Japanese Copper Smelters Face Margin Crisis: What's Behind Mitsubishi Materials' Scaling Plans?

Mitsubishi Materials is considering a significant scaling back of copper concentrate processing operations at its Onahama Smelter & Refinery, highlighting the growing pressure on Japanese copper smelters amid plummeting treatment and refining charges. This strategic shift comes as Chinese competitors accept dramatically lower processing fees, creating an increasingly challenging economic environment for Japanese producers.

Why Are Japanese Copper Smelters Struggling?

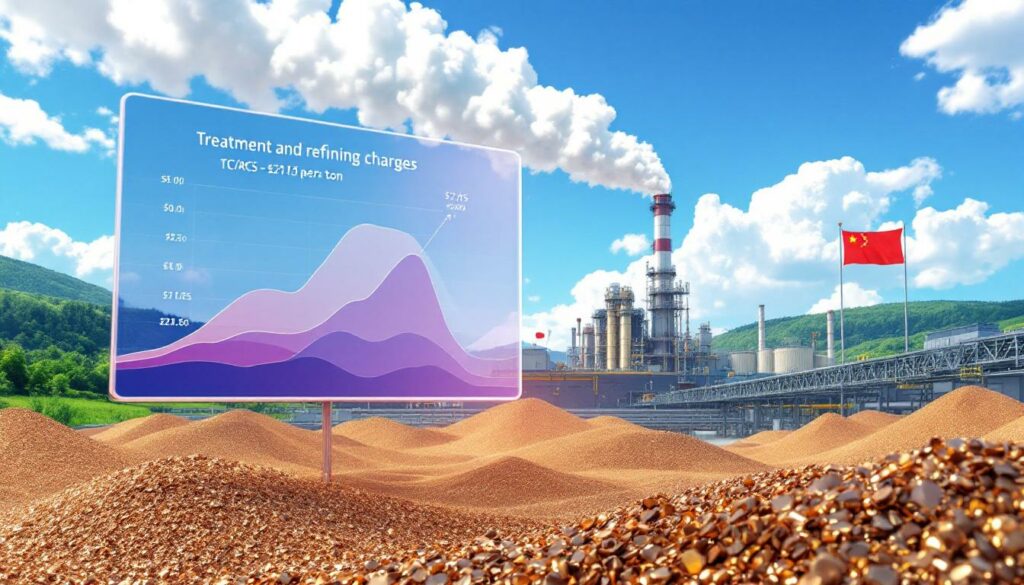

The Declining Treatment and Refining Charges Crisis

Japanese copper smelters are facing an unprecedented crisis as treatment and refining charges (TC/RCs) have fallen dramatically in 2025. Chinese smelters have accepted rates as low as $0 per metric ton and 0 cents per pound with Chilean miner Antofagasta during mid-year talks, according to Reuters reporting via MINING.com. This represents a severe decline from the 2025 annual benchmark of $21.25 per ton and 2.125 cents per pound.

These dramatically reduced rates are creating significant margin erosion for Japanese smelters, including industry leader Mitsubishi Materials, as TC/RCs constitute a critical revenue stream for processing operations. The situation has become so dire that Japan Mining Industry Association Chair Tetsuya Tanaka, who also serves as Mitsubishi Materials president, has warned that "shrinking smelting margins were putting non-Chinese smelters under severe pressure."

The Japanese copper industry finds itself at a critical juncture where traditional business models may no longer be viable under current market conditions.

How TC/RCs Impact Smelter Profitability

TC/RCs serve as the primary income source for smelters processing copper concentrate into refined metal. These fees are paid by miners to smelters for converting raw materials into usable copper cathodes, and they're negotiated periodically throughout the year with benchmark rates established annually.

When TC/RCs fall as dramatically as they have in 2025, smelters experience immediate and direct impacts on their operational margins. The current market conditions strongly favor miners at the expense of smelting operations, creating an unsustainable economic model for many facilities, particularly those outside China.

