What is Farasis Energy's Solid-State Battery Pilot Production Plan?

Farasis Energy, a Chinese battery manufacturer with significant backing from Mercedes-Benz, is positioning itself at the forefront of next-generation battery technology with an ambitious solid-state battery initiative. According to the latest information from Battery Industry (July 2025), the company is developing a dedicated pilot production line for sulfide-based solid-state batteries, with completion targeted for the end of 2025.

The pilot production facility will have an initial capacity of 0.2 GWh—modest by mass-production standards but substantial for a pilot operation focused on advanced technology. This strategic investment represents a significant technological leap beyond traditional lithium-ion batteries, with potential to revolutionize electric vehicle performance and safety profiles.

Mercedes-Benz's 3% stake in Farasis (acquired in 2020) provides not only financial backing but strategic alignment with one of the world's premier automotive manufacturers, signaling industry confidence in Farasis's technological roadmap and production capabilities.

The pilot line will focus specifically on sulfide-based solid-state technology, which replaces conventional liquid electrolytes with solid sulfide compounds—a chemistry that offers superior safety characteristics while enabling higher energy density configurations that could dramatically extend EV driving ranges.

How Will Farasis Energy's Pilot Production Line Work?

Production Capacity and Timeline

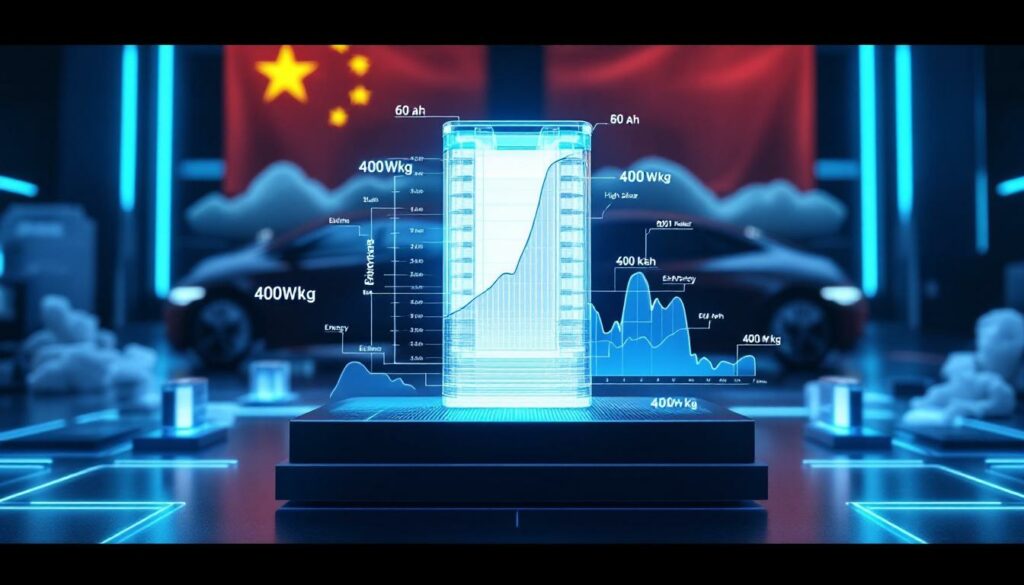

The 0.2 GWh pilot line will initially concentrate on manufacturing 60 Ah sulfide-based solid-state battery samples, primarily targeting strategic partners for testing and validation. These samples represent a critical step in the commercialization process, allowing automotive partners to begin integration testing while Farasis refines its manufacturing processes.

According to Battery Industry reporting, Farasis has outlined an aggressive scaling strategy, with plans to expand to gigawatt-hour capacity as early as 2026—an ambitious timeline that would place them among the first manufacturers to reach commercial-scale production of solid-state batteries.

The company will prioritize initial sample deliveries to key strategic partners, with Mercedes-Benz likely at the front of the queue given their investment relationship. This approach allows Farasis to gather critical feedback from industry leaders before wider distribution.

