Indonesia's Strategic Acquisition of Freeport-McMoRan Assets: Implications and Analysis

Indonesia's pursuit of greater control over its mineral resources has entered a new phase with an imminent deal that will further increase government ownership of one of the world's most valuable mining operations. This strategic maneuver continues the nation's long-term resource nationalism policy while raising questions about the future of foreign investment in Indonesia's mining industry evolution.

What is the Freeport-McMoRan divestment deal in Indonesia?

The 12% Stake Transfer Agreement

Indonesia expects to finalize a deal with Freeport-McMoRan for an additional 12% stake in PT Freeport Indonesia (PTFI), according to Investment Minister Rosan Roeslani. This pivotal stake will be transferred "free of charge," representing an unprecedented structure in mining consolidation trends.

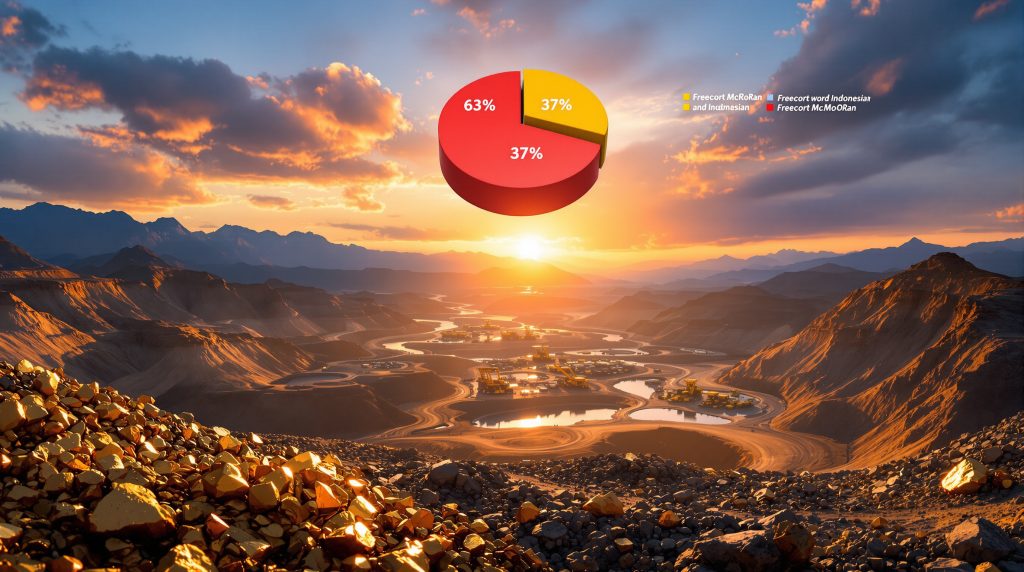

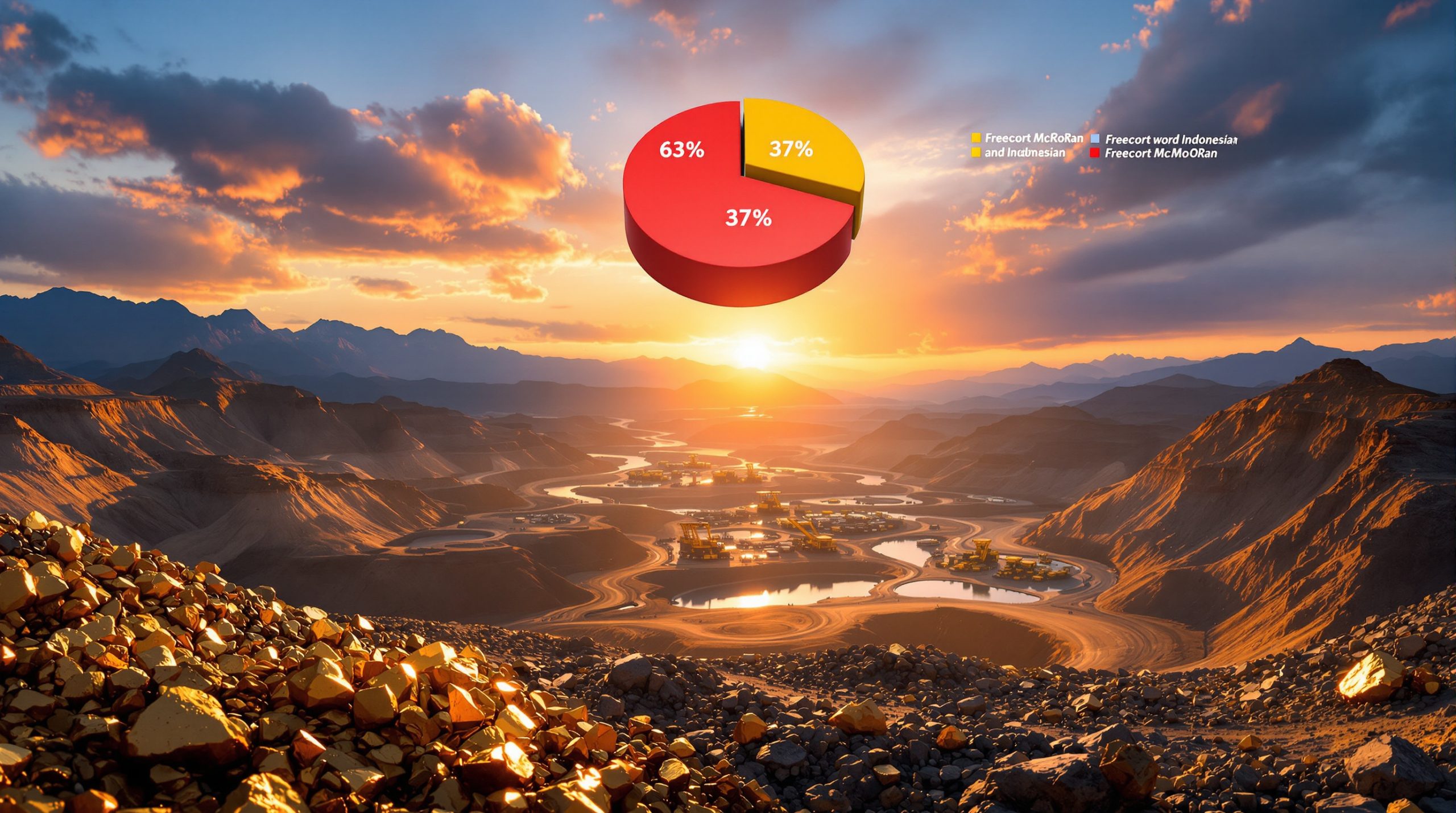

The acquisition builds upon previous agreements that already granted Indonesia's state mining holding company MIND ID a 51% ownership position in PTFI. Upon completion of this latest transaction, Indonesian government entities will effectively control 63% of the Grasberg mining operations.

"This is just an administrative process but we have already agreed on all points of discussions… Once it is done, we can proceed with the signing," Minister Roeslani told reporters, indicating the deal structure has been finalized with only procedural steps remaining.

Strategic Timing and Administrative Process

The timing of this divestment is particularly significant as it coincides with Freeport-McMoRan's ongoing discussions with the Indonesian government regarding rights to operate the Grasberg mine beyond 2041, when the current mining permitting process expires.

Mining Minister Bahlil Lahadalia recently emphasized the importance of reaching an agreement on permit extension, noting it would enable Freeport to "start investing in exploration for future resources to be extracted from Grasberg." This suggests the divestment may be strategically linked to securing long-term operational certainty.

The negotiation process occurs against a backdrop of operational challenges at Grasberg, including recent torrential mudslides that killed two workers and triggered a force majeure declaration. These circumstances create additional complexity while potentially increasing Indonesia's leverage in the negotiations.

