In-Situ Recovery at Ema: Brazilian Critical Minerals' Groundbreaking Rare Earths Trial

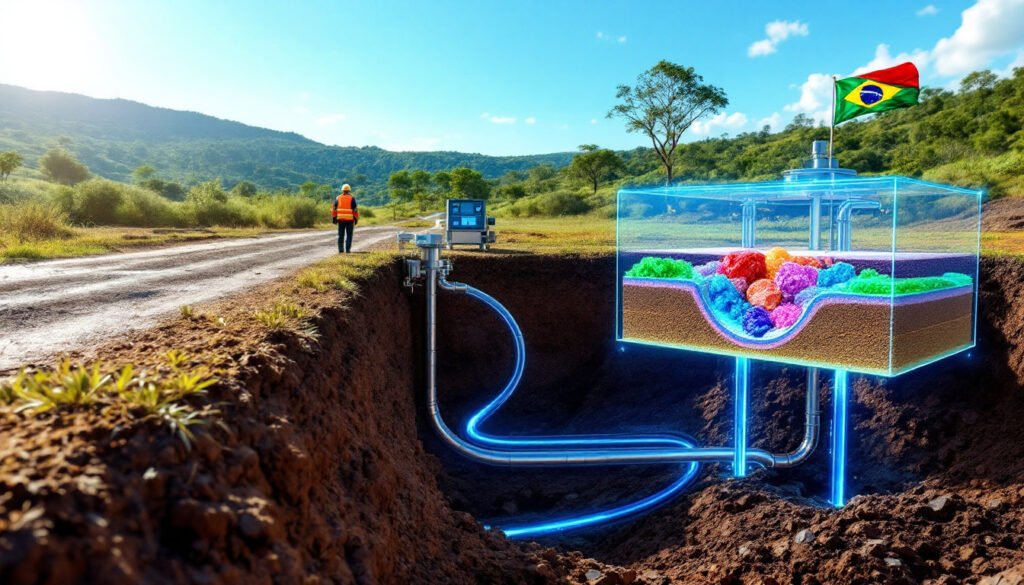

In the heart of Brazil, a revolution in rare earth element (REE) extraction is underway. Brazilian Critical Minerals (BCM) has commenced a groundbreaking field trial of in-situ recovery technology at its Ema project. This innovative approach represents a potential game-changer for the global rare earths industry, promising to dramatically reduce environmental impact while enhancing economic viability.

The field trial, which began in May 2025, marks a critical milestone in the development of what could become one of the Western world's most significant rare earth operations, employing innovative extraction techniques previously dominated by Chinese producers.

Understanding the Ema Project

The Ema rare earths project boasts impressive credentials with a resource size of 943 million tonnes grading 716ppm TREO (Total Rare Earth Oxides). This substantial deposit was discovered just 24 months ago, with the maiden 1 billion tonne mineral resource estimate released 12 months ago in May 2024.

Andrew Reid, BCM Managing Director, explained the significance of the current field trial: "The data collected will confirm hydraulic conductivity, demonstrate clay permeability, and allow us to collect metallurgical samples for further leach optimization."

The project has already demonstrated compelling economics through its recently completed scoping study, revealing a project NPV of US$355 million (even at current depressed REE prices) with a modest capital requirement of just US$55 million—a fraction of the cost typical for conventional rare earth developments.

What is In-Situ Recovery and Why is it Revolutionary for Rare Earths?

In-situ recovery represents a paradigm shift in mineral extraction methodology. Unlike traditional mining, which requires extensive excavation, crushing, and processing of ore, ISR works by injecting a solution directly into the mineral deposit to dissolve target elements before pumping the enriched solution to the surface.

Understanding In-Situ Recovery Technology

The process begins with the drilling of injection and extraction wells into the ore body. A leaching solution—in BCM's case, environmentally responsible magnesium sulfate—is then circulated through the deposit. This solution dissolves the rare earth elements, creating a mineral-rich liquid that is pumped to the surface for processing.

This approach eliminates the need for conventional mining infrastructure such as open pits, waste rock dumps, and tailings facilities. The result is a dramatically smaller environmental footprint and significantly reduced capital requirements.

