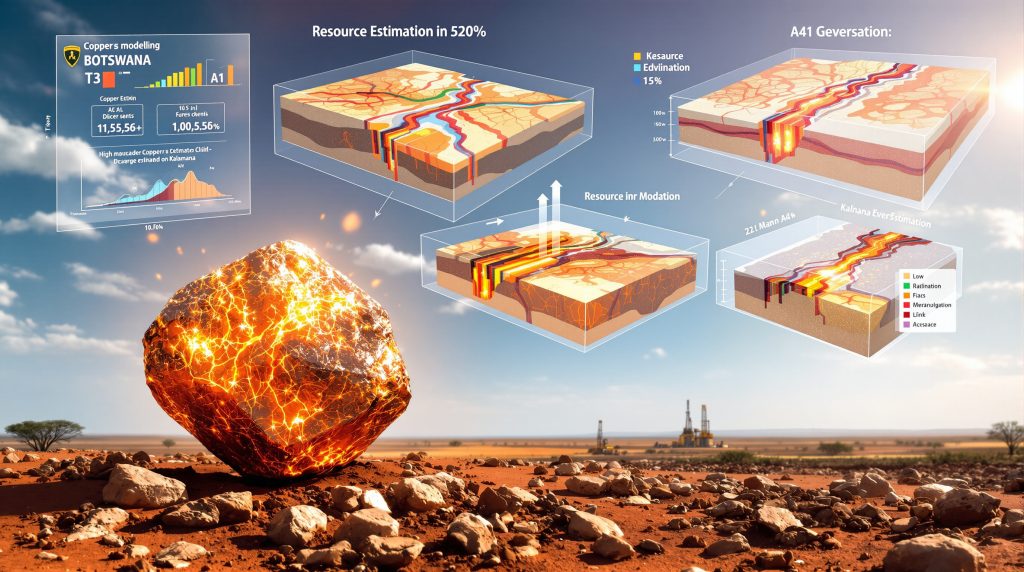

How Has New Geological Data Refined the Motheo Copper Resource?

The Motheo Copper Project in Botswana has undergone significant resource refinement through comprehensive geological investigations and advanced modeling techniques. Sandfire Resources, the project operator, has leveraged cutting-edge technologies to enhance understanding of the T3, A4, and A1 deposits within the Kalahari Copper Belt. The most recent resource update (December 31, 2024) represents a milestone in the project's development, reflecting both mining depletion and improved geological knowledge.

The refined understanding comes from multiple sources, including extensive drilling programs insights, detailed structural analysis, and sophisticated 3D modeling. These efforts have allowed Sandfire to define mineralization boundaries with greater precision, particularly at the critical contact zones between different lithological units where copper mineralization is concentrated.

Key advancements in 3D geological modeling include the integration of multiple data streams – from diamond drill core logging to structural measurements and geophysical surveys – creating a comprehensive framework that better predicts mineralization patterns and guides operational decision-making.

The project represents a significant investment in the emerging Kalahari Copper Belt, a geological province gaining recognition for its copper potential. By applying modern exploration and modeling techniques, Sandfire has been able to mitigate geological uncertainty while identifying new opportunities for resource expansion.

What Are the Latest Resource Estimates for Motheo?

Current Mineral Resource Figures

The consolidated Mineral Resources for the Motheo Copper Project now stand at 59.5 million tonnes at 1.0% copper and 13.6 g/t silver, containing approximately 570,000 tonnes of copper and 26.2 million ounces of silver. These figures reflect a comprehensive assessment of all three deposits – T3, A4, and A1 – as of December 31, 2024.

The resource estimate incorporates all available drilling data, improved geological modeling, and accounts for mining depletion at the T3 deposit, which is currently in production. The slight decrease from previous estimates is primarily attributed to this mining activity and refinements in the geological interpretation at both T3 and A4 deposits.

Updated Ore Reserve Position

The Ore Reserves have been calculated at 42.4 million tonnes at 0.9% copper and 13.5 g/t silver, containing approximately 381,000 tonnes of copper and 18.4 million ounces of silver. These reserves represent the economically extractable portion of the Mineral Resources, taking into account mining methods, metallurgical recoveries, and economic parameters.

