Mogalakwena Underground: Valterra Platinum's Strategic Expansion

Nestled in South Africa's Limpopo province lies Mogalakwena, the world's largest open-pit platinum group metals (PGM) operation and a cornerstone asset for Valterra Platinum. With only 14% of its vast resource extracted over three decades, the company is now strategically developing underground capabilities to tap into higher-grade ore bodies and extend the mine's productive future.

This underground expansion represents a significant evolution for the operation, which currently contributes approximately half of Valterra's total PGM output. The initiative aims to enhance production flexibility, optimize blending capabilities, and strengthen the company's position on the global cost curve for decades to come.

What Makes Mogalakwena's Underground Potential Significant?

Exceptional Resource Endowment

Mogalakwena's resource endowment stands as truly remarkable, with an estimated 150-year resource life remaining. Situated among 64 villages near Mokopane, the mine has established itself as a critical economic driver in the region. Senior General Manager Kobus van den Berg describes it as "the industry's most exciting endowment," highlighting its unique position in the global PGM landscape.

The operation currently maintains production in the lower half of the industry cost curve, producing approximately one million ounces of PGMs annually from its open-pit operations. This competitive advantage is expected to strengthen further as underground mining innovations progress.

Higher-Grade Underground Opportunities

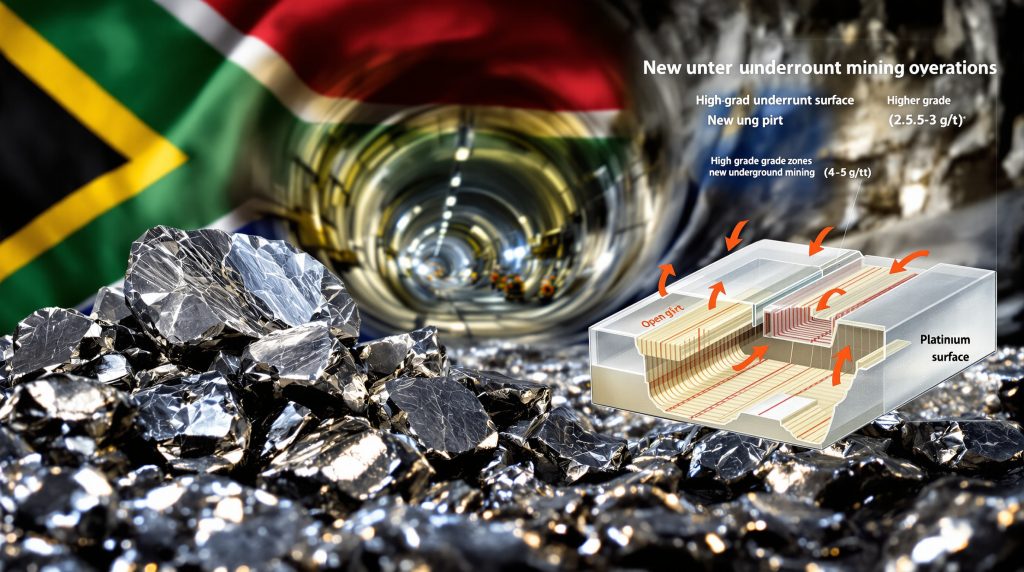

The underground expansion targets the Sandsloot resource—the site of Mogalakwena's first open-pit—which contains substantially higher-grade ore. While current open-pit operations yield grades of 2.7-3.0 g/t, the underground resource promises grades of 4-6 g/t, creating significant blending opportunities and production flexibility.

This grade differential represents a transformative opportunity for Valterra Platinum exploring Mogalakwena underground potential, particularly in a market environment where PGM producers globally face declining ore grades and increasing production challenges. Industry experts note that such grade improvements could position Mogalakwena as one of the most cost-effective PGM operations globally.

How Is Valterra Approaching the Underground Development?

Two-Phase Development Strategy

Valterra has adopted a prudent, two-phase approach to underground development:

Phase 1: Exploration and Trial Mining

- Prefeasibility study completed in H1 2025

- Confirmed reef grades of 4-6 g/t

- Development of an exploration decline into the tier-one orebody

- Extensive drilling program (43+ km completed to date)

- Trial mining scheduled for late 2026

- Initial production target of 2-2.5 million tonnes annually

- Trucking operation to transport ore to the surface

Phase 2: Full-Scale Production

- Feasibility study targeted for completion in H1 2027

- Investment decision milestone in 2027

- Potential ramp-up beyond 2030 to 3.6-4.5 million tonnes annually

- Consideration of advanced ore-handling facilities, including conveyor systems

Stephan Nothnagel, General Manager of the Mogalakwena underground exploration project, emphasizes that "it is a tier-one orebody, and it requires a tier-one mindset and a tier-one design with a capital prudence lens."

