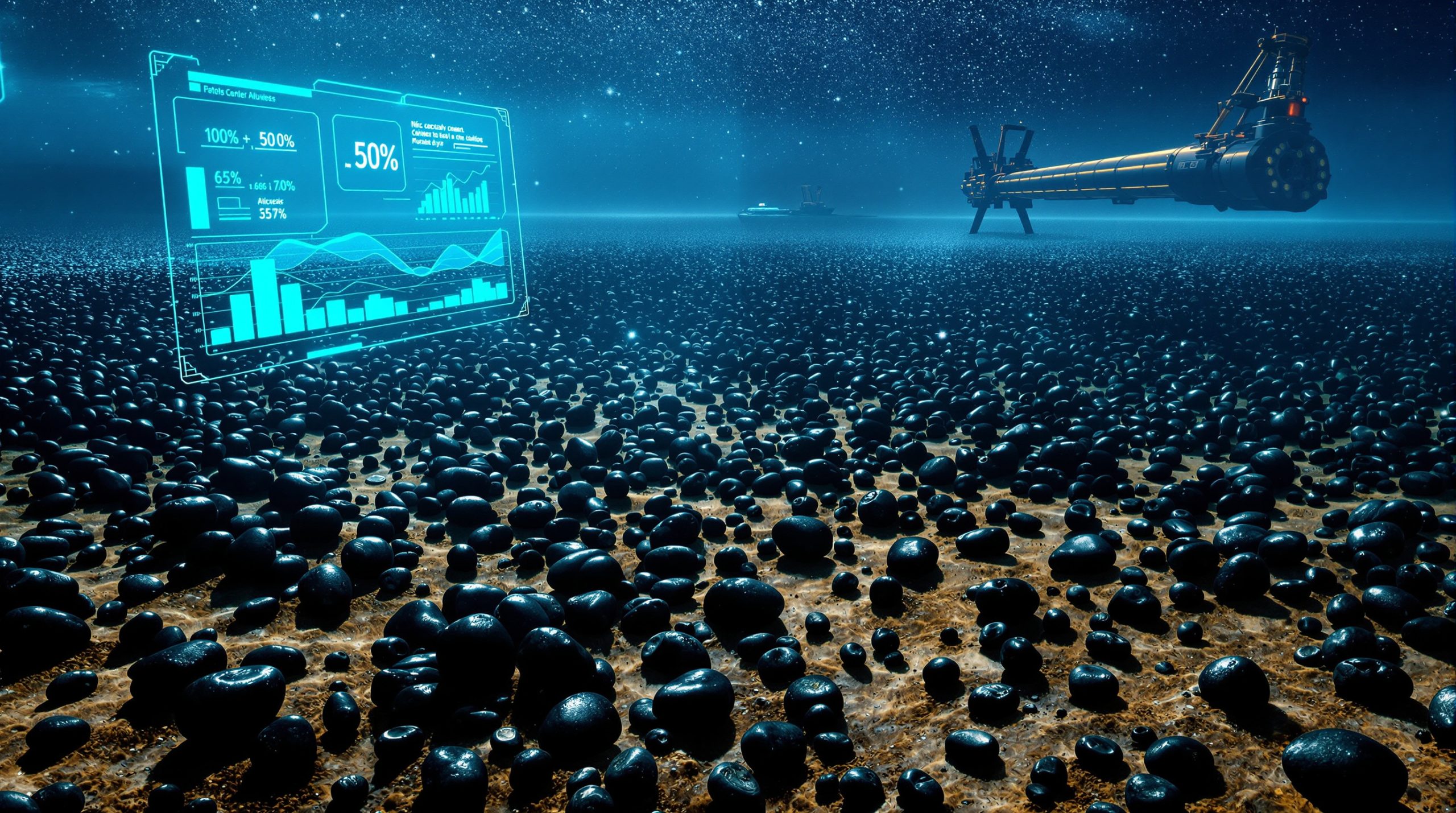

Understanding China's Strategic Iron Ore Market Dynamics

The global iron ore trade continues demonstrating remarkable resilience despite institutional pressures, as evidenced by recent developments between major mining companies and Chinese buyers. Market dynamics reveal how BHP sells iron ore to China despite curbs, maintaining commercial relationships through alternative channels even when facing official resistance from centralised purchasing authorities.