The reserve calculation incorporates detailed modern mine planning, operational experience from the active Motheo operations, and the integration of new structural data that has enhanced understanding of mineralization boundaries.

Comparison with Previous Estimates

The resource update shows modest changes from the previous June 2024 estimates, reflecting:

| Parameter | Current Estimate (Dec 2024) | Previous Estimate (June 2024) | Primary Reason for Change |

|---|---|---|---|

| Resource Tonnage | 59.5 Mt | Slightly higher | Mining depletion at T3 |

| Copper Grade | 1.0% | Similar | Maintained through refined modeling |

| Silver Grade | 13.6 g/t | Similar | Maintained through refined modeling |

| Contained Copper | 570,000 tonnes | Higher | Mining depletion and model updates |

| Contained Silver | 26.2 Moz | Higher | Mining depletion and model updates |

Industry analysts note that maintaining grade consistency while accounting for mining depletion demonstrates the robustness of the geological model and suggests potential for future resource growth with additional exploration.

How Has Advanced Geological Modeling Improved Understanding?

Implementation of 3D Structural Analysis

Sandfire has implemented sophisticated 3D modeling tools to develop a comprehensive understanding of the structural controls on mineralization across the Motheo deposits. These advanced techniques have allowed geologists to visualize and interpret complex geological relationships that weren't previously apparent in conventional 2D representations.

The 3D structural analysis has been particularly valuable in identifying fault systems that control the distribution of high-grade mineralization zones. By understanding these controls, mining engineers can better plan extraction sequences to maximize recovery of valuable material while minimizing dilution.

Enhanced Definition of Mineralization Boundaries

One of the most significant improvements from the advanced modeling has been the more precise delineation of mineralization boundaries. The refined geological models have enabled geologists to:

- Identify subtle lithological contacts that influence mineralization

- Map fault offsets that displace ore zones

- Recognize alteration halos that may indicate proximity to higher-grade material

- Define structural corridors where mineralization is concentrated

This improved definition has direct implications for mine planning and grade control, potentially reducing dilution and optimizing extraction strategies. The ability to predict mineralization boundaries with greater confidence translates to more efficient mining operations and improved resource recovery.

Integration of Multiple Data Sources

The modeling process has incorporated an impressive array of data types:

- Core logging data from diamond drilling providing lithological and structural information

- Assay results from both diamond and reverse circulation drilling defining grade distribution

- Structural measurements from oriented core revealing fault orientations and mineralization controls

- Geophysical survey data highlighting subsurface features not apparent in drilling

- Surface mapping information connecting subsurface interpretations to observable features

This multi-disciplinary approach has created a robust geological framework that supports confident resource classification and mine planning decisions. The integration of diverse data streams allows for cross-validation of interpretations, reducing geological uncertainty and improving prediction accuracy.

What Drilling and Sampling Methods Were Used?

Diamond Core Drilling

Diamond drilling has served as the primary method for resource definition at all three Motheo deposits. This technique provides intact core samples that enable:

- Detailed geological logging of lithologies, alteration, and mineralization styles

- Structural analysis of fault orientations, veining, and foliation

- Collection of high-quality samples for assaying with minimal contamination

- Geotechnical assessment of rock strength parameters for mine design

The orientation of core has been particularly valuable for understanding the structural controls on mineralization. By marking the core's orientation before retrieval, geologists can measure the true dip and direction of geological features, providing crucial data for the 3D structural model.

Reverse Circulation Drilling

Reverse circulation (RC) drilling has complemented the diamond drilling program, offering:

- Faster sampling rates for initial exploration targeting

- Cost-effective infill drilling in less structurally complex zones

- Larger sample volumes that can improve representativity for certain mineralization styles

- Minimal sample contamination compared to conventional percussion drilling

While RC drilling provides less geological and structural information than diamond core, it generates representative chip samples suitable for assay and can significantly accelerate the resource definition process when used appropriately.

