Newmont's Workforce Reduction: Economic Challenges and Industry Impact

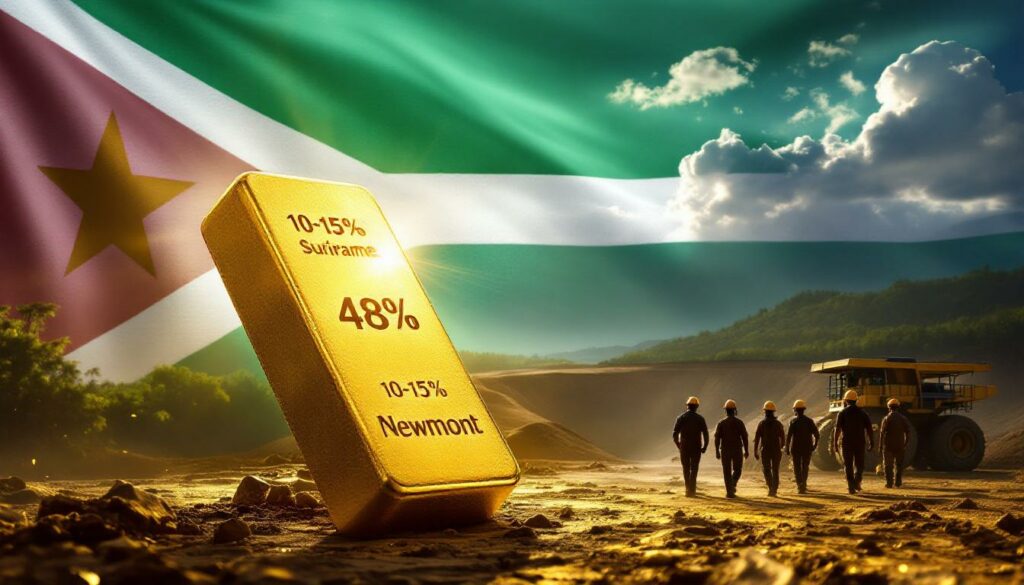

Newmont Corporation's recent announcement to reduce staff at its Merian gold mine in Suriname reflects significant operational challenges facing the world's largest gold producer. The workforce reduction plan, affecting 10-15% of the mine's 1,550 employees, comes amid declining production and increasing pressure to maintain operational viability in a mature mining asset.

What is Happening at Newmont's Merian Mine in Suriname?

Newmont Corporation has announced a significant workforce reduction at its Merian gold mine operation in Suriname. Between 155-233 employees (10-15% of the current workforce) will be laid off as the company adjusts to challenging economic conditions and declining production metrics at the site.

The workforce reduction represents a strategic response to what Newmont describes as increasing pressure on "the long-term sustainability of operation" at the Merian mine. The mine currently employs approximately 1,550 workers, making it a significant employer in the region.

According to Reuters reporting, this staffing adjustment comes as part of broader operational restructuring efforts at the site, which has seen dramatic shifts in production capacity since 2021.

"Since 2021, gold production at Merian has declined 48% while operating costs have fallen by 50%," Newmont stated in its official announcement, highlighting the operational challenges facing the mine.

The timing of this decision aligns with Newmont's global portfolio optimization strategy, which has seen the company making similar adjustments at maturing assets across its worldwide operations.

Why is Newmont Reducing Staff at the Merian Operation?

Production Decline and Economic Challenges

The primary driver behind Newmont's workforce reduction is the mine's significant production decline. Official company statements confirm that gold production at Merian has fallen by a substantial 48% since 2021. This dramatic decrease in output presents fundamental challenges to maintaining previous staffing levels.

Simultaneously, operating costs at the operation have been reduced by 50% during the same period, indicating that Newmont has already implemented substantial efficiency measures before turning to workforce reductions.

This parallel trajectory—48% production decline matched by 50% cost reduction—suggests the company has reached the limits of operational efficiency gains without addressing personnel numbers. The close correlation between these figures indicates a systematic approach to maintaining operational viability through cost management.

Gold Market Context and Operational Sustainability

The workforce reduction must be viewed within the broader context of gold mining economics. Gold prices have shown significant volatility in recent years, requiring producers to maintain strict cost discipline, particularly at mature mining operations where grades typically decline over time.

For Merian specifically, the 48% production decline likely reflects:

- Ore grade deterioration: As mines mature, the highest-grade material is typically extracted first, leaving lower-grade ore that yields less gold per ton processed

- Increasing mining depths: Deeper operations typically increase costs and complexity

- Reserve depletion: Natural progression of mining operations as they approach later stages of their productive life

Industry analysts note that gold producers like Newmont must constantly balance operational costs against production value, especially as mines enter later stages of their life cycle. The decision to reduce staffing typically comes after exhausting other efficiency options.

