Understanding the Gold to Silver Ratio

What Is the Gold to Silver Ratio?

The gold-to-silver ratio quantifies the ounces of silver required to purchase one ounce of gold. At approximately 100:1 as of April 2024, this metric has only breached triple digits three times in the past century: in 1991, March 2020, and April 2024. Historically, the ratio averaged 15:1 during ancient monetary systems and 50:1 over the last 50 years, but modern market forces—including central bank policies and industrial demand—have reshaped its relevance.

Historical Gold to Silver Ratio Patterns

The ratio's extremes often signal macroeconomic stress or shifts in investor sentiment. In 1980, after the Hunt brothers' attempt to corner the silver market, the ratio narrowed to 16:1 as silver peaked near $50/oz. By 1991, an 11-year bear market in silver pushed the ratio to 100:1, marking a generational buying opportunity ahead of a 60% price surge over the next two years. Similarly, the COVID-19 pandemic-driven ratio of 126:1 in March 2020 preceded a 140% silver rally within months.

Why Is Silver Potentially Undervalued?

Expert Analysis from Christopher Pablava

Christopher Pablava, Chief Investment Officer at Financial Sense Wealth, highlights the ratio's predictive power, noting that each 100:1 milestone since 1991 catalyzed substantial silver rebounds. After the 2020 low of $11/oz, silver rallied to $30/oz by August 2020, demonstrating its volatility and upside potential. Pablava projects a 60% surge to $50/oz by late 2025, driven by mean reversion and record short positions in silver ETFs.

Technical Indicators Supporting a Silver Rally

The iShares Silver Trust (SLV) and Sprott Physical Silver Trust (PSLV) show record short interest, mirroring conditions before the 2011 and 2020 rallies. A short-covering squeeze could amplify gains, particularly if silver breaches key resistance levels like $26/oz. Additionally, the 2020–2022 support zone around $18–$20/oz has held, suggesting a bullish reversal pattern.

How Does Today's Situation Differ from Previous Opportunities?

Unique Market Dynamics in 2024

Central banks purchased 1,037 tons of gold in 2023, the highest since 1967, propelling gold to all-time highs above $2,400/oz. Unlike past cycles, silver's industrial demand—over 10,000 applications in solar panels, electronics, and EVs—insulates it from pure monetary speculation. However, U.S.-China trade tensions and China's gold ETF strategies have skewed investor preference toward gold, exacerbating the ratio's divergence.

The "New Normal" for the Gold to Silver Ratio

Pablava suggests the ratio's historical average of 50:1 may no longer apply, with a "new normal" closer to 70–80:1 due to diverging demand drivers. Gold's role as a hedge contrasts with silver's sensitivity to industrial cycles, reducing the likelihood of a sub-50:1 ratio seen in 1980 or 2011.

Should You Buy Silver Now?

Factors to Consider Before Investing

Silver's dual identity as a monetary and industrial metal introduces unique risks. A global economic slowdown could dampen industrial demand, while inflationary pressures might boost its safe-haven appeal. Investors must also weigh storage costs (3–5% annually for physical silver) against paper alternatives like ETFs, which incur management fees of 0.3–0.7%.

Investment Strategies for Silver

Dollar-cost averaging mitigates volatility, as silver's 20% annual price swings exceed gold's 10–15%. Physical investors should prioritize low-premium products like 1-oz rounds (5–8% premiums) or 100-oz bars (2–4% premiums). Allocating 5–10% of a portfolio to precious metals balances risk without overexposure.

