The Devastating Collapse at El Teniente: Codelco's Path to Recovery

On July 28, 2023, Chile's mining industry was shaken to its core when a catastrophic underground collapse at El Teniente copper mine claimed the lives of six workers and injured nine others. This tragedy not only represents a profound human loss but has triggered a complex recovery process for Codelco, Chile's state-owned mining giant, as it navigates the delicate balance between resuming critical copper production and ensuring worker safety.

The Deadly Collapse and Its Immediate Aftermath

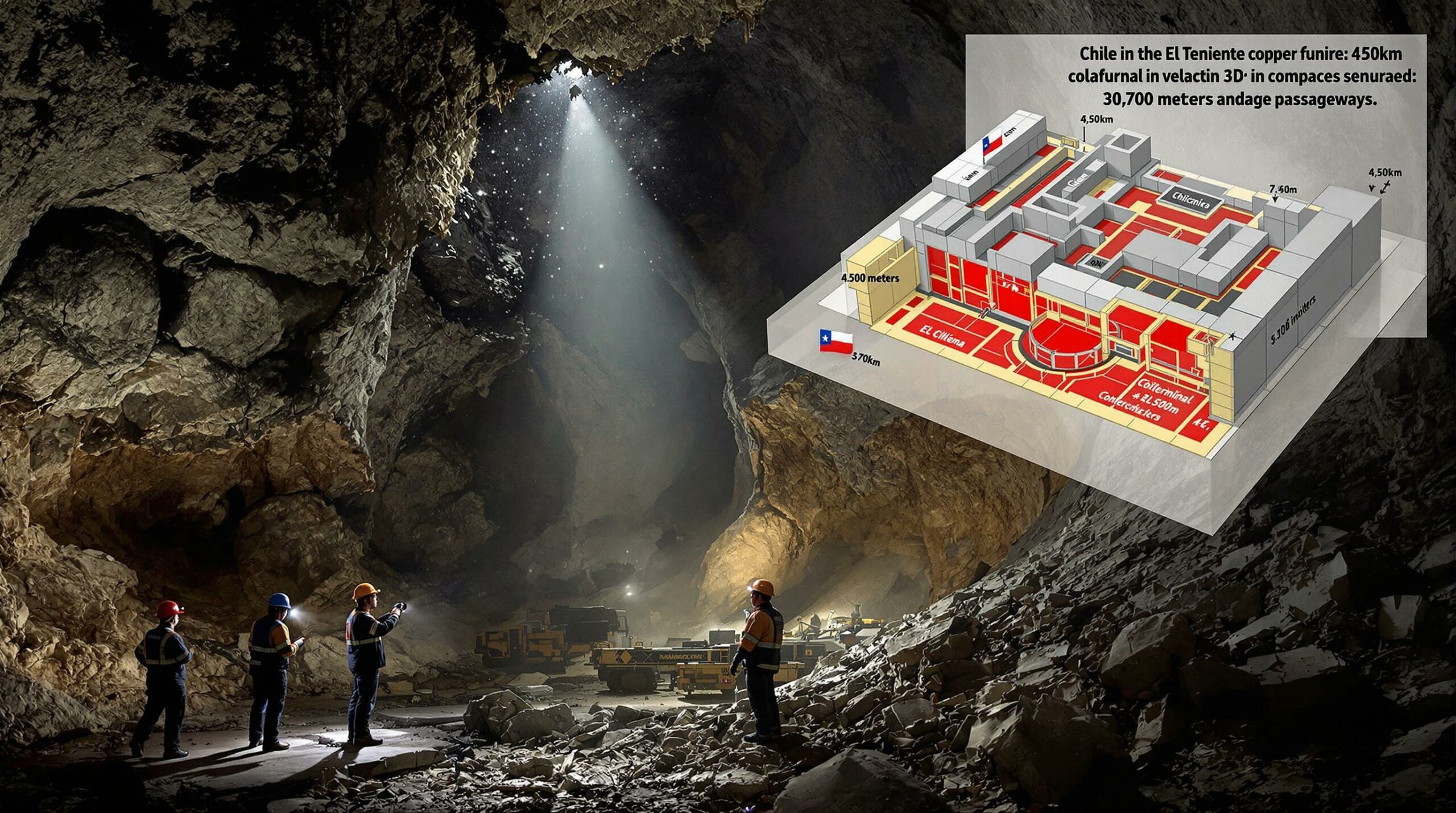

The collapse at El Teniente—the world's largest underground engineering marvels copper mine—immediately halted all operations at the facility, sending shockwaves through global copper markets. Located in the Andes Mountains about 80 kilometers southeast of Santiago, El Teniente has been in continuous operation for over a century, making it one of Chile's most iconic mining operations.

"This represents one of the most serious safety incidents in recent Chilean mining history," noted mining safety expert Carlos Fuentes in an interview with Reuters. "The complete shutdown of such a significant operation demonstrates the severity of the situation."

