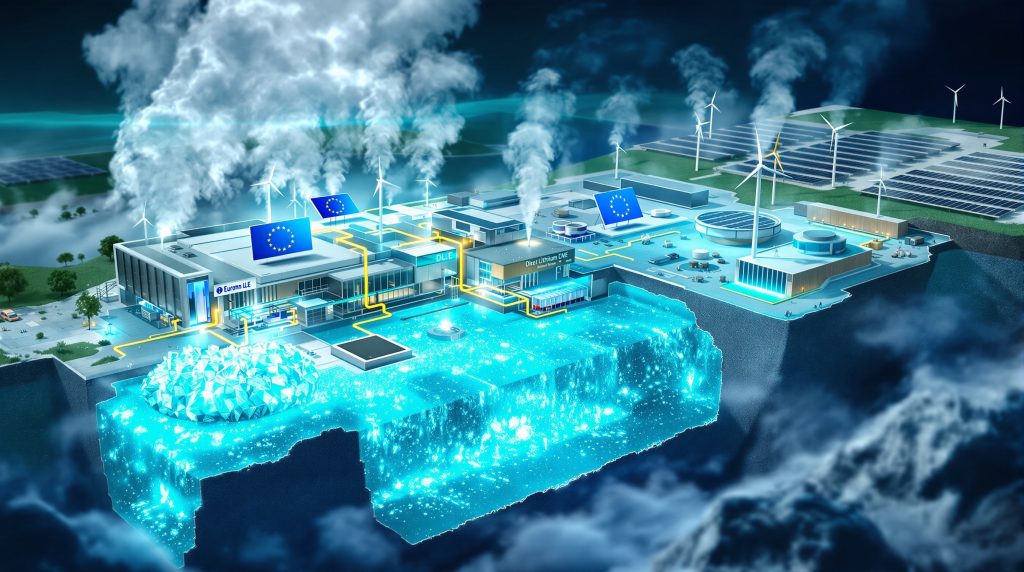

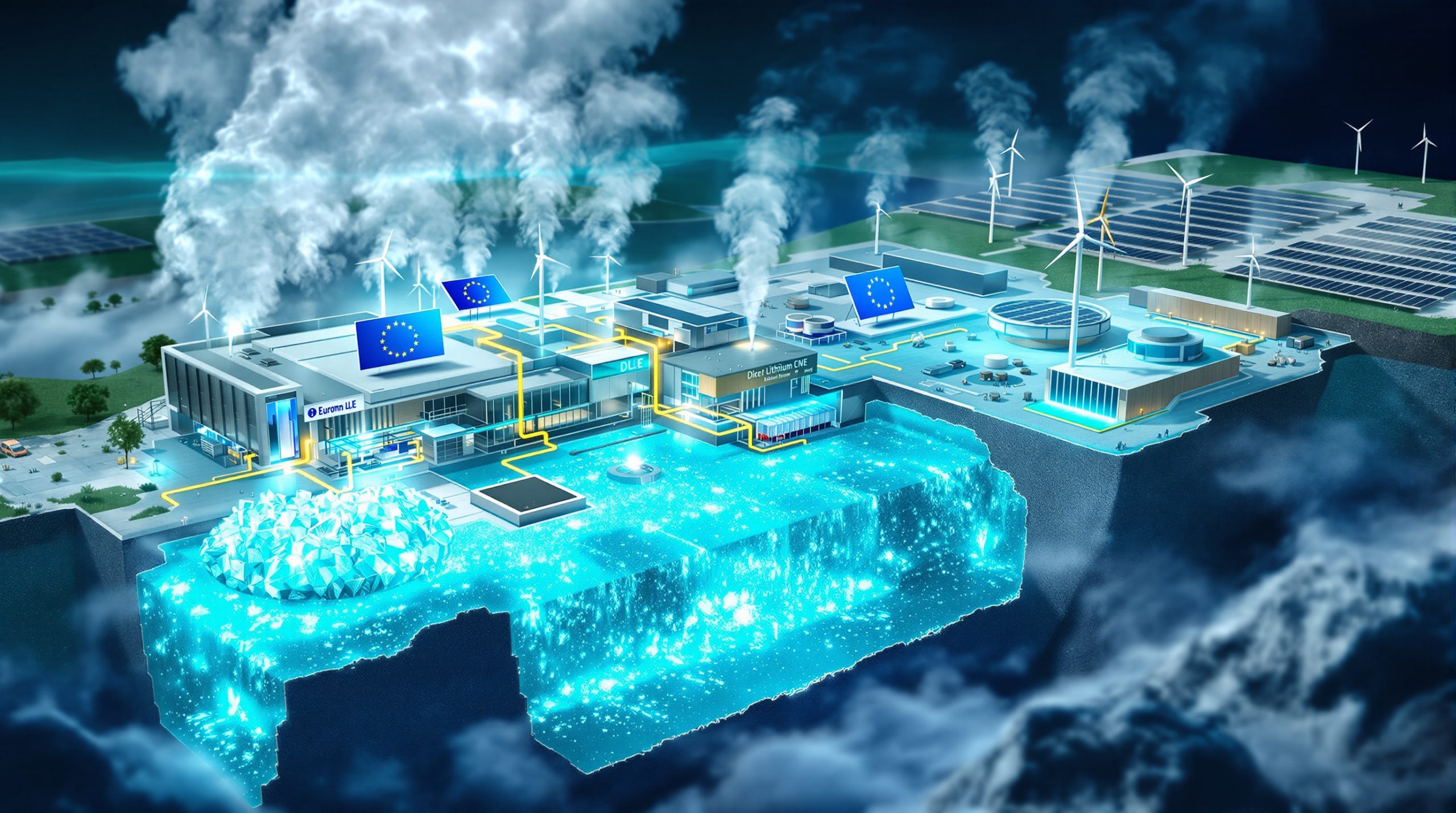

Direct Lithium Extraction in Europe: Revolutionizing Sustainable Battery Supply Chains

Europe stands at a critical crossroads in its energy transition journey. With ambitious electrification targets but a startling dependency on imported battery materials, the continent faces a significant supply chain vulnerability that threatens to undermine its strategic autonomy. Direct Lithium Extraction (DLE) has emerged as a promising solution uniquely suited to European conditions, offering a more sustainable and locally-adaptable approach to lithium industry innovations.

What is Direct Lithium Extraction and Why Does Europe Need It?

Understanding Direct Lithium Extraction Technology

Direct Lithium Extraction represents an innovative approach to lithium production that fundamentally differs from traditional methods. Rather than relying on extensive evaporation ponds or energy-intensive hard rock mining, DLE technologies utilize specialized adsorbent materials, ion exchange processes, or solvent extraction methods to selectively capture lithium ions directly from brine solutions.

The process works by pumping lithium-containing brine through columns or chambers filled with these selective materials, which physically or chemically bind to lithium while allowing other elements to pass through. This selective extraction creates a concentrated lithium solution that can be further processed into battery-grade materials with significantly reduced environmental impact.

Europe's Strategic Need for Domestic Lithium Production

