The future of resource extraction may lie beneath thousands of meters of ocean water, where deep-sea polymetallic nodule mining represents one of the most promising yet controversial developments in critical metal supply. These potato-sized mineral concretions contain exceptionally high concentrations of nickel, cobalt, copper, and manganese – exactly the materials needed for electric vehicle batteries and renewable energy infrastructure driving the global energy transition.

What Are Deep-Sea Polymetallic Nodules and Why Do They Matter?

Understanding the Formation and Composition of Ocean Floor Minerals

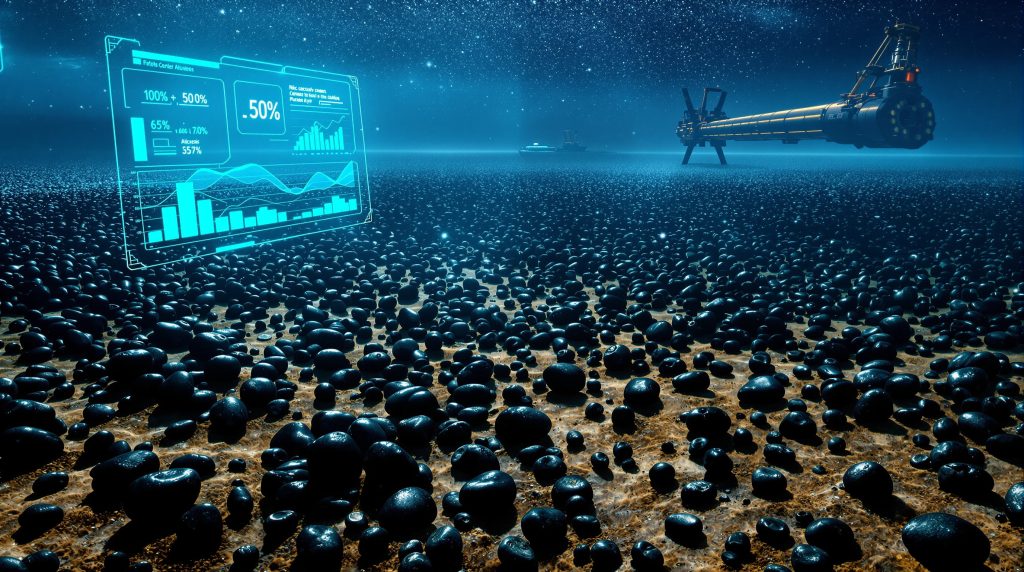

Deep-sea polymetallic nodules represent one of Earth's most remarkable geological phenomena, formed through incredibly slow precipitation processes spanning millions of years. These potato-sized concretions develop on abyssal plains at depths exceeding 4,000 meters, where sediment accumulation rates remain minimal and ocean chemistry conditions create the perfect environment for metal concentration.

The nodules contain exceptionally high concentrations of critical metals essential for modern technology. Analysis from the NORI-D project reveals nodules grading 1.30% nickel, 0.20% cobalt, 1.2% copper, and 30.2% manganese – concentrations that significantly exceed most terrestrial ore deposits. Furthermore, this superior metal content makes ocean floor nodules particularly attractive for industrial applications, especially battery manufacturing and renewable energy infrastructure, highlighting the polymetallic nodules benefits for emerging industries.

Size variations across ocean basins reflect different formation environments and geological histories. In the Clarion-Clipperton Zone, nodules typically range from 2-15 centimeters in diameter, with abundance patterns reaching 12.8 kg/m² in high-grade areas. These concentrations far exceed the economic thresholds established for land-based mining operations, creating compelling investment opportunities for resource companies.

The formation process involves complex interactions between seawater chemistry, microbial activity, and sediment deposition rates. Metal ions precipitate around nucleus materials such as shark teeth, whale bones, or rock fragments, gradually building concentric layers over geological timescales. This natural concentration mechanism produces remarkably consistent metal grades across vast seafloor areas.

The Critical Metals Crisis Driving Ocean Exploration

Global demand for battery metals has created unprecedented supply chain pressures, particularly for nickel, cobalt, and copper required in electric vehicle batteries and renewable energy storage systems. Traditional mining regions face increasing geopolitical instability, environmental restrictions, and resource depletion, driving exploration toward alternative sources including ocean floor deposits.

