Understanding Iron Ore 65% Fe Brazil-Origin Fines Price Corrections

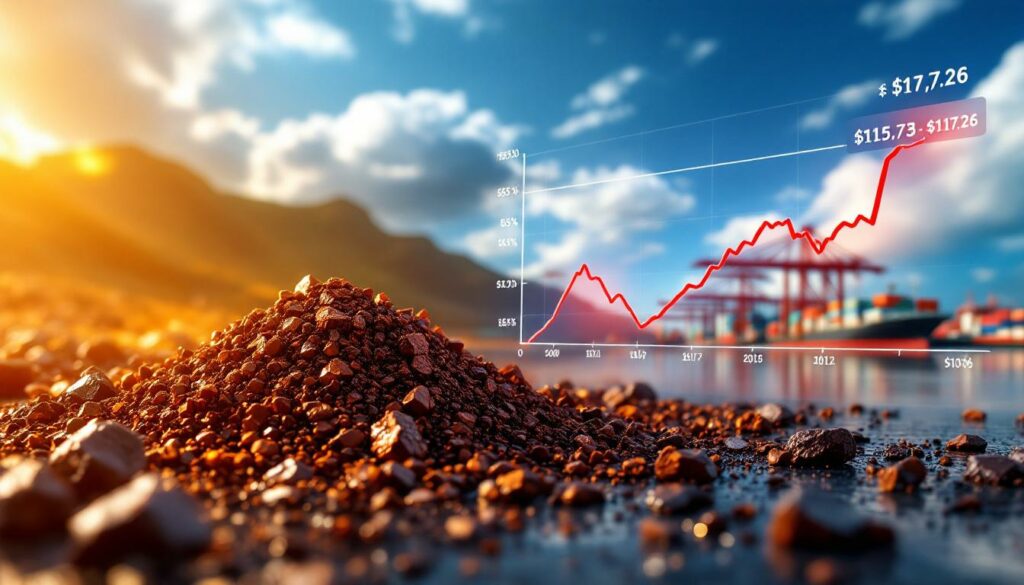

Iron ore price corrections play a crucial role in maintaining market integrity and ensuring accurate pricing information for traders, steel mills, and financial institutions. When examining the 65% Fe Brazil-origin fines market specifically, these corrections have significant implications due to the premium nature of this high-grade product. Recent corrections, such as the July 30, 2025 adjustment from $115.73 to $117.26 per tonne, demonstrate how even small pricing discrepancies can impact market valuations and trading strategy focus.

Price reporting agencies (PRAs) like Fastmarkets implement rigorous verification processes to maintain data accuracy, typically resolving discrepancies within 24 hours of discovery. The swift implementation of corrections helps preserve market confidence and ensures that derivative contracts and physical transactions reflect fair market values.

Definition and Specifications

Iron ore 65% Fe Brazil-origin fines represent a premium product in the global iron ore market. These high-grade fines contain 65% iron content, significantly above the standard 62% Fe benchmark that dominates global trade. This product originates specifically from Brazilian mining operations, primarily from major producers in the Carajás region, known for its exceptional ore quality.

The standard specifications for this product include:

- 65% iron content (Fe)

- Base silica (SiO₂) content of 2.7% (recently increased from 2.2%)

- Delivered on CFR (Cost and Freight) basis to Qingdao, China

- Pricing in USD per dry metric tonne

The recent change in silica specifications from 2.2% to 2.7% reflects evolving market standards and production realities. This adjustment has prompted the development of new indices to support market transition, including dedicated Value-in-Use (VIU) adjustments for specific elements like silicon.

Market Significance

The 65% Fe Brazil-origin fines serve as a benchmark product for high-grade iron ore trading globally. This premium product commands higher prices than standard 62% Fe benchmarks due to several factors:

- Efficiency improvements: Higher iron content means less material needed per tonne of steel produced

- Environmental benefits: Reduced energy consumption and lower emissions in steel production

- Quality advantages: Lower impurity levels result in higher-quality steel output

- Reference pricing: Used as a baseline for contracts and derivatives

For steel producers focused on higher-grade steel manufacturing, particularly those in markets with stringent environmental regulations, these premium fines provide both economic and environmental advantages despite the price premium.

How Do Price Corrections Impact Iron Ore Markets?

Price corrections, while necessary for market integrity, can create short-term volatility and operational challenges for market participants. The ramifications extend beyond simple numerical adjustments to affect multiple aspects of the iron ore supply chain.

