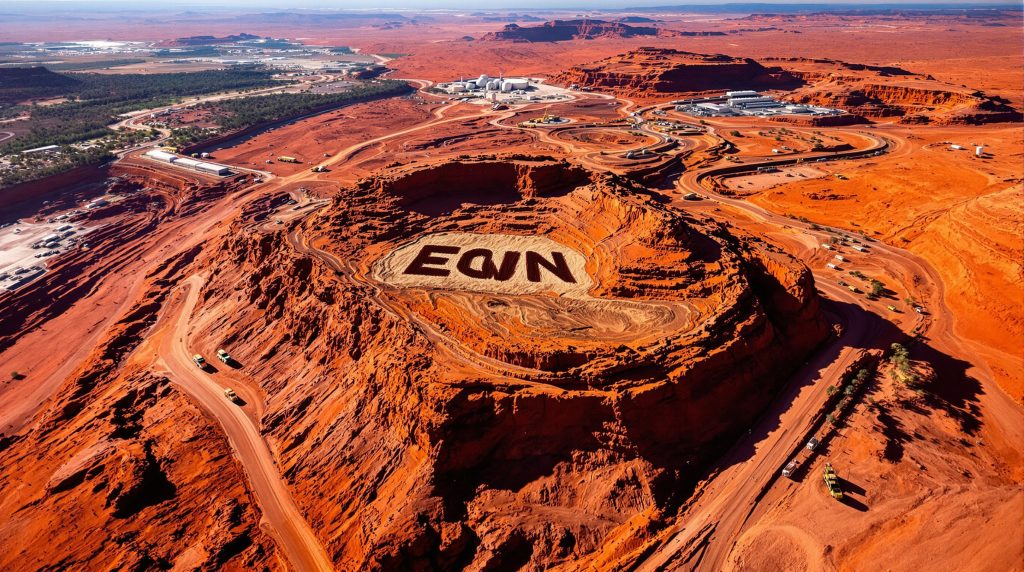

Equinox Resources Streamlines Portfolio with Strategic Divestment of Alturas Antimony Project

Binding Option Agreement Secures C$700,000 in Combined Cash and Equity Consideration

Equinox Resources (ASX: EQN) has executed a binding Property Option Agreement with Maxus Mining Inc. (CSE: MAXM) to divest its Alturas Antimony Project in British Columbia, Canada. The strategic move will generate C$300,000 in cash and C$400,000 in Maxus shares, providing both immediate liquidity and potential upside exposure through equity.

The transaction represents a calculated portfolio refinement for Equinox, allowing the company to exit the British Columbia region entirely and redirect its focus and capital toward its flagship Hamersley Iron Ore Project in Western Australia. The company is simultaneously evaluating its Brazilian assets to identify priority development targets and potential partnership opportunities.

"Divesting Alturas is a straightforward step that converts a non-core asset into cash and listed equity. It also marks our exit from British Columbia and lets us concentrate time and capital on delivering Hamersley in Western Australia," said Managing Director and CEO Zac Komur.

Key Terms of the Alturas Option Agreement

| Term | Details |

|---|---|

| Asset | 100% interest in Alturas Antimony Project, British Columbia |

| Exploration Permit | MX-100000532 (valid until September 30, 2029) |

| Cash Consideration | C$300,000 within 15 business days of effective date |

| Equity Consideration | C$400,000 in Maxus shares within 12 months (priced at 20-day CSE VWAP) |

| Share Restrictions | Released in four equal tranches after 6, 12, 18, and 24 months |

| Transfer Terms | Full title transfer upon receipt of total consideration |

The structure of the agreement provides Equinox with immediate capital while maintaining exposure to the project's future potential through its shareholding in Maxus. The staged release of share trading restrictions creates a balanced approach to monetisation over a 24-month period.

Understanding Antimony: A Critical Mineral with Strategic Importance

Antimony is classified as a critical mineral in many jurisdictions due to its importance in defence applications, flame retardants, and battery technology. The metal is relatively rare, and production is highly concentrated, with China controlling approximately 60% of global supply.

Applications and Demand Drivers

Antimony serves several key industrial applications:

- Flame retardants: The largest application, accounting for approximately 60% of consumption

- Lead-acid batteries: Used to harden lead in battery grids

- Glass and ceramics: Added as a fining agent and opacifier

- Military applications: Critical component in ammunition and military equipment

- Emerging technologies: Increasingly used in microelectronics and solar panels

Supply Dynamics

The global antimony market exhibits significant supply concentration:

- China dominates production with approximately 60% of global output

- Russia, Tajikistan, and Myanmar represent other significant producers

- North American production remains limited, creating regional supply security concerns

For investors, antimony represents an interesting opportunity due to supply constraints and growing demand in emerging technologies. The metal's price has shown volatility in recent years, influenced by Chinese export policies and global supply chain disruptions.