Strategic Blending Capabilities

The underground development creates powerful blending opportunities that could transform Mogalakwena's production profile. Willie Theron, Valterra's mining operations executive head, explains: "Essentially, the value proposition really is to have a blending strategy between the mine and what goes into the concentrator."

By combining low-grade stockpiles with high-grade underground material, Valterra can:

- Maintain consistent output at approximately 3 g/t

- Reduce all-in sustaining costs

- Enhance operational resilience against price fluctuations

- Create production scaling options based on market conditions

This blending approach represents a differentiating factor in PGM production, allowing for strategic grade management that few competitors can match.

What Progress Has Been Made on the Underground Project?

Current Development Milestones

The Mogalakwena underground project has already achieved several significant milestones:

- Completion of 12.8 km of additional exploration drilling in H1 2025

- Development of 1.6 km of key enabling infrastructure

- Delivery of the first bulk ore sample for analysis

- Cumulative completion of over 43 km of exploration drilling

- Development of approximately 8 km of underground infrastructure

These achievements provide crucial drilling exploration insights for the ongoing feasibility study and represent substantial progress toward the trial mining phase scheduled for late 2026.

Open-Pit Optimization in Parallel

While underground development progresses, Valterra continues to optimize its open-pit operations at Mogalakwena. Recent improvements include:

- 5% increase in total drilled meters (2022-2024)

- 13% increase in blasted tonnage

- Revised mining plan targeting northern areas with lower strip ratios (4.5-6.7)

- Activation of the north waste rock dump, yielding 27% reduction in truck cycle times

- Implementation of high-capacity equipment, including Komatsu 4800 rope shovels paired with 300-tonne capacity trucks

These enhancements support Valterra's assertion that there is "no immediate need for underground development to sustain throughput," while positioning the company to maximize value from both open-pit and underground resources in the future.

How Is Valterra Managing Processing Capacity and Environmental Responsibilities?

Concentrator Capabilities

Mogalakwena operates two concentrators with substantial capacity:

- North Concentrator: Commissioned in 2008, it's the world's largest PGM concentrator with 9.5 million tonnes of annual throughput capacity

- South Concentrator: Operational since 1993, processing 4.5 million tonnes annually

Recent technological upgrades include the commissioning of the Jameson cleaner circuit at the North Concentrator, completed in April 2025 with full ramp-up expected by December.

Tailings Management and Environmental Stewardship

Valterra maintains a comprehensive tailings management strategy at Mogalakwena:

- The Vaalkop TSF has been inactive since 2021

- Blinkwater 1 TSF remains active until 2028

- Construction of Blinkwater 2 is underway to expand overall storage capacity

- Implementation of rock impound facility construction began in 2025

The company employs rigorous monitoring systems, including drone surveillance, daily satellite displacement monitoring, and water pressure tracking. An independent technical review panel conducts annual assessments, with comprehensive external safety reviews every five years (most recently in 2022, with the next scheduled for 2027).

Mogalakwena is fully compliant with the Global Industry Standards on Tailings Management (GISTM), with its public compliance disclosure most recently updated in August 2025.

What Does the Future Hold for Valterra and Mogalakwena?

Strategic Positioning Post-Separation

Following its separation from Anglo American earlier in 2025, Valterra Platinum has emerged as an independent entity with listings on both the JSE and LSE. The company has focused on simplifying and strengthening its organizational structure to enhance competitiveness.

Yvonne Mfolo, Valterra's corporate affairs and sustainability executive head, emphasizes that "it is important that we are efficient, sweat our assets, manage our cash flows and expand our margins, as well as invest in our portfolio for maximum value and ensure disciplined capital allocation."

Market Outlook and Growth Strategy

Despite challenges in the PGM market, including potential demand shifts related to the rise of battery electric vehicles, Valterra executives remain confident in the long-term fundamentals. The company sees growth opportunities in emerging applications such as hydrogen production and fuel-cell electric vehicles.

The Mogalakwena underground development represents a cornerstone of Valterra's growth strategy, providing:

- Production flexibility and scalability

- Enhanced blending capabilities to optimize grade profiles

- Improved cost positioning

- Long-term resource security

Industry analysts suggest that this strategic pivot comes at a critical time, as the PGM market undergoes structural changes with automotive catalysts potentially facing declining demand while hydrogen applications create new opportunities.

Why Is This Development Significant for the PGM Industry?