Types of Price Corrections

Price reporting agencies implement corrections for various reasons, including:

- Reporting errors: Miscalculations or input errors requiring immediate rectification

- Methodology adjustments: Changes to assessment procedures affecting historical data

- Technical system errors: Publication platforms experiencing data transmission issues

- Data submission revisions: Market participants providing updated information after initial deadlines

The July 2025 correction exemplifies a reporting error that required prompt attention. The price for 65% Fe Brazil-origin fines was initially published as $115.73 per tonne on July 30, 2025, but was subsequently corrected to $117.26 per tonne—a difference of $1.53—with the correction published the following day.

Market Implications

Price corrections trigger a cascade of adjustments throughout the market:

- Inventory revaluation: Traders and mills must recalculate the value of their physical stocks

- Derivative impacts: Financial instruments referencing the benchmark require adjustment

- Trading strategy shifts: Market participants may need to recalibrate positions based on corrected values

- Contract reconciliations: Term contracts with floating price mechanisms need settlement updates

For a correction of $1.53 per tonne, a steel mill holding 100,000 tonnes of inventory would face a valuation adjustment of $153,000—a significant amount that affects financial reporting and procurement decisions.

"Price corrections, while sometimes overlooked by casual market observers, represent critical moments for risk managers who must quickly assess exposure and implement mitigation strategies," notes industry expert Peter Koh from Metal Intelligence Advisory.

Recent Correction Example

The July 30, 2025 price correction provides a clear illustration of correction protocols in action:

- Initial publication: $115.73 per tonne for MB-IRO-0009 (65% Fe Brazil-origin fines)

- Corrected value: $117.26 per tonne

- Difference: $1.53 per tonne (approximately 1.3% higher)

- Correction timeframe: Published within 24 hours (July 31, 2025)

- Implementation: Database updated to reflect accurate pricing information

This correction followed established protocols for notification and implementation, demonstrating the industry's commitment to transparency and accuracy.

Why Do Price Reporting Agencies Issue Corrections?

Price reporting agencies serve as the trusted information backbone of commodity markets. Their commitment to accuracy reflects both ethical business practices and regulatory obligations.

Maintaining Market Integrity

PRAs issue corrections primarily to preserve the integrity of the pricing benchmarks that underpin billions of dollars in transactions. This commitment manifests through:

- Accuracy prioritization: Ensuring price assessments reflect true market conditions

- Methodological consistency: Adhering to established assessment processes

- Regulatory compliance: Meeting requirements for benchmark administrators

- Market confidence: Maintaining stakeholder trust in published assessments

The credibility of price reporting depends on market participants' confidence that errors will be promptly identified and corrected. This trust is essential for maintaining liquid markets and reliable price discovery mechanisms.

Correction Protocols

When price discrepancies are identified, PRAs follow structured correction procedures:

- Verification: Confirming the existence and extent of pricing errors

- Notification: Immediately alerting market participants to the correction

- Documentation: Clear identification of original and corrected values

- Explanation: Providing context for the correction when appropriate

- Database updates: Ensuring historical price series maintain accuracy

Fastmarkets, for example, implemented these protocols during the July 2025 correction, notifying subscribers promptly and updating their databases to reflect the accurate price of $117.26 for the 65% Fe Brazil-origin fines.

Quality Control Measures

To minimize the need for corrections, PRAs implement robust quality control processes:

- Multi-stage verification: Cross-checking calculations before publication

- Anomaly detection: Algorithmic identification of statistical outliers

- Editorial oversight: Experienced editors reviewing assessments

- Methodology reviews: Regular evaluation of assessment procedures

- Market feedback: Structured processes for stakeholder input

These preventive measures significantly reduce correction frequency while ensuring that when corrections are necessary, they're implemented efficiently and transparently.

How Are Iron Ore Price Assessments Conducted?

The creation of reliable iron ore price benchmarks involves sophisticated data collection and analysis methodologies designed to capture accurate market conditions.

Data Collection Methodologies

Price reporting agencies employ multiple data sourcing approaches:

- Direct submissions: Collecting transaction data from qualified market participants

- Market observation: Monitoring publicly reported deals and exchange platforms

- Bid/offer analysis: Evaluating executable buying and selling interest

- Trend assessment: Considering price movements in related products and markets

For the 65% Fe Brazil-origin fines assessment, PRAs typically prioritize actual transaction data while supplementing with bids, offers, and professional judgment when necessary to bridge information gaps.