Quality Control Protocols

All sampling has followed rigorous quality control procedures to ensure data reliability:

- Reference materials insertion: Certified standards with known values inserted at regular intervals

- Field duplicates: Second samples collected from the same interval to assess sampling precision

- Laboratory duplicates: Samples split and analyzed twice to evaluate analytical precision

- Blank samples: Barren material inserted to monitor potential contamination

- Inter-laboratory checks: Selected samples sent to different laboratories to verify accuracy

These protocols create a comprehensive quality assurance framework that ensures the reliability of the data used for resource estimation and provides confidence in the resulting resource figures. The quality control results are regularly reviewed by independent consultants to validate the sampling and analytical processes.

How Were the Resources Estimated?

Estimation Methodology

The resource estimates were developed using industry-standard geostatistical techniques, including:

- Domain definition: Geological boundaries established based on lithology, alteration, and structural features

- Statistical analysis: Distribution of sample data examined within domains to determine appropriate estimation parameters

- Variography: Spatial continuity of mineralization assessed to determine optimal interpolation parameters

- Block modeling: Three-dimensional model created with blocks sized appropriately for the deposit characteristics

- Grade interpolation: Statistical methods applied to estimate grades within blocks based on nearby samples

- Validation: Multiple methods used to confirm the reasonableness of the estimates

This methodical approach ensures that the resource estimates accurately reflect the underlying geology and mineralization patterns. The process incorporates both geological understanding and mathematical rigor to produce reliable results.

Treatment of High-Grade Outliers

High-grade outliers were identified through statistical analysis and managed through appropriate top-cutting or capping to prevent overestimation of metal content. This conservative approach ensures that:

- Isolated high-grade samples don't unduly influence surrounding blocks

- Metal content isn't artificially inflated by non-representative samples

- Resource estimates remain realistic and achievable during mining

The top-cut values were determined separately for each estimation domain based on the specific grade distribution within that domain, rather than applying a single value across the entire deposit.

Validation Procedures

The resource models underwent comprehensive validation, including:

- Visual inspection: Block grades compared with drill hole data on screen to identify any obvious discrepancies

- Statistical comparison: Block estimate statistics compared with input data statistics to ensure reasonable representation

- Swath plots: Averages compared along sections through the deposit to assess local estimation accuracy

- Previous estimates: New model compared with earlier versions to identify and explain significant changes

Technical note: Validation is critical for ensuring resource estimates reflect actual mineralization patterns rather than mathematical artifacts. The multi-faceted validation approach at Motheo provides high confidence in the resource figures.

These validation steps provide confidence in the reliability of the resource estimates and help identify areas where additional data may be required for future updates.

What Economic Parameters Were Applied?

Cut-Off Grade Determination

The resource estimates are based on a 0.3% copper cut-off grade, which represents the minimum grade that could reasonably be extracted economically in an open-pit mining scenario. This cut-off was determined through economic analysis that considered:

- Mining costs based on similar operations in the region

- Processing costs derived from metallurgical testwork and engineering studies

- Metal recoveries established through comprehensive test programs

- Transport, refining, and marketing costs

- Administrative and overhead expenses

The 0.3% copper cut-off represents a conservative approach that ensures material included in the resource estimate has reasonable prospects for eventual economic extraction, as required by international reporting codes.

Price Assumptions

The resource and reserve estimates assume a copper price of US$4.44/lb, which aligns with market forecasts and provides a reasonable basis for economic evaluation. This price assumption:

- Falls within the range of analyst consensus forecasts

- Provides a balance between current spot prices and long-term projections

- Creates a reserve base that remains economic across a range of market conditions

- Aligns with the company's internal strategic planning assumptions

Industry analysts note that the chosen price point reflects a pragmatic approach that neither overstates the resource through aggressive price assumptions nor understates it through excessive conservatism.

Operating Cost Basis

The economic parameters applied to the Ore Reserves are based on actual costs and operating data from the Motheo operations, providing a high level of confidence in their applicability. These parameters include:

- Mining costs: Derived from contractor quotes and operational experience

- Processing costs: Based on actual plant performance and consumption rates

- General and administrative costs: Reflecting current site management expenses

- Metallurgical recoveries: Established through extensive testwork and operational data

- Royalties and fees: Incorporating all applicable government charges and royalties

Using operational data rather than purely theoretical estimates significantly enhances the reliability of the economic assumptions underpinning the reserve calculation.