Recent trading activity shows that multiple Chinese entities, including both state-controlled and private merchants, continue acquiring iron ore cargoes through discrete commercial arrangements. These transactions typically occur at substantial discounts compared to standard benchmark pricing, with settlements maintained in US dollars despite preferences for yuan-denominated payments.

The situation illustrates broader themes in global commodity relationships, where political considerations intersect with commercial necessities, ultimately finding equilibrium through market-based solutions rather than complete trade disruption.

The Genesis of Commercial Tensions

The underlying friction stems from fundamental disagreements about contract structures and payment mechanisms. Mining companies typically advocate for annual pricing arrangements tied to established benchmark indices, providing stability and predictable revenue streams. Chinese purchasers, however, prefer quarterly arrangements linked to spot market valuations that often offer more favourable terms during periods of price volatility.

Currency and Settlement Disputes

A secondary friction point involves payment denominations, creating additional complexity in negotiations. Mining giants maintain preferences for US dollar transactions, citing established international trading standards and currency stability. Chinese entities increasingly push for yuan-based settlements to reduce foreign exchange exposure and strengthen domestic currency usage in international trade.

This currency disagreement reflects broader geopolitical trends, where nations seek to reduce dependence on dollar-denominated transactions while maintaining access to critical raw materials. The $130 billion iron ore market represents a significant battleground for these competing financial strategies.

How Iron Ore Sales Continue Despite Official Restrictions

Private Market Resilience

Recent market analysis reveals that iron ore transactions persist through diversified commercial channels, demonstrating the adaptability of global commodity supply chains. Furthermore, understanding iron ore price trends becomes crucial for market participants navigating these complex dynamics. Key transaction characteristics include:

- Product Varieties: Mining Area C and Newman fines continue finding buyers

- Loading Schedules: Late November through early December shipments proceed normally

- Pricing Adjustments: Double-digit discounts to monthly index averages maintain demand

- Payment Terms: US dollar denominated transactions despite institutional preferences for yuan

Buyer Diversification Strategies

Mining companies have adopted sophisticated market segmentation approaches, targeting multiple buyer categories rather than relying solely on centralised state purchasing. This diversification encompasses:

- Regional steel producers operating with operational autonomy

- Private trading houses maintaining established commercial relationships

- Smaller state-owned enterprises with independent purchasing authority

- International traders possessing Chinese market access and expertise

The resilience of these alternative channels demonstrates how BHP sells iron ore to China despite curbs, utilising commercial flexibility to maintain market presence.

Product-Specific Market Impacts

Selective Restriction Implementation

Rather than implementing comprehensive trade sanctions, Chinese authorities have adopted targeted approaches affecting specific ore grades while allowing continued commerce in others. This strategy suggests commercial leverage tactics designed to influence pricing negotiations rather than complete trade cessation.

The Jimblebar blend fines product line has experienced the most significant market disruption, with near-complete rejection following official directives. This particular iron ore grade, previously popular amongst blast furnace operators, now faces systematic avoidance across major Chinese steel facilities.

Quality and Grade Considerations

Different iron ore products face varying levels of market acceptance based on their technical specifications and strategic importance to Chinese steel production. Higher-grade ores with superior metallurgical properties often maintain better market access, reflecting the practical constraints of steel manufacturing requirements.

The 62% Fe iron ore benchmark continues serving as the primary pricing reference point, though actual transaction prices frequently incorporate discounts reflecting market tensions and negotiating positions. Additionally, examining iron ore demand insights provides valuable context for understanding these pricing dynamics.

Financial Impact Assessment

Revenue Protection Mechanisms

Current market analysis indicates minimal immediate disruption to shipping volumes, primarily because the majority of 2025 allocations were secured through pre-existing contracts before restrictions took effect. This contractual buffer provides temporary insulation from market volatility.

| Protection Factor | Impact Level | Duration |

|---|---|---|

| Pre-existing contracts | High | Through 2025 |

| Alternative buyer access | Medium | Ongoing |

| Pricing flexibility | Medium | Transaction-dependent |

| Product diversification | High | Long-term |

Future Market Vulnerability

The real test emerges when mining companies begin marketing January 2026 delivery cargoes, as these new allocations will face the full impact of purchasing restrictions without protection from existing contractual commitments. Market observers anticipate this timeline will reveal the true scope of commercial disruption.

Industry analysts estimate that iron ore spot prices may experience increased volatility during this transition period, as supply-demand dynamics adjust to new commercial realities.