Assessment Frequency

Price benchmarks are published according to established schedules aligned with market trading patterns:

- Daily assessments: For liquid benchmarks including 65% Fe Brazil-origin fines

- Weekly assessments: For less frequently traded specialty grades

- Monthly assessments: For certain specialty products or regional benchmarks

- Special assessments: During market disruptions or holiday periods

This consistent publication schedule provides market participants with reliable reference points for contract settlements and trading decisions.

Quality Specifications Impact

Iron ore assessments incorporate detailed quality specifications that significantly influence pricing:

| Parameter | Impact on Pricing | Typical Adjustment |

|---|---|---|

| Iron content (Fe%) | Primary value driver | +/- 1-2% per Fe% deviation |

| Silica (SiO₂) | Negative impact on value | -0.5 to -1.5% per 1% above base |

| Alumina (Al₂O₃) | Significant negative impact | -1 to -3% per 1% above base |

| Phosphorus (P) | Substantial penalties above threshold | -2 to -5% per 0.1% above limit |

| Moisture | Affects shipping economics | Adjustments to dry metric tonne basis |

The recent change in silica specifications for 65% Fe Brazil-origin fines from 2.2% to 2.7% demonstrates how these parameters evolve to reflect changing market conditions and production realities.

What Changes Are Occurring in Iron Ore Benchmarks?

The iron ore benchmark landscape continually evolves to reflect changing market dynamics, production characteristics, and consumer preferences.

Recent Specification Amendments

Several significant changes have recently impacted iron ore benchmark specifications:

- Silica base increase: Adjustment from 2.2% to 2.7% for 65% Fe Brazil-origin fines

- New index introduction: Development of specialized indices for market transition

- VIU refinements: Updated value-in-use adjustments for impurity elements

- Port stock specifications: Modified parameters for inventories at key trading hubs

The silica specification change responds to evolving production profiles from Brazilian miners, acknowledging that maintaining the previous 2.2% specification was becoming increasingly challenging while still preserving the premium characteristics of the product.

Market Consultation Process

Benchmark administrators implement specification changes through structured consultation procedures:

- Proposal publication: Announcement of potential changes to market participants

- Comment period: Collection of stakeholder feedback (typically 30-60 days)

- Impact analysis: Evaluation of potential market effects

- Implementation planning: Development of transition timelines and support mechanisms

This collaborative approach ensures that benchmark changes reflect genuine market needs while providing sufficient adaptation time for affected parties.

New Index Development

To support market transitions during specification changes, price reporting agencies often develop complementary indices:

- High-grade iron ore 0.5% Si VIU index: Provides value adjustment for silicon variations

- Transition indices: Temporary benchmarks bridging old and new specifications

- Specialized indicators: Metrics tracking specific quality parameters

- Regional variants: Localized versions of global benchmarks

These supporting indices help market participants navigate specification changes while maintaining contractual continuity and price discovery efficiency.

How Do Traders Use Iron Ore Price Assessments?

Iron ore price assessments serve as essential tools for trading operations, risk management, and strategic decision-making throughout the supply chain.

Contract Pricing Applications

Market participants employ price assessments in various contractual arrangements:

- Term contracts: Multi-month or annual agreements with floating price mechanisms

- Spot negotiations: Short-term deals referencing published benchmarks

- Premium/discount calculations: Adjustments for non-standard specifications

- Netback pricing: Determining origin values based on destination benchmarks

For Brazilian miners exporting 65% Fe fines to China, the published assessment serves as the foundation for negotiations, with adjustments for specific cargo characteristics and delivery terms.

Risk Management Strategies

Price assessments enable sophisticated risk management approaches:

- Physical hedging: Protecting inventory values against market fluctuations

- Derivatives utilization: Employing futures, options, and swaps for price risk

- Mark-to-market valuation: Daily portfolio assessment using benchmark prices

- Scenario planning: Stress-testing exposures against potential price movements

A trading company holding 200,000 tonnes of 65% Fe Brazil-origin fines might hedge its position using SGX futures or OTC swaps referenced to the published benchmark, adjusting hedge ratios as market conditions change.

Trading Decision Support

Beyond pricing and risk management, assessments inform strategic decision-making:

- Market timing: Optimizing purchase and sales based on price trends

- Cargo routing: Directing shipments to maximize returns across regions

- Blending opportunities: Combining different ore grades to meet specifications

- Arbitrage identification: Exploiting price differentials between products or locations

By closely monitoring the spread between 65% Fe and 62% Fe benchmarks, traders can identify opportunities to optimize their portfolio composition and maximize returns.

