Konkola Copper Mines' Ambitious Turnaround Strategy

Vedanta Resources has announced a comprehensive refurbishment of its Zambian smelter at Konkola Copper Mines (KCM), marking a pivotal moment in the company's efforts to revitalize copper production in Zambia. The ambitious plan comes at a critical juncture for both the company and the country, as KCM's operations have been severely constrained by aging infrastructure and underperforming assets.

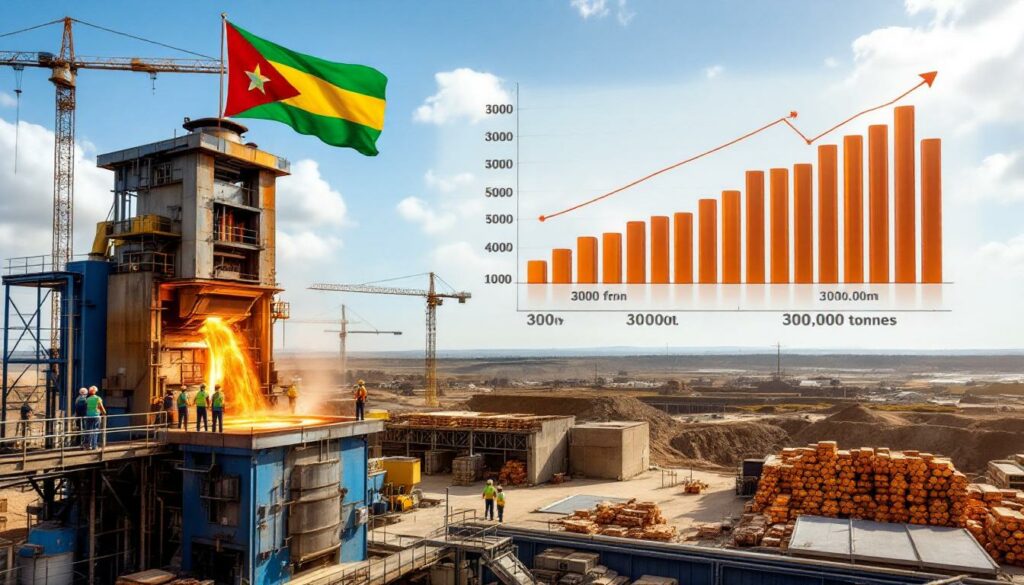

Currently, KCM's copper output stands at less than 30,000 tonnes annually—a mere 10% of its ambitious 300,000-tonne target. This significant shortfall not only represents lost revenue but has also compelled Zambia, Africa's second-largest copper producer, to waive export taxes on 255,000 tonnes of copper concentrates due to insufficient domestic processing capacity.

"The planned shutdown and overhaul aim to restore structural integrity and improve efficiency," according to Vedanta's announcement reported by Bloomberg. This statement underscores the critical nature of the refurbishment in addressing fundamental operational issues that have plagued the facility.

KCM's unique position as Zambia's largest integrated copper producer, with operations spanning four locations (Chingola, Chililabombwe, Nampundwe, and Kitwe), makes this refurbishment particularly significant for the country's mining sector. The company encompasses the complete production value chain from mining to refining, representing a strategic national asset with untapped potential.

The Strategic Importance of KCM's Smelter Upgrade

The smelter refurbishment represents more than just an operational improvement—it's a cornerstone of Vedanta's strategy to unlock KCM's considerable resource potential. The mining complex boasts copper deposits with grades exceeding 2.4%, significantly higher than many competing operations globally. Additionally, KCM possesses substantial cobalt reserves that could position it among the top five global cobalt producers, adding a strategic dimension to the refurbishment beyond copper production alone.

This upgrade comes at a time when global copper demand continues to rise, driven primarily by renewable energy technologies and electrification trends. As the only mining entity in Zambia with facilities across four locations, KCM's enhanced production capabilities could significantly impact regional economic development and global copper supply forecast.

Note: The global copper market is expected to face growing supply constraints as the clean energy transition accelerates, with electric vehicles requiring up to four times more copper than conventional vehicles.

Current Production Challenges and Limitations

The smelter's current inefficiencies represent a critical bottleneck in KCM's production pipeline. Its inability to process available copper concentrates has forced Zambia to permit the export of raw materials for processing elsewhere—a situation that causes the country to miss out on the value-added component of refined copper production.