Why is the Grasberg mine so important to both parties?

Global Significance of the Grasberg Operation

Grasberg's importance can hardly be overstated in the global mining landscape. It stands as the world's largest gold mine and second-largest copper mine, making it a cornerstone asset for both Freeport-McMoRan and Indonesia's mineral wealth portfolio.

The mine's production volumes significantly impact global copper supply chains and pricing mechanisms. Recent operational disruptions following mudslides have already affected international copper markets, demonstrating the mine's outsized influence on global commodity trends.

Industry analysts project that Grasberg may not return to pre-accident operating rates until at least 2027, creating prolonged supply constraints in an already tight copper market. With copper being essential to renewable energy infrastructure and electrification projects worldwide, the mine's performance has implications far beyond Indonesia's borders.

Strategic Value to Indonesia's Resource Control

For Indonesia, increasing ownership of Grasberg represents a major milestone in the government's strategy to maximize domestic benefits from critical minerals transition. The mine generates substantial export revenue and provides critical economic contributions to Papua province, where the operation is located.

By controlling nearly two-thirds of this world-class asset, Indonesia gains greater leverage in determining how the mine's resources are extracted, processed, and monetized. This control aligns with broader Indonesian policies requiring domestic processing of minerals to enhance value creation within the country.

The divestment also strengthens Indonesia's position in negotiations over the post-2041 operational period. With Freeport-McMoRan seeking to secure long-term mining rights, the government can use its increased ownership stake to influence future investment decisions and operational strategies.

How does this divestment fit into Indonesia's broader mining strategy?

Evolution of Indonesia's Resource Nationalism

The current divestment continues Indonesia's systematic approach to increasing domestic control over strategic mining assets. In 2018, Indonesia secured majority (51%) ownership of PTFI through a complex series of negotiations that fundamentally altered the relationship between the government and Freeport-McMoRan.

