Mali's Mining Revolution: How New Agreements Under Revised Code Reshape the Industry

What Changes Does Mali's 2023 Mining Code Introduce?

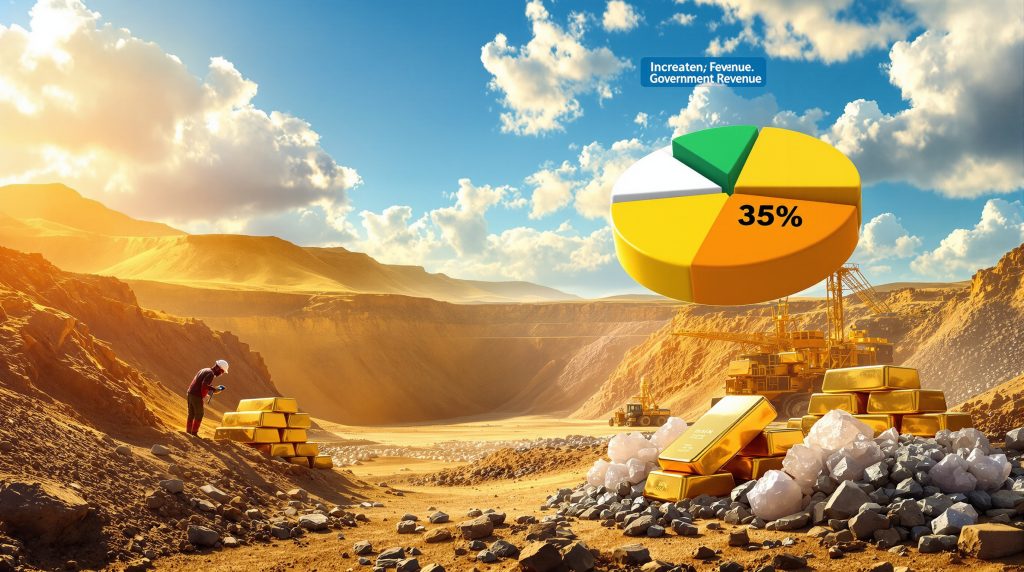

Mali's 2023 mining code represents a fundamental shift in how the country manages its valuable mineral resources. The revised framework increases state participation in mining operations from 20% to a minimum of 35%, giving the government a significantly stronger position in these ventures. This ownership stake is structured as non-dilutable, ensuring the state's interest cannot be reduced through future financing rounds.

The code also implements a substantial increase in royalty rates, jumping from 6.5% to 10%. This adjustment is expected to generate millions in additional revenue for Mali's treasury annually, providing much-needed funds for public services and infrastructure development.

Another key innovation is the priority dividend access mechanism, which ensures the Malian government receives its share of profits before distribution to other shareholders. This approach significantly strengthens Mali's financial position in mining partnerships and represents a core aspect of the country's resource nationalism strategy.

The overall framework aims to correct what the current administration views as historical imbalances in how mining wealth has been distributed between international companies and the host nation. These changes align with similar trends across Africa where governments are asserting greater control over natural resources.

Which Major Mining Projects Fall Under the New Agreements?

Seven exploration and exploitation agreements have been approved by Mali's Council of Ministers under the revised code. These agreements cover some of the country's most significant mining operations, including several world-class gold mines that form the backbone of Mali's mineral export sector.

The Sadiola project, operated by Allied Gold, represents one of Mali's longest-running gold mining operations. Having undergone ownership changes in recent years, this established mine remains a crucial part of the country's gold production capacity and will now operate under the new regulatory framework.

B2Gold's Fekola mine, another operation covered by the new agreements, stands as one of West Africa's largest gold producers. The high-grade, open-pit operation has been a flagship project in Mali's mining portfolio, with production capacity that significantly contributes to national export figures.

Resolute Mining's Syama site, known for pioneering underground automation technology in the region, is also included in the new agreements. This operation has distinguished itself through technological innovation in what has traditionally been a challenging mining environment.

Beyond gold, the agreements extend to Ganfeng's Bougouni lithium project, signaling Mali's strategic interest in diversifying into critical minerals transition essential for the global energy transition. This project represents an important step in reducing the country's historical dependence on gold production.

These preliminary agreements, initially signed between September and November 2024, have now received full government approval, cementing the new regulatory relationship between Mali and these major mining operators.

How Are Companies Responding to Mali's New Requirements?

Mining companies have shown varied responses to Mali's revised regulatory framework. Endeavour Mining has emerged as an early adopter, having already signed agreements aligned with the updated mining code. This proactive approach suggests that some major operators view the new terms as manageable within their business models, despite the increased costs.

In stark contrast, Barrick Mining remains in a prolonged standoff with Malian authorities. The Canadian company's negotiations have been further complicated by an unusual development—one of its former negotiators has switched sides and now serves as an adviser to Mali's president. This situation highlights the complex interplay between commercial interests and political considerations in the mining sector.

