Why Are Iranian Oil Tankers Drifting in Southeast Asia?

Iran faces an unprecedented oil storage dilemma as sanctions pressure intensifies, forcing millions of barrels to remain stranded at sea. The strategic implications of this buildup extend beyond Iran to impact global energy markets, regional politics, and international trade relations.

What's Causing Iran's Floating Storage Buildup?

Renewed Sanctions Pressure

The current U.S. administration has implemented aggressive sanctions targeting Iran's oil export infrastructure, including traders, middlemen, and shipping networks. This comprehensive approach has expanded beyond direct Iranian entities to include foreign companies facilitating Iranian oil trade, particularly those in China.

The sanctions net has grown increasingly sophisticated, with enforcement mechanisms designed to identify even complex ownership structures and shell companies used to disguise Iranian crude shipments.

Expanding Enforcement Scope

Recent months have seen sanctions extended to Chinese refineries, port operators, and midstream companies allegedly handling Iranian oil. This widening enforcement net has created significant hesitation among traditional buyers, particularly in China's Shandong province where several independent "teapot" refineries have been specifically targeted.

These enforcement actions represent a strategic shift from previous sanctions regimes that primarily focused on Iranian entities rather than foreign companies handling Iranian exports.

Blacklisted Vessels

More than 400 tankers now appear on international blacklists, severely restricting Iran's shipping options. With approximately 50 individuals and 20 companies directly sanctioned for involvement in Iranian oil trade, the logistical challenges of moving crude to market have multiplied.

This unprecedented scale of vessel blacklisting has forced Iran to rely heavily on its aging "shadow fleet" – vessels operating outside normal international maritime regulations and often lacking proper insurance.

Compliance Warning: Maritime insurance companies and classification societies face significant legal exposure when providing services to vessels carrying Iranian oil, even indirectly. Companies in the shipping sector should conduct thorough due diligence on vessel ownership and cargo origin.

How Much Oil Is Iran Storing at Sea?

Record-Breaking Floating Storage Volumes

Current Storage Levels

Maritime tracking data shows Iranian crude held in floating storage has surged to 33.4 million barrels as of early August 2025, representing a nearly 300% increase from the 9 million barrels recorded in mid-January. This marks the highest level of Iranian floating storage since 2020, when COVID-19 lockdowns crashed global oil demand.

This volume represents approximately 17 days of total Iranian production at current rates, creating a significant financial burden as storage costs mount.

Strategic Location Choices

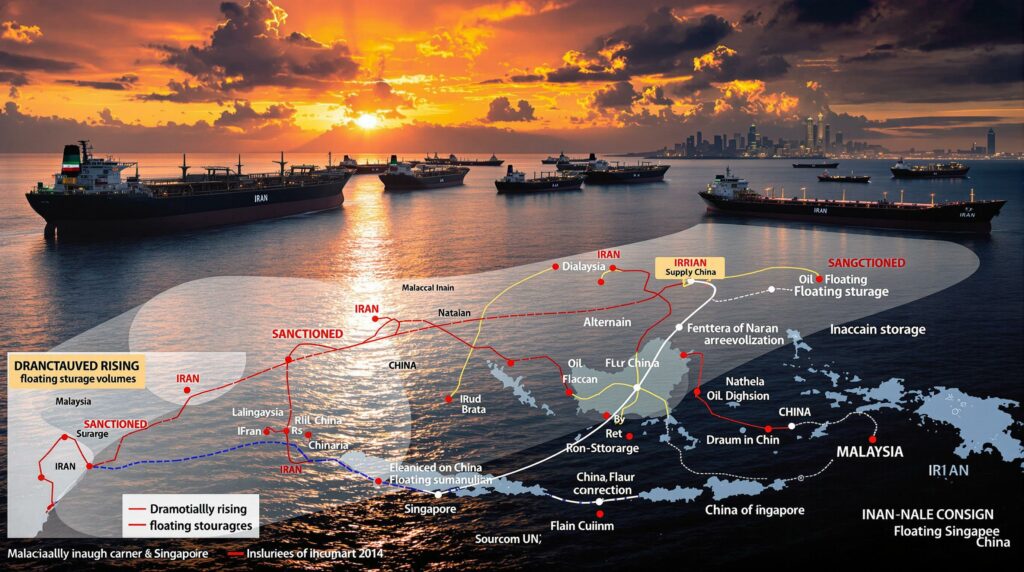

The vast majority of these oil-laden tankers are positioned in territorial waters near Singapore and Malaysia, creating a concentration of Iranian crude in the Malacca Strait. These locations have historically served as primary hubs for Iranian ship-to-ship (STS) transfer operations.

