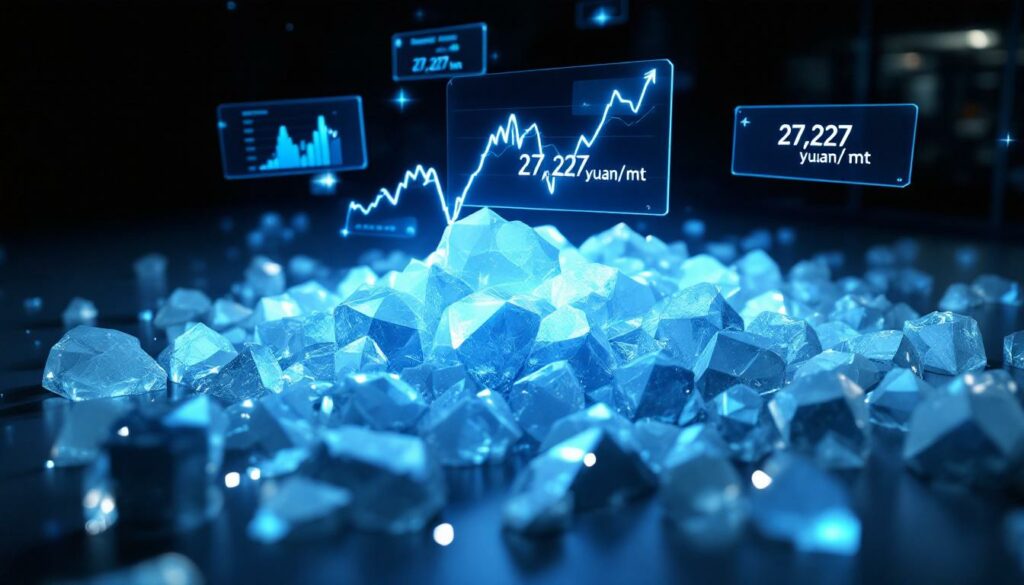

Understanding Current Nickel Sulphate Price Dynamics

In today's battery materials market, nickel sulphate prices have entered a period of notable stability amid complex market forces. The current SMM battery-grade nickel sulphate price index stands at 27,227 yuan/mt, with quotations ranging between 27,200-27,640 yuan/mt. This stability reflects a delicate balance between cost pressures and tepid demand in the battery materials supply chain.

"Despite LME nickel's recent rebound amid broader nonferrous metal gains, nickel sulphate prices remain in the doldrums," notes the SMM Nickel Research Group in their July 11, 2025 market review. While immediate nickel salt production costs have shown some upward movement, this hasn't significantly disrupted market equilibrium.

Battery manufacturers and materials traders should understand that this price stability masks underlying volatility in raw material markets. The London Metal Exchange (LME) nickel price fluctuations serve as an early indicator of potential cost pressures, though these haven't yet translated to significant battery metals investment price movements due to weak downstream demand.

Battery-Grade Nickel Sulphate Price Index Analysis

The current price index of 27,227 yuan/mt represents a carefully negotiated middle ground in the market. With quotations narrowly ranging between 27,200-27,640 yuan/mt, producers and buyers appear to have reached a temporary consensus on valuation.

Key price characteristics:

- Stable day-to-day average pricing

- Narrow trading range (440 yuan spread)

- Resistance to LME nickel price volatility

- Maintenance of battery-grade premium over industrial grades

This price stability comes despite the usual correlation between LME nickel and battery-grade sulphate prices, suggesting that market-specific dynamics are currently outweighing broader commodity trends.

Cost Factors Influencing Pricing

Several interconnected factors are currently influencing nickel sulphate production costs and market prices:

-

LME nickel price movements – Recent rebounds in LME nickel have created modest upward pressure on raw material costs, though these haven't fully translated to sulphate prices.

-

Production cost dynamics – According to SMM data, immediate nickel salt production costs have shown some rebound, though the overall impact remains contained.

-

Refining premiums – Battery-grade material commands a significant premium over industrial grades due to the stringent purity requirements for EV battery applications (99.9%+ purity).

-

Energy and acid costs – Production requires substantial energy inputs and sulfuric acid, both subject to their own market dynamics.