Technical Specifications and Design

The technical architecture of Farasis's solid-state batteries incorporates several cutting-edge design elements:

- High-nickel ternary cathodes for maximum energy density

- Soft pack design optimized for thermal management and packaging efficiency

- Stacked cell architecture for improved power delivery and thermal performance

- Advanced anodes featuring either high silicon content or lithium-metal formulations

- Target energy density exceeding 400 Wh/kg—approximately 50% higher than today's best lithium-ion cells

Perhaps most encouraging for commercialization prospects, current third-generation prototypes (which entered testing around January 2025) are demonstrating stable cycle performance in testing regimes, suggesting the technology is maturing toward practical application.

The stacked cell configuration, combined with soft-pack enclosure, represents a pragmatic approach to solid-state battery design—maintaining manufacturing familiarity while integrating revolutionary cell chemistry.

What Advantages Do Solid-State Batteries Offer Over Traditional Lithium-Ion?

Performance Improvements

Solid-state batteries offer several transformative advantages over conventional lithium-ion technology:

-

Enhanced safety profile: By eliminating flammable liquid electrolytes, solid-state batteries dramatically reduce fire risks and eliminate leakage concerns, potentially eliminating the need for complex thermal management systems.

-

Superior energy density: With target densities exceeding 400 Wh/kg (compared to 250-300 Wh/kg in advanced lithium-ion), solid-state technology could extend EV ranges by 30-50% without increasing battery weight.

-

Extended lifespan: Preliminary research indicates solid-state chemistry may support significantly more charge-discharge cycles before capacity degradation.

-

Faster charging capability: The solid electrolyte's superior conductivity properties may enable higher charging rates without degradation or safety concerns.

-

Elimination of thermal runaway risk: The inherent stability of solid electrolytes prevents the cascading failure modes that plague liquid-based systems.

Note: While theoretical advantages are well-established, real-world performance data from Farasis's specific implementation remains limited, as the technology is still in pre-commercial development.

Market Readiness Challenges

Despite promising laboratory results, several hurdles remain before solid-state batteries achieve mainstream adoption:

-

Manufacturing scalability: Transitioning from laboratory-scale production to gigawatt-hour volumes presents significant engineering challenges, particularly in maintaining consistent electrolyte-electrode interfaces.

-

Material supply chains: New material requirements, particularly for sulfide electrolytes, necessitate development of dedicated supply infrastructure.

-

Cost considerations: Initial production will likely carry significant price premiums until economies of scale develop.

-

Integration engineering: Vehicle manufacturers must redesign battery packs and thermal systems to optimize for solid-state characteristics.

These challenges explain why, despite the technology's promise, Farasis and competitors are pursuing methodical development paths rather than rushing to market with potentially flawed implementations.

How Has Farasis Progressed in Solid-State Battery Development?

Recent Technological Milestones

Farasis has achieved several significant milestones in their solid-state battery development program:

-

Third-generation prototypes: According to Battery Industry reporting, Farasis's third-generation solid-state cells entered practical testing approximately six months prior to July 2025 (around January 2025).

-

Performance validation: These prototypes have demonstrated stable cycle performance in testing protocols, suggesting the core technology is maturing.

-

Sulfide electrolyte mastery: The company has successfully developed manufacturing techniques for sulfide-based solid electrolytes, addressing one of the most challenging aspects of solid-state production.

-

Dual technology tracks: Beyond their primary sulfide approach, Farasis is simultaneously advancing research on oxide/polymer composite systems as a parallel development path.

This multi-pronged approach demonstrates technological sophistication and risk management—if one chemistry encounters insurmountable obstacles, alternative pathways remain viable.

Next-Generation Development

Looking beyond their current prototype generation, Farasis is actively pursuing several advanced technology tracks:

-

Oxide/polymer composite system research, which could potentially offer easier manufacturing processes compared to sulfide-based approaches

-

Next-generation energy density targets up to 500 Wh/kg—nearly double today's commercial lithium-ion cells

-

Continued refinement of lithium-metal anodes, which offer theoretical capacity far exceeding graphite or silicon alternatives

-

Optimization of high-nickel cathode formulations to maximize energy density while maintaining structural stability

These parallel development efforts suggest Farasis is positioning for both near-term commercialization (sulfide-based) and longer-term technological leadership (oxide/polymer systems).

Who Are Farasis Energy's Key Partners and Customers?