Supply chain vulnerabilities have become increasingly apparent as technology manufacturers struggle to secure reliable metal supplies. The concentration of cobalt production in the Democratic Republic of Congo creates particular concern, given political instability and ethical mining practices. However, ocean-based resources could provide geographic diversification and reduced dependence on politically sensitive regions, helping secure critical minerals supply for essential applications.

Economic projections indicate potential metal shortages reaching critical levels by 2030-2040 without significant new supply sources. The International Energy Agency estimates global nickel demand could increase 400% by 2040 driven by electric vehicle adoption and grid-scale battery deployment. Similar demand trajectories affect copper and cobalt, creating market conditions favorable for deep-sea mining development.

The strategic importance of these metals extends beyond commercial applications to national security considerations. Countries controlling reliable access to critical metals gain significant advantages in technological development and economic competitiveness. Consequently, this reality drives government support for deep-sea mining exploration and development programs worldwide.

Where Are the World's Richest Polymetallic Nodule Deposits Located?

Clarion-Clipperton Zone: The Pacific Ocean's Mineral Treasure Trove

The Clarion-Clipperton Zone represents the world's most promising deep-sea mining region, spanning approximately 6 million square kilometers between Mexico and Hawaii. This vast abyssal plain contains an estimated 21 billion tonnes of polymetallic nodules with superior metal concentrations, making it the focus of international exploration efforts and commercial development plans.

Resource estimates for the CCZ suggest it contains more nickel than all known land-based reserves combined. The NORI-D project alone reports measured and indicated mineral resources of 73 million tonnes of wet nodules, representing just a fraction of the zone's total potential. These deposits occur at depths ranging from 4,000-6,000 meters, presenting significant technical challenges but also protection from surface weather conditions.

The geological characteristics of the CCZ create ideal conditions for nodule formation and preservation. Minimal sediment input from terrestrial sources, combined with specific ocean chemistry conditions, has produced exceptionally high-grade deposits over millions of years. In addition, the seafloor topography remains relatively flat, facilitating potential collection operations using remotely operated vehicles.

Comparison with global land-based reserves reveals the transformative potential of CCZ deposits. The zone potentially contains 280 million tonnes of nickel, compared to current global reserves of approximately 95 million tonnes. Similar ratios apply to cobalt and copper, suggesting ocean mining could fundamentally reshape global metal supply chains.

Emerging Hotspots in Indian and Atlantic Ocean Basins

The Peru Basin in the southeastern Pacific Ocean contains significant polymetallic nodule deposits with particularly high manganese concentrations. These deposits occur at depths of 4,200-4,800 meters and cover approximately 3 million square kilometers, though exploration remains in early stages compared to the CCZ.

Indian Ocean exploration zones show unique metal profiles with elevated rare earth element concentrations alongside traditional battery metals. The Central Indian Ocean Basin contains an estimated 8 billion tonnes of nodules, though metal grades typically remain lower than Pacific Ocean deposits. Furthermore, several countries including India, China, and South Korea hold exploration licenses in this region.

Cook Islands' exclusive economic zone contains smaller but economically viable nodule deposits with favorable political and regulatory conditions. The islands' government actively promotes deep-sea mining development while maintaining environmental oversight, creating attractive investment conditions for international companies.

Regional variations in nodule composition reflect different oceanic conditions and geological processes. Atlantic Ocean deposits generally show lower metal concentrations but remain commercially viable under certain market conditions. Consequently, these variations provide opportunities for specialized mining operations targeting specific metal requirements.

Global Nodule Deposit Comparison

| Ocean Basin | Estimated Resources | Key Metals | Depth Range | Commercial Status |

|---|---|---|---|---|

| CCZ Pacific | 21 billion tonnes | Ni, Co, Cu, Mn | 4,000-6,000m | Advanced exploration |

| Indian Ocean | 8 billion tonnes | Ni, Cu, REE | 3,500-5,500m | Early exploration |

| Peru Basin | 3 billion tonnes | Mn, Co, Ni | 4,200-4,800m | Research phase |

How Does Deep-Sea Mining Technology Actually Work?