Despite recent cost increases, nickel sulphate prices remain in lower historical ranges. The SMM Nickel Research Group notes that even with the modest rebound in LME prices, "nickel prices remain in the doldrums recently," indicating that we're still observing pricing well below peak levels.

How Is Supply Affecting Nickel Sulphate Markets?

The supply side of the nickel sulphate equation reveals a strategic balancing act by producers attempting to maintain price stability amid challenging demand conditions. Current market dynamics show a carefully managed approach to production and inventory management.

"Smelters maintained the same quotation levels as yesterday, while partial producers raised prices recently," reports SMM, highlighting the mixed strategies employed by suppliers attempting to defend price levels. However, these efforts face significant headwinds as "weak buyer demand resulted in limited transactions," creating a challenging environment for meaningful price increases.

Smelter Production Strategies

Nickel sulphate producers are demonstrating remarkable pricing discipline despite demand challenges. Their current strategies include:

-

Quotation consistency – Major producers have maintained stable price levels despite cost pressures, indicating a preference for volume stability over margin growth.

-

Selective price adjustments – Some manufacturers have attempted upward price movements, testing market receptiveness to higher valuations.

-

Transaction flexibility – Despite published quotations, actual transaction prices often reflect negotiated discounts for volume buyers, creating a two-tier pricing reality.

-

Output management – Production curtailment rather than price reduction has become the preferred strategy for maintaining market balance.

This producer behavior suggests a collective effort to establish a price floor, though the effectiveness remains challenged by persistent demand weakness.

Inventory and Production Levels

Current inventory management practices reveal much about market sentiment and future price expectations:

-

Reduced stock levels – According to SMM analysis, inventories are being "maintained at lower levels," indicating cautious production planning.

-

Production discipline – Facilities operating at "reduced operational capacity" reflect a strategic pullback rather than maximizing output.

-

Supply chain adjustments – The reduction in available material creates potential for rapid price responses when demand eventually recovers.

This deliberate inventory management approach demonstrates that producers are prioritizing price stability over volume growth, creating a foundation for potential future price recovery once demand improves.

What's Happening with Nickel Sulphate Demand?

The demand side presents perhaps the most significant challenge to market balance, with multiple indicators pointing to subdued buyer activity. Current purchasing patterns reveal a market in waiting rather than active procurement.

"Although some producers have initiated purchases, market procurement enthusiasm remains subdued as the purchasing period has not yet arrived," notes SMM's analysis, highlighting both the cyclical nature of the market and the current position in that cycle.

Buyer Behavior Analysis

Purchasing patterns reveal several important market dynamics:

-

Limited engagement – Despite some signs of renewed activity, overall buyer participation remains constrained.

-

Strategic postponement – Buyers appear to be delaying major purchases in anticipation of either price decreases or improved visibility into their own production requirements.

-

Cycle positioning – The current market position outside the typical purchasing cycle suggests potential for increased activity in coming weeks, though timing remains uncertain.

-

Price sensitivity – Transaction volumes indicate heightened buyer price sensitivity, with purchases occurring primarily at the lower end of the quotation range.

This buying behavior reflects a market where downstream customers maintain significant negotiating leverage due to their ability to postpone purchases without immediate production consequences.

Downstream Industry Impact

The battery manufacturing ecosystem's current conditions provide important context for nickel sulphate demand patterns:

-

Battery production adjustments – Reduced cell manufacturing schedules have directly impacted material procurement timelines.

-

EV sales correlation – Electric vehicle production slowdowns have created ripple effects throughout the battery materials supply chain.

-

Inventory optimization – Battery manufacturers appear to be working through existing material stocks before initiating new procurement cycles.

-

Energy storage influences – The growing energy storage sector provides some demand offset, though not enough to compensate for EV-related slowdowns.

These interconnected factors create a demand environment where recovery depends not just on nickel prices but on improved conditions throughout the electric vehicle ecosystem.

What Are the Short-Term Price Forecasts?

Despite various market pressures, nickel sulphate prices appear set to maintain their current trajectory in the near term. Market analysts and industry indicators point to continued range-bound trading within established parameters.

"Despite sustained price support from nickel salt smelters, nickel sulphate prices are expected to remain rangebound at low levels… due to declining production costs and weak downstream demand," concludes the SMM analysis, providing a clear perspective on the balance of market forces.