How Are the Resources Classified?

Classification Criteria

The resources are classified according to industry-standard criteria that consider multiple factors affecting confidence levels:

- Drilling density: Closer-spaced drilling provides higher confidence in geological continuity

- Data quality: Sampling method, recovery, and analytical precision affect reliability

- Geological complexity: Simpler geology allows more confident interpolation between drill holes

- Estimation quality: Statistical measures of estimation reliability influence classification

- Operational experience: Knowledge gained from mining provides insights for classification

This multi-factor approach ensures that classification reflects the true level of confidence in the resource estimate rather than relying solely on arbitrary drilling spacings.

Confidence Levels by Category

The resource classification follows standard industry definitions with three confidence levels:

-

Measured Resources: The highest confidence level, based on close-spaced drilling (typically 25-50m spacing) with high-quality data. These resources have sufficient confidence for detailed mine planning and production scheduling.

-

Indicated Resources: Moderate confidence level, based on wider-spaced drilling (typically 50-100m spacing) but still with good geological understanding. These resources are suitable for preliminary mine planning and reserve conversion with appropriate modifying factors.

-

Inferred Resources: Lower confidence level, based on limited drilling (typically >100m spacing) but with reasonable geological continuity. These resources provide an indication of potential but require additional drilling before detailed planning or reserve conversion.

Current Classification Distribution

The classification distribution across the Motheo deposits reflects their different development stages:

- T3 Deposit: Contains substantial Measured and Indicated Resources due to close-spaced drilling and production experience

- A4 Deposit: Primarily classified as Indicated with some Inferred material at depth and on the margins

- A1 Deposit: Currently classified entirely as Inferred Resource due to the wider drill spacing and early stage of geological understanding

Additional drilling is planned to upgrade portions of the A1 resource to higher confidence categories in the future, potentially adding to the reserve base and extending mine life.

What Is the Significance of the A1 Deposit?

New Discovery Importance

The A1 deposit represents a significant new discovery within the Motheo project area, demonstrating the continued exploration potential of the Kalahari Copper Belt. This deposit adds substantial resources to the overall project and provides several strategic advantages:

- Production pipeline extension: A1 could potentially extend the overall mine life of the Motheo operation

- Operational synergies: Proximity to existing infrastructure allows for cost-effective development

- Geological model validation: Similar mineralization style supports regional exploration models

- Growth narrative: Demonstrates organic growth potential to investors and stakeholders

The discovery of A1 following the successful development of T3 and A4 validates Sandfire's exploration strategy and suggests potential for additional discoveries within their extensive land package.

Geological Characteristics

The A1 deposit shows geological similarities to the T3 and A4 deposits but also exhibits unique characteristics that enhance understanding of the regional mineralization controls. Key geological features include:

- Copper-silver mineralization hosted in similar sedimentary sequences

- Structural controls with some variations from the other deposits

- Comparable alteration signatures suggesting similar mineralization processes

- Nuances in grade distribution that inform regional exploration models

These geological insights from A1 have provided valuable information for targeting additional deposits throughout the broader Kalahari Copper Belt, potentially leading to future discoveries.

Future Development Potential

Sandfire CEO Brendan Harris has indicated that a maiden Ore Reserve for the A1 deposit is targeted for the June 2026 quarter, highlighting the company's confidence in the deposit's economic potential. This timeline suggests a methodical approach to development:

- Current phase: Resource definition drilling and geological interpretation

- Next 12-18 months: Infill drilling to upgrade resource classification

- 2025-2026: Technical studies and reserve calculation

- Post-2026: Potential development decision

The structured approach to A1's development demonstrates Sandfire's disciplined capital allocation strategy while still advancing the growth pipeline for the Motheo operation.

What Exploration Activities Are Ongoing?

Current Drilling Programs

Ongoing drilling programs are pursuing multiple objectives across the Motheo project area:

- Resource definition at the A1 deposit to improve geological understanding and confidence

- Exploration of additional targets identified through regional geological analysis and geophysical surveys

- Infill drilling to upgrade resource classifications and support detailed mine planning

- Sterilization drilling for infrastructure planning to ensure valuable resources aren't covered by waste dumps or facilities

These concurrent programs reflect a balanced approach that addresses both near-term operational needs and longer-term strategic growth.

