Halls Creek Project Review Targets Major Uplift in Value

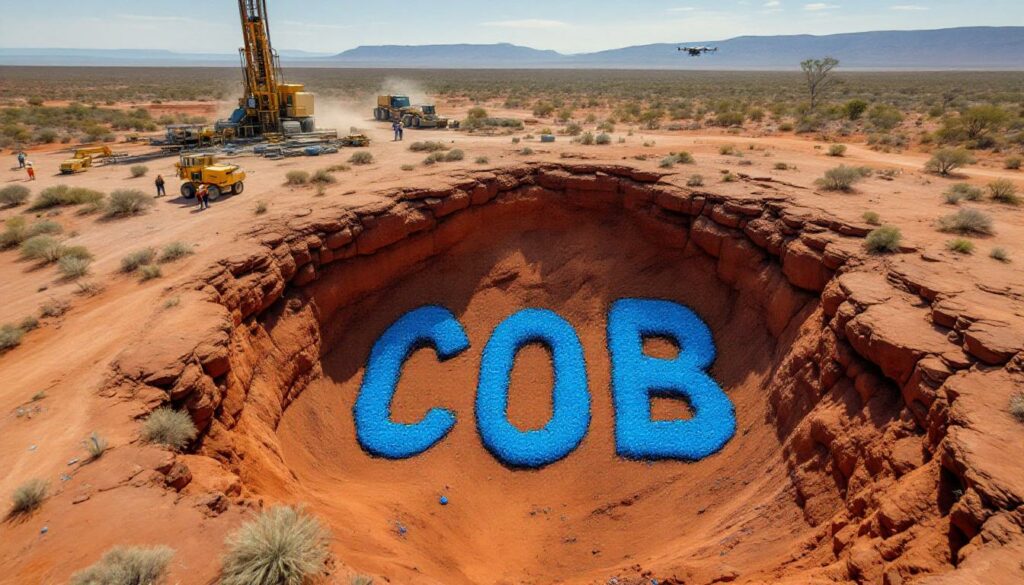

Cobalt Blue Holdings' Halls Creek Project demonstrates significant potential for enhanced economics through targeted value engineering and resource growth opportunities. The company's recent review has identified several avenues to boost margins and extend project life beyond the already robust economics outlined in its June 2025 Scoping Study.

Engineering Breakthroughs Set to Boost Profitability

Cobalt Blue Holdings (ASX: COB) has identified multiple value engineering opportunities that could significantly enhance the Halls Creek Project economics. Three key areas present substantial upside potential:

-

Silver recovery at Onedin presents a major opportunity to boost Stage 1 margins. The current production target delivers material at an average grade of 37 g/t silver (equating to 3.6 million ounces of contained silver). At current silver prices of approximately A$58/oz, silver credits could significantly enhance project economics beyond the already attractive Stage 1 C1 cash cost of US$1.33/lb copper.

-

Cobalt inclusion at Sandiego could provide valuable by-product credits for Stage 2, enhancing cost competitiveness with high-grade intersections including:

- 8m at 2.0% Cu, 4.2% Zn and 0.28% Co from 112m (SRC060)

- 37m at 3.9% Cu and 0.10% Co from 267m (SRCD028A)

- 10.37m at 9.9% Cu and 0.46% Co from 393.73m (SRCD064)

-

A centralised processing hub could integrate satellite deposits, extend mine life, increase throughput, and lower unit capital intensity, providing a pathway to scale the operation beyond the initial 10-year mine life.

"The upside opportunities presented offer immense value-add to the core project outlined in the recent Scoping Study. COB has the right team to unlock silver and cobalt credits, potentially driving major uplifts in cashflow and return on installed plant," stated Cobalt Blue's CEO Dr. Andrew Tong.

Sandiego North Emerges as High-Impact Discovery Target

Beyond engineering optimisations, Cobalt Blue Holdings has identified Sandiego North as a priority target for near-term resource growth at the Halls Creek Project, characterised by:

- A 700-meter copper-in-soil anomaly with multiple samples exceeding 200 ppm Cu

- Drill hole ASWB01 intersecting 5m at 1.37% Cu and 2m at 1.71% Cu, confirming copper mineralisation north of the existing resource

- Deep drilling showing mineralisation trending toward Sandiego North with high-grade gold strike remaining open along strike

The soil sampling programme defined a broad northeast-southwest copper anomaly extending from the northern limits of Sandiego through to ASWB01, with a prominent 150m x 100m geochemical zone that remains completely untested by drilling.