How Will This Impact the Local Economy and Workforce?

Employment and Community Effects

The announced workforce reduction will directly impact between 155-233 workers based on the 10-15% reduction from the current 1,550 employees. This represents a significant employment shift in Suriname's mining sector, where skilled mining jobs are highly valued.

Mining operations like Merian typically create extensive economic multiplier effects in local economies through:

- Direct employment (now being reduced)

- Local supplier contracts and services

- Induced economic activity from employee spending

- Tax and royalty payments to local and national governments

The specialized nature of mining employment may create challenges for displaced workers seeking similar positions within Suriname's economy. Many roles at modern gold mining stocks operations require technical training and certifications that may not transfer easily to other sectors.

Regional Mining Industry Implications

Suriname's economy has historically relied heavily on natural resource extraction, with gold mining representing a cornerstone industry. The country ranks among significant gold producers in South America, making employment trends at operations like Merian particularly consequential.

This workforce reduction follows patterns seen elsewhere in Latin America, where major gold producers have implemented similar efficiency measures at maturing assets. The mining sector in Suriname has experienced cyclical employment patterns, though the specialized workforce developed through operations like Merian represents valuable human capital for the country's resources sector.

For workers with transferable skills, opportunities may exist at other mining operations in the region, though relocation presents its own challenges. The industry has seen increasing competition for experienced mining professionals, particularly those with technical specializations in modern mining methods.

What Does This Mean for Newmont's Global Operations?

Corporate Strategy and Portfolio Management

Newmont's decision at Merian reflects the company's broader approach to portfolio optimization following its acquisition of Goldcorp in 2019 and more recently, Newcrest Mining. As the world's largest gold producer, Newmont continually evaluates asset performance against corporate benchmarks for returns and operational efficiency.

Within Newmont's global portfolio, South American operations represent an important production region, though one facing increasing challenges from maturing assets, regulatory complexities, and varying political landscapes. The Merian reduction appears to align with Newmont's stated strategy of focusing capital and resources on tier-one assets with longer production horizons.

Industry analysts typically categorize gold mining assets along several performance metrics:

| Asset Classification | Annual Production | Mine Life | All-in Sustaining Cost |

|---|---|---|---|

| Tier 1 | >500,000 oz | >10 years | Bottom quartile |

| Tier 2 | 250,000-500,000 oz | 5-10 years | Second quartile |

| Tier 3 | <250,000 oz | <5 years | Higher cost quartiles |

Merian's 48% production decline suggests it may be transitioning between these asset classification guide tiers, potentially explaining the operational restructuring.

Financial Performance Indicators

For Newmont, workforce reductions at operations like Merian represent efforts to maintain competitive cost profiles across their global portfolio. Gold mining investors closely track metrics like:

- All-in sustaining costs (AISC) per ounce of gold produced

- Free cash flow generation at various gold price points

- Production guidance adherence and consistency

- Reserve replacement ratio indicating future production potential

The 50% operating cost reduction at Merian since 2021 demonstrates Newmont's focus on maintaining cost discipline despite production challenges. However, workforce reductions typically come after other efficiency measures have been implemented, suggesting limited further optimization potential without addressing personnel numbers.

How Does This Compare to Industry Trends in Gold Mining?

Global Gold Mining Workforce Patterns

Newmont's staffing reduction at Merian mirrors similar adjustments across the gold mining sector, particularly at operations facing production declines. Industry benchmarks suggest workforce optimization becomes increasingly critical as mines mature and production economics change.

Several factors are reshaping employment patterns across the gold market outlook industry:

- Technological adoption: Increased automation reducing workforce requirements while improving safety and efficiency

- Operational maturity: Natural staffing adjustments as mines progress through their life cycles

- Cost pressures: Industry-wide focus on maintaining competitive cost structures

- Skills evolution: Changing workforce needs as mining methods and technologies advance

Major gold producers have increasingly focused on "lean operations" that maximize productivity per employee while maintaining safety standards and production targets. This trend has accelerated as digital technologies, automation, and remote operations become more prevalent.

Production Efficiency Metrics in Gold Mining

Gold mining efficiency is typically measured through several key metrics that Newmont and its peers use to benchmark operational performance:

- Ounces produced per employee: A fundamental productivity measure

- Tons moved per hour/shift: Measuring mining efficiency

- Recovery rates: Percentage of gold successfully extracted from processed ore

- Energy efficiency: Power consumption per ounce produced

- Equipment utilization: Maximizing return on capital-intensive mining fleet

The industry has established that personnel costs typically represent 30-40% of total operating expenses at most gold mining operations, making workforce optimization a natural focus area when addressing cost challenges in declining production environments.