This progressive acquisition of mining assets reflects Indonesia's commitment to implementing mining regulations that favor national interests while still maintaining sufficient foreign investment to support operational expertise and capital requirements.

The "free of charge" nature of the latest 12% stake transfer represents an especially assertive application of resource nationalism principles, signaling to other foreign mining companies Indonesia's determination to maximize domestic benefits from mineral resources.

Balancing Foreign Investment and National Interest

Indonesia faces the perpetual challenge of asserting control over its natural resources while maintaining an attractive environment for the foreign investment needed to develop those resources optimally. The Grasberg divestment exemplifies this delicate balancing act.

Mining Minister Bahlil Lahadalia has acknowledged the importance of reaching a mutually beneficial agreement on permit extension to ensure Freeport continues investing in exploration activities. This recognition demonstrates the government's understanding that operational expertise and capital from international mining companies remain essential to maximizing the value of Indonesia's critical minerals reserve.

The arrangement aims to create a partnership structure that secures national interests through majority ownership while preserving the operational continuity needed for long-term development. How successfully this balance is maintained will likely determine Grasberg's productivity and profitability in the coming decades.

What challenges does the divestment present?

Operational and Financial Considerations

The divestment introduces complex operational and financial questions for both parties. Recent mudslides at Grasberg that killed two workers have already forced Freeport to declare force majeure, signaling significant disruption to production schedules and contractual obligations.

With Freeport projecting that operations may not return to pre-accident levels until at least 2027, the increased Indonesian ownership stake comes during a period of operational vulnerability. This timing raises questions about responsibility for recovery investments and how decision-making will function under the new ownership structure during this critical rehabilitation phase.

Financial considerations include how capital expenditures for recovery and future expansion will be allocated between the partners, particularly given the "free of charge" nature of the ownership transfer. The agreement's structure will need to address these investment responsibilities to ensure operational stability.

Negotiating Future Operations

The divestment negotiations are occurring in parallel with discussions about extending Freeport's mining rights beyond their current 2041 expiration date. This creates a complex negotiating environment where the ownership transfer may influence the terms of any future operational agreements.

Phoenix-based Freeport has confirmed ongoing discussions with the Indonesian government regarding rights to operate Grasberg beyond 2041. The company must balance its diminishing ownership percentage against the need to secure long-term operational rights that justify continued capital investment in exploration and development.

For both parties, aligning interests around future mine development, environmental management, and community relations will be essential for maintaining operational stability through the ownership transition and beyond the current permit period.

How might this affect global copper markets?

Short-term Market Impacts

The operational disruptions at Grasberg have already influenced global copper prices, with supply concerns driving market volatility. As one of the world's largest copper producers, any extended production shortfall from Grasberg creates ripple effects throughout international markets.

The uncertainty surrounding the ownership transition adds another layer of market complexity. Commodity traders are closely monitoring the negotiations for signals about future production stability, investment patterns, and Indonesia's broader approach to resource governance.

The force majeure declaration following recent mudslides has intensified market concerns about medium-term copper supply. With full recovery potentially taking years, analysts anticipate continued supply pressure from this key production source through at least 2027.

Long-term Supply Chain Implications

Grasberg's significant contribution to global copper production means that changes in its ownership structure and operational approach carry long-term implications for international supply chains. The mine's output is particularly important given growing demand for copper in renewable energy infrastructure, electric vehicles, and electronics.

Indonesia's increasing control may influence production targets, expansion plans, and export policies in ways that affect global copper availability and pricing. The resolution of these negotiations will provide important signals to international markets about future supply reliability from this critical source.

As the energy transition accelerates worldwide, stable copper supply from major producers like Grasberg becomes increasingly strategic. How the new ownership structure influences operational decision-making will have consequences far beyond Indonesia's borders.

What are the investment implications for Freeport-McMoRan?

Strategic Positioning and Future Operations

Despite its reduced ownership percentage, Freeport-McMoRan maintains operational control of PTFI. This arrangement allows the company to continue applying its technical expertise while adapting to Indonesia's increased equity position.

The company appears to be making a strategic trade-off, accepting diminished ownership in exchange for the possibility of securing longer-term operational rights beyond the current 2041 expiration. This approach prioritizes operational longevity over maximum equity stake.

Freeport must balance shareholder interests against Indonesian government requirements while managing the complex operational challenges created by recent mudslides. The company's ability to navigate these multifaceted negotiations will significantly influence its long-term position in Indonesia.

Financial Impact Assessment

The "free of charge" nature of the divestment raises inevitable questions about shareholder value. Freeport must demonstrate to investors that long-term operational rights and stability compensate for the ownership dilution represented by the stake transfer.