Remotely Operated Collection Systems and Seafloor Harvesting

Deep-sea polymetallic nodule mining employs sophisticated remotely operated vehicles designed to operate at extreme depths and pressures. These collector vehicles navigate across the seafloor using advanced positioning systems, selectively gathering nodules while minimizing sediment disturbance through precision engineering and real-time monitoring capabilities. Moreover, advances in modern mining technology enable increasingly sophisticated deep-sea operations.

Hydraulic suction systems represent the primary collection mechanism, using water flow to lift nodules from the seafloor into storage containers. The technology resembles underwater vacuum systems but operates at industrial scales with pumps capable of handling thousands of tonnes per day. Collection heads incorporate screens and separators to distinguish nodules from sediment and marine life.

Riser pipe technology connects seafloor collectors to surface production vessels, transporting materials through vertical columns extending up to 6,000 meters. These pipes must withstand enormous pressure differentials and dynamic ocean conditions while maintaining structural integrity. However, advanced materials and engineering designs ensure reliable operation in harsh deep-sea environments.

Real-time monitoring systems provide operators with continuous feedback on collection performance, environmental conditions, and equipment status. Satellite communication links enable shore-based control centers to oversee operations remotely, reducing crew requirements and improving safety. In addition, navigation systems use acoustic positioning to maintain precise collector positioning across vast seafloor areas.

Processing and Refining Pathways for Ocean-Sourced Metals

Onboard pre-processing systems remove seawater and separate nodules from unwanted materials before transport to shore-based facilities. Dewatering techniques reduce transportation costs and improve processing efficiency, while screening systems ensure consistent nodule quality. These preliminary steps significantly enhance the economics of deep-sea mining operations.

Shore-based metallurgical processing relies on proven rotary kiln electric furnace technology to extract metals from nodules. The NORI-D project proposes using existing infrastructure in Japan and Indonesia for initial processing, producing nickel, cobalt, and copper intermediates. This approach leverages established supply chains and reduces capital investment requirements, reflecting broader mining industry innovation trends.

Recovery rates for ocean-sourced nodules typically exceed those achieved in traditional mining operations. The uniform composition and high metal concentrations enable recovery rates approaching 95% for primary metals. Waste minimization strategies include processing tailings for secondary metal recovery and utilizing manganese-rich residues for industrial applications.

Integration with existing refinery infrastructure provides cost advantages and accelerated development timelines. Final refining processes convert intermediate products into battery-grade materials meeting stringent purity requirements. Future processing facilities could be strategically located near major battery manufacturing centers to optimize supply chain efficiency.

Advanced collection systems can potentially achieve 95% nodule recovery rates while minimizing seafloor disturbance through precision targeting and selective harvesting techniques.

What Are the Environmental Implications of Deep-Sea Nodule Extraction?

Ecosystem Disruption and Biodiversity Concerns in Abyssal Plains

Deep-sea ecosystems represent some of Earth's least understood biological communities, with unique species adapted to extreme pressure, darkness, and limited food availability. Benthic organisms often depend directly on polymetallic nodules for habitat structure and attachment surfaces, creating complex ecological relationships that could be severely disrupted by mining activities. Nevertheless, ongoing research from institutions like the Woods Hole Oceanographic Institution continues examining these delicate ecosystem dynamics.

Species endemism in deep-sea environments means local extinctions could result in permanent biodiversity loss. Many abyssal species exist nowhere else on Earth and exhibit extremely slow growth rates and reproduction cycles. The removal of nodules eliminates critical habitat features that may have taken millions of years to develop, with recovery timelines potentially extending centuries.

Sediment plume generation during collection operations poses risks to water column ecosystems far beyond immediate mining areas. These plumes can travel hundreds of kilometers, affecting filter-feeding organisms and disrupting food webs throughout the water column. However, the long-term impacts of sediment dispersion remain poorly understood due to limited deep-sea research.

Recovery timelines for deep-sea environments differ dramatically from terrestrial ecosystems. Where forest ecosystems might recover within decades, deep-sea communities may require 50-200 years to reestablish basic ecological functions. Some ecosystem components may never fully recover, representing permanent environmental costs of mining operations. These concerns have fueled significant deep‐sea mining concerns among scientists and environmental groups.

