The Devastating Collapse at El Teniente: Impact on Global Copper Markets

On July 30, 2025, a catastrophic collapse at Codelco's El Teniente copper mine in Chile sent shockwaves through the global mining industry. The tragedy claimed six lives and left nine workers injured, immediately halting operations at what is recognized as the world's largest underground copper mine and the sixth biggest by reserve size.

This unexpected shutdown has removed approximately 30,000 metric tons of copper from global supply each month—representing a quarter of Codelco's total production capacity and creating significant ripple effects across copper-dependent industries worldwide.

Codelco's Response and Restart Efforts

The state-owned mining giant has submitted a formal request to Chile's mines regulator, Sernageomin, seeking permission to restart operations in unaffected areas of the El Teniente complex. According to reports from Bloomberg News, the regulator has requested additional information from the company, which Codelco is currently preparing.

"Codelco is looking to resume underground mining in areas of the El Teniente complex unaffected by the collapse," noted mining officials familiar with the situation. "Under the plan, an investigation into causes of the incident and its implications for safety and operations would continue during the return to work."

Proposed Phased Return Strategy

Codelco's carefully structured return-to-work plan includes several key components:

- Resuming underground mining activities only in sections demonstrably unaffected by the collapse

- Continuing the thorough investigation into the accident's causes while operations partially resume

- Implementing enhanced safety protocols in reopened sections, including increased monitoring

- Gradually scaling up production as comprehensive safety assessments are completed

This measured approach reflects the delicate balance between operational necessities and safety priorities that mining companies must maintain, especially following catastrophic events.

Regulatory Hurdles to Overcome

The restart plan faces significant regulatory challenges before operations can resume:

- Sernageomin must approve all safety aspects of the proposal through a rigorous review process

- Labor authorities must separately sign off on worker protection measures

- An international expert panel is being assembled to audit the mine and determine what happened

- No guarantee exists that regulators will approve the current proposal

Mining safety experts note that Chilean regulators have become increasingly stringent following several high-profile incidents in the country's mining sector over the past decade.

Global Market Implications of the El Teniente Shutdown

The prolonged shutdown at El Teniente creates far-reaching consequences for global copper markets at a time when demand for the metal continues to grow, particularly driven by renewable energy technologies and electrifying copper demand.

Supply Chain Disruptions

The sudden removal of 30,000 metric tons of copper monthly—equivalent to approximately 360,000 tons annually—represents a significant supply shock in an already tight market. This disruption comes at a particularly challenging time as:

- Global copper inventories were already at historically low levels

- Demand from green energy and electrification projects continues to accelerate

- Few alternative sources can quickly ramp up production to fill the gap

- Processing and refining bottlenecks limit the ability to increase output elsewhere

Price Implications and Market Response

Copper prices have responded to the supply disruption, with futures contracts seeing increased volatility. Market analysts are closely monitoring how prolonged the shutdown might be, as extended production losses could drive prices significantly higher from the current level of approximately $4.42 per pound.

Mining industry consultant Ryan Johnson notes, "The El Teniente shutdown creates a supply gap that cannot be easily filled in the short term. With global copper supply forecast to grow substantially over the next decade for energy transition, even temporary disruptions can have outsized price impacts."

Setbacks for Codelco's Recovery Plans

This incident represents a major blow to Codelco's operational strategy and financial position. The company had been implementing ambitious plans to reverse years of production decline through targeted investments and operational improvements.

The El Teniente collapse:

- Further complicates the company's efforts to reverse a multi-year output slump

- Delays critical investment projects aimed at modernizing aging infrastructure

- Creates additional financial pressure after Codelco recently raised $8 billion to address existing challenges

- Potentially impacts Chile's national finances, as Codelco is state-owned and a significant revenue contributor

Financial analysts estimate that each month of complete shutdown at El Teniente could cost Codelco over $350 million in lost revenue, not including remediation costs and potential compensation for affected workers and families.

El Teniente's Strategic Importance in Global Copper Production

Understanding the mine's significance helps contextualize why this shutdown has such widespread implications.