The urgency for European lithium production becomes clear when examining the current supply dynamics. As of 2024, European lithium chemical consumption reached only 26,000 tonnes, representing a mere 2% of global demand. More concerning is that approximately 98% of Europe's lithium arrives through imported finished batteries rather than as raw materials or chemicals that could support domestic manufacturing.

This disconnect between Europe's ambitious electrification goals and its current supply infrastructure highlights a critical vulnerability. Without developing domestic lithium resources, Europe risks remaining dependent on extended, potentially unstable supply chains primarily controlled by non-European entities. This dependency directly contradicts the continent's strategic goals for industrial resilience and energy sovereignty.

Industry experts have described this situation as "a cart without the horse," emphasizing that Europe's push for domestic lithium must be matched with corresponding investments across the entire value chain, including cathode production and battery metals investment capacity.

How Does DLE Compare to Traditional Lithium Extraction Methods?

Environmental Footprint Comparison

Traditional lithium extraction methods carry significant environmental burdens. Evaporation ponds used in South American operations can span thousands of hectares, dramatically altering landscapes and ecosystems. Hard rock mining operations, which have recently overtaken brine as the dominant global production method, require extensive energy for crushing, processing, and refining.

DLE facilities, in contrast, maintain a substantially smaller physical footprint—typically less than 10% of the land area required for equivalent production from evaporation ponds. This compact design makes them particularly compatible with Europe's densely populated landscapes where large-scale industrial operations often face spatial constraints.

