Strategic Free-Peg Acquisition of Nico Young Creates Major Battery Metals Opportunity

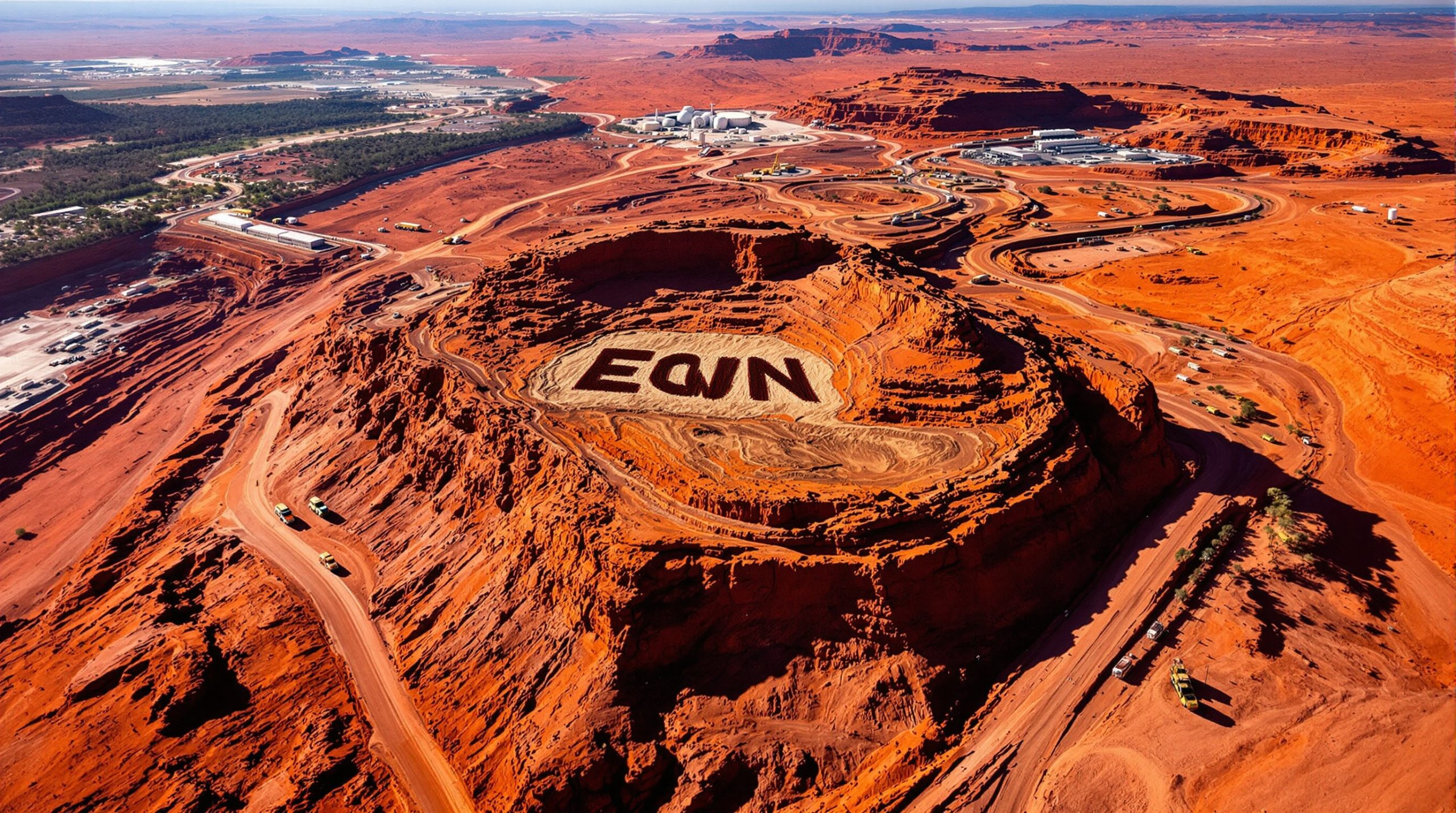

In a significant counter-cyclical move, Legacy Minerals (ASX: LGM) has secured an Exploration Licence Application over the Nico Young nickel-cobalt deposit in NSW, positioning itself to capitalize on what is one of Australia's largest nickel resources—all at zero acquisition cost.

The deposit contains a substantial JORC 2012 compliant resource of 167.8 million tonnes at 0.59% nickel and 0.06% cobalt, translating to approximately 996,700 tonnes of contained nickel and 96,600 tonnes of cobalt. This strategic acquisition came after the administrator of Jervois Global Limited (in liquidation) relinquished the exploration licence, creating an opportunity for Legacy to acquire this nationally significant deposit through Exploration Licence application ELA6901.

"A free-peg, representing a zero-dollar acquisition cost, of a near 1-million tonne, nationally significant, JORC 2012 compliant, nickel-cobalt deposit is a great, long-term opportunity for our shareholders," said Legacy Minerals CEO Christopher Byrne. "Securing an exploration license application over the Nico Young Nickel-Cobalt Project represents a highly strategic, counter-cyclical move with immense upside."

Understanding Lateritic Nickel Deposits: Key to Nico Young's Value

The Nico Young deposit is a lateritic nickel resource—a geological formation created through the weathering of nickel-rich serpentinite rocks. During this weathering process, nickel and cobalt become concentrated in clay-rich layers as they're leached from the parent rock.