While Equinox has chosen to divest this asset, Maxus Mining gains a strategic property that complements their existing operations in the region, potentially creating operational synergies and resource scale benefits.

Equinox's Refined Strategic Direction

With the divestment of the Alturas Project, Equinox Resources is demonstrating a clear commitment to portfolio optimisation and capital allocation discipline. The company is now positioned with:

- Sharpened focus on the Hamersley Iron Ore Project in Western Australia

- Enhanced liquidity through immediate cash infusion

- Retained upside via Maxus equity holdings

- Simplified operational footprint with exit from British Columbia

- Ongoing assessment of Brazilian assets for value creation opportunities

The company's management has indicated they are actively reviewing partnership opportunities that could accelerate development timelines and value creation across their project portfolio.

Hamersley Iron Ore Project: The New Core Focus

With the divestment of Alturas, Equinox can direct additional resources toward advancing the Hamersley Iron Ore Project in Western Australia. This project represents a substantial opportunity in a premier iron ore jurisdiction with established infrastructure and proximity to key export markets.

The Western Australian iron ore sector benefits from:

- World-class ore bodies with competitive grades

- Established infrastructure including rail and port facilities

- Proximity to key Asian markets

- Stable regulatory and operating environment

- Strong historical pricing dynamics

Brazilian Asset Review

In addition to focusing on Hamersley, Equinox is conducting a strategic review of its Brazilian assets. This process involves:

- Ranking projects based on development potential and economics

- Identifying priority targets for accelerated advancement

- Evaluating partnership opportunities to enhance value

- Considering optimal capital allocation across the portfolio

This dual-track approach allows Equinox to maintain a presence in multiple jurisdictions while focusing its primary resources on the most promising near-term development opportunities.

Why This Transaction Matters for Investors

This strategic divestment represents a significant positive for Equinox investors for several reasons:

-

Portfolio rationalisation – Converting non-core assets into cash and equity strengthens the balance sheet without diluting existing shareholders

-

Capital reallocation – Resources can be directed toward the company's most promising assets with near-term development potential

-

Retained upside exposure – The equity component provides continued exposure to Alturas' potential success under Maxus' development

-

Strategic focus – Management can concentrate efforts on fewer, higher-quality assets with clearer paths to value creation

For investors tracking Equinox Resources, this transaction demonstrates management's pragmatic approach to asset management and willingness to make decisive portfolio adjustments to maximise shareholder value.

Non-Dilutive Funding Strategy

A key aspect of this transaction is that it provides Equinox with additional capital without requiring further equity issuance. This preserves the company's capital structure while enhancing its financial position, a considerable advantage in the current market environment where capital raising can be challenging and potentially dilutive.

The combination of immediate cash and future equity value creates a balanced approach to monetisation that supports near-term liquidity needs while maintaining exposure to potential future value creation.

Investment Outlook: A Company Refining Its Path Forward

Equinox Resources now presents a more focused investment proposition with this strategic divestment. The company has:

- Streamlined its asset base to concentrate on priority projects

- Demonstrated capital discipline through non-dilutive funding mechanisms

- Retained optionality through equity stakes in divested assets

- Created a clearer investment narrative around its core projects

Investors should watch for further announcements regarding the company's Hamersley Iron Ore Project development timeline and any strategic decisions regarding its Brazilian assets, as these will be the key value drivers moving forward.

Market Positioning

The transaction positions Equinox as a more streamlined, focused company with a clear strategic direction. For investors seeking exposure to the iron ore sector, particularly in Western Australia, the company now offers a more direct investment proposition without the complexity of a highly diversified asset portfolio spanning multiple commodities and jurisdictions.

Near-Term Catalysts

Potential near-term catalysts for Equinox include:

- Further updates on Hamersley Iron Ore Project development milestones

- Results from the Brazilian asset review process

- Potential strategic partnerships to accelerate development

- Improved balance sheet flexibility from the cash component of the Alturas transaction

With this transaction, Equinox has shown its commitment to portfolio optimisation while maintaining exposure to potential upside, positioning the company for a more focused approach to value creation in its core operating regions of Western Australia and Brazil.

The divestment reflects a clear strategic vision from management and demonstrates their willingness to make decisive moves to enhance shareholder value through portfolio refinement and capital allocation discipline.

Want to Invest in a Focused Iron Ore Player?

With Equinox Resources streamlining its portfolio to concentrate on the promising Hamersley Iron Ore Project in Western Australia, now is an opportune time to consider your investment options. Their strategic divestment of the Alturas Antimony Project demonstrates management's commitment to capital discipline and value creation through focused development. To explore Equinox's refined strategy and learn more about their Western Australian and Brazilian assets, visit their website for comprehensive investor information and project updates.