When powered by renewable energy sources, DLE operations can achieve carbon footprints as low as 1-3 kg CO₂ equivalent per kilogram of lithium carbonate equivalent produced. This represents a substantial improvement over conventional production methods, which typically generate 5-15 kg CO₂ equivalent per kilogram.

Water Usage and Resource Efficiency

Water conservation represents another crucial advantage of DLE technology in the European context. Traditional evaporation methods can lose vast quantities of water to evaporation—a particularly problematic aspect in water-stressed regions. Modern DLE processes, by comparison, can recycle up to 95% of process water, dramatically reducing freshwater consumption per tonne of lithium produced.

This efficiency is achieved through closed-loop systems that treat and recirculate brine after lithium extraction, minimizing both water consumption and wastewater discharge. Some advanced DLE operations are even designed to operate with zero liquid discharge, further reducing environmental impact in sensitive watersheds.

Technological Maturity Assessment

Despite perceptions that DLE represents experimental technology, commercial applications have existed since 1996, providing nearly three decades of operational experience. As Francis Wedin of Vulcan Energy Resources has emphasized, "DLE has been used commercially since 1996, so nearly 30 years. It's not new."

What is new, however, is the adaptation of these technologies to Europe's specific geological and regulatory conditions. Recent technological advancements have improved selectivity, reduced energy requirements, and enhanced recovery rates from increasingly diverse brine sources. These improvements have made DLE increasingly viable for European geothermal brines, which often contain lower lithium concentrations than South American salars.

Where Are Europe's Most Promising DLE Projects Located?

Upper Rhine Valley Projects (Germany)

The Upper Rhine Valley represents one of Europe's most promising geothermal lithium resources, with brines containing lithium concentrations between 150-200 mg/L. This region benefits from well-established geothermal infrastructure that can be leveraged for lithium production, creating synergistic operations that produce both renewable energy and battery materials.

Several projects are advancing in this region, including Vulcan Energy's Zero Carbon Lithium initiative, which aims to demonstrate that geothermal energy can power the entire lithium extraction process, creating a truly carbon-neutral supply chain. These integrated operations aim to produce battery-grade lithium hydroxide with minimal carbon footprint, with commercial production targeted to begin by 2026-2027.

The region benefits from proximity to major European automotive manufacturing centers, potentially enabling shorter, more resilient supply chains. Local governments have generally supported these developments, recognizing their potential contribution to regional economic development and energy transition goals.

Cornwall Basin Development (United Kingdom)

The Cornwall region hosts significant geothermal lithium resources within granite-heated brines. This area combines a rich mining heritage with newly recognized lithium potential, creating opportunities to revitalize traditional mining regions with sustainable, modern extraction methods.

Projects in this area, including those by Cornish Lithium, are developing customized DLE technologies specifically designed for the unique geochemical signature of Cornish brines. These operations face distinct challenges related to the UK's post-Brexit regulatory environment but benefit from strong government support for critical minerals development.

Neil Elliot of Cornish Lithium has identified economic viability as the fundamental challenge: "The biggest one for me is going to be, fundamentally, the cost and whether you can actually produce at an economic level." This pragmatic focus on commercial competitiveness reflects the maturity of the Cornish projects, which are moving beyond technical proof-of-concept to address real-world economic challenges.

Alsace Region Initiatives (France)

The Alsace region is advancing DLE projects that utilize specialized "lithium sponge" materials to selectively extract lithium from geothermal brines. These projects benefit from France's supportive policy environment for critical minerals development and proximity to planned battery gigafactories, potentially creating an integrated, localized supply chain.

Commercial production targets suggest output beginning around 2030, with projected capacity of 10,000-15,000 tonnes of lithium carbonate equivalent annually. These operations are being designed to integrate with France's decarbonization goals, utilizing low-carbon electricity to minimize environmental impact.

What Technical Challenges Must European DLE Projects Overcome?

Scaling From Pilot to Commercial Production

The transition from laboratory and pilot-scale operations to full industrial facilities producing 20,000+ tonnes annually represents perhaps the most significant technical hurdle facing European DLE projects. This scaling challenge requires substantial engineering expertise and capital investment to ensure that technologies proven at smaller scales maintain their efficiency, selectivity, and reliability when expanded to commercial volumes.