These limitations have persisted since Vedanta regained control of KCM in 2024, following the resolution of a protracted dispute with the Zambian government. The smelter's underperformance highlights the technical challenges involved in maintaining complex metallurgical operations in developing economies, where skilled labor, reliable power, and supply chain logistics present ongoing challenges.

What Does the Refurbishment Plan Include?

The planned smelter refurbishment at KCM focuses on two primary objectives: restoring structural integrity and improving operational efficiency. While Vedanta has not disclosed comprehensive technical details, the scope likely encompasses several critical components that modern copper smelters require to operate efficiently.

Technical Aspects of the Smelter Upgrade

Industry experts suggest the refurbishment will likely include:

- Upgrading furnace technology to improve metal recovery rates

- Enhancing emissions control systems to meet international environmental standards

- Modernizing instrumentation and control systems for better process management

- Improving material handling systems to increase throughput capacity

- Optimizing energy efficiency to reduce operational costs

These technical improvements are essential for transforming the facility from its current underperforming state to a modern operation capable of supporting KCM's ambitious production targets.

The refurbishment aligns with global trends in smelter modernization, where facilities are increasingly focused on improving recovery rates, reducing environmental impact, and lowering energy consumption. Modern copper smelters typically achieve recovery rates above 98%, significantly higher than older technologies that may struggle to reach 95%.

Timeline and Investment Considerations

While specific timeline details remain undisclosed, the smelter refurbishment falls within Vedanta's broader $1.2 billion investment commitment over five years (2024-2029). The company has already invested approximately $400 million in various operational improvements, including:

- $250 million for debt clearance

- $124 million toward ongoing projects

This substantial financial commitment indicates the strategic importance Vedanta places on restoring KCM to full operational capacity. The refurbishment timeline must balance the urgency of increasing production with the technical requirements of properly executing complex metallurgical upgrades.

The project's success will largely depend on effective project management, procurement of specialized equipment, and coordination with other operational improvements across KCM's integrated value chain.

Why is This Refurbishment Strategically Important?

The smelter refurbishment at KCM represents a strategic inflection point for both Vedanta Resources and Zambia's mining sector, with implications extending beyond immediate production increases.

Zambia's Position in Global Copper Markets

Zambia stands as Africa's second-largest copper producer, yet the country has struggled to maximize its potential despite possessing world-class copper deposits. The global copper market is increasingly characterized by:

- Growing demand from renewable energy sectors: Solar panels, wind turbines, and electric vehicles all require significant copper inputs

- Supply constraints: Few major new copper discoveries have been made in recent years

- Geopolitical considerations: Copper is increasingly viewed as a strategic metal for energy transition

For Zambia, increasing domestic copper processing capacity through projects like the KCM smelter refurbishment offers opportunities to capture more value from its mineral resources. Rather than exporting concentrates for processing elsewhere (as evidenced by the government's recent tax waiver on 255,000 tonnes of copper concentrates), enhanced smelting capacity allows the country to export higher-value refined copper.

KCM's Untapped Potential

KCM represents a unique asset within Zambia's mining landscape for several reasons:

- High-grade resources: Copper deposits exceeding 2.4% grade (substantially above global averages)

- Significant cobalt reserves: Positioning it as a potential top-five global cobalt producer

- Integrated operations: The only mining entity in Zambia with facilities across four locations

- Complete value chain: From mining to refining capabilities

The smelter refurbishment addresses a critical chokepoint in realizing this potential. Without adequate processing capacity, KCM's high-grade copper resources cannot be efficiently converted into marketable products, resulting in significant opportunity costs for both the company and Zambia's economy.

Additionally, unlocking KCM's cobalt potential becomes increasingly important as global demand for battery materials continues to rise, driven by electric vehicle production and energy storage requirements.

How Does the Refurbishment Fit Into Vedanta's Broader Strategy?

The smelter refurbishment represents one component of Vedanta's comprehensive strategy to transform KCM into a world-class copper producer and maximize returns on its Zambian investments.

Vedanta's Investment Commitments and Progress

Since regaining control of KCM after resolving its dispute with the Zambian government in 2024, Vedanta has demonstrated significant financial commitment to revitalizing operations:

- $1.2 billion investment plan: Spanning five years (2024-2029)

- $400 million already invested: Including $250 million for debt clearance and $124 million for ongoing projects

- Konkola Deep development: A parallel project to access deeper, higher-grade copper reserves

This substantial financial commitment underscores Vedanta's confidence in KCM's long-term potential despite current operational challenges. The company appears to be pursuing a holistic approach that addresses multiple aspects of KCM's value chain simultaneously, rather than focusing exclusively on the smelter.