Building a Strategic Battery Metals Portfolio

The inclusion of cobalt at Sandiego presents a compelling strategic fit with Cobalt Blue Holdings' proposed Kwinana Cobalt Refinery, potentially adding a high-value, future-facing revenue stream to the Halls Creek Project. This aligns with the company's broader strategy to position itself as a key player in the battery metals supply chain. Furthermore, recent graphene supercapacitor breakthroughs highlight the growing importance of advanced materials in energy storage applications.

Understanding Copper-Zinc Deposits: The Metallogenic Setting

Volcanogenic Massive Sulphide (VMS) Deposits

The Sandiego and Onedin deposits at the Halls Creek Project show characteristics of VMS-style mineralisation, formed when metal-rich hydrothermal fluids are discharged into seawater near submarine volcanic activity. These deposits typically contain:

- Copper, zinc, lead, silver, and gold in varying proportions

- Distinct zones of metal enrichment (copper-rich cores and zinc-rich peripheries)

- Strong structural control on mineralisation

VMS deposits are valuable exploration targets because they often occur in clusters, explaining why Cobalt Blue Holdings is targeting Sandiego North and other regional prospects along prospective stratigraphy.

The formation process typically begins with the circulation of seawater through hot volcanic rocks, where the water becomes enriched with dissolved metals. When these metal-laden fluids encounter cold seawater, they rapidly cool and precipitate metal sulphides, creating distinct ore bodies with zonation patterns similar to those seen in the high-grade silver discovery at Elizabeth Hill.

This geological setting provides Cobalt Blue Holdings with multiple potential targets across the broader Halls Creek Project tenement package, offering significant exploration upside beyond the currently defined resources at Onedin and Sandiego.

Investment Thesis: A Multi-Dimensional Growth Story

Cobalt Blue Holdings' Halls Creek Project represents a compelling investment proposition driven by:

-

Near-term cash flow potential from the staged development approach, with Stage 1 (Onedin) and Stage 2 (Sandiego) providing a foundation for sustainable operations

-

Multiple margin enhancement opportunities through silver and cobalt credits that aren't yet incorporated in the project economics

-

Significant resource growth potential at Sandiego North and across the broader 250km² tenement package

-

Strategic alignment with battery metal demand through the cobalt potential and integration with Cobalt Blue Holdings' Kwinana refinery strategy

Future Plans and Timelines

Following the successful Scoping Study in H1 2025, Cobalt Blue Holdings is advancing the Halls Creek Project on two parallel tracks:

-

Project optimisation – Incorporating silver and cobalt recovery into the process flowsheet and evaluating the centralised hub concept

-

Resource growth – Systematic exploration of priority targets, with Sandiego North positioned as the immediate focus for drilling

This dual-track strategy of project optimisation and resource growth provides multiple avenues for value creation as the company progresses toward a potential development decision. Additionally, resistivity survey techniques similar to those used at other copper projects could help identify new mineralisation zones.

Why Investors Should Follow Cobalt Blue Holdings

Cobalt Blue Holdings presents a unique opportunity for investors seeking exposure to critical minerals with both near-term production potential and significant growth upside at the Halls Creek Project:

- Robust base-case economics with Stage 1 and Stage 2 C1 cash costs of US$1.33/lb and US$1.11/lb copper, respectively

- Multiple value-add opportunities not yet incorporated in the economic model

- Clear pathway to resource growth through high-priority exploration targets

- Strategic positioning in both copper-zinc and battery metals markets

With engineering studies underway and a systematic exploration programme being implemented, Cobalt Blue Holdings is poised to deliver a series of value-creating milestones as it advances the Halls Creek Project toward development. Recent gold discovery mineralisation at other nearby projects demonstrates the rich mineral endowment of the broader region.

Want to Capitalise on the Next Major Mineral Discovery?

Discovery Alert's proprietary Discovery IQ model delivers instant notifications on significant ASX mineral discoveries like those from the copper and battery metals sector, turning complex data into actionable investment insights. Explore why major mineral discoveries can lead to substantial returns by visiting the Discovery Alert discoveries page and begin your 30-day free trial today.