Stefan Debruyne of SQM Lithium has highlighted this challenge, noting the significant gap between pilot demonstrations and operational industrial-scale facilities. This scaling process requires not only technical solutions but also the patience and financial commitment to work through inevitable optimization challenges that emerge at larger scales.

Many European projects are adopting phased approaches, starting with smaller commercial modules that can be replicated and expanded as operational experience accumulates. This strategy aims to reduce technical risk while still progressing toward meaningful production volumes.

Brine Chemistry Complexities

European geothermal brines typically contain complex mixtures of elements beyond lithium, including potentially interfering ions such as calcium, magnesium, and boron. The specific "chemical soup" varies significantly between regions and even between wells within the same field, requiring customized solutions based on each brine's unique fingerprint.

DLE technologies must achieve high selectivity for lithium while managing these impurities, which can affect process efficiency, product purity, and equipment longevity. Some projects are developing multi-stage processes that combine different extraction technologies to address specific impurity profiles, while others are creating custom adsorbents tailored to their particular brine chemistry.

Adsorbent Material Supply Security

Many DLE technologies rely on specialized adsorbent materials that selectively capture lithium ions. Ensuring secure supply chains for these critical materials represents a strategic challenge, particularly when some components originate from geopolitically sensitive regions.

As Francis Wedin has noted, these adsorbents often come from supply chains that themselves may require securing to ensure European strategic autonomy. European projects are increasingly focusing on developing regionally-sourced adsorbents to reduce supply vulnerabilities and create more resilient operations.

Research into next-generation adsorbent materials continues at several European universities and research institutes, with goals of increasing selectivity, durability, and regeneration capacity while reducing dependence on imported materials.

What Economic Factors Will Determine DLE Success in Europe?

Capital Intensity and Investment Requirements

European DLE projects typically require substantial upfront capital investment, with integrated geothermal-lithium facilities often exceeding €500 million in development costs. This capital intensity necessitates strong financial backing and patient investment horizons, as projects may require 5-7 years from initial exploration to commercial production.

Industry experts have characterized these projects as "massively capital-intensive," highlighting the need for investors with long-term perspectives who understand both the strategic importance and potential returns of domestic lithium production. Public-private partnerships and strategic government investments may play crucial roles in bridging funding gaps, particularly for first-generation projects that face higher perceived risks.

The European Investment Bank and various national investment agencies have shown increasing interest in supporting critical minerals projects, recognizing their strategic importance to the continent's industrial future.

Production Cost Competitiveness

For European DLE operations to succeed commercially, they must achieve production costs competitive with established global suppliers. Current cost estimates for European DLE projects range from €7,000-12,000 per tonne of lithium carbonate equivalent, which must compete with traditional producers whose costs can be as low as €5,000-8,000 per tonne.

This cost differential reflects several factors, including higher labor costs, stricter environmental regulations, and the early-stage nature of European operations that have not yet benefited from learning-curve efficiencies. However, several factors may improve European competitiveness over time:

- Technological improvements reducing energy and reagent consumption

- Economies of scale as production volumes increase

- Integration benefits from co-production of geothermal energy

- Potential carbon border adjustment mechanisms that may level the playing field for lower-carbon production

- Reduced transportation and logistical costs from proximity to European battery manufacturers

Value Chain Integration Opportunities

The economic viability of European DLE projects may be enhanced through vertical integration with downstream processing and manufacturing. By producing battery-grade lithium chemicals in proximity to cathode and cell manufacturers, European producers can potentially capture additional value while reducing transportation costs and carbon emissions associated with global shipping.

Several projects are exploring integrated business models that span multiple steps in the battery value chain, creating more resilient local ecosystems. This integration approach aligns with broader European industrial policy goals of developing complete, regionally anchored supply chains for strategic technologies.

How Will Regulatory and Social Factors Shape European DLE Development?

Permitting and Regulatory Timelines

European regulatory frameworks for lithium extraction remain in development, with permitting processes often requiring 2-3 years or longer. This regulatory uncertainty represents a significant challenge for project developers and investors, potentially delaying deployment timelines and increasing development costs.

Astrid Karamira of the International Lithium Association has identified permitting and regulation as equally important factors alongside cost competitiveness for determining project success. Industry stakeholders are advocating for streamlined permitting procedures that maintain environmental safeguards while reducing administrative delays.