Expert Opinions: Contrasting Views

Bullish Case for Silver

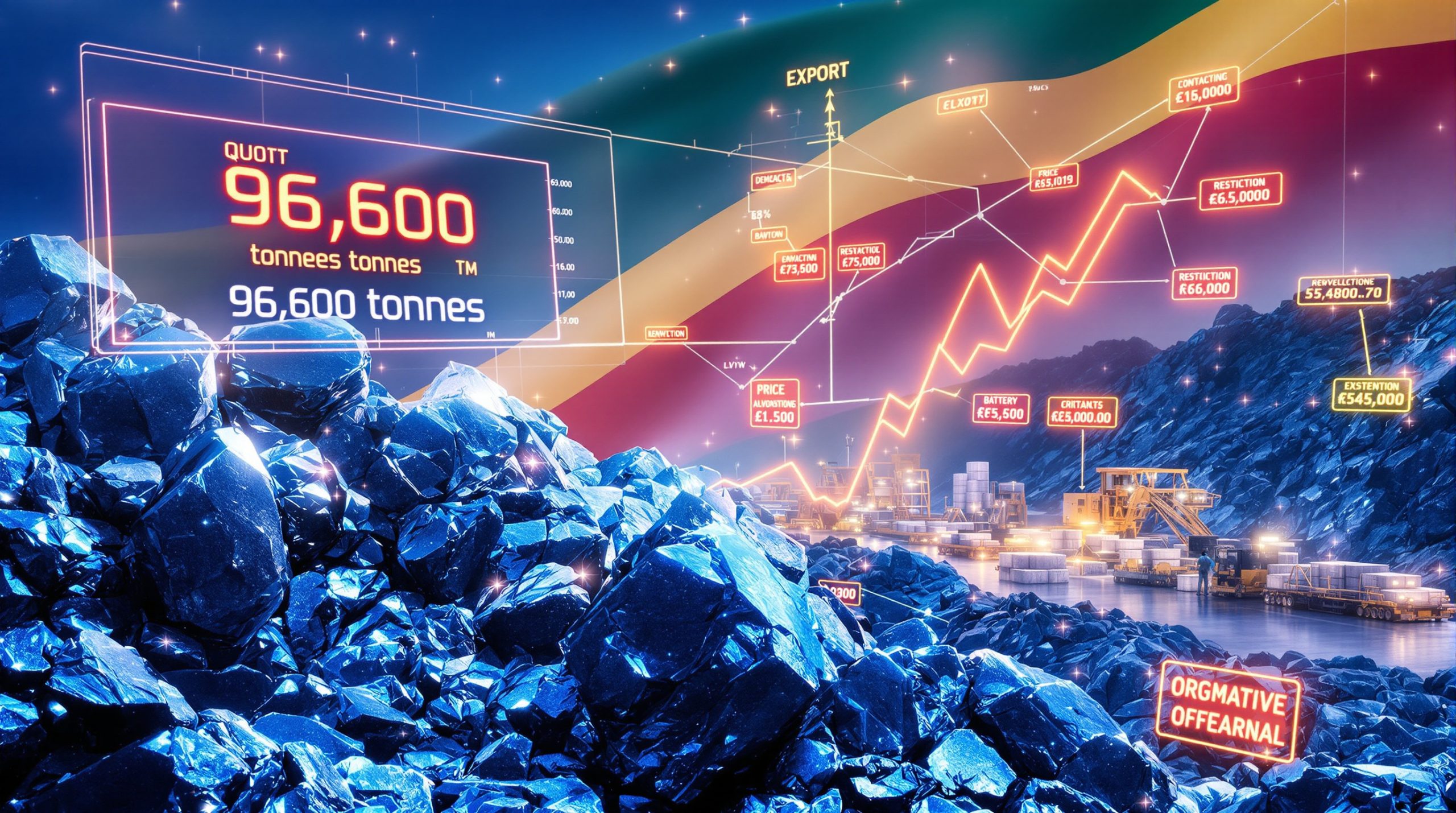

Historically, ratios above 90:1 preceded median 12-month silver returns of 40%. The green energy transition alone could add 500 million ounces of annual silver demand by 2030, straining already tight supplies. With mine production stagnant since 2016, a supply deficit of 176 million ounces in 2024 could ignite prices.

Cautious Perspective

Gold's dominance in central bank reserves (35,715 tons vs. silver's negligible holdings) limits silver's monetary resurgence. Additionally, 70% of silver derives from base metal mining, linking its supply to copper and zinc markets. If the ratio's "new normal" persists, silver may underperform gold despite favorable gold price analysis indicators.

FAQs About the Gold to Silver Ratio

What Is Considered a "Normal" Gold to Silver Ratio?

Pre-20th-century bimetallism pegged the ratio at 15:1, but modern averages range from 50:1 to 60:1. Post-2020, analysts argue 70–80:1 reflects structural shifts in demand.

How Can Investors Use the Ratio?

Traders swap gold for silver when the ratio exceeds 90:1 and reverse near 50:1. Long-term investors use extremes to rebalance portfolios, selling silver when the ratio contracts.

What Factors Could Drive Silver Prices Higher?

Industrial demand growth remains the primary catalyst, with solar panel production requiring over 100 million ounces annually. Green energy initiatives could double this demand by 2030. Additionally, investor sentiment could shift rapidly if inflation persists or geopolitical tensions escalate, triggering a flight to tangible assets beyond gold.

What Risks Should Silver Investors Be Aware Of?

Silver's price volatility can exceed 30% annually, compared to gold's 15-20%. Mining disruptions, particularly in major producing countries like Mexico and Peru, could impact supply chains unexpectedly. Moreover, technological advancements might reduce silver requirements in electronics, offsetting some industrial demand growth.

Conclusion: Is This Truly a Once-in-a-Generation Opportunity?

The 100:1 gold-to-silver ratio presents a high-risk, high-reward scenario. While historical precedents favor silver, modern macroeconomic forces suggest tempered expectations. Investors should prioritize diversification, balancing physical holdings with mining stocks guide or ETFs like SILJ. With silver's 2024 fundamentals tighter than in 2011 or 2020, a rally to $40–$50/oz remains plausible—but not guaranteed.

Key Considerations for Investors

Timing matters with silver investments, as the metal typically outperforms during the middle to late stages of precious metals bull markets. Understanding silver's unique seasonal patterns—historically strongest in January and weakest in June—can help optimize entry points. For tax-advantaged accounts, silver mining stocks or royalty companies offer leverage to price movements without the challenges of physical storage or dealer premiums.

Long-Term Perspective

Despite short-term volatility, silver's fundamentals point to a structural deficit that could persist through 2030. With above-ground inventories declining and mine development constrained by years of underinvestment, the supply side remains constrained. Patient investors who can weather 20-30% corrections may find the current gold to silver ratio an attractive entry point for positions intended to be held for 3-5 years or longer, especially when considering the gold market outlook 2025.

Want to Capitalise on the Next Major Mineral Discovery?

Stay ahead of the market with Discovery Alert's proprietary Discovery IQ model, which instantly identifies significant ASX mineral discoveries and converts complex data into actionable investment insights. Understand why historic discoveries can generate substantial returns by visiting Discovery Alert's dedicated discoveries page and begin your 30-day free trial today.