China Mineral Resources Group's Strategic Role

Centralised Authority Structure

China Mineral Resources Group Co. (CMRG) represents Beijing's attempt to consolidate iron ore purchasing power and influence global pricing mechanisms through coordinated demand management. While lacking formal regulatory authority over individual mills, the organisation wields significant influence through political connections and strategic coordination.

The entity's establishment reflects China's broader commodity security strategy, aimed at reducing dependence on volatile international markets whilst strengthening negotiating positions with major suppliers.

Market Influence Mechanisms

CMRG's recommendations carry substantial weight amongst Chinese steel producers due to several interconnected factors:

- Political Alignment: Direct connection to state industrial policy objectives

- Market Coordination: Demonstrated ability to synchronise buyer behaviour across multiple entities

- Strategic Importance: Central role in national resource security planning

- Economic Influence: Significant impact on domestic steel industry competitiveness and profitability

Despite lacking formal regulatory powers, CMRG's influence stems from its strategic positioning within China's broader industrial policy framework and its ability to coordinate purchasing decisions across multiple state-owned entities.

Global Market Adaptation Strategies

Alternative Supply Chain Development

The ongoing situation has accelerated development of alternative supply relationships and commercial arrangements. Mining companies are investing increased resources in market diversification, reducing dependence on single-buyer relationships while maintaining access to China's massive steel production capacity.

Price Discovery Evolution

Continued transaction activity despite official restrictions demonstrates the resilience of market-based price discovery mechanisms. Commercial realities ultimately drive actual trading behaviour, even when institutional pressures suggest otherwise.

The Platts IODEX pricing system continues functioning effectively, though with increased price volatility reflecting supply chain uncertainties and negotiating tensions between major market participants. However, detailed analysis of price decline patterns reveals additional market complexities that traders must navigate.

Industry-Wide Competitive Implications

Market Share Dynamics

Other major iron ore suppliers, particularly Rio Tinto and Vale, monitor these developments closely as potential indicators of broader trade relationship shifts. Some suppliers may view current tensions as market share opportunities, though the integrated nature of global supply chains limits dramatic shifts in buyer-supplier relationships.

The Big Three iron ore miners (BHP, Rio Tinto, and Vale) collectively control approximately 75% of global seaborne iron ore supply, creating inherent limitations on China's ability to completely redirect purchasing patterns without significant economic consequences. Furthermore, understanding the BHP strategic pivot provides insight into how major miners are adapting their approaches.

Strategic Positioning Adjustments

Mining companies are reassessing their China exposure strategies, balancing the enormous revenue potential of Chinese markets against the risks associated with concentrated customer dependencies. This strategic recalibration includes:

- Enhanced market diversification across geographic regions

- Improved contract flexibility to accommodate changing commercial conditions

- Strengthened relationships with alternative buyers in India, Japan, and Europe

- Investment in downstream processing capabilities to reduce commodity price exposure

Technical and Geological Considerations

Iron Ore Quality Specifications

Different iron ore grades face varying market reception based on their chemical composition and metallurgical properties. Higher iron content ores (above 60% Fe) typically maintain better market access during periods of commercial tension due to their superior efficiency in steel production processes.

The Pilbara Blend specifications continue meeting Chinese steelmaker requirements, with typical chemical compositions including:

- Iron content: 61-62% Fe

- Silica levels: 4-6% SiO2

- Alumina content: 2-4% Al2O3

- Phosphorus: Less than 0.08% P

Mining Area Characteristics

Western Australian iron ore deposits demonstrate remarkable geological consistency, enabling predictable product quality that Chinese steel producers have integrated into their operational processes over decades. This technical compatibility creates natural commercial inertia that political tensions struggle to overcome completely.

The scale of operations at the largest iron ore mines globally demonstrates the industrial complexity that makes sudden supply chain shifts economically challenging for all parties involved.

Market Psychology and Trading Behaviour

Risk Premium Integration

Current pricing structures increasingly incorporate risk premiums reflecting supply chain uncertainties and political tensions. Traders systematically adjust their bidding strategies to account for potential delivery disruptions or contract modifications.

Psychological Market Drivers

Beyond fundamental supply-demand factors, market psychology plays an increasingly important role in pricing and transaction decisions. Key psychological elements include:

- Uncertainty Premiums: Additional costs reflecting potential supply disruption risks

- Relationship Values: Premiums for maintaining long-term commercial partnerships

- Flexibility Pricing: Cost adjustments for contract terms that accommodate changing conditions

- Political Risk Assessment: Systematic evaluation of geopolitical factors in commercial decisions

Investment Strategy Implications

Portfolio Diversification Approaches

Institutional investors are reassessing their mining sector allocations, considering the implications of increased China-related commercial volatility. Sophisticated investment strategies now incorporate geopolitical risk factors alongside traditional financial metrics.