Technical and Historical Significance

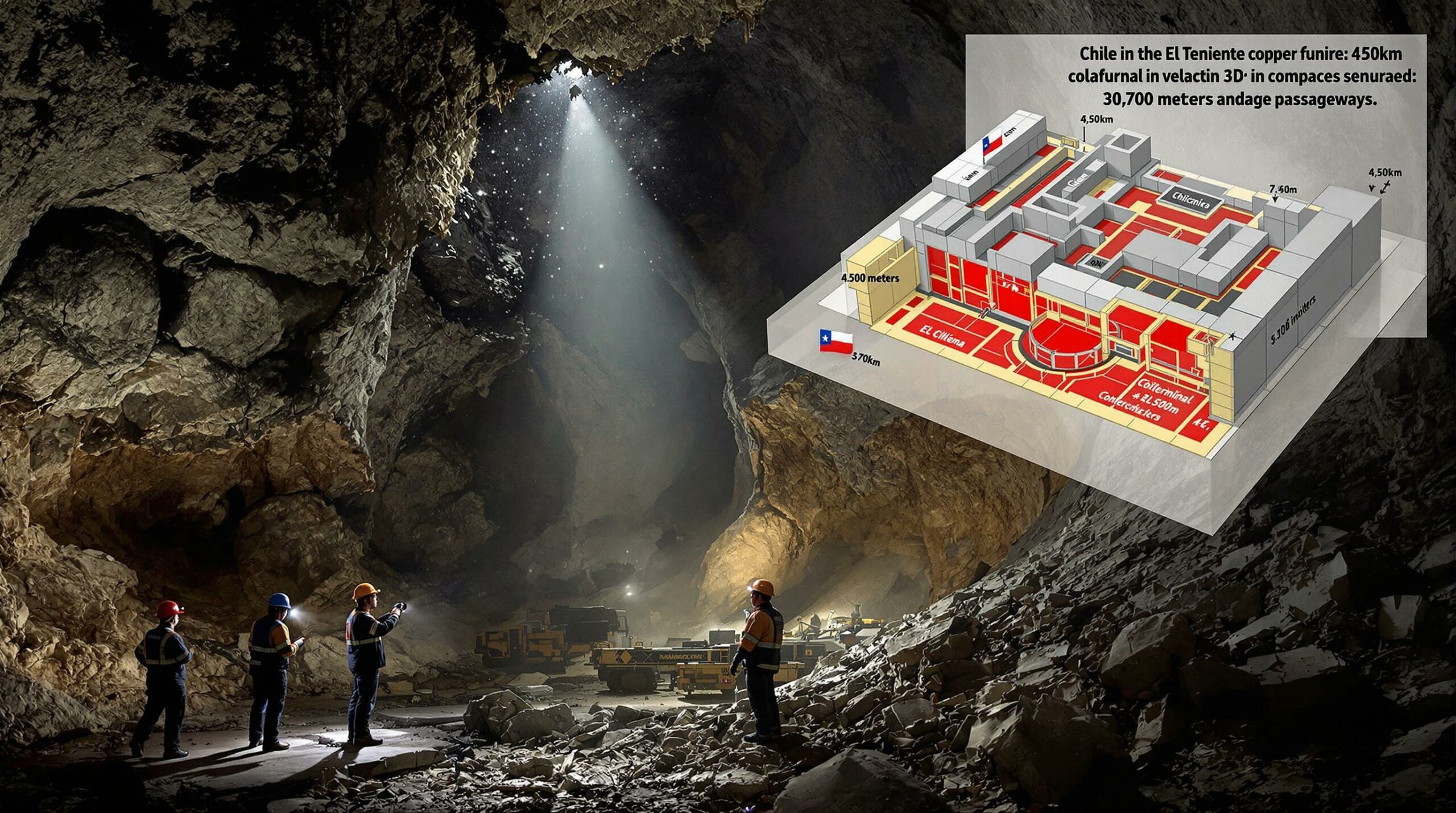

El Teniente holds several distinctive characteristics that make it a cornerstone of global copper production:

- Over 110 years of continuous operation, making it one of the world's oldest active copper mines

- Pioneering underground block-caving mining techniques that set industry standards

- Complex underground infrastructure spanning hundreds of kilometers of tunnels

- Advanced automation and remote operation systems for challenging mining environments

Production Capacity and Economic Impact

The mine is a crucial contributor to both Codelco's portfolio and Chile's broader economy:

| Production Metric | Approximate Value |

|---|---|

| Annual Copper Production | 400,000+ tons |

| Percentage of Codelco Output | 25% |

| Contribution to Chilean GDP | 0.5% (direct) |

| Employment (direct and indirect) | 15,000+ workers |

The surrounding communities of Rancagua and Machalí have developed symbiotically with the mine, creating a regional economy heavily dependent on its continued operation.

The Path Forward: Investigation and Safety Overhaul

In the aftermath of the collapse, multiple parallel processes are underway to determine causes and prevent future tragedies.

Comprehensive Technical Investigation

The investigation into the collapse involves:

- Detailed structural analysis of the affected mining sections

- Review of recent geological data and any warning signs that may have been missed

- Examination of maintenance records and inspection protocols

- Assessment of ground control measures and their implementation

- Evaluation of emergency response procedures and their effectiveness

Mining safety expert Maria Fuentes explains: "Underground collapses often result from a complex interplay of factors including geological stresses, water infiltration, and mining practices. Investigating such incidents requires careful forensic analysis to identify both immediate triggers and systemic issues."