Strategic Automotive Partnerships

Farasis has cultivated several key automotive partnerships that will be critical to commercialization:

-

Mercedes-Benz: The German luxury automaker acquired a 3% stake in Farasis in 2020, establishing a strategic relationship that positions Mercedes as a likely early recipient of solid-state battery samples. This partnership provides Farasis with both capital and automotive engineering expertise.

-

Geely: This major Chinese automotive group, which owns brands including Volvo and Lotus, has established a partnership with Farasis, potentially opening multiple vehicle platforms for solid-state integration.

-

Togg: The Turkish manufacturer has collaborated with Farasis on battery development, representing an opportunity to expand beyond the Chinese and European markets.

-

Additional manufacturers: According to industry reporting, several other vehicle manufacturers have expressed interest in Farasis's solid-state technology, though specific names remain undisclosed.

These partnerships span multiple global markets, positioning Farasis to scale rapidly once production capabilities mature.

Market Expansion Strategy

Farasis appears to be implementing a staged market entry strategy:

- Initial sample delivery to strategic partners (projected late 2025)

- Expanded sample distribution to additional automotive customers

- Validation testing and integration engineering with partner vehicle platforms

- Gradual production scaling to meet increasing demand

This methodical approach reflects the technological complexity of solid-state batteries and the critical importance of validation before mass deployment in consumer vehicles.

By securing partnerships across multiple automotive tiers—from luxury (Mercedes) to mass-market (Geely)—Farasis has created multiple commercialization pathways for their technology.

What Is the Outlook for Solid-State Battery Commercialization?

Industry Implications

The emergence of commercially viable solid-state batteries could fundamentally reshape the electric vehicle landscape:

-

Potential disruption of current lithium-ion market: Established battery manufacturers may face significant challenges if they fall behind in solid-state development.

-

Accelerated electric vehicle adoption: Extended range and improved safety could address two primary consumer concerns about EVs, potentially accelerating market penetration.

-

Competitive landscape shifts: Automotive manufacturers with early access to solid-state technology may gain significant market advantages through superior vehicle performance.

-

Supply chain realignment: New material requirements will create opportunities for mining, processing, and component manufacturing companies specializing in securing lithium supply and other materials.

Solid-state technology represents a potential inflection point in battery evolution—similar to the transition from lead-acid to lithium-ion, but with even greater performance implications.

Timeline Projections

Based on Farasis's announced plans and industry analysis:

- 2025: Completion of pilot production line (0.2 GWh)

- Late 2025: Initial sample distribution to strategic partners

- 2026: Scaling to gigawatt-hour production capacity

- 2027-2028: Potential first commercial vehicle applications (following extensive validation)

- Early 2030s: Possible cost parity with conventional lithium-ion (as production scales)

Disclaimer: These projections are based on currently available information and represent potential outcomes rather than guaranteed developments. Technical challenges could alter timelines significantly.

How Does Farasis Compare to Other Solid-State Battery Developers?

Competitive Landscape Analysis

While specific comparison data is limited in available sources, the solid-state battery field includes several significant competitors:

-

QuantumScape: Backed by Volkswagen, this American company is developing ceramic separator technology for solid-state batteries, with a focus on automotive applications.

-

Solid Power: Partnering with BMW and Ford, Solid Power is working on sulfide-based solid electrolytes with similarities to Farasis's approach.

-

Toyota: The Japanese automotive giant has invested heavily in solid-state research, with patents suggesting a focus on sulfide electrolytes and manufacturing processes.

-

Samsung SDI and LG Energy Solution: These established battery manufacturers have active solid-state development programs, leveraging their extensive manufacturing experience.

Each competitor brings different strengths—from automotive integration expertise to manufacturing scale—making the race to commercialization multifaceted.

Farasis's Competitive Advantages

Farasis's position includes several potential competitive advantages:

-

Established manufacturing infrastructure from their conventional lithium-ion business, providing expertise in scaled production

-

Strong automotive partnerships, particularly with Mercedes-Benz, offering direct pathways to vehicle integration

-

Dual-track technology development (sulfide-based and oxide/polymer systems), reducing technology risk

-

Practical testing experience with third-generation prototypes, providing valuable real-world performance data

The company's decision to focus on soft-pack formats rather than cylindrical or prismatic cells may also offer advantages in thermal management and vehicle integration. Additionally, their experience with direct lithium extraction techniques provides further competitive edge in raw material processing.

