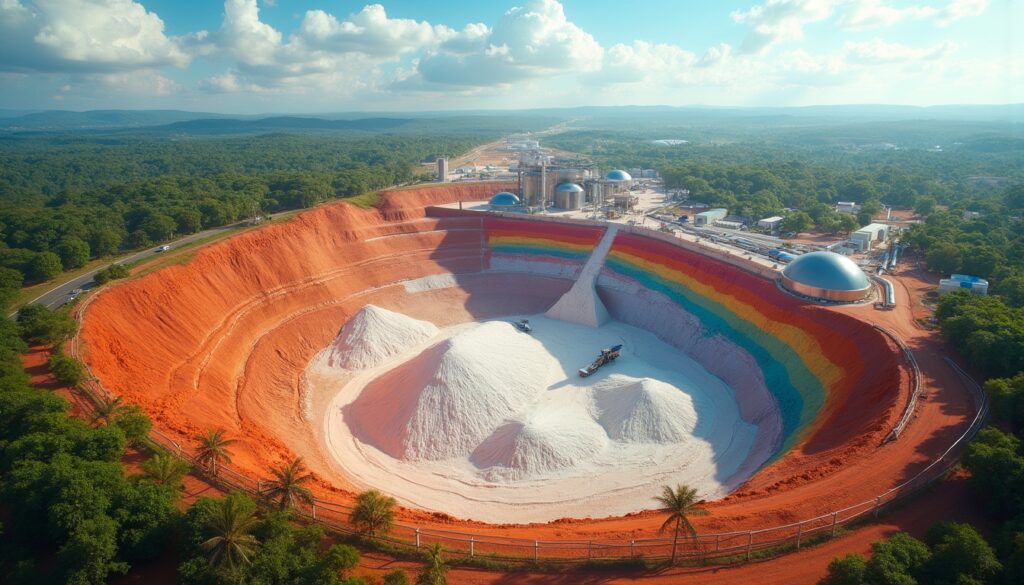

Atlantic Lithium's Ewoyaa Lithium Project is rapidly progressing through critical development phases in Ghana's central region. Strong fundamentals support Atlantic Lithium future production in Ghana. The project recently received its mine operating permit, marking a major milestone in the regulatory process.

The company now awaits final mining lease ratification from the Ghanaian government. Industry analysts expect ratification in Q2 2025, highlighting the lithium mining challenges and opportunities.

Ewoyaa is among West Africa’s most advanced lithium developments. Its resource base of 35.3 million tonnes at 1.25% Li₂O positions it favourably against global competitors. The favourable mineralogy allows for simplified processing.

Further details are outlined on projects in ghana.

A recent report on lithium production outlook provides additional context on these developments.

How Does Atlantic Lithium Plan to Fund the Ewoyaa Project?

Atlantic Lithium has developed a multi-faceted funding strategy. This approach leverages strategic partnerships and diversified capital sources. A key element is the partnership with Piedmont Lithium, which has committed US$70 million towards project development.

Other strategic partners include Sayona Mining and Assore International. Their involvement brings extra expertise and capital. This collaborative model distributes risk and leverages complementary capabilities.

In response to market conditions, Atlantic Lithium has widened discussions with non-Chinese off-takers across Europe, the Middle East, and Asia. This strategy is designed to diversify revenue streams.

Additionally, A$10 million in extra funding has been secured for project optimisation. This capital will support metallurgical testwork, engineering refinements, and community development initiatives.

What Are the Economic Advantages of the Ewoyaa Lithium Project?

The Ewoyaa project offers several compelling economic advantages. Atlantic Lithium projects production among the world’s lowest-cost, with all-in sustaining costs estimated at around US$400–450 per tonne of spodumene concentrate.

Efficient open-pit mining is enabled by a 1.25% Li₂O resource and a beneficial strip ratio of 3.8:1. This operational efficiency sustains resilience against market volatility.

Proximity to key infrastructure is another advantage. The site is 110km from Ghana’s deep-sea port at Takoradi. Existing roads, water, and power reduce capital requirements, as noted in projects in ghana.

Additional benefits include a high feldspar content (approximately 10%) in the ore. This valuable by-product supports the domestic ceramics industry and creates extra revenue.

How is the Lithium Market Affecting Atlantic Lithium's Strategy?

Despite recent market turbulence, Atlantic Lithium remains confident in long-term fundamentals. Global lithium demand is set to rise amid increasing electric vehicle adoption and growing stationary energy storage needs. Such trends will support Atlantic Lithium future production in Ghana.

Lithium prices have dropped from record highs in 2022. This market recalibration offers opportunities for low-cost producers. Further insights on evolving markets are provided in lithium market trends and price dynamics.

Interest from off-takers outside of China has increased significantly. European and North American battery manufacturers are particularly keen on ensuring a stable, long-term supply. This diversification further strengthens the project’s strategy.

