Understanding Current EMM Market Dynamics

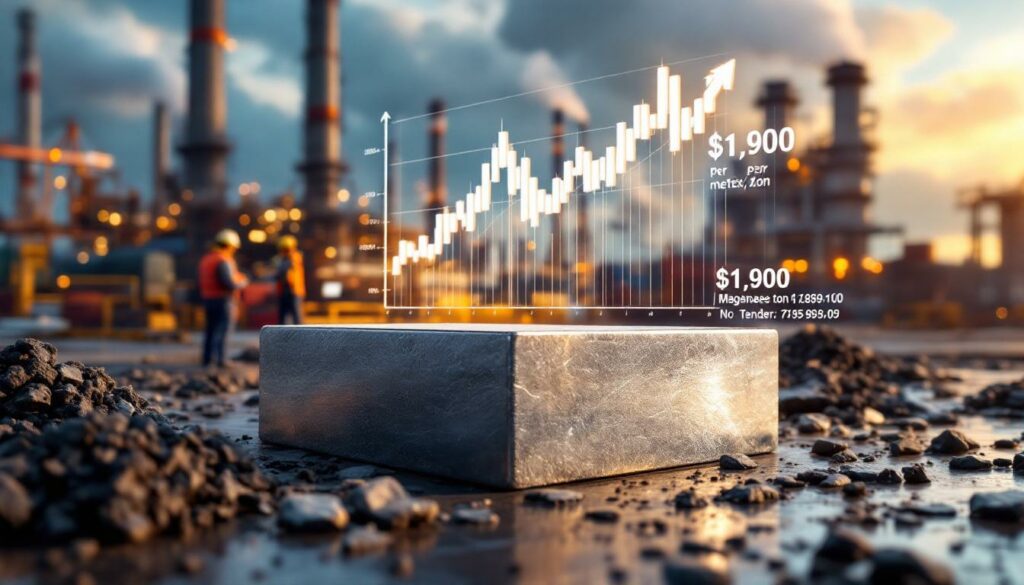

In the world of specialty metals, the Electrolytic Manganese Metal (EMM) market continues to exhibit remarkable manganese plant offers and spot price stability across key producing regions. As of mid-July 2025, domestic spot prices have maintained steady levels at 13,500-13,600 yuan/mt in major production centers, with FOB export prices similarly holding firm at $1,880-$1,920/mt. Perhaps most notably, these price points have shown zero month-over-month fluctuation, creating an unusually consistent market environment during what would typically be a more volatile period.

This price stability reflects a carefully balanced market where producers are exercising significant discipline in their output and pricing strategies, while buyers—primarily from the steel sector—adopt a measured approach to procurement. The coordinated behavior of market participants suggests a maturing market structure with sophisticated understanding of supply-demand dynamics.

Key Price Indicators

The current EMM market demonstrates several important pricing characteristics:

- Regional consistency across major production areas, with minimal geographical price variations

- Export-domestic price correlation showing logical spreads between FOB and local pricing

- Extended stability period exceeding normal cyclical patterns for specialty metals

- Resistance to external pressures despite global economic uncertainties

This price steadiness comes at a time when many other industrial metals have experienced more typical seasonal fluctuations, highlighting EMM's unique market position and the effectiveness of producer strategies in maintaining price discipline.

Strategic Responses from EMM Producers

The producer side of the EMM market is demonstrating remarkable coordination in response to current conditions. According to market intelligence from Shanghai Metal Markets, "Most EMM plants maintain firm quotes," with some producers strategically "holding back from selling temporarily" to support market stability.

This approach reflects a sophisticated understanding of market dynamics, where producers recognize that price discipline benefits the entire sector more than short-term volume gains through discounting. The manufacturing facilities have effectively created an environment where price undercutting is minimized.

Producer Inventory Management

EMM producers are implementing several key strategies:

- Strategic inventory control with selective sales timing

- Coordinated pricing policies maintaining narrow quote ranges

- Production discipline to avoid market oversupply

- Selective fulfillment prioritizing long-term relationships and contract customers

These approaches have created a situation where, as noted by SMM analysts, "it is difficult to find low-priced goods in the market" despite typical seasonal pressures that might otherwise drive discounting behavior. This suggests that producers have developed effective communication channels and shared market intelligence that allows for coordinated responses to changing conditions.