What Are Value-in-Use (VIU) Adjustments in Iron Ore Pricing?

Value-in-Use adjustments represent sophisticated mechanisms for standardizing prices across different iron ore specifications, enabling fair comparison and valuation.

Definition and Purpose

VIU adjustments serve several critical functions in iron ore markets:

- Standardization: Normalizing prices across varying specifications

- Value quantification: Assigning monetary impact to quality differences

- Comparison framework: Enabling evaluation between diverse ore types

- Pricing mechanism: Providing formula-based adjustments for non-standard materials

These adjustments translate technical specifications into economic terms, reflecting the actual impact of quality variations on steel production economics.

Key VIU Elements

The most significant VIU elements include:

- Iron content (Fe%): Primary value driver, typically worth $1-2 per 1% Fe above/below standard

- Silica (SiO₂): Penalties ranging from $0.5-1.5 per 1% above specification

- Alumina (Al₂O₃): Significant penalties of $1-3 per 1% above baseline

- Phosphorus (P): Substantial penalties for levels exceeding steelmaking requirements

- Moisture: Adjustments to standardize pricing on dry metric tonne basis

For 65% Fe Brazil-origin fines, the silica specification change from 2.2% to 2.7% necessitated recalibration of VIU adjustments to maintain pricing consistency during the transition period.

Application in Market Practice

Market participants apply VIU adjustments in multiple contexts:

- Price normalization: Converting reported prices to standard specifications

- Cargo valuation: Determining appropriate premiums/discounts for specific shipments

- Blending optimization: Calculating optimal mix of different ore types

- Contract settlement: Adjusting benchmark prices for actual delivered quality

A steel mill purchasing 65% Fe Brazil-origin fines with 2.9% silica (0.2% above the new 2.7% base) would apply the appropriate silica VIU adjustment to the benchmark price when settling the transaction.

FAQ: Iron Ore Price Assessments and Corrections

How quickly are price corrections typically implemented?

Price corrections are typically implemented within 24 hours of the error being identified. The process includes verification of the correct price, notification to market participants, and updating of all relevant databases and platforms. The July 2025 correction exemplifies this timeline, with the correction published on July 31 following the initial erroneous publication on July 30.

Who can submit price information to iron ore assessments?

Market participants actively involved in buying, selling, or trading iron ore can submit price information. This includes miners, steel mills, trading companies, and brokers who meet the price reporting agency's qualification criteria. Submitters must typically demonstrate regular market activity and adhere to data quality standards established by the PRA.

How are confidentiality concerns addressed in price submissions?

Price reporting agencies maintain strict confidentiality protocols for submitted data. Comments and information marked as confidential are not shared publicly, while non-confidential feedback may be made available upon request to promote transparency. PRAs typically aggregate data points to prevent identification of specific transactions unless explicitly authorized by the submitting party.

What happens to contracts that referenced an incorrect price before correction?

The handling of contracts depends on the specific terms within each agreement. Some contracts may include provisions for price corrections, while others might require negotiation between counterparties to address the impact of the correction. Many sophisticated market participants incorporate explicit correction clauses that automatically implement adjusted prices once officially published by the PRA.

How can market participants provide feedback on price assessments?

Market participants can provide feedback by contacting the relevant price reporters directly via email or phone. For formal methodology consultations, structured feedback processes are typically established with clear timelines and submission formats. PRAs regularly solicit market input on proposed methodology changes, specification adjustments, or new index developments to ensure alignment with market needs.

Further Exploration: Understanding Iron Ore Market Dynamics

Readers interested in deeper insights into iron ore pricing can explore additional resources focused on market fundamentals, quality differentials, and regional dynamics. Current iron ore price trends and forecast analysis provide valuable context for understanding market movements.

The evolving nature of iron ore benchmarks—exemplified by the recent silica specification change for 65% Fe Brazil-origin fines—highlights the importance of staying informed about market developments. Furthermore, understanding the potential decline impact analysis and miners demand insights can help market participants better navigate this complex commodity landscape and optimize their trading and risk

Ready to Invest in ASX Mining Opportunities?

Discover significant mineral announcements before the market with Discovery Alert's proprietary Discovery IQ model, transforming complex ASX mining data into actionable investment opportunities. Explore how historic discoveries have generated substantial returns by visiting the Discovery Alert discoveries page and begin your 30-day free trial today.