local conditions while still advancing overall sustainability goals.

Balancing cost considerations with environmental objectives across operations remains a key challenge, requiring sophisticated financial modeling that accounts for both current energy economics and potential future policy changes such as carbon pricing mechanisms.

How Is Vedanta Advancing Low-Carbon Products?

Beyond energy sourcing, Vedanta is focusing on developing products with reduced carbon footprints to meet growing market demand for sustainable materials, positioning itself to capture premium pricing opportunities in emerging green markets.

Current Low-Carbon Product Portfolio

Low-carbon products currently represent less than 20% of Vedanta's total output, indicating significant room for growth as market demand for sustainable materials increases. The company has focused these initial efforts primarily on aluminum and zinc segments, where market premiums for low-carbon alternatives are beginning to emerge.

These products utilize renewable energy and hydrogen in manufacturing processes to reduce embedded carbon, creating differentiated offerings that appeal to environmentally conscious customers and those facing their own scope 3 emissions reduction targets.

The development of these products represents an important strategic initiative, positioning Vedanta to meet the growing demand for materials with verified sustainability credentials as industries across the economy face increasing pressure to reduce their carbon footprints.

Expansion Strategy for Green Products

Vedanta is actively scaling production capacity for low-carbon metals, investing in both the processing technology and energy infrastructure needed to expand these offerings. This expansion aligns with forecasts of growing price premiums for sustainable materials as downstream manufacturers seek to reduce their supply chain emissions.

The company is responding to premium pricing opportunities in sustainable materials markets, where early evidence suggests customers are willing to pay more for metals with lower carbon footprints. These premiums help offset the additional costs associated with low-carbon production methods.

Developing robust certification and traceability systems for carbon footprint verification represents another key initiative, as credible documentation of environmental performance becomes increasingly important for customers seeking to validate their sustainability claims.

What Are Vedanta's Copper Production Goals in Zambia?

Vedanta has significant ambitions for its Zambian copper operations, with production targets that will require substantial infrastructure investment, including the energy solutions previously discussed.

Current Production Status

The company has successfully restored copper production to 180,000-200,000 metric tons annually, returning to production levels last achieved in 2018. This restoration represents an important operational achievement following several challenging years.

This production recovery demonstrates Vedanta's commitment to its Zambian operations despite the significant infrastructure challenges, including the severe power shortages that affect the region. The company's willingness to invest in solving these challenges indicates the strategic importance of these copper assets.

The successful navigation of operational challenges in recent years positions Vedanta for its ambitious expansion plans, building on restored operational capabilities and demonstrated resilience in a challenging operating environment.

Future Expansion Plans

Vedanta has established a three-year target to reach 300,000 metric tons of annual copper production in Zambia, representing a 50-67% increase from current levels. This substantial capacity increase will require reliable energy infrastructure, directly linking to the company's plans for the 300MW power facility.

This expansion reflects Vedanta's bullish outlook on copper demand, driven by global electrification trends and the metal's central role in renewable energy technologies and electric vehicles. Industry analysts project continued strong demand growth for copper as the global energy transition accelerates.

While the company has previously considered a potential IPO for its Zambian operations, no specific timeline has been established for such a move. Any future listing would likely depend on the successful execution of the production expansion plans and stabilization of the operational environment, including reliable energy access.

Why Is Vedanta Not Pursuing Lithium Mining in India?

Despite lithium's growing importance in the energy transition, particularly for battery metals outlook, Vedanta has made a strategic decision not to enter this market segment in India, focusing instead on its core mineral strengths.

Strategic Rationale

The company cites limited demonstrated exploration potential in India for lithium resources as a key factor in this decision. Unlike countries such as Australia, Chile, and Argentina with established lithium reserves, India has yet to prove significant commercially viable lithium deposits.

Vedanta has chosen to focus on core competencies in its existing mineral portfolios, where it has established expertise, infrastructure, and market position. This strategic focus allows for more efficient capital allocation and operational improvement rather than venturing into unproven territory.

The prioritization of operational improvements in established business segments reflects a disciplined approach to growth and resource allocation, concentrating investment where the company has the greatest competitive advantages and clearest path to returns.

India's Lithium Resource Context

India's lithium exploration landscape remains underdeveloped compared to global lithium-producing regions, with limited comprehensive geological surveys specifically targeting lithium resources. This early stage of exploration creates significant uncertainty about the country's lithium potential.

The uncertain resource potential compared to established global lithium regions makes investment in Indian lithium exploration relatively high-risk compared to other opportunities within Vedanta's portfolio. The company appears to be taking a wait-and-see approach, allowing early-stage exploration to better define the opportunity before considering entry.

Regulatory and infrastructure challenges for new mineral development in India present additional barriers, including permitting complexities, land acquisition issues, and the need for specialized processing facilities. These factors further increase the risk profile of lithium development compared to expansion of existing operations.

What Are the Implications of Vedanta's Energy Strategy for Investors?

Vedanta's balanced approach to energy transition carries both opportunities and risks for investors considering the company's future prospects, requiring careful analysis of both short-term operational requirements and long-term positioning for a lower-carbon economy.

Financial Considerations

The company faces significant capital expenditure requirements for dual energy infrastructure, needing to maintain and potentially expand coal-fired capacity while simultaneously investing in renewable alternatives. This dual-track investment approach may pressure near-term capital allocation and returns.