The Economic and Environmental Advantages of ISR

The benefits of ISR technology for rare earth extraction are multifaceted:

- Simplified processing: ISR reduces processing complexity by approximately 60%, eliminating numerous stages from the conventional rare earth processing flowsheet

- Reduced capital intensity: Initial development costs are typically 60-70% lower than traditional mining operations

- Minimal surface disruption: Without the need for open pits or large processing facilities, land disturbance is limited to well fields and solution processing areas

- Lower water consumption: ISR requires significantly less water than conventional mining and processing

- Accelerated timeline: Development and production timelines can be substantially shortened

These advantages combine to create a compelling case for ISR adoption, particularly in today's climate of increasing environmental scrutiny and capital constraints.

Current Global Implementation Status

While ISR technology has revolutionized uranium mining—accounting for approximately 40% of global uranium production, primarily in Kazakhstan according to the World Nuclear Association—its application for rare earth elements remains limited outside of China.

Currently, approximately 30% of global rare earth production comes from ionic adsorption clay deposits in southern China, Malaysia, and parts of Myanmar where ISR techniques are employed. These operations, particularly in Southern China's Longnan County region, have dominated global heavy rare earth supply for decades.

The opportunity for Western adoption of this technology represents a significant shift in the rare earth supply landscape, potentially enabling cost-competitive production outside traditional centers of production.

How is Brazilian Critical Minerals Implementing ISR at Ema?

BCM's approach to implementing ISR technology at Ema demonstrates careful planning and expert collaboration, designed to validate laboratory results in real-world conditions.

The Ema Project: Key Specifications and Timeline

The Ema rare earths project represents a significant resource with impressive specifications:

- 943 million tonnes of resource material

- Average grade of 716 ppm total rare earth oxides (TREO)

- Discovered in early 2023

- Maiden 1 billion tonne mineral resource estimate released in May 2024

- Scoping study completed in February 2025 demonstrating favorable economics

This rapid progression from discovery to field trial highlights the project's strategic importance and technical merit.

Field Trial Methodology and Objectives

The current ISR field trial at Ema involves several key components:

- Injection of magnesium sulfate (an environmentally responsible reagent) into shallow clay horizons

- Collection of comprehensive geotechnical, hydrogeological, and metallurgical data

- Assessment of hydraulic connectivity between test injection points

- Demonstration of clay permeability characteristics

- Collection of REE-rich solution samples for further metallurgical optimization

These objectives align with industry best practices for ISR testing and provide critical data for future commercial development decisions.

Expert Collaboration and Oversight

To ensure technical excellence and regulatory compliance, BCM has assembled a team of industry specialists for the field trial:

- WSP Brazil (global ISR specialist) conducting the field operations, leveraging their expertise from uranium ISR deployment in projects like Namibia's Husab Mine

- CERN Environmental providing oversight and quality control

- Previous laboratory testwork conducted by ANSTO (Australian Nuclear Science and Technology Organisation), known for their peer-reviewed hydrometallurgy research

- Environmental approval secured from the Environmental Protection Institute of Amazonas state

This collaboration with recognized experts enhances the credibility of the trial and provides valuable knowledge transfer opportunities.

What Makes Ema Uniquely Suited for ISR Mining?

The geological and technical characteristics of the Ema deposit create an ideal environment for ISR implementation, setting it apart from many conventional rare earth resources.

Geological Characteristics Supporting ISR Application

The Ema deposit possesses several critical attributes that make it particularly amenable to ISR:

- Soft, friable clay material requiring minimal processing

- Quartz-rich composition facilitating solution flow through enhanced permeability

- Demonstrated high recoveries of key magnet rare earths in laboratory testing

- Short leaching duration requirements

- Favorable hydrogeological conditions

When contrasted with China's Ganzhou deposits (500–1,000ppm TREO), Ema's grade of 716ppm TREO places it firmly within the economically viable range for ISR extraction based on operational Chinese projects.

Previous Laboratory Results and Their Significance

Laboratory testwork conducted by ANSTO has already validated several key aspects of the project:

- High recovery rates for critical rare earth elements

- Effective leaching using environmentally responsible reagents

- Favorable leaching kinetics (short duration periods)

- Promising economics driven by simplified processing requirements

These laboratory results provide a strong foundation for the current field trial, with preliminary indicators suggesting that real-world recovery rates may match or exceed laboratory performance.

Economic Implications Based on Scoping Study

The recently completed scoping study highlights the project's compelling economics:

- Project NPV of US$355 million (even at current depressed spot prices)

- Modest capital requirement of just US$55 million, compared to Lynas' Kalgoorlie Rare Earths Plant which required approximately $500 million

- Ultra-low operating costs compared to conventional rare earth projects

- Potential for rapid development timeline

These economic indicators place Ema among the most capital-efficient rare earth development projects globally, with potential to withstand market volatility while delivering strong returns.