Some European countries have begun designating critical minerals projects for expedited review processes, recognizing their strategic importance to energy transition goals. However, these reforms remain unevenly implemented across the continent.

Community Acceptance and Social License

Public acceptance represents a critical success factor for European DLE projects, particularly given their proximity to populated areas. Developers must demonstrate long-term commitment to community engagement, transparency, and shared benefits.

Axel Wenke of Neptune Energy has emphasized this point: "You have to show people you are there for the long term, and that they are happy for you to be there." This perspective recognizes that social license to operate cannot be taken for granted but must be continuously earned through responsible operations and meaningful community partnerships.

Projects that successfully integrate with local economic development priorities while minimizing environmental impacts are likely to achieve stronger community support. Several developers are implementing early and extensive stakeholder engagement programs, incorporating community input into project design and creating transparent monitoring programs to build trust.

Strategic Autonomy Policies

European policy initiatives supporting strategic autonomy in critical minerals are creating a more favorable environment for domestic lithium production. The European Critical Raw Materials Act aims to ensure that by 2030, at least 10% of the EU's annual lithium consumption is extracted within Europe, providing policy backing for DLE development.

These strategic priorities may translate into concrete support mechanisms, including:

- Research and development funding for DLE technology improvement

- Financial guarantees or low-interest loans for project development

- Preferential procurement policies for European-sourced materials

- Expedited permitting for projects designated as strategically important

- Infrastructure investments supporting critical minerals development

What Are the Environmental Implications of European DLE Projects?

Carbon Footprint Analysis

When powered by renewable energy sources, European DLE operations can achieve carbon footprints as low as 1-3 kg CO₂ equivalent per kilogram of lithium carbonate equivalent. This represents a significant improvement over conventional lithium production methods, which typically generate 5-15 kg CO₂ equivalent per kilogram of product.

This carbon advantage becomes particularly significant when considering lifecycle emissions of battery production, where raw material extraction represents a substantial portion of overall emissions. By reducing this footprint, European DLE can contribute to producing genuinely low-carbon batteries that better fulfill the environmental promises of electrification.

Several projects are conducting detailed life cycle assessments to quantify their environmental performance, providing transparent data that can inform both policy decisions and customer purchasing choices.

Land Use and Biodiversity Considerations

The compact footprint of DLE facilities offers substantial environmental advantages in land-constrained Europe. Typical DLE operations require less than 10% of the land area needed for equivalent production from conventional evaporation ponds, reducing habitat disruption and preserving agricultural and natural landscapes.

This reduced spatial impact is particularly important in Europe, where competing land uses and high population density make large industrial footprints problematic. Some DLE projects are being designed for integration with existing industrial zones or previously disturbed areas, further minimizing new environmental impacts.

Waste Management Approaches

European DLE projects are developing innovative approaches to manage process residues and spent materials. Several operations are investigating the recovery of valuable by-products from brines, including potassium, boron, and magnesium, potentially transforming waste streams into additional revenue sources while reducing disposal requirements.

Circular economy principles are being incorporated into facility designs, with goals of minimizing waste generation and maximizing resource recovery. These approaches align with broader European waste management priorities and may provide competitive advantages as regulatory frameworks increasingly favor circular production models.

How Might European DLE Reshape Global Lithium Markets?

Supply Diversification Impact

Successful European DLE deployment could significantly diversify global lithium supply chains, currently dominated by Australia, Chile, Argentina, and China. By 2030, European projects collectively target production capacity of 80,000-100,000 tonnes of lithium carbonate equivalent annually, potentially representing 5-8% of projected global supply.

This diversification would reduce concentration risk in global markets and potentially increase overall supply security for battery manufacturers worldwide. European production would be particularly valuable for its geographical and political stability, potentially commanding premium pricing from customers seeking supply chain resilience.

Price Stability Implications

Increased European lithium production could contribute to greater price stability in global markets by reducing reliance on concentrated supply sources. The diversification of production geographies and technologies may help mitigate supply disruptions and moderate price volatility that has characterized lithium markets in recent years.

While European production volumes are unlikely to dominate global markets, they could provide a stabilizing influence by offering alternative supply options during disruptions affecting traditional producing regions. This stabilizing effect would benefit the entire battery supply chain by improving planning certainty and reducing risk premiums.