Comparative Environmental Footprint Analysis

Land-based mining operations typically generate massive waste streams, with copper mining producing approximately 99 tonnes of waste per tonne of metal extracted. Surface mining operations also require extensive deforestation, groundwater disruption, and community displacement, creating long-lasting environmental and social impacts across large geographical areas.

Ocean mining operations generate minimal solid waste compared to terrestrial alternatives. Deep-sea polymetallic nodule mining produces near-zero tailings since nodules are collected directly from the seafloor without requiring crushing, grinding, or chemical processing typical of land-based operations. This fundamental difference significantly reduces waste management requirements and environmental contamination risks.

Carbon footprint considerations favor deep-sea mining for several operational reasons. Ocean mining eliminates the need for massive earthmoving equipment, extensive transportation networks, and energy-intensive crushing operations. However, the energy requirements for deep-sea collection and long-distance riser pipe systems may offset some of these advantages, requiring detailed life-cycle analysis for accurate comparisons.

Social disruption represents another significant advantage for ocean-based mining operations. Deep-sea mining avoids community displacement, indigenous land rights conflicts, and competition for agricultural resources that characterize many terrestrial mining projects. Consequently, this social dimension creates additional value propositions for companies and governments seeking responsible resource extraction methods.

Deep-sea polymetallic nodule mining potentially generates 90% less solid waste than equivalent land-based mining operations while avoiding deforestation and community displacement issues.

Which Countries and Companies Are Leading Ocean Mining Development?

International Seabed Authority Licensing and Regulatory Framework

The International Seabed Authority currently oversees 30+ exploration contracts across multiple ocean basins, representing billions of dollars in committed exploration investment. These licenses provide exclusive rights to explore designated areas while requiring environmental baseline studies and technology demonstration programs. The two-year timeline established in 2023 for commercial mining applications creates regulatory certainty for industry development.

National consortiums from major economies dominate current exploration activities. China holds multiple exploration licenses and leads technological development through state-sponsored research programs. Japan and South Korea pursue strategic initiatives to secure critical metal supplies for their technology industries, while European nations coordinate regional exploration efforts through international partnerships.

Private sector partnerships bring specialized expertise in offshore engineering, remotely operated vehicle technology, and metallurgical processing. These collaborations combine government strategic interests with commercial expertise, accelerating technological development and reducing individual project risks. Technology sharing agreements and joint ventures characterize much of the current industry structure.

Regulatory frameworks continue evolving to address environmental concerns while enabling commercial development. The ISA requires comprehensive environmental impact assessments, real-time monitoring systems, and adaptive management approaches. Furthermore, these regulatory requirements drive technological innovation while establishing industry standards for responsible deep-sea mining operations.

Major Players and Strategic Partnerships in the Industry

Canadian company The Metals Company leads commercial development efforts through its NORI-D project, partnering with Dutch offshore engineering company Allseas for operational expertise. This partnership combines TMC's exploration assets with Allseas' proven track record in complex marine operations, creating a formidable development team.

Technology companies develop specialized collection and processing systems tailored for deep-sea conditions. These firms leverage expertise from offshore oil and gas operations, underwater robotics, and marine engineering to create innovative mining solutions. Intellectual property development and technology licensing create additional revenue streams beyond direct mining operations.

Shipping and offshore engineering companies provide essential operational capabilities including vessel design, logistics coordination, and marine operations management. Their experience with deep-water operations proves invaluable for developing reliable mining systems capable of operating in harsh ocean environments year-round.

Metal trading companies secure future supply agreements to ensure market access for deep-sea mining production. These agreements provide financial certainty for project development while guaranteeing strategic metal supplies for downstream industries. Long-term contracts help justify massive capital investments required for deep-sea mining infrastructure.

What Economic Projections Drive Deep-Sea Mining Investment?

Market Disruption Potential for Critical Metal Supply Chains

Deep-sea mining could fundamentally transform global nickel markets through massive supply additions. The NORI-D project alone projects 97,000 tonnes annually of nickel production, representing approximately 3% of current global production from a single operation. When combined with other CCZ projects, ocean mining could supply 25% of global nickel demand within two decades.