The immediate production impact has been substantial:

- 30,000 metric tons of monthly copper production removed from global supply

- Represents approximately 25% of Codelco's total production capacity

- Significant disruption to global copper markets during a period of growing demand

- Major setback for a company already battling production challenges

The collapse occurred in a section of the vast underground complex that spans hundreds of kilometers of tunnels. While the specific cause remains under investigation, underground mining experts point to the inherent challenges of maintaining aging infrastructure in century-old mines.

Industry Context: El Teniente has been in continuous operation since 1905, making it one of the oldest large-scale copper mining operations still active today. The mine's underground network extends over 3,000 kilometers of tunnels—enough to stretch from Santiago to Buenos Aires.

Codelco's Phased Restart Strategy

Facing immense pressure to resume operations while respecting the tragic loss of life, Codelco has developed a measured approach to restarting production. The company has formally requested permission from Sernageomin, Chile's national geology and mining service, to implement a phased return to operations.

The restart strategy includes several key components:

- Selective resumption in underground sections unaffected by the collapse

- Gradual return-to-work plan developed in consultation with union representatives

- Parallel investigation continuing alongside partial operations

- Enhanced safety protocols for all active mining areas

- International expert oversight to ensure compliance with best practices

"The company is convening an international panel to audit the mine and determine what happened," according to Bloomberg News reporting. This independent review represents an unprecedented level of external scrutiny for the state-owned miner.

The phased approach acknowledges both the economic necessity of resuming operations and the paramount importance of worker safety. Codelco officials have emphasized that no production targets will supersede safety considerations during the restart process.

Regulatory Hurdles and Safety Oversight

Before any workers can return to the mine, Codelco must navigate a complex regulatory landscape. Multiple government agencies are involved in the approval process:

| Regulatory Body | Area of Oversight | Current Status |

|---|---|---|

| Sernageomin | Technical safety and mining operations | Reviewing restart proposal |

| Ministry of Labor | Worker safety conditions | Must approve return-to-work plan |

| Ministry of Mining | Overall mining policy compliance | Monitoring the situation |

| Local authorities | Community impact assessment | Consulting with affected communities |

The approval process involves detailed technical reviews of:

- Structural stability assessments of unaffected mining sections

- Updated emergency response protocols

- Enhanced monitoring systems

- Revised evacuation procedures

- Worker training and safety equipment upgrades

"There are no assurances the plan will be approved," cautions Bloomberg News, highlighting the stringent regulatory environment in Chile following several high-profile mining incidents in recent years.

The investigation into the collapse's causes will continue in parallel with any approved restart activities. Regulatory findings could potentially impact long-term operations at El Teniente and may lead to revised safety standards across Chile's mining sector.

Economic Significance and Market Implications

The shutdown at El Teniente comes at a particularly challenging time for both Codelco and global copper markets. The company has raised $8 million to address the immediate crisis, but the financial implications extend far beyond this initial response.

Codelco's Pre-existing Challenges

Even before the collapse, Codelco was facing significant operational and financial pressures:

- Declining production over multiple consecutive years

- Aging infrastructure requiring substantial modernization investments

- Rising production costs eroding profit margins

- Environmental compliance upgrades demanding significant capital expenditure

The El Teniente disruption compounds these existing challenges and threatens to derail Codelco's strategic transformation plan aimed at maintaining its position as the world's leading copper producer.

Global Copper Market Impacts

El Teniente's significance extends well beyond Chile's borders. As the world's sixth-largest copper mine by reserve size, its production is critical to global supply chains:

- The 30,000 metric tons monthly production represents approximately 1.8% of global copper supply

- The shutdown coincides with increasing copper demand for renewable energy infrastructure

- Electric vehicle manufacturing requires 2-4 times more copper than conventional vehicles

- Global copper stockpiles were already at historically low levels before the disruption

Copper market analysts have noted that prolonged disruption at El Teniente could potentially drive price increases, particularly if the restart faces significant delays. This would impact industries ranging from construction to electronics manufacturing.

Market Context: Copper is often considered a bellwether for global economic health due to its widespread use across multiple industries. Supply disruptions can have ripple effects throughout manufacturing supply chains worldwide.

Recovery Timeline and Operational Challenges

While Codelco has filed its restart request, the path to full operational recovery remains uncertain. Mining experts suggest several factors will influence the timeline:

- Regulatory approval process – Could take weeks to months depending on findings

- Remediation requirements – Structural reinforcements may be necessary

- Worker confidence – Rebuilding trust in safety systems takes time

- Phased implementation – Different sections will resume at different times

- Ongoing investigation impacts – Findings could alter restart plans

"The gradual return to operations will likely follow a carefully structured sequence," explains mining engineer Maria Gonzalez. "Beginning with the areas furthest from the collapse zone and progressively expanding as safety is confirmed."