Many vessels employ a "loitering pattern" – moving slowly in circular routes to appear operational while actually serving as floating storage units awaiting buyers.

Comparison to Historical Patterns

While Iran has previously utilized floating storage during sanctions periods, the current volume represents a significant escalation compared to recent years, indicating more severe market access challenges.

- 2018-2019 Sanctions Period: Peak floating storage reached 25 million barrels

- 2020 COVID-19 Impact: Storage peaked at 46 million barrels (primarily demand-driven)

- 2023 Average: Approximately 11 million barrels

- Current (August 2025): 33.4 million barrels and rising

Why Southeast Asia?

Logistical Advantages

Positioning tankers near Malaysia and Singapore offers Iran strategic flexibility. These locations provide:

- Shorter delivery times to Chinese ports (7-8 days from Singapore to Qingdao versus 20 days from Iran's Kharg Island)

- Established infrastructure for ship-to-ship transfers

- Relative political neutrality compared to Middle Eastern waters

The Malacca Strait region also offers a concentration of smaller tankers available for ship-to-ship transfers, allowing large shipments to be divided into smaller parcels that can be more easily absorbed by regional refiners.

Security Considerations

Recent geopolitical tensions in the Middle East, including the 12-day conflict with Israel, have heightened security risks near Iranian shores. Storing oil further from this volatile region reduces the threat of military action against these valuable assets.

The positioning also places Iranian oil beyond the reach of potential maritime blockades in the Strait of Hormuz, providing a strategic buffer against escalating regional tensions.

How Are Chinese Buyers Responding?

Declining Import Volumes

Dramatic Shift in Purchase Patterns

Chinese imports of Iranian crude have fallen significantly in recent months:

- January-March 2025: Averaged 1.5 million barrels per day

- March 2025: Peaked at 2 million barrels per day (record high)

- June 2025: Declined to approximately 1.5 million barrels per day

- July 2025: Further dropped to 1.1 million barrels per day

This 45% decline from March to July represents one of the sharpest reductions in Chinese imports of Iranian crude in recent years, creating a significant supply overhang.

Sanctions Impact on Chinese Refiners

Three Chinese refineries have been directly sanctioned for processing Iranian crude in 2025:

| Refinery | Processing Capacity | Sanctions Date |

|---|---|---|

| Shandong Shouguang Luqing Petrochemical | 100,000 b/d | March 20, 2025 |

| Shandong Shengxing Chemical | 44,000 b/d | April 16, 2025 |

| Hebei Xinhai Chemical Group | 120,000 b/d | May 8, 2025 |

These sanctions effectively cut these facilities off from the global financial system, creating a powerful deterrent for other potential buyers. The gradual escalation pattern suggests U.S. authorities are systematically targeting facilities identified through intelligence gathering rather than implementing blanket sanctions.

Industry Insight: Sanctioned refineries typically face challenges beyond direct financial restrictions. They often struggle to source replacement crude from alternative suppliers and face difficulties selling refined products internationally as counterparties fear secondary sanctions exposure.

Diversification of Supply Sources

Increased Russian Imports

As Chinese refiners reduce Iranian purchases, they're turning to alternative suppliers. July 2025 saw imports of Russia's ESPO blend surge to over 900,000 barrels per day – a 30% increase from March and the highest level in four months.

ESPO crude offers Chinese "teapot" refineries several advantages:

- Similar quality profile to Iranian Light crude

- Established payment channels through non-dollar currencies

- Shorter shipping routes from Russian Far East ports

- Perceived lower political risk compared to Iranian barrels

Strategic Risk Management

This supply diversification represents a calculated effort by Chinese importers to:

- Minimize exposure to politically sensitive supply routes

- Reduce vulnerability to further sanctions

- Maintain energy security through multiple supply channels

The shift also reflects evolving geopolitical priorities as China navigates complex relationships with both Iran and Western powers.

What Makes Iranian Oil Still Attractive Despite Risks?

Deepening Price Discounts

Growing Price Advantage

Iranian Light crude's discount to international benchmark prices has widened dramatically:

- March 2025 (pre-sanctions on Chinese refiners): $0.80 per barrel below ICE Brent

- July 2025: $3.50-4.00 per barrel below ICE Brent

This widening discount translates to approximately $3.5-4 million in savings per standard 1-million-barrel VLCC cargo compared to benchmark-priced alternatives – a significant economic incentive for refiners operating on thin margins.

Economic Pressure on Iran

This six-month trend of deepening discounts reflects Iran's growing desperation to move inventory as floating storage costs accumulate and production capacity remains constrained.