Price stabilization effects from increased supply diversity could benefit technology manufacturers through more predictable input costs. Current metal markets experience significant volatility due to supply concentration in politically unstable regions. Ocean mining provides geographic diversification that could moderate price swings and improve supply security for critical industries.

Supply security benefits extend beyond commercial considerations to national economic competitiveness. Countries with preferential access to ocean-sourced metals could gain significant advantages in electric vehicle manufacturing, renewable energy deployment, and advanced technology development. This strategic dimension drives government support for domestic deep-sea mining capabilities.

Economic modelling suggests break-even production costs for deep-sea mining range from $15,000-25,000 per tonne of nickel, depending on operational efficiency and market conditions. Current nickel prices averaging $18,000-20,000 per tonne provide adequate margins for profitable operations, though metal price volatility creates ongoing risk factors for investors.

Capital Requirements and Infrastructure Development Costs

Initial capital investment for commercial deep-sea mining projects ranges from $500 million to $8 billion depending on scale and technological complexity. The NORI-D project estimates offshore development costs at $492 million with additional onshore refinery development requiring $4.4 billion. These massive capital requirements limit the number of potential operators while creating barriers to entry.

Operational expenditure comparisons with traditional mining ventures show mixed results depending on specific circumstances. Ocean mining eliminates costs associated with land acquisition, community relations, and waste disposal while incurring specialised marine operation expenses. Maintenance costs for deep-sea equipment may exceed terrestrial equivalents due to harsh operating conditions and accessibility challenges.

Revenue projections based on current metal prices suggest attractive returns for successful projects. The NORI-D project estimates an after-tax net present value of $5.5 billion with internal returns of 27% over the project lifetime. Combined development scenarios across multiple CCZ areas project net present values exceeding $23 billion, demonstrating significant wealth creation potential.

Risk assessment for investors includes technology validation, regulatory approval, environmental compliance, and market volatility factors. Technology risks remain highest during initial commercial deployment phases, while regulatory and environmental risks could delay or prevent project implementation. Market risks affect all commodity investments but may be mitigated through long-term supply agreements.

Economic Viability Metrics

| Project Phase | Capital Investment | Timeline | Key Risk Factors |

|---|---|---|---|

| Exploration | $50-200 million | 5-10 years | Regulatory approval |

| Development | $2-8 billion | 3-7 years | Technology validation |

| Operations | $100-500 million/year | 15-25 years | Market volatility |

What Regulatory Challenges Face Deep-Sea Mining Operations?

International Maritime Law and Jurisdictional Complexities

The United Nations Convention on the Law of the Sea provides the fundamental legal framework governing deep-sea mining activities in international waters. This comprehensive treaty establishes the International Seabed Authority as the regulatory body responsible for licensing, environmental oversight, and benefit-sharing arrangements for mineral extraction beyond national jurisdictions.

National exclusive economic zones create additional jurisdictional considerations where they overlap with potential mining areas. Countries maintain sovereign rights over resources within their EEZs, potentially creating conflicts with international mining licenses. These boundary disputes require diplomatic resolution and may delay commercial development in contested areas.

Environmental impact assessment requirements demand extensive baseline studies and ongoing monitoring programmes that significantly increase project costs and development timelines. Companies must demonstrate their operations will not cause serious environmental harm while establishing comprehensive mitigation and restoration measures. These requirements reflect international recognition of deep-sea ecosystem vulnerability, as detailed in studies by the International Seabed Authority.

Liability frameworks for environmental damage remain underdeveloped, creating uncertainty for both operators and affected parties. Current international law provides limited guidance on compensation mechanisms, restoration requirements, or long-term monitoring responsibilities following environmental incidents. This regulatory gap represents a significant risk factor for all stakeholders.

Growing Opposition and Moratorium Movements

Scientific communities increasingly call for precautionary approaches to deep-sea mining based on incomplete understanding of ocean ecosystem functions. Over 780 marine scientists have signed petitions requesting moratoria on commercial mining until comprehensive environmental research addresses knowledge gaps. These scientific concerns influence regulatory decision-making and public opinion.

Environmental organisations campaign actively against commercial deep-sea mining through public awareness campaigns, legal challenges, and political lobbying efforts. Groups such as Greenpeace and the World Wildlife Fund argue that environmental risks outweigh potential benefits, particularly given advancing metal recycling technologies and alternative supply sources.