What Are the Long-Term Prospects for Merian Mine?

Future Operational Outlook

The substantial production decline at Merian (48% since 2021) raises questions about the operation's long-term viability. While Newmont has not publicly disclosed updated reserve figures or mine life projections in this announcement, the workforce reduction suggests a recalibration of operational expectations.

For maturing gold mines like Merian, several pathways typically emerge:

- Exploration success: Discovering new mineralization to extend mine life

- Process optimization: Extracting more value from existing resources

- Operational downsizing: Adjusting scale to match remaining economic reserves

- Eventual closure and rehabilitation: Implementing progressive mine closure

The workforce reduction suggests Merian may be following the operational downsizing pathway, though exploration potential always exists in geologically prospective areas. Gold mining operations frequently discover satellite deposits that can extend production timelines.

Sustainability and Closure Planning

As mining operations mature, environmental management and community transition planning become increasingly important. Modern mining companies typically implement:

- Progressive rehabilitation: Restoring mined areas concurrently with ongoing operations

- Community transition programs: Preparing local economies for eventual mine closure

- Environmental monitoring: Ensuring long-term stability of reclaimed areas

- Alternative economic development: Supporting diversification in mining-dependent communities

Industry best practice: Responsible mining companies begin planning for eventual closure from the earliest stages of mine development, with detailed closure plans that are regularly updated throughout the mine's operational life.

For Newmont, the workforce reduction at Merian likely represents an intermediate step in the operation's evolution rather than immediate closure planning. However, it does signal the need for stakeholders to consider longer-term transition strategies for the operation and surrounding communities.

FAQ: Newmont's Merian Mine Workforce Reduction

Q: When will the layoffs at Merian mine take effect?

Newmont has announced the workforce reduction plan but has not specified an exact implementation timeline in their initial statement. Mining companies typically phase such reductions over several months to maintain operational continuity and allow for proper transition planning.

Q: What percentage of Newmont's global workforce does this reduction represent?

The 155-233 affected employees represent a small fraction of Newmont's global workforce, which numbers in the tens of thousands across operations on multiple continents. However, the impact is significant for the Merian operation specifically and the local Suriname mining sector.

Q: Are there other Newmont operations facing similar workforce reductions?

While Newmont regularly evaluates operational efficiency across its portfolio, this announcement specifically addresses the Merian operation in Suriname based on its particular production challenges. As a global operator, Newmont continually optimizes staffing across its operations based on individual mine performance metrics.

Q: How does Merian's production decline compare to other gold mines of similar age?

A 48% production decline over a four-year period is significant but not unprecedented for maturing gold operations, particularly as higher-grade zones are depleted and mining moves to lower-grade areas. The rate of decline varies considerably based on deposit type, mining method, and ore body characteristics.

Q: What support will be provided to affected employees?

Newmont has not detailed specific transition support programs in their announcement, though major mining companies typically provide severance packages and transition assistance during significant workforce reductions. Industry standards include outplacement services, retraining opportunities, and priority consideration for positions at other company operations.

Key Considerations for Mining Industry Observers

Industry Trend Alert: Newmont's workforce reduction at Merian reflects a broader pattern of operational streamlining across mature gold mining assets globally, as companies focus on maintaining profitability amid fluctuating gold market surge and rising production costs.

Economic Context: The parallel decline in both production (48%) and operating costs (50%) suggests Newmont has been actively managing operational efficiency, but has reached a point where workforce reduction became necessary for continued viability.

Future Outlook: Mining operations typically follow production curves that eventually decline as deposits are depleted. Merian's significant production reduction may signal the mine is entering a later stage of its operational life cycle.

Mining companies must balance operational efficiency with social responsibility, particularly in regions where they represent significant employers. The workforce reduction at Merian highlights the inherent challenges in managing mining assets through their full life cycle, from development through production and eventually toward closure.

For investors, such workforce adjustments typically signal efforts to maintain cost discipline, though they also raise questions about future production profiles and reserve replacement strategies. Gold mining remains a cyclical industry where operational adjustments are an expected part of asset management.

Ultimately, the sustainability of mining operations depends on their ability to adapt to changing economic conditions, ore characteristics, and market environments. Newmont's actions at Merian demonstrate this ongoing optimization process that defines modern mining management.

Ready to Get Ahead of Major Mining Discoveries?

Discovery Alert's proprietary Discovery IQ model provides real-time notifications on significant ASX mineral discoveries, transforming complex data into actionable investment opportunities before the broader market catches on. Visit our discoveries page to see how historic mineral discoveries have delivered exceptional returns and start your 30-day free trial today.