Geopolitical Significance

The development of domestic European lithium production carries significant geopolitical implications, potentially reducing the continent's vulnerability to supply chain disruptions and trade tensions. European DLE represents an important component of broader strategic efforts to secure critical minerals necessary for the energy transition.

By developing indigenous lithium resources, Europe can strengthen its negotiating position in global markets while reducing vulnerability to potential export restrictions or politically motivated supply disruptions. This enhanced security directly supports the continent's broader energy transition and industrial policy goals.

What Is the Future Outlook for Direct Lithium Extraction in Europe?

Technology Evolution Trajectories

European DLE technologies continue to evolve rapidly, with research focused on improving selectivity, reducing energy requirements, and enhancing recovery rates. Next-generation adsorbents and process designs may achieve lithium recovery rates exceeding 90% while further reducing water and energy consumption.

Several promising development paths are emerging:

- Advanced nano-structured adsorbents with higher selectivity and capacity

- Membrane-based systems that reduce energy requirements

- Electrochemical processes that eliminate or reduce chemical reagent use

- Integrated systems that simultaneously extract multiple valuable elements

- Artificial intelligence optimization of process parameters for maximum efficiency

These technological improvements will be critical to achieving cost competitiveness while maintaining environmental performance advantages.

Integration with Renewable Energy Systems

Future European DLE operations will likely feature deeper integration with renewable energy systems, potentially including dedicated solar and wind generation alongside geothermal resources. This integration offers opportunities for energy storage and grid balancing services that could provide additional revenue streams while further reducing carbon footprints.

Some projects are exploring innovative thermal management approaches that utilize excess heat from industrial processes or lower-grade geothermal resources to power lithium extraction, further improving energy efficiency and economic performance.

Circular Economy Potential

European DLE projects are increasingly adopting circular economy principles, with several operations planning to recover lithium from end-of-life batteries alongside virgin production. This integrated approach could eventually create closed-loop systems where lithium cycles between extraction, battery manufacturing, and recycling within European borders.

By 2035, recycled materials could potentially supply 15-25% of European lithium demand, complementing direct extraction operations and further reducing import dependence. This circular approach aligns perfectly with Europe strategic minerals goals while potentially offering economic and security advantages.

FAQ: European Direct Lithium Extraction

Is DLE technology proven at commercial scale?

Yes, DLE technology has been commercially operational since 1996, providing nearly 30 years of industrial application experience. While European projects represent new implementations, the core technology principles have been demonstrated at commercial scale in various global contexts. The challenge lies not in the fundamental technology but in adapting it to Europe's specific geological, regulatory, and economic conditions.

How does European DLE compare to traditional lithium sources in environmental impact?

European DLE typically demonstrates superior environmental performance compared to traditional sources, with smaller land footprints, reduced water consumption, and lower carbon emissions when powered by renewable energy. These advantages are particularly significant when compared to conventional evaporation pond operations that can occupy thousands of hectares and consume substantial water resources through evaporation.

What timeline can we expect for European lithium production from DLE?

The first commercial European DLE operations are expected to begin production between 2026-2027, with additional projects coming online through 2030. By 2030, European DLE could potentially supply 5-8% of global lithium demand, representing a significant contribution to domestic battery supply chains. These timelines assume continued progress in permitting, financing, and technical development without major delays.

Will European DLE be cost-competitive with global lithium sources?

Current projections suggest European DLE will initially operate at the higher end of the global cost curve, with production costs 15-30% above traditional sources. However, ongoing technological improvements, integration benefits, and potential carbon pricing mechanisms may improve relative competitiveness over time. European producers may also command premium pricing based on sustainability credentials and supply chain security benefits.

Further Exploration

Readers interested in learning more about developments in European lithium extraction can explore related educational content from industry conferences such as Fastmarkets' European Battery Raw Materials conference, which regularly features discussions on emerging technologies and market trends in the battery materials sector. Furthermore, projects like the Thacker Pass lithium mine in the United States offer additional insights into alternative lithium extraction methods that could complement European lithium brine insights and technologies.

Ready to Spot the Next Major Mineral Discovery?

Don't miss a single significant ASX announcement—receive instant alerts on major discoveries with Discovery Alert's proprietary Discovery IQ model, helping you make faster, better-informed investment decisions. Explore historic returns from game-changing discoveries at https://discoveryalert.com.au/discoveries/ and position yourself ahead of the market.