Industry experts note that the current TC/RC collapse represents one of the most challenging periods for copper processing economics in recent memory. Without these processing fees, many smelters struggle to cover basic operational costs, especially in regions with higher labor, energy, and regulatory expenses like Japan.

What Changes Is Mitsubishi Materials Planning?

Partial Production Facility Shutdown

In response to these challenging market conditions, Mitsubishi Materials has announced it is considering scaling back copper concentrate processing at its Onahama Smelter & Refinery. According to the company's statement reported by Reuters, they are "considering the possibility of a partial shutdown of production facilities and a reduction in copper concentrate processing at Onahama."

The company plans to implement these changes following scheduled maintenance between October and November 2025. This timing allows for operational adjustments to be made during an already planned downtime, minimizing additional disruption costs.

Mitsubishi Materials' decision follows similar announcements from industry peers, including JX Advanced Metals in June 2025. These adjustments represent a significant shift in Japan's copper processing landscape and signal growing concerns about the sustainability of traditional smelting operations under current market conditions.

Strategic Pivot to Alternative Feedstocks

Beyond simply reducing capacity, Mitsubishi Materials has outlined a more comprehensive strategic shift. The company stated: "To maintain and improve profitability, we need to raise the ratio of recycled raw materials and accelerate the shift to feedstock less vulnerable to TC/RC fluctuations."

This pivot toward recycled materials represents an attempt to diversify revenue streams and reduce dependence on processing fees from miners. Recycled copper sources typically involve different pricing mechanisms and can provide more stable margins compared to concentrate processing, particularly when TC/RCs are severely depressed.

The transition highlights the growing importance of recycled copper in the global copper supply outlook and suggests a significant rethinking of traditional smelting business models. By increasing the proportion of recycled feedstock, Mitsubishi Materials aims to create more economic resilience in its operations while still maintaining some concentrate processing capacity.

How Does This Compare to Global Copper Processing Trends?

Chinese Smelters' Competitive Advantage

The benchmark deal between Chinese smelters and Chilean miner Antofagasta set TC/RCs at $0 per metric ton—a rate that Japanese smelters have explicitly stated they cannot accept. This stark difference highlights growing regional disparities in copper processing economics.

Chinese smelters appear willing to operate with dramatically reduced processing margins, potentially due to different cost structures, government support mechanisms, or strategic priorities that allow them to remain profitable even with minimal TC/RC income. Some industry analysts suggest Chinese operations may prioritize securing material supply and market share over immediate processing margins.

The competitive pressure this creates for Japanese and other non-Chinese operations is substantial, as Tetsuya Tanaka noted when referring to the "extremely low terms agreed by Chinese smelters" and their impacts on the wider industry.

Industry-Wide Implications

The situation may lead to a significant restructuring of global copper processing capacity. Multiple Japanese smelters are now considering production cuts or operational changes in response to these market pressures. If this trend continues, it could result in a further concentration of processing capacity in regions with competitive advantages, particularly China.

Reduced Japanese smelting capacity could affect regional copper cathode availability, potentially creating supply chain disruptions for copper-dependent industries in Japan and neighboring countries. This shift in processing capacity may also alter global copper trade flows, with more concentrate potentially flowing to Chinese facilities.

The current situation represents a potential inflection point for the copper processing industry, with long-established operations reconsidering their business models and strategic positioning within the global supply chain.

What Are the Potential Market Impacts?

Supply Chain Considerations

Reduced processing capacity in Japan could create regional copper cathode supply constraints, particularly if multiple smelters implement similar cutbacks. This potential tightening of refined copper availability may force downstream manufacturers to secure alternative supply sources or adjust production schedules.

The shift may increase reliance on Chinese processing capabilities, potentially creating new dependencies within global metal supply chains. For industries requiring just-in-time delivery or those with specific quality requirements, these changes could present significant challenges.

Copper-dependent industries in Japan and neighboring countries may face procurement challenges, including potentially higher premiums for locally produced material or increased logistical costs for imported cathodes.

These disruptions highlight the complex interconnectedness of global metal processing networks and the ripple effects that can occur when significant capacity adjustments take place in major producing regions.