Commodity Exposure Management

Investment professionals recommend diversified approaches to iron ore exposure that account for supply chain resilience and alternative market development. This includes:

- Geographic Diversification: Exposure to miners serving multiple regional markets

- Value Chain Integration: Investment in companies with downstream processing capabilities

- Alternative Materials: Allocation to companies developing iron ore substitutes or efficiency technologies

- Currency Hedging: Sophisticated hedging strategies addressing multi-currency commercial arrangements

Regulatory and Policy Landscape

Trade Policy Evolution

Current developments reflect broader trends in international trade policy, where nations increasingly use commercial relationships as tools for advancing strategic objectives. Mining companies must navigate these evolving regulatory landscapes whilst maintaining operational efficiency.

Compliance Framework Adaptations

Companies are investing significant resources in compliance systems capable of managing multiple regulatory requirements across different jurisdictions. This includes enhanced monitoring of trade restrictions, payment regulations, and documentation requirements.

Future Market Evolution Scenarios

Negotiation Timeline Expectations

Based on historical precedents, similar commercial negotiations have typically required four to six months for resolution, suggesting patience with current impasses whilst maintaining operational flexibility. Mining company leadership emphasises decades-long commercial relationships, viewing current tensions as cyclical negotiation dynamics rather than permanent trade disruption.

Resolution Pathway Options

Potential resolution mechanisms include several compromise approaches:

- Hybrid Pricing Models: Structures combining annual and quarterly pricing elements

- Currency Compromise Solutions: Mixed payment denominations accommodating both parties' preferences

- Product-Specific Arrangements: Tailored commercial terms for different iron ore grades

- Volume-Price Guarantees: Long-term supply commitments exchanged for pricing flexibility

Strategic Adaptation Timeline

Market participants anticipate a 12-18 month adjustment period during which new commercial equilibriums will emerge. This timeline reflects the complexity of renegotiating multi-billion dollar supply relationships whilst maintaining steel production continuity across China's industrial base.

In addition, comprehensive price decline analysis suggests that market fundamentals will ultimately drive long-term relationship stability beyond current political tensions.

Long-term Market Structural Changes

Supply Security Strategies

Current tensions are accelerating long-term structural changes in global iron ore markets, including increased investment in alternative supply sources and enhanced supply chain resilience measures.

Market Concentration Evolution

The concentration of global iron ore supply amongst a small number of major producers creates inherent market power that limits the effectiveness of buyer-side coordination efforts. This structural reality ultimately supports continued commercial relationships despite temporary disruptions.

Furthermore, recent reports from the Australian Financial Review indicate that major mining companies remain optimistic about long-term demand prospects despite current commercial tensions.

Risk Management and Mitigation

Commercial Risk Factors

Mining companies face multiple risk categories requiring sophisticated management approaches:

- Counterparty Risk: Evaluation of buyer financial stability and contract compliance

- Currency Risk: Multi-currency transaction exposure and hedging strategies

- Political Risk: Assessment of regulatory changes and trade policy evolution

- Market Risk: Price volatility and demand fluctuation management

Operational Contingency Planning

Successful navigation of current market conditions requires comprehensive contingency planning addressing various disruption scenarios whilst maintaining operational efficiency and profitability.

The ongoing demonstration of how BHP sells iron ore to China despite curbs illustrates the fundamental resilience of global commodity markets and their ability to adapt to political pressures whilst maintaining essential material flows. This adaptability reflects both the critical nature of iron ore in global steel production and the sophisticated commercial arrangements that major mining companies have developed to manage complex international relationships.

Through strategic diversification, flexible pricing mechanisms, and maintenance of multiple commercial channels, the global iron ore market continues functioning effectively despite institutional tensions, providing valuable lessons for other commodity sectors facing similar geopolitical pressures.

Looking to Capitalise on Global Commodity Market Disruptions?

Discovery Alert's proprietary Discovery IQ model instantly identifies significant ASX mineral discoveries, turning complex market dynamics like iron ore trade tensions into actionable investment opportunities for both short-term traders and long-term investors. Begin your 30-day free trial today and discover why major mineral discoveries can generate substantial returns during periods of global market uncertainty.