For Iranian authorities, the calculus increasingly favors selling at deeper discounts over the alternatives:

- Storage costs on aging tankers can exceed $0.50 per barrel per month

- Production shut-ins risk permanent reservoir damage

- Budget pressures require maintaining minimum export volumes regardless of price

Competitive Market Dynamics

Refiner Profit Calculations

For price-sensitive refiners, particularly smaller independent operations, these steep discounts create compelling economics despite regulatory risks. The processing margin advantage may soon outweigh compliance concerns for some operators.

A typical small Chinese independent refinery processing 100,000 barrels per day could realize additional margins of $350,000-400,000 daily by utilizing Iranian crude at current discount levels – a powerful economic incentive that may eventually overwhelm regulatory concerns for some operators.

Comparative Advantage

As global oil price movements remain relatively firm, the widening discount makes Iranian barrels increasingly competitive against alternative sources, creating a growing temptation for buyers willing to navigate sanctions risks.

The economics become particularly compelling for refiners with:

- Limited access to dollar-based financial systems

- Existing relationships with sanctioned shipping networks

- Physical facilities capable of receiving cargoes through ship-to-ship transfers

- Domestic rather than export-oriented product markets

How Does This Impact Regional Politics?

Malaysia's Diplomatic Balancing Act

Growing International Pressure

Malaysia faces increasing scrutiny as Iranian floating storage accumulates in its vicinity. U.S. officials have signaled that countries perceived as enabling sanctions evasion could face tariffs or other punitive measures.

The precedent was set in late July 2025 when the U.S. imposed a 25% tariff on Indian refiners importing Russian crude, effective August 27 – a clear signal that similar measures could target countries facilitating Iranian oil trades.

Limited Enforcement Options

While Malaysian authorities have taken some visible enforcement actions, including detaining several tankers engaged in undocumented STS operations in 2023 and 2024, their jurisdiction ends at territorial water boundaries, limiting their practical control over the situation.

Malaysia's maritime enforcement capacity faces several practical limitations:

- Extensive coastline requiring monitoring

- Limited naval resources for enforcement

- Complex international maritime laws governing vessel movements

- Challenges in definitively proving sanctions violations

China-Malaysia Relations

Malaysia's own economic ties with China create additional complexity, as aggressive enforcement against Iranian tankers could strain its relationship with Beijing at a time when Malaysia is working to strengthen bilateral trade.

Recent Malaysian economic data shows China accounting for:

- 16.8% of total Malaysian exports

- 22.3% of Malaysian imports

- Over $35 billion in direct investment projects

This economic relationship creates significant leverage that complicates Malaysia's ability to aggressively enforce maritime restrictions that might affect Chinese interests.

Broader Geopolitical Implications

U.S.-China Trade Negotiations

The Iranian oil situation has become entangled with broader U.S.-China trade discussions. Current negotiations are set to expire on August 12, 2025, creating uncertainty about whether Iranian oil trade might become subject to additional tariffs or other measures.

Trade analysts note that energy flows have become an increasingly central component of U.S.-China negotiations, with sanctions enforcement serving as both leverage point and potential concession in broader trade war oil impact discussions.

Regional Security Dynamics

The concentration of Iranian oil assets in Southeast Asian waters introduces new security considerations for regional powers, potentially drawing countries like Singapore, Indonesia, and Malaysia deeper into Middle East-centered geopolitical tensions.

The presence of sanctioned vessels also creates navigation and environmental risks in the strategically vital Malacca Strait, where approximately 25% of global trade passes annually.

What's Next for Iran's Floating Storage Crisis?

Potential Market Scenarios

Price Pressure Tipping Point

If discounts continue to deepen, economic incentives may eventually overcome regulatory concerns for some buyers, potentially leading to a partial revival of Iranian exports despite sanctions.

Industry analysts suggest a discount threshold of $5-6 per barrel below Brent might trigger renewed buying interest, particularly from smaller independent refiners with limited international exposure.

Storage Capacity Constraints

Iran faces physical limitations on how much oil it can keep in floating storage. As this capacity is approached, Tehran may be forced to either cut production or accept even steeper discounts to move inventory.

The current floating storage fleet includes:

- Approximately 20 Very Large Crude Carriers (VLCCs) with 2 million barrel capacity each

- 15-20 Suezmax tankers with 1 million barrel capacity each

- Various smaller vessels serving as temporary storage

Many of these vessels are aging tankers nearing the end of their operational life, creating both capacity constraints and increasing environmental risks.

Sanctions Enforcement Evolution

The effectiveness of current sanctions will largely depend on consistent enforcement and the willingness of key market participants to comply despite economic incentives to do otherwise.