Regional Exploration Strategy

The broader exploration strategy encompasses Sandfire's extensive Kalahari Copper Belt landholdings, with systematic programs designed to identify additional mineralization centers. The exploration approach includes:

- Target generation: Using geological, geochemical, and geophysical data to identify prospective areas

- Reconnaissance drilling: Testing high-priority targets with wide-spaced holes

- Follow-up programs: Focusing on the most promising results with more detailed investigation

- Resource definition: Converting discoveries to resources through systematic drilling

This methodical approach maximizes the efficiency of exploration expenditure while building a pipeline of potential development opportunities to support the long-term future of the Motheo operation.

Advanced Exploration Technologies

Exploration activities incorporate advanced technologies that enhance targeting effectiveness and efficiency:

- Airborne electromagnetic surveys to identify conductive bodies that may represent sulfide mineralization

- Detailed structural mapping using high-resolution satellite imagery and field verification

- Soil geochemistry programs with low-detection analysis for pathfinder elements

- Machine learning algorithms to identify subtle patterns in multidisciplinary datasets

- 3D inversion modeling of geophysical data to create subsurface targets

These technologies represent the cutting edge of mineral exploration insights, allowing Sandfire to "see through" the cover rocks that obscure much of the Kalahari Copper Belt and identify targets that would be invisible to traditional exploration methods.

How Does This Update Impact Motheo's Future?

Production Implications

The refined resource and reserve estimates provide a solid foundation for ongoing production planning at Motheo. While the slight decrease in overall figures reflects mining depletion, the improved geological understanding enhances confidence in future production forecasts in several ways:

- Better definition of ore boundaries improves grade control and reduces dilution

- Enhanced structural understanding allows more precise blast design and fragmentation control

- More accurate resource models enable optimized mine scheduling and equipment utilization

- Improved confidence supports reliable production forecasting and financial planning

The combination of operational experience and refined geological models creates a virtuous cycle of continuous improvement that should enhance operational performance over time.

Mine Life Considerations

The current resource and reserve base supports a substantial mine life for the Motheo operation, with potential for further extensions through multiple pathways:

- Resource upgrades at the A1 deposit could convert inferred material to reserves

- Depth extensions at the T3 and A4 deposits may add resources below current pit designs

- Additional discoveries within the project area could supplement existing deposits

- Processing optimizations might lower cut-off grades and increase recoverable metal

Industry perspective: Copper projects with established infrastructure and multiple resource centers have significant advantages in terms of development flexibility and capital efficiency. The multi-deposit nature of Motheo provides strategic optionality for production planning and expansion.

The multi-faceted approach to resource growth creates resilience in the mine plan and increases the probability of successful mine life extension.

Strategic Growth Opportunities

Sandfire's CEO has emphasized the growing strength of the Motheo operations and the company's understanding of the Kalahari Copper Belt. With two mines in production (T3 and A4) and a third under study (A1), the company is positioned for continued growth through:

- Operational optimization of existing mines to maximize cash flow

- Staged expansion of processing capacity to accommodate additional ore sources

- Regional consolidation opportunities as a major player in the Kalahari Copper Belt

- Exploration success converting the company's extensive land package into resources

This multi-pronged growth strategy provides investors with clear visibility on the potential for value creation beyond the current resource base.

What Challenges and Opportunities Lie Ahead?

Geological Complexity Management

The complex structural controls on mineralization present both challenges and opportunities for the Motheo operation:

Challenges:

- Fault offsets can create mining complications and potential ore loss

- Variable mineralization thickness affects mining selectivity and dilution

- Structural complexity requires detailed grade control drilling for optimal extraction

- Geological boundaries may not always be visually distinctive during mining

Opportunities:

- Structural traps often host higher-grade mineralization zones

- Advanced modeling allows targeting of these high-grade structural features

- Experience gained from T3 mining improves predictability at A4 and A1

- Complexity creates barriers to entry that benefit established operators with geological expertise

Managing this complexity effectively will be critical to maximizing the value of the Motheo resources. Sandfire's growing geological understanding provides a competitive advantage in this regard.