What Are the Next Steps Following the ISR Field Trial?

The successful completion of the field trial will launch several subsequent development phases on the pathway to commercial production.

Production of Mixed Rare Earth Carbonate

Following successful field trials, Brazilian Critical Minerals plans to:

- Process the collected REE-rich solutions to produce a mixed rare earth carbonate (MREC)

- Provide MREC samples to strategic partners for quality control testing

- Advance discussions toward formal offtake agreements

- Further optimize the leaching process based on field trial data

MREC production represents a critical step, as this intermediate product serves as the primary feedstock for rare earth separation facilities and ultimately for the production of NdFeB magnets used in electric vehicles and wind turbines.

Commercial Scale-Up Considerations

Scaling from field trials to commercial operations will require several key developments:

- Integration of field trial data into detailed engineering designs

- Optimization of well field patterns and solution management systems

- Development of processing facilities for the REE-rich solutions

- Implementation of environmental monitoring and management systems

This scale-up process benefits from the modular nature of ISR operations, allowing for phased implementation and reduced upfront capital requirements compared to conventional mining operations.

Strategic Importance in Global Rare Earths Supply Chain

The Ema project could play a significant role in diversifying global rare earths supply:

- Providing non-Chinese supply of critical magnet rare earths

- Demonstrating commercial viability of ISR for rare earths outside Asia

- Establishing Brazil as a significant player in the critical minerals energy transition

- Supporting growing demand for rare earths in renewable energy and EV applications

With magnet rare earth demand projected to grow at a CAGR of 10% through 2030 according to Adamas Intelligence, new sources of supply like Ema will be essential to meeting global needs.

How Does ISR Compare to Traditional Rare Earth Mining Methods?

The distinctions between ISR and conventional mining approaches are substantial, with implications for economics, environmental impact, and development timelines.

Process Comparison: ISR vs. Conventional Mining

| Aspect | In-Situ Recovery | Conventional Mining |

|---|---|---|

| Surface Disturbance | Minimal (well fields only) | Extensive (open pits, waste dumps) |

| Water Usage | Low to moderate | High |

| Processing Complexity | Significantly reduced | Complex multi-stage processes |

| Capital Requirements | Typically 60-70% lower | High capital intensity |

| Operating Costs | Substantially reduced | Higher labor and energy costs |

| Timeline to Production | Potentially faster | Lengthy development periods |

| Environmental Footprint | Smaller overall impact | Larger land disturbance |

This comparison highlights the transformative potential of ISR for the rare earths sector, particularly for deposits with suitable geological characteristics.

Case Studies: Successful ISR Applications

While rare earth ISR remains relatively uncommon outside China, successful applications of the technology in other mineral sectors provide valuable insights:

- Uranium mining in Kazakhstan accounts for approximately 40% of global production according to the World Nuclear Association

- Copper recovery operations in Arizona and Chile, including BHP's Escondida pilot project

- Pilot projects for nickel and cobalt recovery in Australia

These examples demonstrate the versatility and scalability of ISR technology across different geological settings and commodity types.

Technical Challenges and Solutions

Implementing ISR for rare earths presents several challenges that must be addressed:

- Ensuring adequate permeability throughout the ore body

- Maintaining solution containment within the target zone

- Optimizing reagent usage and recovery

- Developing efficient downstream processing methods

- Monitoring and managing potential environmental impacts

BCM's approach addresses these challenges through careful site selection, comprehensive testing, and collaboration with experienced technical partners. The company's focus on deposits with favorable permeability characteristics and the use of environmentally responsible reagents mitigates many common concerns.

What is the Market Context for Rare Earth Elements?

Understanding the broader rare earth market provides essential context for evaluating the strategic importance of projects like Ema.

Current Rare Earth Market Dynamics

The rare earth market presents both challenges and opportunities:

- Current depressed pricing environment following period of volatility

- Growing demand for magnet rare earths (neodymium, praseodymium, dysprosium, terbium)

- Chinese dominance of processing capacity (approximately 85% of global production according to USGS data)

- Western nations seeking supply chain diversification, with initiatives like the U.S. Defense Logistics Agency's strategic stockpiling of NdPr

- Increasing focus on sustainable mining practices

This complex landscape creates opportunities for projects that can achieve competitive production costs while meeting environmental standards.