Price and Availability Outlook

Processing capacity reductions could contribute to tighter refined copper markets, potentially supporting higher premiums in regions experiencing reduced smelting output. Regional price differentials may develop, with Japanese-processed copper potentially commanding higher premiums due to reduced availability.

The situation adds another layer of complexity to already volatile copper markets, which have been navigating supply constraints, demand fluctuations, and macroeconomic uncertainties. Industry analysts are closely monitoring how these changes might affect global copper flows and regional price dynamics.

For copper consumers, these developments underscore the importance of supply chain resilience and the potential benefits of diversified sourcing strategies. Companies heavily dependent on Japanese copper supplies may need to develop contingency plans to address potential availability constraints.

How Can Copper Smelters Adapt to Changing Market Conditions?

Diversification of Revenue Streams

Forward-thinking smelters are increasing their focus on precious metal recovery from copper concentrates, capturing additional value from gold, silver, and other valuable by-products. This approach can generate significant supplementary revenue that helps offset depressed TC/RC income.

Developing specialized processing capabilities for complex or lower-grade materials represents another adaptation strategy. Concentrates with higher impurity levels or more challenging metallurgical properties typically command premium processing fees, providing better margins than standard copper concentrates.

Some operations are exploring vertical integration opportunities to capture more value across the copper supply chain. By expanding into downstream activities or securing ownership stakes in mining operations, smelters can reduce their dependence on processing fees alone.

Investments in technologies that reduce processing costs and environmental impact can also improve competitiveness. Energy efficiency improvements, automation, and process optimization can help lower operational expenses, partially offsetting the impact of reduced TC/RCs.

Innovation in Processing Technologies

Developing more energy-efficient smelting processes represents a critical adaptation strategy, particularly in high-energy-cost regions like Japan. Innovations that reduce power consumption can significantly impact overall processing economics.

Implementing advanced automation and digitalization to improve productivity and reduce labor costs offers another pathway to maintaining competitiveness. Smart smelting technologies that optimize operations in real-time can extract maximum value from each ton of material processed.

Some forward-looking companies are exploring new metallurgical approaches that can process a wider range of materials, including those previously considered uneconomical. This flexibility allows operations to adapt to changing market conditions and feedstock availability.

Investments in technologies that reduce environmental footprint and regulatory compliance costs can also provide competitive advantages. As environmental regulations become increasingly stringent, facilities with superior environmental performance may face lower compliance costs and fewer operational restrictions.

FAQ: Japanese Copper Smelting Industry

What are TC/RCs and why are they important?

Treatment charges and refining charges (TC/RCs) are fees that miners pay to smelters for processing copper concentrate into refined copper. These charges represent the primary revenue source for smelters and are typically negotiated annually, with mid-year adjustments.

The dramatic decline in these fees from the 2025 benchmark of $21.25 per ton to as low as $0 in mid-year negotiations directly impacts smelter profitability. Without adequate TC/RCs, many smelting operations struggle to cover operational costs, particularly in regions with higher operating expenses like Japan.

Why are Chinese smelters accepting lower TC/RCs than Japanese counterparts?

Chinese smelters may have different cost structures, government support mechanisms, or strategic priorities that allow them to operate profitably at lower TC/RC levels. Some Chinese operations may have advantages in labor costs, energy pricing, or regulatory compliance expenses that provide greater operational flexibility.

Additionally, some Chinese operations may prioritize market share or vertical integration benefits over immediate processing margins. Securing material supply might take precedence over maximizing short-term processing fees, particularly for operations integrated with downstream manufacturing.

The competitive dynamics within China might also play a role, with domestic competition driving acceptance of lower processing terms to maintain operating rates and market position.

How might Mitsubishi Materials' decision affect global copper markets?

Reduced processing capacity in Japan could potentially create regional supply tightness for refined copper. If multiple Japanese smelters follow Mitsubishi Materials' lead, it could shift more processing volume to Chinese facilities, potentially changing trade flows and regional price dynamics in the copper market.