Resource Growth Potential

Significant opportunities exist for resource growth across multiple dimensions:

- Depth extensions at the T3 deposit where mineralization remains open down-dip

- Lateral extensions at the A4 deposit, particularly along strike to the northeast and southwest

- Resource definition at the A1 deposit, where the current inferred classification suggests substantial upside with additional drilling

- New discoveries within the broader project area, applying the geological understanding gained from the known deposits

The multiple pathways for resource growth reduce the risk profile of the operation and increase the probability of successful mine life extension. Exploration success at any of these targets could significantly impact the project's net present value.

Operational Optimization

The refined geological understanding provides opportunities for operational optimization across several dimensions:

- Improved grade control through better prediction of high-grade zones

- Enhanced mine planning with more accurate geological boundaries

- Optimized processing parameters tailored to specific ore types

- Reduced mining dilution through selective extraction of well-defined ore zones

These operational improvements can potentially enhance project economics without requiring additional capital investment, making them particularly attractive from a return-on-investment perspective.

FAQ: Understanding the Motheo Copper Resource Update

What is the Motheo Copper Project?

The Motheo Copper Project is Sandfire Resources' flagship copper development in the Kalahari Copper Belt of Botswana. It comprises multiple deposits including T3 (currently in production), A4 (in development), and the newly defined A1 deposit (under study). The project represents a significant investment in Botswana's emerging copper sector.

How significant is the resource update?

The update reflects both mining depletion and improved geological understanding, with total Mineral Resources now standing at 59.5 million tonnes containing approximately 570,000 tonnes of copper. While slightly decreased from previous estimates due to mining activity, the improved geological understanding enhances confidence in future production planning.

What exploration techniques were used to refine the resource?

Sandfire employed diamond drilling, reverse circulation drilling, advanced 3D modeling, and comprehensive quality control procedures to enhance geological understanding. The integration of multiple data sources – including core logging, assay results, and structural measurements – created a robust framework for resource estimation.

How does the A1 deposit fit into Motheo's future?

The A1 deposit represents a significant new discovery that could support future production expansion, with a maiden Ore Reserve targeted for the June 2026 quarter. Currently classified as an Inferred Resource, A1 demonstrates the continued exploration potential of the Kalahari Copper Belt and provides a potential pathway for mine life extension.

What economic assumptions underpin the resource estimates?

The estimates assume a copper price of US$4.44/lb and apply a 0.3% copper cut-off grade, reflecting realistic open-pit mining economics based on actual operating data from the Motheo operations. These parameters create a balance between current market conditions and long-term strategic planning.

What is the significance of the Kalahari Copper Belt?

The Kalahari Copper Belt is an emerging copper province with geological similarities to the prolific Central African Copper Belt. Extending for approximately 1,000 kilometers from northeast Botswana to western Namibia, this geological feature hosts numerous copper-silver deposits in sedimentary sequences. The belt remains underexplored compared to other major copper provinces, offering substantial potential for additional discoveries.

Further Exploration:

Readers interested in learning more about copper exploration and development in the Kalahari Copper Belt can also explore related educational content, such as Mining Review Africa's article "New geological data refines Motheo copper resource".

For investors and industry professionals seeking to understand the broader implications of the Motheo resource update, consider examining:

- The geological similarities between the Kalahari and Central African Copper Belts

- The evolving role of advanced modeling technologies in resource definition

- The strategic importance of copper assets in the global copper supply outlook

- Botswana's position as an emerging copper jurisdiction with favorable mining policies

As copper demand continues to grow driven by electrification and renewable energy trends, projects like Motheo with established infrastructure, multiple resource centers, and exploration upside may command premium valuations in the global mining landscape.

Want to Spot the Next Major Mineral Discovery Before the Market Does?

Stay ahead of the market with Discovery Alert's proprietary Discovery IQ model, delivering real-time notifications when significant mineral discoveries are announced on the ASX. Explore how historic discoveries have generated substantial returns by visiting our dedicated discoveries page and begin your 30-day free trial today.