Lateritic nickel deposits like Nico Young typically feature a layered profile with:

- Hematitic and limonitic clay in upper layers, often containing scandium

- Nickel and cobalt enrichment concentrated in the saprolite and weathered serpentinite layers

- Near-surface mineralisation making them amenable to open-pit mining

Unlike sulphide deposits that require underground mining, lateritic deposits can be processed through various methods, with heap leaching proving particularly effective for Nico Young's ore type. Previous test work conducted by Jervois demonstrated extraction rates of 75-80% for both nickel and cobalt, with scandium extraction exceeding 80%.

This geological profile makes Nico Young particularly valuable as a potential low-cost, open-pit mining operation with established processing pathways.

Strategic Positioning in the Battery Metals Landscape

The Nico Young deposit places Legacy Minerals in elite company among Australia's critical minerals players. The deposit is one of four major nickel-cobalt/scandium deposits in central NSW, alongside:

| Project | Company | Resource Highlights |

|---|---|---|

| Nico Young | Legacy Minerals (ASX: LGM) | 167.8Mt @ 0.59% Ni, 0.06% Co |

| Sunrise | Sunrise Energy Metals (ASX: SRL) | 160Mt @ 0.56% Ni, 0.09% Co, 71ppm Sc |

| Platina | Rio Tinto (ASX: RIO) | Undisclosed |

| Melrose | Rimfire (ASX: RIM) | Undisclosed |

Legacy's timing is particularly notable given current nickel market conditions. Nickel prices are at cyclical lows due to oversupply from Chinese-owned refineries in Indonesia. By acquiring this asset counter-cyclically, Legacy positions itself to benefit from eventual market recovery while minimising holding costs.

The deposit's strategic location approximately 300 kilometres west of Wollongong and Sydney ports, with proximity to the Cooper Basin gas pipeline, rail, and major highways, further enhances its long-term development potential.

Leveraging Extensive Previous Development Work

The acquisition allows Legacy to capitalise on more than $25 million in previous development work carried out by Jervois Global, including:

- Multiple drilling campaigns establishing a robust resource estimate

- Metallurgical testing confirming viable extraction methods

- Extensive environmental studies

- Process development work exploring multiple extraction pathways

This previous investment dramatically reduces Legacy's initial assessment costs and accelerates potential project advancement. The deposit comes with no liabilities, encumbrances, or private royalties—providing Legacy with exceptional optionality and leverage to future nickel and cobalt price recoveries.

Future Plans and Value Creation Strategy

Legacy Minerals has outlined a clear strategy to maximise shareholder value from this acquisition:

-

Seek Strategic Partnerships: The company is actively looking to secure a partner for the project, leveraging its status as one of Australia's largest nickel deposits to attract national and international parties seeking strategic critical minerals exposure.

-

Minimise Holding Costs: Legacy will preserve the asset with minimal expenditure, funded from existing cash reserves, until market conditions improve.

-

Maintain Core Focus: The Drake, Thomson, and Black Range Projects remain the company's core focus, supported by joint ventures with Newmont, S2 Resources, Helix, and EarthAi.

-

Review Enhancement Opportunities: Desktop studies will assess the potential for scandium and platinum group elements that may enhance the deposit's overall value.

The company's disciplined approach balances maintaining its gold-copper exploration focus while strategically positioning for future battery metals demand.

Why Investors Should Take Note

Legacy Minerals' acquisition of Nico Young represents a compelling investment case for several reasons:

-

Zero-Cost Entry into Critical Minerals: The company has secured a major nickel-cobalt resource without upfront acquisition costs, creating immediate shareholder value.

-

Substantial Resource Scale: With nearly 1 million tonnes of contained nickel and close to 100,000 tonnes of cobalt, Nico Young ranks among Australia's largest nickel deposits.

-

Counter-Cyclical Timing: The acquisition comes when nickel prices are depressed, positioning Legacy to benefit from any future market recovery.

-

Diversified Portfolio: The addition of Nico Young creates a balanced portfolio of precious metals (gold, silver) and critical battery metals (nickel, cobalt, copper) exposures.

-

Low-Risk Strategy: By leveraging existing work and minimising holding costs, Legacy has structured a low-risk approach to maintaining this strategic asset.

The company's multi-commodity, multi-project approach—now spanning gold, copper, silver, nickel, and cobalt—provides shareholders with exposure to both near-term exploration catalysts and long-term strategic mineral resources essential for the energy transition.

Legacy Minerals has positioned itself at an inflection point in the critical minerals space, adding substantial resource-backed value while maintaining disciplined capital allocation and exploration focus.

Want to Capitalise on This Opportunistic Nickel-Cobalt Acquisition?

Discover how Legacy Minerals has strategically secured one of Australia's largest nickel resources at zero acquisition cost, positioning shareholders for significant long-term value. With nearly 1 million tonnes of contained nickel and 96,600 tonnes of cobalt in a JORC-compliant resource, this counter-cyclical move adds substantial asset value while the company maintains its core exploration focus. For more information about Legacy Minerals and its expanding portfolio of precious and battery metals projects, visit www.legacyminerals.com.au.