Other companies have been more measured in their public responses. Resolute Mining declined to comment when approached by media, while Allied Gold, B2Gold, and Ganfeng did not immediately respond to queries about the new agreements. This cautious communication strategy reflects the sensitive nature of these negotiations and their potential impact on investor relations.

Mining executives must now evaluate how the increased state participation and higher royalty rates affect project economics. For established operations with significant sunk costs, adaptation may be more straightforward than for early-stage projects where investment decisions remain pending.

The industry response also highlights a broader challenge facing international mining companies operating in jurisdictions with evolving regulatory frameworks—balancing shareholder expectations with host country demands for greater economic benefits from resource extraction.

What Prompted Mali's Mining Code Revision?

The revision of Mali's mining code emerges from multiple interconnected factors, with economic sovereignty considerations at the forefront. The military government that seized power in 2020 has consistently emphasized the need to ensure national resources primarily benefit Malian citizens. Government officials have characterized previous mining arrangements as insufficiently advantageous to the country.

Regional competition has also played a significant role. Several neighboring countries have implemented similar reforms to their mining permitting insights, creating a regional trend toward increased state participation and higher royalty rates. Mali's government has closely studied these developments to ensure its terms remain competitive while maximizing returns.

The country's ongoing fiscal challenges provide another crucial context for these changes. With security issues consuming a substantial portion of the national budget and limited alternative revenue sources, maximizing income from mineral resources has become an economic imperative. The mining sector represents one of the few reliable sources of foreign exchange and government revenue.

Mali's policy shift also reflects a broader geopolitical realignment. The government has moved away from traditional Western partners toward increased cooperation with Russia. This realignment has added fresh layers of uncertainty for Western mining companies operating in the country and influenced the negotiating dynamic between these companies and the Malian authorities.

What Economic Benefits Does Mali Expect?

Mali anticipates significant economic benefits from the revised mining framework. The increase in royalty rates from 6.5% to 10% creates an immediate boost to government revenue without requiring additional production. For a country where gold typically represents over 80% of export earnings, this adjustment substantially impacts foreign exchange availability.

The enhanced state participation structure—moving from 20% to 35% minimum ownership—creates a longer-term benefit stream through dividend payments. The priority dividend access mechanism further strengthens this position by ensuring the government receives its share before other investors.

Beyond direct financial returns, the agreements include provisions for local economic development. Requirements for local procurement create business opportunities for Malian enterprises, while employment quotas ensure mining benefits extend to the workforce. These provisions aim to build stronger economic linkages between mining operations and surrounding communities.

The revenue generated through these mechanisms is expected to support critical infrastructure development, including roads, power generation, and water systems. Additionally, the government has indicated plans to allocate a portion of mining revenue toward education and healthcare improvements in mining regions.

For a country facing significant development challenges, the revised mining framework represents a strategic effort to convert mineral wealth into tangible socioeconomic progress. However, realizing these benefits depends on effective governance systems that ensure transparency in revenue collection and judicious allocation of the resulting funds.

How Does This Fit Into Mali's Broader Economic Strategy?

Mali's mining code revision represents a cornerstone of the country's broader economic strategy, centered on resource nationalism. The government has clearly signaled its determination to ensure natural resources primarily benefit Malian citizens rather than foreign shareholders. This approach mirrors similar policies implemented across several African nations seeking greater economic sovereignty, including South Africa beneficiation initiatives.

The changes align with Mali's broader geopolitical realignment away from traditional Western partners toward Russian interests. This shift has created a more complex operating environment for Western mining companies accustomed to previous arrangements. Russian mining interests, meanwhile, may find opportunities as this realignment continues.

From a development perspective, the mining framework connects directly to Mali's infrastructure expansion goals. The government has announced plans to channel increased mining revenues toward critical transportation networks, energy systems, and water resources, addressing fundamental constraints to economic growth.

Mali's approach also reflects a recognition of changing global mining landscape patterns. The inclusion of the Bougouni lithium project within the new agreements demonstrates awareness of critical mineral opportunities beyond gold. As global demand for battery materials increases, Mali aims to position itself advantageously within emerging supply chains.

The success of this strategy ultimately depends on striking a delicate balance—capturing a larger share of mining value without discouraging future investment. Too aggressive an approach risks deterring exploration and development activities that generate future revenue streams. The government appears to recognize this tension, as evidenced by its willingness to approve seven major agreements rather than adopting a more confrontational stance.

What Implementation Challenges Exist?

Despite the potential benefits, Mali faces several significant challenges in implementing its revised mining framework. Security concerns remain paramount in certain regions, with armed groups continuing to threaten stability in parts of the country. Mining operations require secure environments for personnel, equipment, and transportation, making security provision a critical prerequisite for successful implementation.

Administrative capacity constraints present another substantial hurdle. Effectively monitoring compliance with complex provisions like local content requirements demands technical expertise and robust oversight systems. Building this capacity requires investment in regulatory institutions and professional development for government officials responsible for mining sector governance.

Market volatility introduces additional uncertainty. Gold prices, while historically resilient, remain subject to fluctuation. A significant price decline could undermine revenue projections based on the new royalty rates. Similarly, lithium markets have shown considerable volatility in recent years, affecting the economics of diversification efforts like the Bougouni project.