Cost Management Focus

While maintaining price discipline, producers are also focusing internally on operational efficiencies to protect margins. Though specific production costs aren't publicly disclosed, industry experts note that energy costs remain a significant component of EMM production expenses, with electricity typically representing 35-40% of total production costs.

This cost sensitivity explains why producers are unwilling to discount prices even in a cautious buying environment—their profit margins would quickly erode given the high fixed-cost nature of EMM production.

Buyer Behavior in the Current Market

On the demand side, a clear pattern has emerged among the primary EMM consumers. According to SMM market reports, "Downstream steel mills mostly adopted a wait-and-see sentiment" regarding their EMM procurement. This cautious approach is typical when buyers perceive price stability and feel no urgency to secure material ahead of potential increases.

Steel producers, as the dominant consumers of EMM, are driving market dynamics through their purchasing behaviors. Their current procurement strategy suggests confidence in continued material availability while they assess their own production requirements for the coming quarter.

Tender-Based Purchasing Strategy

A key factor influencing buyer behavior is the emergence of a structured tender process. SMM reports that "steel tenders are entering the market one after another," creating a formalized procurement system that affects both timing and volume decisions.

This tender-based purchasing model provides several advantages:

- Standardized price discovery through competitive bidding

- Volume commitments providing forward visibility

- Transparent qualification requirements for suppliers

- Structured delivery scheduling for improved supply chain management

The sequential nature of these tenders creates a rhythm in the market where participants can anticipate procurement cycles and position inventories accordingly. This has contributed to market stability by reducing the sporadic large-volume purchases that might otherwise create price volatility.

Trader Positioning

Market intermediaries have aligned their strategies with producer pricing, with SMM noting that "traders mostly followed the firm quotes of manganese plants." This suggests limited arbitrage opportunities in the current environment, as the price consistency across production centers and sales channels has narrowed potential profit margins for pure trading activity.

Traders are likely focusing on service differentiation and logistics optimization rather than price advantages in the current market environment. Their alignment with producer pricing further reinforces market stability by eliminating a potential source of price variability.

Steel Industry Tenders: Market Impact Assessment

The sequential release of steel industry procurement tenders has become a focal point for market participants. According to SMM market intelligence, "All parties in the market paid close attention to the progress of steel tenders," highlighting their significance as price indicators and volume commitment mechanisms.

These formal procurement processes represent a maturation of the EMM market, moving from relationship-based transactions to structured bidding systems that provide greater transparency and predictability. The tender outcomes serve as important market barometers, signaling both price direction and volume expectations.

Tender Structure and Timing

While specific tender details remain confidential, industry sources indicate that major steel producers typically structure their EMM tenders with:

- Minimum supplier qualification requirements regarding quality certification and supply history

- Volume flexibility clauses allowing for adjusted delivery schedules

- Price validity periods typically extending 30-45 days

- Quality specification requirements with penalty clauses for non-compliance

The sequential timing of these tenders creates a continuous cycle of price discovery, with each outcome influencing subsequent bidding strategies. This creates a more orderly market environment compared to the ad-hoc purchasing patterns that characterized earlier market stages.

Market Sentiment Indicators

The attention focused on tender outcomes underscores their importance as sentiment indicators. Successful tenders at stable prices reinforce market confidence, while failed tenders or significant price movements can trigger broader market reassessment.

"The tender results provide a window into real transaction prices that may not be fully captured in spot market assessments," notes one industry analyst. "They represent the most reliable price discovery mechanism in the current market structure."

This emphasis on tenders reflects their dual role as both transaction mechanisms and market indicators, providing concrete data points in an otherwise opaque specialty metals market.