What Technical Challenges Remain for Solid-State Battery Production?

Manufacturing Hurdles

Despite promising prototype results, several significant challenges must be overcome before solid-state batteries can achieve mainstream adoption:

-

Scaling production from laboratory to commercial volumes: Maintaining precise manufacturing tolerances across millions of cells presents enormous technical challenges.

-

Quality control across larger production batches: Detecting microscopic defects in solid electrolytes that could lead to premature failure.

-

Optimizing electrode-electrolyte interfaces: Ensuring consistent contact between solid materials throughout the charge-discharge cycle.

-

Performance consistency: Eliminating cell-to-cell variation that could compromise pack-level performance.

These manufacturing challenges explain why Farasis is implementing a staged approach—beginning with a modest 0.2 GWh pilot line before attempting full commercial scale.

Material Science Considerations

Beyond manufacturing, several fundamental material science challenges remain:

-

Stability of solid electrolytes over extended cycling: Preventing micro-fractures that can develop after repeated expansion/contraction cycles.

-

Interface management between electrodes and solid electrolytes: Maintaining consistent electrical contact between dissimilar materials.

-

Lithium dendrite formation prevention: Eliminating microscopic lithium filaments that can grow through solid electrolytes and cause short circuits.

-

Temperature sensitivity management: Ensuring consistent performance across automotive temperature ranges (approximately -30°C to +60°C).

Addressing these challenges requires interdisciplinary expertise spanning electrochemistry, material science, and manufacturing engineering—explaining why solid-state batteries have remained elusive despite decades of research. Furthermore, developing a battery-grade lithium refinery infrastructure will be essential to support mass production.

FAQ About Farasis Energy's Solid-State Battery Production

When will Farasis Energy's solid-state batteries be available in commercial vehicles?

While pilot production begins in late 2025, commercial availability in vehicles will likely follow several years of testing and validation, potentially in the 2027-2028 timeframe. Automotive qualification processes are particularly rigorous for safety-critical components like batteries.

What makes sulfide-based solid-state batteries different from conventional lithium-ion batteries?

Sulfide-based solid-state batteries replace the liquid electrolyte with a solid sulfide compound, eliminating leakage risks, improving safety, and enabling higher energy density through the use of lithium-metal anodes. The solid electrolyte serves both as ion conductor and physical separator.

How much improvement in driving range could solid-state batteries provide?

With energy densities potentially exceeding 400 Wh/kg (compared to ~250-300 Wh/kg for advanced lithium-ion), electric vehicles could see 30-50% improvements in driving range, depending on integration efficiency. A 300-mile EV could potentially reach 400-450 miles with the same battery weight.

Will solid-state batteries be more expensive than current lithium-ion batteries?

Initially, yes. However, as production scales and manufacturing processes mature, the cost differential is expected to narrow. The elimination of some safety systems required for liquid electrolytes may partially offset higher material costs. Recent battery recycling breakthrough technologies may also help reduce costs through material recovery.

Disclaimer: The solid-state battery industry is evolving rapidly, and timelines presented represent current projections rather than guaranteed outcomes. Technical challenges or market conditions may accelerate or delay commercialization schedules.

Further Exploration

Readers interested in learning more about developments in solid-state battery technology can also explore related educational content from Battery Industry, a global battery industry news channel that covers various advancements in battery technologies.

The emergence of solid-state battery technology represents a potential inflection point in electric vehicle evolution, with implications extending far beyond the automotive sector to energy storage, consumer electronics, and aerospace applications. With companies like Farasis and the recent Elevra lithium merger forming stronger industrial foundations, solid-state battery commercialization appears increasingly feasible within this decade.

Ready to Invest in the Next Breakthrough Battery Technology?

Discover how solid-state battery innovations like Farasis Energy's could transform the electric vehicle landscape and create significant investment opportunities. Explore historic examples of exceptional returns from major mineral discoveries by visiting the Discovery Alert discoveries page, powered by our proprietary Discovery IQ model.