Recent patterns suggest U.S. authorities are pursuing a strategy of:

- Identifying and targeting specific facilitators rather than broad industry segments

- Escalating penalties gradually to signal enforcement commitment

- Focusing on financial rather than physical interdiction

- Using advanced technologies to track evasion attempts

Broader Market Implications

Global Supply Balance

The eventual resolution of Iran's floating storage situation – whether through renewed exports or production cuts – will impact global supply-demand balances and potentially influence benchmark crude prices.

A complete disruption of Iranian exports to China would remove approximately 1 million barrels per day from global markets – equivalent to approximately 1% of total world oil demand. This could potentially trigger an oil price crash similar to previous market disruptions.

Sanctions Effectiveness Test

The current standoff represents a significant test case for sanctions effectiveness in a multipolar world where economic incentives sometimes run counter to geopolitical objectives.

The outcome will likely influence future sanctions design and implementation, particularly as policymakers evaluate the effectiveness of targeting midstream and downstream operators rather than focusing solely on the source country.

Trade Route Adaptations

The Iranian situation is prompting evolution in global oil trading patterns, with increasing sophistication in sanctions avoidance techniques that may have lasting impacts on market transparency.

Innovations in sanctions evasion include:

- Complex ownership structures designed to obscure vessel control

- Ship-to-ship transfers conducted at night or in remote locations

- AIS transponder manipulation to create false location data

- Document falsification to misrepresent cargo origin

- Use of shell companies across multiple jurisdictions

FAQ: Iran's Floating Oil Storage Crisis

How does floating storage impact Iran's oil production?

Storage constraints eventually force production decisions. If Iran cannot move its oil to market or store additional volumes, it may need to reduce production at its fields, which can damage reservoirs and reduce long-term recovery rates.

Production constraints are particularly problematic for Iran's aging fields, many of which require constant water or gas injection to maintain pressure. Temporary shutdowns can lead to permanent production losses of 5-15% due to reservoir damage and water encroachment, contributing to overall US oil production decline trends seen globally.

What happens to oil quality during extended floating storage?

Crude oil quality can degrade during extended storage periods, particularly for certain grades. Sedimentation, water contamination, and light end evaporation can reduce value and require additional processing.

For Iranian Light crude, which contains relatively high percentages of lighter components, extended storage typically results in:

- API gravity reduction of 0.5-1.5 degrees

- Increased sulfur content by 0.1-0.2%

- Higher sediment and water content

- Loss of more valuable light fractions through evaporation

These quality issues typically result in additional discounts of $0.50-1.00 per barrel for extended-storage crude.

Are there environmental risks associated with the floating storage buildup?

Aging tankers used for long-term storage present increased environmental risks, including potential leaks or spills. Many vessels in Iran's "shadow fleet" operate outside normal international safety protocols.

Environmental concerns include:

- Hull integrity issues on aging vessels

- Reduced maintenance standards on sanctioned ships

- Limited insurance coverage for potential spills

- Remote locations that would complicate spill response

The concentration of these vessels in the ecologically sensitive Malacca Strait region creates particular environmental vulnerabilities for coastal communities dependent on fishing and tourism.

How do ship-to-ship transfers work in the context of sanctions evasion?

STS transfers allow cargo ownership to change hands without vessels entering ports where documentation might be scrutinized. Typically, a larger vessel transfers oil to smaller vessels that then deliver to multiple destinations, obscuring the original source.

The technical process involves:

- Vessels meeting at predetermined coordinates, often in international waters

- Physical connection of transfer hoses between ships

- Pumping of cargo from one vessel to another (typically taking 12-24 hours)

- Exchange of paperwork that may misrepresent cargo origin

- Vessels departing to separate destinations

These operations often occur at night and may involve temporary deactivation of vessel tracking systems to avoid detection.

What role do "dark fleet" tankers play in Iranian oil exports?

Iran increasingly relies on vessels that operate with transponders turned off to avoid tracking. These "dark fleet" tankers typically lack proper insurance and often use fraudulent documentation to disguise cargo origin.

Characteristics of the dark fleet include:

- Vessels typically 15+ years old (beyond preferred age for major shipping companies)

- Ownership obscured through multiple shell companies

- Frequent name and flag changes to complicate tracking

- Limited or non-existent insurance coverage

- Operation outside recognized classification societies

Industry experts estimate the global "dark

Ready to Stay Ahead of Major Resource Discoveries?

Discover how to capitalise on significant ASX mineral discoveries with Discovery Alert's proprietary Discovery IQ model, delivering real-time alerts that transform complex data into actionable investment insights. Visit our discoveries page to explore historic examples of exceptional returns and begin your 30-day free trial today.