The investment strategy follows a logical sequence:

- Clear legacy debts to stabilize operations

- Address critical bottlenecks (including the smelter)

- Develop new resources (Konkola Deep) to ensure long-term supply

Potential US Listing and Capital Raising

In April 2025, Vedanta announced exploration of a public listing in the United States specifically for KCM, with the goal of raising approximately $1 billion for mine development. This potential listing suggests several strategic considerations:

- Access to deeper capital markets: US listings typically provide access to a broader pool of investors

- Higher valuation multiples: Mining assets often command premium valuations on US exchanges compared to other markets

- Strategic flexibility: A separate listing creates options for future partnerships or transactions

- Project financing: Targeted funding for capital-intensive projects like Konkola Deep

The timing of this announcement—following initial investments but preceding the completion of major projects like the smelter refurbishment—indicates a phased approach to KCM's revitalization. The successful completion of the smelter project would likely enhance KCM's attractiveness to potential investors in a US listing scenario.

This capital-raising strategy also allows Vedanta to potentially accelerate development timelines beyond what would be possible using only internally generated cash flows.

What Impact Will the Refurbishment Have on Production?

The smelter refurbishment represents a critical inflection point in KCM's production trajectory, with potential to dramatically increase copper output and unlock additional value streams.

Production Targets and Capacity Improvements

KCM's current production of less than 30,000 tonnes annually stands in stark contrast to its ambitious target of 300,000 tonnes by the start of the next decade—a tenfold increase. The smelter refurbishment directly addresses a primary bottleneck preventing this growth.

Modern copper smelters offer several advantages over aging facilities:

- Higher recovery rates: Typically 1-3% improvement in metal recovery, which translates to significant value given copper price insights

- Increased throughput: Modern furnaces and material handling systems can process more concentrate per day

- Reduced downtime: More reliable operations with fewer unplanned maintenance shutdowns

- Flexibility to handle varying feed quality: Important when processing materials from multiple mining operations

For KCM, these improvements could potentially enable production increases in phases:

- Initial recovery: Returning to historical production levels

- Incremental growth: Steadily increasing output as supporting operations improve

- Target achievement: Reaching the 300,000-tonne annual production goal

The phased production increase would likely align with developments in the mining operations that supply the smelter, particularly the Konkola Deep project.

Value Chain Integration Benefits

As Zambia's largest integrated copper producer, KCM stands to benefit significantly from improved smelter operations beyond simple production increases:

- Reduced reliance on third-party processing: Currently, concentrates must be exported for processing due to domestic capacity constraints

- Capture of additional value streams: Including potential recovery of precious metals and other by-products

- Operational flexibility: Ability to optimize mining operations based on smelter capabilities

- Reduced transportation costs: Processing materials locally eliminates costs associated with concentrate exports

This integration represents a competitive advantage that few other Zambian mining operations possess. While other miners must negotiate terms with third-party processors, KCM can potentially capture the full value chain from mine to refined metal—provided the smelter operates efficiently.

What Challenges Might the Refurbishment Face?

Despite its strategic importance, the smelter refurbishment project faces numerous potential challenges that could impact its timeline, cost, and ultimate success.

Technical and Operational Risks

Smelter refurbishments represent complex engineering projects with inherent technical challenges:

- Construction and commissioning delays: Major metallurgical projects frequently encounter timeline extensions

- Cost overruns: Specialized equipment and materials often face price volatility

- Performance shortfalls: Modernized facilities may not immediately achieve design specifications

- Integration complications: Connecting new systems with existing infrastructure can present unexpected difficulties

- Skills gaps: Operating modernized facilities requires specialized technical expertise

These challenges are particularly acute in the Zambian context, where the mining sector has faced periods of underinvestment and skills exodus. Vedanta may need to supplement local technical capabilities with international expertise during both the refurbishment and initial operational phases.

Additionally, the refurbishment must balance comprehensive modernization with practical considerations regarding downtime. Extended shutdowns could further impact KCM's already constrained production, creating short-term financial pressures even as long-term capabilities improve.

Market and Economic Considerations

The success of the refurbishment project will be influenced by broader market conditions:

- Copper price volatility: Return on investment strategy insights depend on copper price assumptions

- Energy costs: Smelting is energy-intensive, making power reliability and pricing crucial factors

- Input availability: Steady supply of concentrates required to maximize smelter utilization

- Currency fluctuations: Capital equipment imports and export revenues are subject to exchange rate risks

- Regulatory changes: Mining taxation and environmental regulations may evolve during the project timeline

For Vedanta, managing these market risks requires careful project staging and potentially hedging strategies to protect against adverse price movements during the capital-intensive refurbishment period.