The cumulative impact of multiple production curtailments could result in tighter refined copper availability in certain regions, potentially leading to higher regional premiums or altered trade patterns. Industries dependent on Japanese copper supplies might need to secure alternative sources or adjust production schedules.

These changes could accelerate the ongoing realignment of global copper processing capacity, potentially resulting in further concentration in regions with competitive advantages or supportive policy environments.

What alternatives do copper smelters have to traditional concentrate processing?

Smelters can increase their focus on recycled copper processing, which is less dependent on TC/RC negotiations. As Mitsubishi Materials stated in their announcement, they plan to "raise the ratio of recycled raw materials and accelerate the shift to feedstock less vulnerable to TC/RC fluctuations."

They can also develop specialized capabilities for processing complex concentrates that command premium processing fees. Materials with higher impurity levels or challenging metallurgical properties typically incur higher processing costs but also command higher TC/RCs, potentially offering better margins.

Exploring vertical integration to capture more value from the copper supply chain represents another alternative. By expanding into downstream activities or securing ownership stakes in mining operations, smelters can reduce their dependence on processing fees alone.

Future Outlook for Japanese Copper Smelting

Industry Consolidation Possibilities

Challenging economics may drive consolidation among Japanese copper processors as companies seek economies of scale and operational efficiencies. Shared facilities or joint ventures could emerge as smelters look to maintain operational scale while reducing costs.

Strategic partnerships between miners and smelters might develop to ensure processing capacity while providing more stable economic arrangements than traditional TC/RC negotiations. These partnerships could include long-term processing agreements, equity investments, or other collaborative structures.

Government intervention may become necessary if the situation threatens strategically important industrial capacity. Japan's industrial policy has historically supported key manufacturing capabilities, and copper processing represents a critical input for many high-value manufacturing sectors.

Long-term Sustainability Strategies

An increased focus on circular economy approaches and recycled copper processing appears likely as companies follow Mitsubishi Materials' lead in diversifying feedstock sources. Recycled copper processing typically offers more stable economics and reduced exposure to TC/RC volatility.

Development of more flexible processing capabilities to handle diverse feed materials will be essential for future competitiveness. Operations that can efficiently process a wide range of materials—from primary concentrates to various secondary materials—will have greater adaptability to changing market conditions.

Investment in technologies that reduce energy consumption and environmental impact will become increasingly important, particularly in high-cost operating environments like Japan. Energy efficiency improvements, process optimization, and emissions reduction technologies can improve both economic and environmental performance.

Strategic repositioning within the global copper value chain may be necessary for long-term viability. Japanese smelters may need to focus on higher-value specialized products, unique technical capabilities, or strategic partnerships to maintain competitive positions in an increasingly challenging global landscape.

Industry Perspective:

The current situation represents a significant inflection point for copper processing economics globally. As Japan Mining Industry Association Chair Tetsuya Tanaka noted, the "extremely low terms agreed by Chinese smelters" are creating "severe pressure" on non-Chinese operations, potentially reshaping the industry's competitive landscape for years to come.

The mitsubishi materials scale back copper smelting decision comes amid a broader trend of supply chain adjustments in the global copper industry. Similar pressures are being felt in other regions, as evidenced by the recent Glencore smelter shutdown impact in Chile. These developments are occurring at a critical time when market analysts are closely watching copper price predictions that suggest potential upside amid supply constraints.

For investors, these industry shifts create both challenges and opportunities. Understanding various copper investment strategies becomes increasingly important in this volatile environment. Furthermore, the emphasis on technological adaptation and process innovation highlights the importance of following broader mining industry innovation trends that may reshape competitive dynamics in the sector.

Looking to Identify the Next Major Mineral Discovery?

Discovery Alert's proprietary Discovery IQ model instantly notifies investors when significant ASX mineral discoveries are announced, turning complex data into actionable insights for immediate market advantage. Explore why major mineral discoveries can lead to substantial returns by visiting Discovery Alert's dedicated discoveries page and position yourself ahead of the market.