Recovery from recent operational disruptions remains the immediate financial priority, with significant capital expenditure likely required to restore production capacity. The allocation of these costs between the ownership partners will be a critical aspect of the divestment agreement.

Future investment in exploration depends heavily on securing operational extensions beyond 2041. Without this long-term certainty, Freeport may hesitate to commit substantial capital to developing new ore bodies, potentially affecting the mine's long-term production profile.

What does this mean for Indonesia's mining sector governance?

Evolving Regulatory Framework

The divestment process demonstrates Indonesia's increasingly sophisticated approach to managing foreign mining interests. The government has progressively refined its regulatory framework to increase domestic benefits while maintaining sufficient operational expertise through foreign partnerships.

This case represents a significant test of Indonesia's mining regulations and their implementation in one of the country's most valuable natural resource projects. The outcome will likely establish precedents for other foreign-operated mines in Indonesia.

The government's ability to balance assertive resource nationalism with practical operational considerations will determine the long-term success of this governance approach. Excessive government control could potentially compromise operational efficiency, while insufficient oversight might limit domestic economic benefits.

Balancing Development and Control

Indonesia continues to pursue policies aimed at increasing domestic processing and value addition in the mining sector. The government's strategy seeks to move beyond raw material exports toward higher-value processed products that create additional economic benefits within Indonesia.

The divestment represents a key component of this broader strategy to develop domestic mining capabilities while maintaining access to the foreign expertise and capital needed for optimal resource development.

Success will ultimately depend on maintaining operational efficiency under the new ownership structure while advancing Indonesia's legitimate interest in maximizing domestic benefits from its mineral resources.

FAQs About the Freeport-McMoRan Divestment in Indonesia

What is the current ownership structure of PT Freeport Indonesia?

Currently, Indonesia's state mining holding company MIND ID owns 51% of PTFI, with Freeport-McMoRan controlling the remaining 49%. Upon completion of the new divestment, Indonesian government entities will control 63% of the operation, with Freeport-McMoRan retaining 37%.

How has the recent force majeure at Grasberg affected negotiations?

The recent mudslides that killed two workers and triggered a force majeure declaration have created additional urgency around securing long-term operational stability. This operational crisis may have influenced both parties' willingness to reach agreement on the divestment terms, recognizing the need for collaborative solutions to complex operational challenges.

What happens to Grasberg operations after 2041?

Freeport-McMoRan is currently in discussions with the Indonesian government regarding rights to operate the Grasberg mine beyond 2041. The divestment agreement may facilitate these negotiations, but no formal extension has been announced. Mining Minister Bahlil Lahadalia has emphasized the importance of reaching an extension agreement to enable continued exploration investment.

How does this divestment compare to similar arrangements in other countries?

Indonesia's approach represents one of the more assertive resource nationalism strategies globally. While countries like Chile, Peru, and Zambia have implemented various forms of increased state participation in mining operations, the "free of charge" nature of Indonesia's divestment arrangement is particularly noteworthy in comparison to typical commercial transactions in the mining sector.

The Future of Mining Partnerships in Indonesia

The expected divestment of an additional 12% stake in PT Freeport Indonesia marks a significant evolution in Indonesia's resource governance approach. By securing 63% ownership of one of the world's most valuable mines, Indonesia demonstrates its determination to increase domestic control over critical natural resources while maintaining the operational expertise provided by international mining companies.

The agreement highlights the delicate balance between resource nationalism and the need for foreign investment and technical expertise. Indonesia's approach to this balance will likely influence how other resource-rich nations structure their relationships with multinational mining companies in an era of increasing state assertion of mineral rights.

As global demand for copper continues to grow, particularly for energy transition technologies and infrastructure, the resolution of ownership and operational questions at Grasberg carries implications far beyond Indonesia's borders. The mine's production capacity significantly impacts international copper markets, making its governance structure a matter of global economic interest.

Both Freeport-McMoRan and the Indonesian government appear to recognize their mutual dependence. The divestment potentially paves the way for longer-term operational agreements that could justify continued investment in exploration and development, ensuring Grasberg remains productive beyond its current permit expiration.

The successful implementation of this agreement will ultimately determine whether Grasberg can maintain its position as one of the world's premier mining operations in the decades ahead, balancing Indonesian sovereignty with operational excellence in one of the industry's most challenging and valuable mining environments.

The resolution of these ownership negotiations represents just one aspect of Grasberg's complex operational future. With production recovery from recent mudslides potentially taking years, both partners must focus on restoring operational stability while establishing governance structures that serve their respective long-term interests.

Wondering How to Stay Ahead of Major Mineral Discoveries?

Discovery Alert's proprietary Discovery IQ model provides instant notifications when significant mineral discoveries are announced on the ASX, giving you actionable insights before the market reacts. Explore how historic discoveries have generated substantial returns by visiting the dedicated discoveries page and position yourself to capitalise on the next major find.