Market Expert Predictions

Expert forecasts for nickel sulphate point to continued stability:

-

Range expectations – Prices likely to remain within the current 27,200-27,640 yuan/mt band, with resistance to both significant increases and decreases.

-

Support factors – Producer price maintenance efforts create an effective floor, preventing rapid declines despite demand weakness.

-

Limiting factors – A combination of "declining production costs and weak downstream demand" creates strong resistance to upward price movements.

-

Cyclical considerations – The approaching purchasing cycle may provide temporary support, though not necessarily sustained price increases.

This balance of factors creates a market environment where dramatic price moves appear unlikely in either direction without significant changes to underlying conditions.

Technical Market Indicators

Several technical metrics reinforce the range-bound forecast:

-

Resistance level analysis – The upper boundary around 27,640 yuan/mt has proven difficult to breach despite some producer attempts.

-

Support level durability – The lower threshold near 27,200 yuan/mt has demonstrated resilience, creating an effective price floor.

-

Volume trends – Reduced trading activity suggests limited momentum for price breakouts in either direction.

-

Cost-price relationship – The narrowing gap between production costs and market prices creates natural resistance to further declines.

These technical factors, combined with fundamental market conditions, reinforce expectations for continued price stability in the immediate term.

How Do Global Factors Impact Nickel Sulphate Markets?

The nickel sulphate market operates within a complex global ecosystem, with multiple international factors influencing local price dynamics. While domestic Chinese factors remain paramount, global considerations continue to shape market fundamentals.

Market Insight: The relationship between LME nickel and battery-grade sulphate prices has weakened in recent months as domestic Chinese factors increasingly drive price formation independent of global benchmarks.

International Market Influences

Several global factors currently impact the nickel sulphate market:

-

LME nickel pricing – Global nickel trading patterns create baseline cost structures, though the correlation has weakened in recent months.

-

Indonesian export policies – As the world's largest nickel producer, Indonesia's resource nationalism policies continue to shape global supply chains.

-

International shipping costs – Logistics expenses for precursor materials impact overall production costs, particularly for imported raw materials.

-

Alternative sourcing development – Efforts to develop new nickel-copper project sites outside traditional supply regions introduce uncertainty into long-term supply forecasts.

These international dynamics create a complex backdrop against which domestic market forces operate, sometimes reinforcing and sometimes counteracting local trends.

Regulatory and Environmental Considerations

Evolving standards and policies add another layer of complexity to market dynamics:

-

Battery material traceability – Emerging requirements for material provenance documentation create compliance costs throughout the supply chain.

-

Carbon footprint metrics – Growing emphasis on emissions profiles impacts production methods and sourcing decisions.

-

Government incentive programs – EV subsidy structures in major markets indirectly influence battery material demand and pricing.

-

Resource development policies – National strategies regarding critical minerals policy affect investment patterns and long-term supply outlooks.

These regulatory factors create a constantly evolving landscape that market participants must navigate alongside traditional supply-demand considerations.

What Should Industry Participants Monitor?

For stakeholders throughout the nickel sulphate value chain, several key indicators warrant close attention as potential early warning signs of market shifts.

Key Market Indicators to Watch

Industry participants should monitor:

-

Production cost trends – Shifts in raw material, energy, or acid costs can signal coming price pressures.

-

Downstream demand signals – Electric vehicle production announcements and battery factory utilization rates provide forward demand indicators.

-

Inventory level changes – Unexpected builds or drawdowns often precede price movements.

-

Purchasing cycle timing – Historical patterns suggest potential upcoming demand increases as the typical procurement cycle approaches.

-

LME nickel price divergence – Unusual gaps between LME and sulphate prices may indicate market dislocations.

These metrics provide valuable early warnings of potential market direction changes, allowing proactive adjustment of procurement or sales strategies.

Strategic Considerations for Market Players

Different market participants face distinct strategic challenges:

For buyers:

- Optimal purchasing timing depends on balancing inventory costs against price movement risks

- Contract structures should incorporate flexibility for market volatility

- Diversification of supply sources provides both price and availability security

For producers:

- Production scheduling must balance fixed costs against market demand

- Pricing strategy requires careful positioning within established ranges

- Inventory management represents a critical tool for market stabilization

For traders:

- Arbitrage opportunities exist between different geographical markets

- Timing spread between physical and paper markets creates potential value

- Risk management requires sophisticated understanding of market correlations

These strategic considerations highlight the importance of market intelligence and relationship networks in navigating the current environment.