Over the longer term, Vedanta may realize potential cost advantages from renewable energy as technology costs continue to decline and carbon pricing mechanisms potentially increase fossil fuel costs. These economic dynamics could eventually flip the cost advantage from coal to renewables, benefiting companies positioned for this transition.

Investors must balance assessment of short-term operational needs with long-term sustainability investments when evaluating Vedanta's strategy. While immediate capital requirements may be higher, the company's gradual approach may prove more financially sustainable than more aggressive transition timelines that could compromise operational reliability.

Risk Management Approach

Vedanta's strategy represents a hedging approach against future carbon pricing and regulatory changes, positioning the company to adapt as policy environments evolve. By maintaining operational flexibility while gradually increasing renewable capacity, the company reduces exposure to potential regulatory risks.

The emphasis on maintaining operational stability through energy diversification addresses one of the most significant business risks in mining operations – reliable power access. This risk management priority reflects the reality that production interruptions due to power failures can quickly overwhelm any cost savings from less reliable energy sources.

The company's approach to addressing investor ESG concerns while ensuring business continuity demonstrates a pragmatic balance between sustainability aspirations and operational realities. This balanced positioning may appeal to investors seeking exposure to mining with reasonable sustainability credentials rather than pure-play green investments.

Competitive Positioning Outlook

Vedanta's energy strategy may create potential for improved market access through sustainability credentials, particularly as downstream manufacturers increasingly scrutinize the carbon footprints of their supply chains. The development of low-carbon product lines positions the company to meet these emerging requirements.

The company faces the ongoing challenge of balancing cost competitiveness with environmental performance in a sector where production costs remain a critical competitive factor. This balance requires careful optimization of energy investments to achieve sustainability improvements without compromising cost position.

Vedanta's positioning for future market premiums for low-carbon products represents a forward-looking strategy that anticipates evolving market preferences. If these premiums materialize as expected, early movers in low-carbon metals production may capture significant value, justifying current investments in clean energy and production technologies.

How Does Vedanta's Strategy Align with Global Decarbonization Trends?

The company's approach reflects the practical realities of energy transition in heavy industry while acknowledging the direction of global climate policy, positioning for a gradual shift that maintains operational viability.

Decarbonization Timeline Considerations

Vedanta's strategy demonstrates recognition of the continued role of fossil fuels during the transition period, acknowledging that immediate elimination of coal dependency is not technically or economically feasible for energy-intensive industrial processes. This perspective aligns with most technical assessments of industrial decarbonization pathways.

The company's focus on progressive reduction rather than immediate elimination of coal dependency reflects a realistic assessment of the time required to develop and scale alternative energy solutions for industrial applications. This measured approach acknowledges both the urgency of climate action and the practical constraints of industrial energy systems.

Vedanta's transition timeline aligns with sector-specific decarbonization pathways and timelines, which generally recognize that energy-intensive industries like mining and metals will require longer transition periods than sectors with readily available technological alternatives.

Policy and Regulatory Alignment

The company is positioning for compliance with evolving climate regulations, gradually reducing its carbon intensity while maintaining operational viability. This approach reduces the risk of stranded assets or compliance challenges as policy environments become increasingly stringent.

Vedanta's strategy reflects the need to balance energy security needs with emissions reduction targets, particularly in developing regions where reliable power access remains a significant challenge. This balance acknowledges the development imperatives that often complicate climate policy in emerging economies.

The company appears to be preparing for potential carbon pricing and border adjustment mechanisms, gradually reducing its exposure to carbon costs while maintaining operational flexibility. This preparation positions Vedanta to adapt as global climate policy continues to evolve toward stricter emissions controls and pricing mechanisms.

FAQs About Vedanta's Energy Strategy

What percentage of Vedanta's energy currently comes from coal?

Coal currently accounts for approximately 70% of Vedanta's total energy mix, making it the dominant energy source for the company's operations. This high percentage reflects the energy-intensive nature of mining and metals processing and the need for reliable baseload power.

What is Vedanta's target for reducing coal dependency?

The company aims to reduce coal's share in its energy mix to 50-60% over the next 3-4 years, representing a significant but measured transition. This target balances decarbonization goals with practical operational requirements for reliable energy.

How is Vedanta addressing energy challenges in Zambia?

Vedanta plans to build a 300-megawatt power facility in Zambia, with capacity split equally between coal and renewable sources, to address severe power shortages and support mining expansion. This balanced approach reflects the immediate need for reliable power while still advancing clean energy goals.

What is Vedanta's copper production target in Zambia?

The company aims to increase copper production in Zambia from the current 180,000-200,000 metric tons to 300,000 metric tons within the next three years, representing a 50-67% increase that will require substantial infrastructure investment, including reliable energy access.

Is Vedanta planning to enter lithium mining in India?

No, the company has stated it has no plans to venture into lithium mining in India, citing the country's yet unproven exploration potential for this resource. Vedanta is instead focusing on core competencies in its existing mineral portfolios.

What percentage of Vedanta's products are classified as low-carbon?

Currently, less than 20% of Vedanta's total output consists of low-carbon products, though the company is actively scaling up production in this category. These products are focused primarily in the aluminum and zinc segments, utilizing renewable energy and hydrogen in manufacturing processes.

Want To Profit From the Next Major ASX Mining Discovery?

Stay ahead of the market with Discovery Alert's proprietary Discovery IQ model, which instantly notifies you of significant mineral discoveries on the ASX before the wider market reacts. Explore our dedicated discoveries page to understand how historic mineral discoveries have generated substantial returns for early investors.