Labor Relations and Community Impact

The human dimension of this tragedy extends far beyond immediate casualties:

- The main union representing El Teniente workers has indicated hope for an agreement allowing gradual return to work

- Psychological support services have been established for workers and families

- Community assistance programs are being developed for the broader impact on local economies

- Discussions about enhanced compensation for high-risk mining roles are ongoing

Chile's Mining Safety Context and Regulatory Environment

The El Teniente collapse does not occur in isolation but within Chile's broader mining safety landscape, which has seen significant evolution in recent decades.

Recent Safety Trends in Chilean Mining

Chile's mining industry has experienced several significant safety incidents in recent years:

- The 2010 Copiapó mining accident (San José mine) trapped 33 miners underground for 69 days

- Multiple fatalities at various operations have prompted regulatory reviews

- Increasing focus on modernizing safety standards for underground operations

- Growing pressure from labor organizations for enhanced protections

These events have progressively strengthened Chile's regulatory framework, though implementation challenges remain.

Balancing Production and Safety

The incident highlights the ongoing challenge facing mining operations globally:

- Economic pressure to maintain production amid rising copper price predictions

- Technical complexity of accessing deeper, lower-grade ore bodies safely

- Aging infrastructure requiring significant capital investment

- Balancing automation benefits with maintaining skilled workforce capabilities

Industry analysts note that underinvestment in infrastructure maintenance and safety systems is a common factor in mining incidents worldwide, particularly as operations extend beyond their original design parameters.

Looking Ahead: Implications for Global Copper Supply

The El Teniente situation raises important questions about copper supply reliability at a critical juncture in global demand.

Short-Term Market Adjustments

In the immediate term, market participants are implementing several strategies:

- Consumers drawing down existing inventories where possible

- Traders repositioning to capitalize on potential price movements

- Producers evaluating possibilities for modest output increases at other sites

- Recyclers accelerating processing to capture higher prices

Long-Term Strategic Considerations

The incident highlights several strategic considerations for the copper industry:

- The vulnerability of global supply chains to disruptions at major production centers

- The need for diversified supply sources as copper becomes increasingly critical for energy transition

- The importance of balancing cost efficiency with robust safety systems

- The potential acceleration of new project development to address supply constraints

Industry Perspective: "What we're seeing at El Teniente underscores the fragility of copper supply chains at precisely the moment when reliable supply becomes most critical for global energy transition efforts. This could accelerate investment decisions for projects currently in development phases." – International Mining Consultant

FAQs About the El Teniente Mine Collapse

When did the collapse at El Teniente occur?

The collapse occurred on July 30, 2025, resulting in six fatalities and nine injuries among the workforce.

How much copper production has been lost due to the shutdown?

Approximately 30,000 metric tons of copper production per month has been removed from global supply, representing about 25% of Codelco's total output.

What is Codelco doing to restart operations?

Codelco has filed a request with Chile's mining regulator to resume operations in unaffected areas while continuing to investigate the accident's causes and implementing enhanced safety measures.

What makes El Teniente significant in global copper production?

El Teniente is the world's largest underground copper mine and ranks sixth globally by reserve size, making it a crucial supplier to global copper markets.

What regulatory approvals are needed before operations can resume?

Both the mines regulator (Sernageomin) and labor authorities must approve Codelco's restart plan, with no guarantee that the current proposal will be accepted.

Important Safety and Investment Considerations

The El Teniente situation contains important lessons for stakeholders throughout the mining industry and copper supply chain:

- Safety Investment: Regular modernization of safety systems and infrastructure should be viewed as essential operational expenditure rather than optional capital improvement

- Risk Assessment: Mining operations should implement more frequent and comprehensive risk assessments as operations extend beyond original design parameters

- Supply Chain Resilience: Copper-dependent industries may need to develop more robust inventory strategies and supply diversification

- Community Engagement: Mining companies must maintain transparent communication with local communities about both economic benefits and safety risks

Furthermore, this situation follows other significant disruptions in Chile's copper sector, including the planned Glencore Chile copper smelter shutdown announced earlier this year. For investors looking to navigate these market conditions, experts recommend unlocking copper investment strategies that account for both supply disruptions and growing demand trends.

Disclaimer: This article contains analysis of a developing situation. While all facts have been verified against available sources, the full investigation into the El Teniente collapse remains ongoing. Market implications and timelines for potential restart are subject to change as new information becomes available.

Looking for Real-Time Updates on Critical Mining Events?

Discover breaking mining news the moment it happens with Discovery Alert's proprietary Discovery IQ model, delivering instant alerts on significant ASX mineral discoveries and market-moving events. Explore our dedicated discoveries page to understand how major mineral announcements can lead to exceptional returns.