FAQ: Nickel Sulphate Market Questions

What factors most significantly impact nickel sulphate pricing?

Production costs, downstream demand from battery manufacturers, and broader nickel market trends typically exert the strongest influence on nickel sulphate pricing. Recent market data from SMM shows production costs and weak buyer demand as primary current drivers. The LME nickel price creates a baseline cost structure, though the correlation has weakened in recent months as domestic Chinese factors increasingly drive price formation.

"Despite LME nickel's rebound amid broader nonferrous metal gains, nickel prices remain in the doldrums recently," reports SMM, highlighting how global benchmarks provide context but don't fully determine local pricing.

How does the electric vehicle market affect nickel sulphate demand?

Electric vehicle production directly influences battery manufacturing volumes, which in turn determines nickel sulphate demand. Current market conditions reflect this relationship, with SMM noting that "weak downstream demand" is a key factor in price stability despite cost increases. The cyclical nature of battery production creates predictable demand patterns, though recent slowdowns in EV growth have disrupted traditional cycles.

Market analysts observe that EV production forecasts serve as leading indicators for future nickel sulphate price movements, with procurement cycles typically preceding major production ramps by 2-3 months.

What's the relationship between LME nickel prices and nickel sulphate?

While LME nickel prices provide a baseline for raw material costs, nickel sulphate commands a premium based on processing costs and battery-grade purity requirements. This premium typically ranges from 10-15% above underlying nickel values, though it can compress during periods of weak demand.

Recent data shows that despite some LME price rebounds, this hasn't fully translated to nickel sulphate price increases due to weak demand. As SMM notes, "LME nickel prices rebounded yesterday amid broad nonferrous metal gains," yet sulphate prices remained stable, demonstrating the decoupling effect of local market conditions.

How do seasonal factors affect nickel sulphate markets?

The market typically experiences cyclical purchasing periods throughout the year, aligned with battery and EV production schedules. Current analysis from SMM suggests the market is currently outside a major buying cycle, noting that "market procurement enthusiasm remains subdued as the purchasing period has not yet arrived."

This cyclicality creates predictable patterns of inventory building and drawdowns, though these can be disrupted by unexpected changes in end-market demand or supply chain disruptions. Strategic buyers often time major purchases to coincide with seasonal lows, while producers may adjust production schedules to align with anticipated demand peaks.