Supply-Demand Balance: Key Indicators

The current EMM market demonstrates a remarkably balanced supply-demand equilibrium. While precise production and consumption figures are closely guarded by producers, several qualitative indicators suggest a market in temporary equilibrium:

- Price stability – The sustained price levels without significant movement indicate balanced supply and demand forces

- Producer discipline – The coordinated approach to pricing suggests producers are comfortable with current production levels

- Buyer patience – The lack of urgent procurement suggests adequate near-term inventory positions

- Tender timing – The sequential nature of tenders indicates orderly consumption patterns

This balance appears to be maintaining despite typical seasonal pressures that might otherwise create volatility. Historical patterns would suggest increased procurement activity during this period to build inventories ahead of potential supply constraints, but the current wait-and-see approach indicates confidence in continued material availability.

Regional Production Considerations

While exact production figures remain proprietary, industry observers note that China remains the dominant global EMM producer, with its major manufacturing hubs in Guangxi, Hunan, and Guizhou provinces maintaining disciplined output levels. This regional concentration gives Chinese producers significant influence over global pricing, explaining the strong correlation between domestic Chinese prices and FOB export figures.

The production economics across these regions vary based on:

- Energy cost differences between provinces

- Raw material logistics expenses related to manganese ore transportation

- Environmental compliance requirements that vary by region

- Labor cost variations between different production centers

These regional variations create a complex production landscape where capacity utilization decisions involve multiple economic variables beyond simple market pricing.

Historical Context: Market Evolution

The current price stability marks a departure from historical EMM market patterns, where greater volatility was the norm. While comprehensive historical data is proprietary, market participants note that the current extended period of price consistency represents an evolution in market maturity.

This stability contrasts with previous cycles where:

- Rapid price movements occurred in response to inventory imbalances

- Seasonal patterns created predictable price fluctuations

- Supply disruptions from production regions caused temporary spikes

- Consumption volatility from downstream industries created demand uncertainty

The current coordinated approach among producers represents a strategic shift from volume-focused competition to margin protection, reflecting a more sophisticated understanding of sustainable market dynamics.

Market Structure Development

The EMM market has undergone significant mining industry evolution over recent years. Key developments include:

- Increased information transparency through specialized reporting services

- More sophisticated contract structures between producers and consumers

- Greater coordination among major producers regarding production discipline

- Formalized procurement processes via tender systems

This maturation has created a more stable market environment with reduced volatility and improved price discovery mechanisms. The transition from opportunistic trading to relationship-based procurement reflects the strategic importance of EMM in steel production and other industrial applications.

Technical Market Indicators

While the EMM market lacks the formal technical analysis tools applied to more liquid commodity markets, several quantitative indicators provide insight into market conditions beyond simple price levels.

Support and Resistance Analysis

Current price levels demonstrate strong technical support, with the 13,500 yuan/mt level functioning as an effective floor in domestic Chinese markets. This price point has been tested multiple times in recent months but has consistently held, suggesting producer discipline in maintaining minimum acceptable price levels.

Similarly, the $1,880/mt FOB level represents a psychological support point for export markets, with limited transactions occurring below this threshold despite buyer attempts to secure lower pricing.

On the resistance side, historical patterns suggest potential price ceilings around:

- 14,000 yuan/mt for domestic Chinese material

- $2,000/mt for FOB export pricing

These technical levels provide important reference points for market participants in negotiating transactions and planning procurement strategies.

Volume-Price Relationships

Transaction volumes have shown consistent patterns at current price levels, suggesting market acceptance of the manganese plant offers and spot price stability. The steady volume at consistent prices indicates a balanced market without the pressure from either buyers or sellers to move pricing significantly.

This volume-price stability creates a self-reinforcing market environment where participants gain confidence in continued stability, further reducing incentives for disruptive pricing behavior. The lack of speculative positioning in the EMM market also contributes to this stability, as the market primarily consists of physical transactions for industrial consumption rather than financial speculation.

Strategic Outlook for Market Participants

As EMM market participants plan their strategies for the coming quarters, several key factors warrant careful consideration. The outcomes of current and upcoming steel tenders will provide immediate direction for market pricing, with successful transactions at current levels reinforcing stability while any significant price movement could trigger broader market reassessment.

Near-Term Market Considerations

For the immediate future, market participants should monitor:

- Tender results as immediate indicators of price direction

- Producer inventory positions which could signal potential supply adjustments

- Steel production forecasts for Q3-Q4 2025 that will drive consumption

- Energy cost trends that impact production economics

- Chinese domestic policy developments that might affect production or export volumes

"The current stability shouldn't be mistaken for stagnation," cautions one market observer. "The careful balance could shift quickly if any major production or consumption variables change significantly."