What is the Timeline for Ewoyaa's Development and Production?

Atlantic Lithium has established a clear, milestone-driven timeline for the project. Key milestones include:

- Mining lease ratification in Q2 2025

- Final investment decision (FID) in Q3 2025

- Construction commencing soon after FID

- First production targeted within 24 months of construction

Following FID, remaining funding from Piedmont Lithium and additional strategic investors will be released. Construction is expected to take 12–18 months.

Once production commences, Ewoyaa could become Ghana’s first lithium producer and one of Africa’s earliest commercial lithium operations. This phased development approach allows for future expansion.

Such timelines align with pioneering global lithium production initiatives. This schedule is critical to realising Atlantic Lithium future production in Ghana.

How is the Ghanaian Government Supporting the Project?

The Ghanaian government has shown strong support for the project. Officials continue to engage actively throughout the permitting process. Guidance from the Minerals Commission has helped streamline regulatory approvals.

Ghana has designated lithium as a strategic mineral. This designation could expedite the development process by attracting additional government support. Plans for a secondary listing on the Ghana Stock Exchange are also underway.

Furthermore, the government supports plans to develop downstream processing capabilities. Prospective facilities for lithium hydroxide or carbonate production are under consideration. These initiatives are part of Ghana’s broader industrialisation strategy.

What Exploration Potential Exists Beyond the Current Resource?

There is substantial exploration potential within and around the Ewoyaa project area. Atlantic Lithium is actively pursuing exploration programmes in Ghana and neighbouring Côte d'Ivoire. These efforts have already identified several promising targets.

Recent drilling at the Ewoyaa North extension returned intercepts such as 43m at 1.3% Li₂O. Geological modelling suggests that the mineralised system remains open in multiple directions, enhancing the project's upside.

Satellite deposits, including the Kaampakrom and Anokyi prospects, may supplement the primary resource. Early reconnaissance drilling in these areas has yielded promising results.

In Côte d'Ivoire, exploration licences cover about 1,000 square kilometres of favourable pegmatite terrain. Early-stage sampling has identified lithium anomalies, hinting at future project opportunities.

How Does Atlantic Lithium Address ESG Considerations?

Atlantic Lithium has implemented a comprehensive ESG strategy. The company focuses on reducing environmental impacts while enhancing positive outcomes for local communities.

The project design includes water recycling systems that recover approximately 85% of process water. The processing flowsheet avoids potentially harmful flotation chemicals, thereby reducing the environmental footprint.

Community engagement is also a central part of the company’s strategy. Around 70% of the estimated 300 permanent positions may be filled by local hires, particularly from nearby communities. Educational scholarships, healthcare improvements, and agricultural support programmes complement these initiatives.

Such measures address ESG challenges and opportunities in mining. This integration not only supports the social licence but bolsters long-term project economics.

What Are the Key Technical Aspects of the Ewoyaa Project?

The Ewoyaa project benefits from sound technical fundamentals. The resource mainly consists of spodumene-bearing pegmatites with minimal deleterious elements, supporting a straightforward processing flowsheet.

The proposed processing plant employs a conventional crusher-dense media separation configuration. Metallurgical tests have demonstrated the production of a 6% Li₂O concentrate with recoveries exceeding 75%.

A low strip ratio of roughly 3.8:1 minimises mining costs. The coarse-grained spodumene permits effective liberation at coarser crush sizes. This efficiency contributes significantly to the project's capital sustainability.

The phased approach focuses initial investment on the highest-grade areas while keeping options open for expansion later. Recent testwork also points to innovations in lithium production that could further advance processing techniques.

FAQs About Atlantic Lithium and the Ewoyaa Project

When will Atlantic Lithium make a final investment decision?

The final investment decision is expected in Q3 2025 after the mining lease ratification is complete.

What is the expected production capacity?

Initial production is estimated at approximately 300,000 tonnes per annum of spodumene concentrate, with further expansion potential in later phases.

How does the current lithium price affect project viability?

Despite price declines, the project’s low-cost production model and resilient fundamentals ensure robust economics even during market downturns.

What is Atlantic Lithium's relationship with Piedmont Lithium?

Piedmont Lithium is a strategic partner with a US$70 million funding commitment. An offtake agreement covers around 50% of production during the project’s first decade.

Will Atlantic Lithium list on the Ghana Stock Exchange?

Yes, the company plans to list on the Ghana Stock Exchange to enhance local stakeholder participation and strengthen its partnership with Ghanaian communities.

Ready to Get Early Alerts on the Next Major Mineral Discovery?

Stay ahead of the market with Discovery Alert's proprietary Discovery IQ model, which instantly notifies investors of significant ASX mineral discoveries like those that transformed companies such as Atlantic Lithium. Visit the Discovery Alert discoveries page to see how early identification of major mineral finds can generate substantial returns for prepared investors.