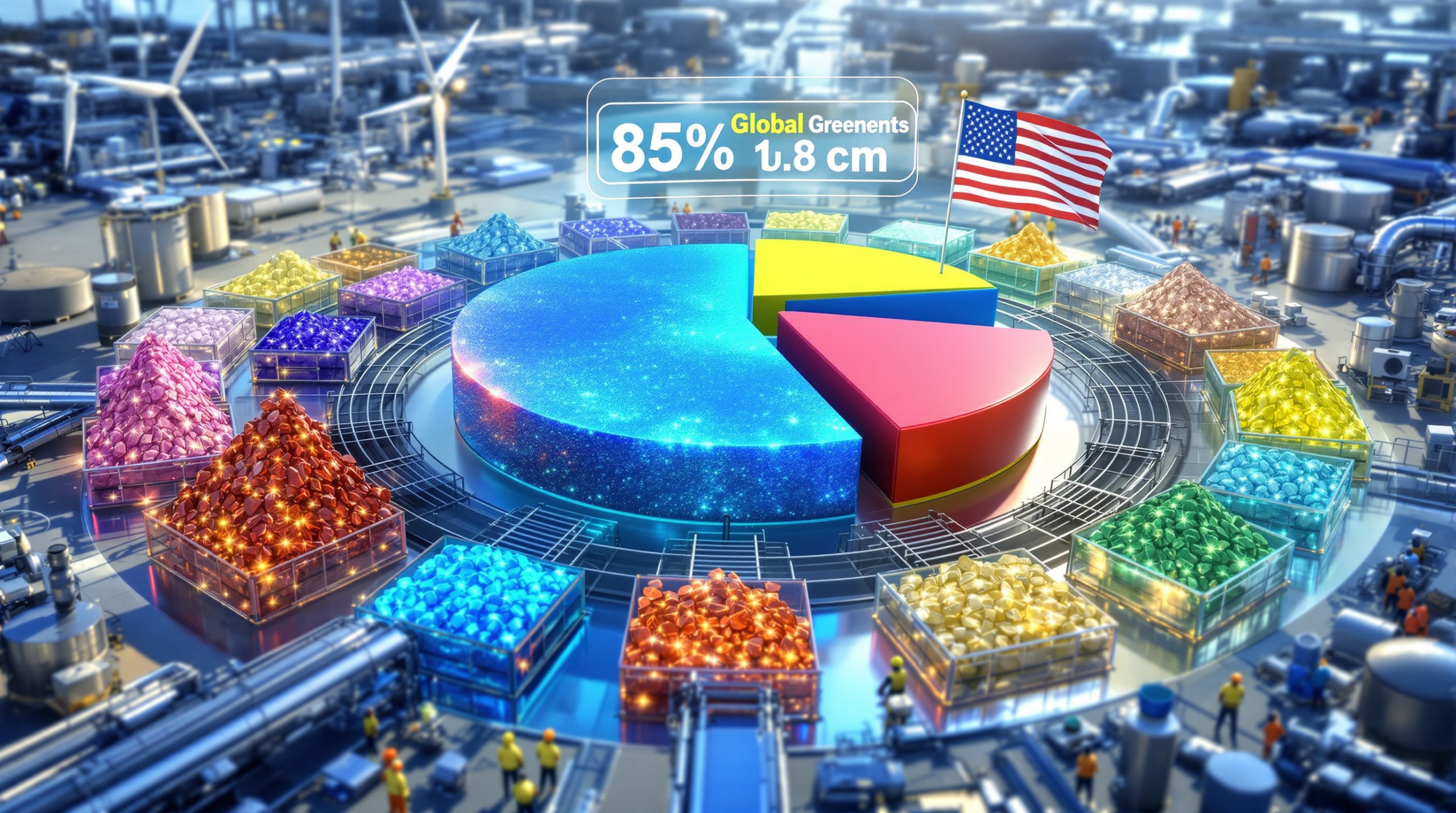

Comparative Analysis: Nickel Sulphate vs. Other Battery Materials

The relative performance of different battery materials provides important context for nickel sulphate's market position and outlook.

| Material | Current Price Range (Yuan/mt) | Recent Price Trend | Primary Application | Supply Outlook |

|---|---|---|---|---|

| Nickel Sulphate (Battery-Grade) | 27,200-27,640 | Stable | High-energy density cathodes | Range-bound at lower levels |

| Lithium Carbonate | 123,500-125,000 | Declining | Cathode material | Oversupply through 2026 |

| Cobalt Sulphate | 55,000-58,000 | Moderately rising | Cathode stability | Tight due to mining constraints |

| Manganese Sulphate | 6,800-7,200 | Stable | Lower-cost cathodes | Abundant supply |

Market Insight: Despite production cost pressures, nickel sulphate producers have maintained price stability through controlled output and inventory management, creating a delicate balance in the current market environment.

This comparative analysis reveals that nickel sulphate occupies a middle position in the battery materials spectrum – neither experiencing the dramatic price declines of lithium compounds nor the tightness of cobalt markets. This positioning reflects nickel's growing but not yet dominant role in battery chemistries, as manufacturers continue to balance performance requirements against material costs.

For industry participants, this comparison highlights the importance of understanding cross-material substitution potential and the evolving critical minerals transition preferences of major battery manufacturers, as these shifts can dramatically impact individual material demand projections and price trajectories. Furthermore, emerging technologies like battery recycling breakthrough initiatives could significantly alter supply-demand balances in the coming years.

Ready to Capitalise on the Next Mineral Discovery?

Stay ahead of the market with Discovery Alert's proprietary Discovery IQ model that instantly identifies significant ASX mineral discoveries and transforms complex data into actionable insights. Explore historic returns from major discoveries on our dedicated discoveries page and begin your 30-day free trial today.