This warning highlights the importance of maintaining vigilance despite the current market calm, as the fundamental drivers of EMM pricing remain in constant flux even when prices appear stable.

Inventory Management Strategies

Different market participants face unique strategic considerations in the current environment:

For Producers:

- Balancing production rates against inventory accumulation

- Maintaining discipline despite potential volume opportunities

- Preserving customer relationships while supporting price levels

- Managing raw material procurement to protect margins

For Consumers:

- Optimizing tender timing and volume commitments

- Balancing spot purchases against tender volumes

- Diversifying supply sources while maintaining quality standards

- Hedging against potential future price movements

For Traders:

- Focusing on logistics and service differentiation

- Maintaining minimal inventory positions during price stability

- Developing market intelligence to anticipate direction changes

- Exploring value-added services beyond simple buy/sell transactions

These strategic considerations reflect the complex interplay of factors affecting the EMM market and the sophisticated decision-making required of all participants.

Essential EMM Market Questions Answered

What factors are currently supporting EMM price stability?

The remarkable price stability in the EMM market stems from a combination of producer discipline, measured demand from steel manufacturers, and balanced inventory positions throughout the supply chain. The coordinated approach from producers, who are maintaining firm quotes and strategically controlling sales timing, has created an environment where price undercutting is minimized.

This producer discipline is matched by cautious procurement from steel manufacturers, who see no urgent need to secure material ahead of potential price increases. The resulting equilibrium has sustained prices at consistent levels despite typical seasonal pressures that might otherwise create volatility.

How are steel industry tenders influencing EMM market dynamics?

Steel industry tenders have become central to EMM market dynamics, creating formalized procurement cycles that provide both price discovery and volume commitments. These structured bidding processes have replaced more ad-hoc purchasing patterns, introducing greater transparency and predictability to the market.

The sequential timing of tenders from major steel producers creates a continuous cycle of price validation, with each outcome influencing subsequent bidding strategies. Market participants closely monitor tender progress and results as indicators of both immediate price direction and longer-term market sentiment.

What strategies are EMM producers employing in the current market?

EMM producers have adopted sophisticated market strategies focused on price discipline and margin protection rather than volume maximization. These approaches include:

- Maintaining firm quotations despite buyer pressure for discounts

- Strategically timing sales to avoid market oversupply

- Temporarily withholding material when advantageous

- Coordinating pricing approaches to maintain market stability

- Focusing on operational efficiencies to protect margins despite fixed pricing

This strategic sophistication represents an evolution in producer behavior from volume-focused competition to more sustainable market management approaches.

How are EMM traders responding to current market conditions?

Trading entities have aligned their strategies with producer pricing in the current stable market environment. The consistent pricing across production centers has reduced arbitrage opportunities, forcing traders to focus on service differentiation and logistics optimization rather than price advantages.

Traders are maintaining minimal inventory positions during this period of price stability, recognizing that the carrying costs of material are not offset by potential price appreciation in the near term. Their focus has shifted to market intelligence gathering and relationship management to position for any future market direction changes.

In the broader context, the EMM market is also being influenced by trends in critical minerals energy transition and potential manganese mine expansion projects. Additionally, the iron ore price decline and tariffs impact on markets may have indirect effects on the overall metals sector, though EMM has thus far maintained its unique stability.

Disclaimer: This market analysis is based on current information and represents the state of the EMM market as of publication date. Market conditions can change rapidly, and readers should conduct their own due diligence before making business decisions based on this information. The analysis contains forward-looking statements that involve risks and uncertainties, and actual outcomes may differ materially from those anticipated.

Ready to Capitalise on the Next Mineral Discovery?

Stay ahead of the market with Discovery Alert's real-time notifications on significant ASX mineral discoveries, powered by our proprietary Discovery IQ model that transforms complex data into actionable investment insights. Explore why historic discoveries can generate substantial returns by visiting our dedicated discoveries page and begin your 30-day free trial today.