Note: Major metallurgical projects typically require 18-36 months from initial shutdown to full operational capability, creating an extended period of vulnerability to market fluctuations.

How Does This Development Affect Zambia's Mining Sector?

The refurbishment of KCM's smelter has implications extending well beyond Vedanta's operations, potentially reshaping Zambia's broader mining sector and economic landscape.

Economic and Fiscal Implications

A successful turnaround at KCM would yield multiple economic benefits for Zambia:

- Increased export revenue: Refined copper commands premium prices compared to concentrates

- Tax revenue growth: Higher production volumes translate to expanded tax base

- Employment opportunities: Both direct jobs at KCM and indirect employment through supply chains

- Skills development: Modern operations require technical training, building human capital

- Foreign exchange earnings: Critical for Zambia's macroeconomic stability

The mining sector remains a cornerstone of Zambia's economy, accounting for a significant portion of export earnings and formal employment. KCM's revitalization could create positive multiplier effects throughout associated industries, from transportation and logistics to professional services and manufacturing.

For local communities near KCM's operations in Chingola, Chililabombwe, Nampundwe, and Kitwe, the economic impact would be particularly pronounced, potentially reversing population decline and business contraction experienced during periods of reduced mining activity.

Regulatory Environment and Government Relations

The refurbishment project unfolds against a backdrop of evolving government-industry relations in Zambia's mining sector:

- Export tax waiver: The government's decision to waive taxes on 255,000 tonnes of copper concentrates signals pragmatic recognition of domestic processing constraints

- Dispute resolution: Vedanta's return to KCM operations following the settlement of legal disputes suggests improved stability

- Investment climate signals: Successful project execution could encourage additional foreign investment in Zambia's mining sector

The government's approach to KCM appears to balance revenue generation with practical considerations regarding production capabilities. This pragmatism, if maintained, creates a more predictable operating environment for Vedanta and other mining investors.

For Zambia, the smelter project represents an opportunity to demonstrate regulatory consistency—a key factor in attracting the long-term capital required for major mining investments. How authorities handle permitting, environmental compliance, and fiscal arrangements during the refurbishment will be closely watched by other potential investors.

What Are the Environmental Considerations?

Modern smelter operations must balance production efficiency with environmental performance, an area where technological advances offer significant improvements over legacy facilities.

Emissions and Efficiency Improvements

While specific details of KCM's refurbishment plan remain undisclosed, modern smelter technologies typically deliver substantial environmental improvements:

- Sulfur dioxide capture: Contemporary acid plants can capture >99% of SO₂ emissions versus 85-90% in older facilities

- Particulate controls: Advanced electrostatic precipitators and baghouses significantly reduce dust emissions

- Energy efficiency: Waste heat recovery systems and improved furnace designs reduce carbon footprint

- Water management: Closed-loop systems minimize freshwater consumption and wastewater discharge

These environmental improvements often coincide with operational efficiency gains, as reducing emissions frequently correlates with better metal recovery and reduced energy consumption. For instance, modern flash smelting technologies can reduce energy requirements by 20-30% compared to older reverberatory furnaces while simultaneously improving environmental performance.

For KCM's neighbors in Chingola and surrounding communities, these environmental improvements would translate to better air quality and reduced impacts on local water resources—addressing historical concerns about mining pollution in the region.

Sustainability Integration

Beyond regulatory compliance, the refurbishment presents an opportunity for KCM to integrate broader sustainability considerations:

- Circular economy approaches: Recovering additional metals and materials from waste streams

- Renewable energy integration: Potential incorporation of solar or other renewable sources for portions of energy needs

- Community environmental monitoring: Transparent reporting and community involvement in environmental performance

- Climate resilience: Designing systems to withstand increasing climate variability in the region

As global copper markets increasingly prioritize responsibly produced materials, these sustainability enhancements could potentially allow KCM to access premium market segments and preferred customer relationships, particularly among manufacturers focused on environmental, social, and governance (ESG) performance in their supply chains. Furthermore, implementing modern [industry innovation trends](https://discov

Ready to Stay Ahead of the Next Major Mining Discovery?

Discover how investors can leverage real-time alerts on significant ASX mineral discoveries with Discovery Alert's proprietary Discovery IQ model, turning complex mining data into actionable insights. Explore why historic discoveries can generate substantial returns by visiting Discovery Alert's dedicated discoveries page.