Pacific Island nations express growing concerns about ecosystem preservation and traditional resource rights. Several countries including Palau, Fiji, and Vanuatu have called for mining moratoria, while others seek greater benefit-sharing arrangements and environmental protections. These political positions could significantly impact regulatory approval processes.

Alternative supply chain development reduces pressure for deep-sea mining by improving metal recycling rates and developing substitute materials. Battery technology advances requiring fewer critical metals, combined with circular economy initiatives, could diminish the economic rationale for ocean mining. These trends create uncertainty about long-term market demand.

How Might Deep-Sea Mining Transform Global Metal Markets?

Supply Chain Diversification and Strategic Resource Security

Deep-sea mining offers unprecedented opportunities to reduce dependence on politically unstable mining regions that currently dominate critical metal production. The Democratic Republic of Congo supplies approximately 70% of global cobalt, while Indonesia and the Philippines control significant nickel production. Ocean mining could provide geographic diversification that enhances supply chain resilience.

Enhanced supply resilience benefits technology sectors through more stable input costs and reduced supply disruption risks. Electric vehicle manufacturers currently face periodic shortages of battery metals due to geopolitical tensions, labour disputes, and natural disasters affecting traditional mining regions. Multiple ocean-based supply sources could mitigate these vulnerabilities through redundant supply chains.

Strategic advantages for nations controlling ocean mining technology extend beyond metal supplies to include technological leadership and economic competitiveness. Countries developing advanced deep-sea mining capabilities could export this expertise globally while securing preferential access to ocean-sourced materials for domestic industries.

Long-term metal pricing stability could result from increased supply diversity and reduced market concentration. Current metal markets experience significant volatility due to supply disruptions in concentrated production regions. Ocean mining could moderate price swings through diversified supply sources less vulnerable to individual country-specific risks.

Integration with Renewable Energy and Technology Manufacturing

Direct supply relationships with battery manufacturers could optimise supply chain efficiency and reduce costs throughout the production process. Ocean mining companies may develop integrated operations extending from seafloor extraction through refined metal delivery to battery plants, eliminating intermediary trading and processing steps.

Circular economy opportunities arise through integrating ocean mining with metal recycling systems to maximise resource utilisation. Used batteries and electronic components could supplement ocean-sourced metals while reducing overall environmental impacts. This integrated approach aligns with sustainability goals while optimising economic returns.

Quality advantages of ocean-sourced metals for high-technology applications stem from consistent composition and minimal contamination compared to terrestrial ores. Polymetallic nodules contain fewer impurities than typical mining ores, potentially reducing processing costs and improving final product performance in demanding applications.

Timeline alignment with global decarbonisation goals creates favourable market conditions for deep-sea mining development. The projected timeline for commercial ocean mining operations coincides with massive increases in battery metal demand driven by electric vehicle adoption and renewable energy storage deployment worldwide.

Deep-sea nodule mining could potentially supply 25% of global nickel demand and 50% of cobalt requirements within two decades, fundamentally reshaping critical metal supply chains.

What Does the Future Hold for Ocean Floor Mining?

Technology Advancement Trajectories and Innovation Drivers

Artificial intelligence integration promises to revolutionise autonomous mining operations through real-time decision-making, predictive maintenance, and optimised collection patterns. Machine learning algorithms could analyse seafloor conditions, nodule distribution patterns, and environmental factors to maximise collection efficiency while minimising ecological impact.

Improved environmental monitoring systems enable real-time assessment of mining impacts and adaptive management responses. Advanced sensor networks, autonomous monitoring vehicles, and satellite-based observation systems could provide continuous environmental data streams, allowing operators to modify operations based on ecological conditions.

Enhanced processing efficiency through technological innovation could significantly improve project economics while reducing environmental footprints. Advanced metallurgical processes, waste heat recovery systems, and integrated processing facilities may achieve higher metal recovery rates with lower energy consumption than current technologies.

Cost reduction pathways through technological optimisation focus on automation, economies of scale, and operational efficiency improvements. Mass production of specialised equipment, standardised operating procedures, and shared infrastructure could reduce unit costs significantly as the industry matures.