Balancing competing interests within the implementation process presents a political challenge. Different ministries may have varying priorities regarding mining sector governance, potentially creating coordination problems. Additionally, local communities near mining operations often have expectations that may not fully align with national-level revenue maximization goals.

Foreign exchange management represents yet another implementation challenge. Mining revenues typically arrive in foreign currencies, requiring careful management to avoid exchange rate distortions that could harm other economic sectors. The central bank will need effective policies to sterilize large foreign exchange inflows while ensuring funds remain available for national development priorities.

What Future Mining Investment Trends Can We Expect?

After suspending new mining permits in late 2022, Mali appears to be moving toward a more open stance on exploration activities. The approval of these seven agreements signals a willingness to engage with international mining companies within the framework of the revised code, potentially opening doors for new investment.

Investors evaluating opportunities in Mali now have greater regulatory clarity, albeit with increased cost structures. The predictability provided by formalized agreements may partially offset concerns about higher royalty rates and state participation requirements. Companies with existing geological knowledge of Mali's mineral potential may find continued justification for investment despite increased costs.

The country's competitive position within regional mining consolidation trends will depend on how neighboring nations respond. If nearby countries maintain lower royalty rates or state participation requirements, investors may redirect exploration budgets accordingly. However, Mali's established geological prospectivity provides some insulation against investment flight.

Risk assessment frameworks used by mining companies will need adjustment to account for the new regulatory reality. The increased government take requires higher-grade deposits or lower operating costs to maintain acceptable investment returns. This dynamic may favor companies with technological advantages that enable more efficient operations.

Financing strategies for new projects will likely evolve in response to the 35% state participation requirement. Mining companies may increasingly pursue joint venture structures or phased development approaches to manage capital requirements. International financial institutions may also adjust their lending criteria for Malian projects to account for the revised risk-reward profile.

Understanding Mali's Mining Transformation: Key Questions Answered

What exactly does Mali's 35% state ownership entail?

The 35% minimum state ownership is structured as a non-dilutable equity position, meaning it cannot be reduced through future financing rounds. This ownership is divided between national and local governmental entities, with provisions for representation on management committees and access to operational data.

How do the new royalty rates compare to regional standards?

Mali's 10% royalty rate places it among the higher-end royalty structures in West Africa, though not unprecedented. Neighboring countries typically maintain rates between 3% and 8%, making Mali's approach more aggressive but not entirely outside regional norms.

Will existing mines be required to immediately comply with the new code?

The seven approved agreements suggest a pragmatic implementation approach. While details of transition periods remain confidential, the government appears to be negotiating specific timelines with existing operators rather than demanding immediate full compliance across all operations.

What happens if gold prices significantly decline?

The agreements reportedly lack sliding-scale provisions that would adjust royalty rates during periods of low prices. This creates potential vulnerability for operations during market downturns when fixed royalty rates can disproportionately impact profitability.

How might the revised code affect artisanal mining activities?

While the seven agreements focus on large-scale operations, Mali's artisanal mining sector remains economically significant. The government has indicated plans to formalize more small-scale operations under separate regulations that acknowledge their distinctive operational characteristics, according to recent reports on Mali's mining agreements.

Mali's Mining Sector at a Glance: Key Projects Under New Agreements

| Mining Project | Operator | Primary Mineral | Previous State Stake | New State Stake | Operational Status |

|---|---|---|---|---|---|

| Sadiola | Allied Gold | Gold | 20% | 35% | Producing |

| Fekola | B2Gold | Gold | 20% | 35% | Producing |

| Syama | Resolute Mining | Gold | 20% | 35% | Producing |

| Bougouni | Ganfeng | Lithium | New project | 35% | Development |

The transformation of Mali's mining sector through these revised agreements represents a significant shift in how the country approaches resource governance. By securing increased ownership stakes and higher royalty rates, Mali has positioned itself to capture a larger share of mineral wealth. The successful implementation of these agreements will depend on maintaining a delicate balance—ensuring sufficient benefits flow to the Malian people while preserving an investment environment that supports continued exploration and development.

For mining companies, adapting to this new reality requires strategic flexibility and recognition of evolving expectations regarding resource governance across Africa. Those that successfully navigate this changing landscape may build stronger, more sustainable partnerships with host governments, while those that resist may find their competitive position increasingly challenged, as Mali's junta-led government signs new mining deals under terms more favorable to the nation.

Disclaimer: This article contains analysis of government policies and mining industry trends that may change over time. Readers should consult current official sources and company announcements for the most up-to-date information on specific projects or regulatory requirements. The article does not constitute investment advice regarding specific mining companies mentioned.

Ready to Find the Next Major Mineral Discovery?

Discover significant ASX mineral discoveries the moment they happen with Discovery Alert's proprietary Discovery IQ model, turning complex announcements into actionable investment insights. Explore why major discoveries can lead to exceptional returns by visiting Discovery Alert's dedicated discoveries page and position yourself ahead of the market.