Strategic Applications Driving Demand

Rare earth elements are critical components in numerous high-tech and clean energy applications:

- Permanent magnets for electric vehicles and wind turbines

- Electronics and consumer technology

- Defense systems and aerospace applications

- Catalysts and specialty glass manufacturing

- Emerging robotics and automation technologies

The growth in electric vehicle adoption and renewable energy deployment continues to drive demand for magnet rare earths in particular, creating a strong long-term market outlook despite current pricing pressures.

Supply Chain Vulnerabilities and Opportunities

The current rare earth supply chain presents several strategic concerns:

- Concentrated production in politically sensitive regions

- Environmental challenges with conventional processing methods

- Limited processing capacity outside China

- Growing demand from clean energy transition

- Opportunity for new, cost-effective production methods like ISR

These vulnerabilities have prompted increased government interest in rare earth supply security, creating a supportive policy environment for new projects in politically stable jurisdictions.

Frequently Asked Questions About ISR for Rare Earths

Is In-Situ Recovery Environmentally Safe?

When properly implemented, ISR offers several environmental advantages over conventional mining. The process eliminates the need for large-scale excavation, waste rock dumps, and tailings facilities.

At Ema, the use of magnesium sulfate as the leaching agent represents an environmentally responsible approach compared to more aggressive chemicals used in some operations. Comprehensive monitoring systems and regulatory oversight from the Amazonas state environmental authorities help ensure environmental protection.

"The regulatory framework in Brazil has evolved significantly to address the specific requirements of ISR projects, with the Environmental Protection Institute of Amazonas state providing rigorous oversight while recognizing the reduced environmental footprint compared to conventional mining." — Andrew Reid, BCM Managing Director

How Does ISR Affect Project Economics?

ISR can dramatically improve project economics through:

- Reduced capital requirements (typically 60-70% lower than conventional mining)

- Lower operating costs due to simplified processing

- Faster path to production and cash flow

- Smaller environmental bonding requirements

- Reduced closure and rehabilitation costs

These economic advantages are particularly significant in the current capital-constrained mining finance environment, potentially enabling projects that might be uneconomic using conventional approaches.

What Regulatory Hurdles Exist for ISR Projects?

Regulatory frameworks for ISR vary by jurisdiction but typically involve:

- Groundwater protection regulations and monitoring requirements

- Demonstration of solution containment and control

- Environmental impact assessment processes

- Post-operation restoration planning

- Stakeholder engagement and consultation requirements

Brazilian Critical Minerals has navigated these requirements successfully, securing approval from the Environmental Protection Institute of Amazonas state for the current field trial. This approval process included comprehensive hydrogeological studies and environmental impact assessments.

How Scalable is ISR Technology for Rare Earths?

ISR operations can be scaled incrementally, allowing for phased development and expansion as market conditions warrant. This scalability provides significant flexibility compared to conventional mining operations that often require large upfront capital commitments.

The modular nature of ISR well fields and processing facilities supports this staged approach, potentially allowing for initial production to commence at lower capital cost with subsequent expansion funded from operational cash flow.

Additional Resources for Learning About ISR and Rare Earths

For readers interested in further exploring in-situ recovery methods for critical minerals, several resources provide valuable insights:

- Technical publications from organizations like ANSTO and the International Atomic Energy Agency

- Industry reports from Adamas Intelligence and Roskill on rare earth markets

- Case studies of ISR applications from the World Nuclear Association

- Brazilian Critical Minerals' technical presentations and investor materials

These resources can provide deeper understanding of both the technical aspects of ISR and the strategic importance of rare earth elements in the global mining industry evolution and transition to clean energy technologies.

Furthermore, the application of modern mine planning & ESG principles will be crucial for companies like BCM as they develop these innovative extraction methodologies.

Disclaimer: This article presents information on an emerging technology and development project. While based on published data, actual project outcomes may differ from current projections. Investment decisions should be based on comprehensive due diligence beyond the information presented here.

Ready to Spot the Next Major Mineral Discovery?

Discovery Alert's proprietary Discovery IQ model instantly notifies investors of significant ASX mineral discoveries like Brazilian Critical Minerals' groundbreaking Ema project, turning complex exploration data into actionable investment insights. Understand why major mineral discoveries can lead to substantial returns by exploring the dedicated discoveries page and begin your 30-day free trial today.