Scenario Planning for Commercial Implementation Timelines

Regulatory approval pathways suggest commercial operations could begin by 2027-2030 under favourable conditions, though environmental concerns and political opposition could extend timelines significantly. The International Seabed Authority's regulatory development process will largely determine the pace of commercial development across international waters.

Market conditions favouring deep-sea mining development include sustained high metal prices, supply chain disruptions from traditional mining regions, and accelerated clean energy deployment requiring massive battery metal supplies. Conversely, technological breakthroughs in recycling or alternative materials could reduce demand pressures.

Environmental breakthrough requirements for sustainable operations may include zero-impact collection technologies, comprehensive ecosystem restoration capabilities, and real-time environmental monitoring with automatic operational adjustments. These technological advances could address scientific and environmental concerns while enabling responsible development.

Investment climate factors affecting project development include commodity price volatility, regulatory uncertainty, environmental liability concerns, and competition from alternative supply sources. Successful commercial deployment requires sustained favourable conditions across multiple variables over extended development timelines.

Frequently Asked Questions About Deep-Sea Polymetallic Nodule Mining

Is Deep-Sea Mining Actually More Environmentally Friendly?

Deep-sea mining presents both environmental advantages and risks compared to terrestrial alternatives. Ocean mining eliminates deforestation, groundwater contamination, and community displacement associated with traditional mining while potentially generating 90% less solid waste. However, deep-sea ecosystems remain poorly understood, and mining impacts could prove irreversible in slow-recovering abyssal environments.

The environmental comparison depends heavily on specific operational practices and the particular terrestrial mining operations being replaced. Responsible deep-sea mining with advanced environmental controls could offer significant advantages over poorly regulated land-based mining, while careless ocean operations might cause greater damage than well-managed terrestrial mines.

How Long Would It Take to Recover Metals from Ocean Operations?

Commercial deep-sea mining operations could achieve full production within 5-10 years following project approval, depending on technological readiness and regulatory processes. The NORI-D project targets initial production by late 2027 with full production capacity reached within five years of operations commencement.

Processing and refining timelines depend on utilising existing infrastructure versus constructing new facilities. Projects leveraging established processing plants could achieve faster production ramp-up, while integrated operations requiring new infrastructure may require additional 3-5 years for facility construction and commissioning.

What Happens if Environmental Impacts Are Worse Than Predicted?

Environmental monitoring requirements and adaptive management protocols provide mechanisms to address unexpected impacts through operational modifications or project suspension. Regulatory frameworks under development include specific provisions for halting operations if environmental damage exceeds predicted levels or acceptable thresholds.

Insurance and liability arrangements could provide financial resources for environmental restoration and compensation, though current frameworks remain inadequately developed. The industry and regulators continue working to establish comprehensive liability and remediation systems addressing worst-case environmental scenarios.

Could Deep-Sea Mining Replace All Land-Based Metal Extraction?

Deep-sea mining cannot completely replace terrestrial mining due to limited metal types available in ocean deposits and the massive scale of global metal demand. Ocean mining targets specific critical metals like nickel, cobalt, and copper while land-based mining remains necessary for iron, aluminium, gold, and numerous other materials.

The realistic potential involves deep-sea mining supplementing terrestrial production for specific critical metals while reducing dependence on the most problematic land-based mining operations. This complementary approach could optimise global supply chains by utilising the most appropriate extraction methods for different metals and geological conditions.

Disclaimer: This article contains forward-looking projections and speculative analysis regarding deep-sea mining development, regulatory approval timelines, and market conditions. Actual results may differ materially from these projections due to technological, regulatory, environmental, and market factors. Investment in deep-sea mining projects involves substantial risks and should be evaluated carefully. Environmental impact assessments and regulatory developments continue evolving, potentially affecting project viability and timelines.

Interested in Capitalising on the Next Wave of Critical Metals Discoveries?

Discovery Alert's proprietary Discovery IQ model delivers real-time notifications when significant mineral discoveries are announced on the ASX, transforming complex geological data into actionable investment insights. Explore our discoveries page to understand how major mineral finds have generated substantial historic returns, then begin your 30-day free trial to position yourself ahead of the market for the next breakthrough discovery.