Operational challenges facing the recovery effort include:

- Workforce concerns – Ensuring adequate training and psychological support

- Technical complexity – Verifying structural integrity throughout the vast tunnel network

- Production pressure – Balancing safety with economic imperatives

- Aging infrastructure – Addressing systemic issues beyond the immediate collapse area

The technical complexity of restarting an underground mining operation of this scale should not be underestimated. Each section requires comprehensive geotechnical assessment, ventilation system verification, and emergency response testing before workers can safely return.

Strategic and Financial Implications for Codelco

Beyond the immediate operational challenges, the El Teniente disaster has profound strategic implications for Codelco's future. The company finds itself at a critical juncture:

- The collapse has undermined confidence in Codelco's ability to safely manage aging infrastructure

- Production shortfalls will impact revenue at a time when capital investment is critically needed

- The company faces increased scrutiny from government oversight bodies and the public

- International competitors may gain market share during the production disruption

Financial analysts estimate that each month of complete shutdown at El Teniente represents approximately $200-250 million in lost revenue for Codelco. This places significant pressure on the company's balance sheet and may require additional government support beyond the initial $8 million raised.

The strategic implications extend to Chile's national finances as well. As a state-owned enterprise, Codelco's profits flow directly to the national treasury, with copper exports representing Chile's largest source of foreign exchange. Production disruptions therefore have direct implications for national fiscal policy.

Lessons and Future Outlook

The El Teniente disaster has already catalyzed discussions about the future of underground mining safety in Chile and globally. Several emerging lessons include:

- Aging infrastructure risk – Century-old mines require specialized maintenance approaches

- Early warning systems – Enhanced monitoring technology may help prevent future collapses

- Modernization imperatives – Accelerated investment in infrastructure upgrades may be necessary

- Regulatory evolution – Safety standards will likely be strengthened across the industry

- Workforce engagement – Greater worker participation in safety planning is essential

Looking forward, Codelco faces a challenging path to recovery. The company must demonstrate its commitment to worker mental health strategies while also fulfilling its economic role as Chile's mining flagship. Success will require unprecedented transparency, technical excellence, and stakeholder engagement.

"This tragedy represents a watershed moment for Chile's mining industry," observes mining policy analyst Javier Valenzuela. "How Codelco responds will shape safety practices and regulatory approaches for decades to come."

The El Teniente recovery process will undoubtedly be closely watched by mining companies, regulators, and commodity markets worldwide. As copper demand continues to grow with the global energy transition, ensuring safe and sustainable production practices becomes increasingly critical.

Frequently Asked Questions About the El Teniente Mine Collapse

What is El Teniente's significance in global copper production?

El Teniente is the world's largest underground copper mine and ranks sixth globally by reserve size. It normally contributes approximately 30,000 metric tons of copper monthly, representing about 25% of Codelco's total production. The mine has been operating continuously for over a century and is a cornerstone of Chile's mining heritage.

What caused the collapse at El Teniente?

The exact causes remain under investigation. Codelco has assembled an international panel of experts to conduct a comprehensive audit to determine what happened and how similar incidents can be prevented. Underground mining experts point to the challenges of maintaining structural integrity in century-old tunnel networks as a potential contributing factor.

How will the restart process be managed?

Codelco has proposed a phased restart focusing initially on unaffected areas of the underground complex while continuing investigations. The plan requires approval from both mining regulators (Sernageomin) and labor authorities before implementation. Each section of the mine will undergo rigorous safety verification before workers are permitted to return.

What is the economic impact of this shutdown?

Beyond the tragic human cost, the shutdown has removed approximately 30,000 metric tons of copper monthly from global supply chains. This represents about 1.8% of global copper production and occurs at a time of increasing demand and historically low stockpiles. The disruption affects Codelco's financial position and potentially impacts global copper markets, particularly if the shutdown extends for a prolonged period.

How does this incident affect Chile's copper industry?

As Chile's state-owned mining company and the world's largest copper producer, disruptions at Codelco have national economic implications. The incident highlights ongoing challenges in maintaining aging mining infrastructure while ensuring worker safety. It may lead to more stringent regulatory oversight across Chile's mining sector and accelerate modern mine planning and data-driven mining operations across the industry.

Furthermore, this disaster could potentially influence mine reclamation trends as regulators reassess safety standards and environmental practices throughout the mining lifecycle.

Disclaimer: This article contains analysis of an ongoing situation with potential market implications. The restart timeline and regulatory decisions remain subject to change as the investigation progresses. Readers should consult multiple sources when making investment or business decisions related to copper markets.

Want to Spot the Next Major Mineral Discovery Before the Market?

Discovery Alert's proprietary Discovery IQ model instantly notifies investors of significant ASX mineral discoveries, transforming complex data into actionable insights for immediate market advantage. Explore why historic discoveries can generate substantial returns by visiting Discovery Alert's dedicated discoveries page and begin your 30-day free trial today.