Industry Context and Implications

The Mogalakwena underground development comes at a pivotal time for the PGM industry:

- Declining Surface Resources: Many South African mineral beneficiation producers face declining grades and depleting near-surface resources

- Cost Pressures: Rising input costs and energy challenges require innovative approaches to maintain competitiveness

- Market Transformation: Evolving end-use applications for PGMs necessitate flexible production capabilities

- Supply Security: Development of tier-one resources supports long-term supply stability for critical metals

By pursuing this strategic underground expansion, Valterra is positioning itself to address these industry challenges while capitalizing on Mogalakwena's exceptional resource endowment.

Technological Innovation

The underground development also serves as a platform for technological innovation in PGM mining. The project incorporates:

- Advanced drilling and exploration techniques

- Modern ore handling systems

- Potential for automation and remote operations

- Enhanced safety protocols specific to underground PGM mining

- Real-time grade control and blending optimization

These technological elements could establish new benchmarks for the industry, particularly in the transition from open-pit to underground operations.

What Are the Key Takeaways from Valterra's Underground Strategy?

The Mogalakwena underground development demonstrates several important strategic principles:

- Phased Risk Management: The two-phase approach allows for data-driven decision-making and capital discipline

- Resource Optimization: Blending strategies maximize value from varying ore grades

- Operational Flexibility: The ability to scale production based on market conditions enhances resilience

- Long-term Vision: Development planning that spans decades rather than years

- Technological Integration: Leveraging advanced mining industry innovation to enhance productivity

These principles position Valterra to maximize the value of Mogalakwena's exceptional resource base while maintaining operational excellence and environmental responsibility.

FAQs About Mogalakwena's Underground Development

When will trial mining begin at Mogalakwena Underground?

Trial mining is scheduled to commence in late 2026, focusing on extracting ore from the upper portion of the Sandsloot resource.

What production volume is expected from the underground operation?

Initial production is targeted at 2-2.5 million tonnes annually during Phase 1, with potential to increase to 3.6-4.5 million tonnes annually in Phase 2 (beyond 2030).

How does the underground ore grade compare to open-pit operations?

Underground ore grades range from 4-6 g/t, significantly higher than the current open-pit grades of 2.7-3.0 g/t.

Will the underground development replace open-pit operations?

No, the underground development will complement existing open-pit operations, creating blending opportunities and production flexibility rather than replacing current production.

What is the expected lifespan of the Mogalakwena resource?

The total resource has an estimated life of 150 years, with only 14% extracted over the past 30 years.

How will the underground development impact Valterra's cost position?

The higher-grade underground ore, when blended with open-pit material, is expected to maintain or improve Valterra's position in the lower half of the global PGM cost curve.

Environmental and Community Considerations

Valterra's approach to the Mogalakwena underground expansion incorporates substantial environmental and community considerations:

Water Management

The underground operations will implement a closed-loop water management system designed to minimize freshwater consumption and prevent contamination of local water sources. This is particularly important given the mine's location among 64 surrounding villages.

Energy Efficiency

The project design incorporates energy efficiency measures including:

- Variable speed drives on major equipment

- Energy recovery systems from ventilation

- Potential for renewable energy integration

Community Development

As the operation evolves, Valterra has committed to:

- Skills development programs focused on underground mining techniques

- Support for local supply chain development

- Infrastructure improvements benefiting surrounding communities

- Regular stakeholder engagement to address emerging concerns

These elements are critical for maintaining Mogalakwena's social license to operate over its multi-decade development horizon.

Investor Implications

For investors tracking the PGM sector, Mogalakwena's underground development offers several noteworthy implications:

Long-term Value Creation

The 150-year resource life combined with strategic underground development creates a multi-generational asset that can deliver sustained returns across metal price cycles.

Portfolio Diversification

The blending capabilities provide Valterra with operational flexibility that effectively diversifies risk within a single asset, allowing production adjustments in response to changing market conditions.

Capital Efficiency

The phased development approach minimizes upfront capital requirements while providing decision points for optimization based on real operational data rather than theoretical models.

Competitive Differentiation

Few PGM producers globally can match Mogalakwena's combination of scale, grade quality, and operational flexibility, creating potential for sustained competitive advantage.

These factors make the Mogalakwena underground development a significant indicator of future direction not only for Valterra but for the broader PGM industry as it explores mine reclamation strategies and sustainable mining approaches.

Disclaimer: This article contains forward-looking statements about mining development, production forecasts, and market conditions. Such statements involve inherent risks and uncertainties, and actual results may differ materially from those projected. Investors should conduct their own due diligence before making investment decisions based on information contained herein.

Want to Discover the Next Major Mineral Play Before the Market?

Discovery Alert's proprietary Discovery IQ model instantly notifies investors of significant ASX mineral discoveries, providing actionable insights that could lead to substantial returns. Explore how major discoveries have historically generated exceptional market outcomes by visiting the dedicated discoveries page and position yourself ahead of the market.