What Is Causing the Current Oil Market Shift?

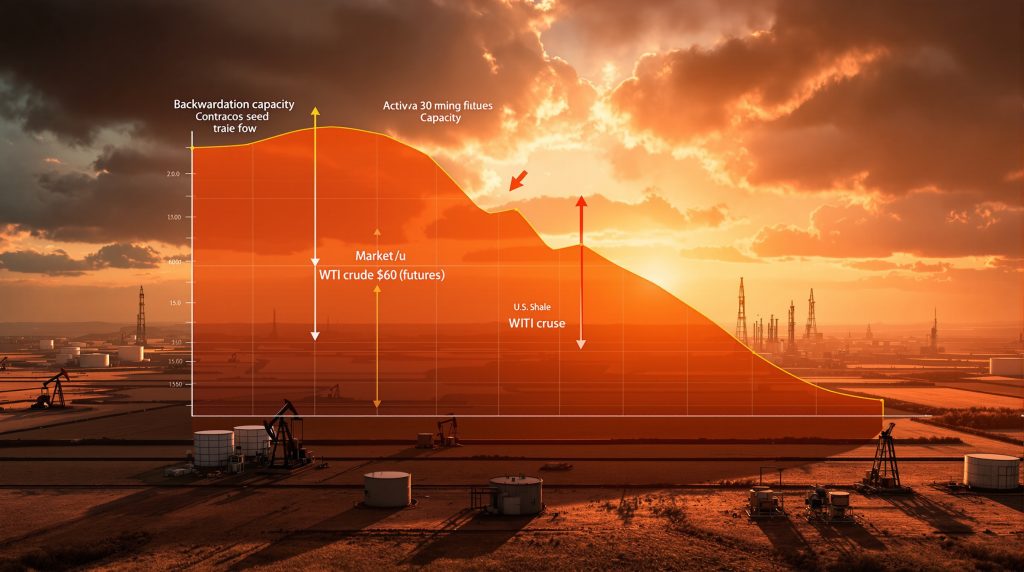

The global oil market is undergoing a significant transformation as it faces dual challenges: an emerging contango price structure and a pronounced slowdown in U.S. shale production. These developments are reshaping market dynamics and raising concerns about future supply-demand balances, particularly as WTI futures for 2026 now trade below the critical $60 per barrel threshold—a level insufficient for most new shale wells to break even.

Industry leaders, including TotalEnergies CEO Patrick Pouyanné and Vitol's Russell Hardy, have issued warnings that persistent low prices could trigger US oil production decline of 200,000-300,000 barrels per day in 2026, potentially creating a tighter market just as demand stabilizes.

As of October 14, 2025, WTI crude trades at $62.67 per barrel, while Brent crude sits at $66.38 per barrel. These current prices mask the concerning longer-term trajectory visible in the futures market, where the entire 2026 curve trades below economically viable levels for new shale development.

How Is Backwardation Giving Way to Contango?

The Shifting Futures Curve Structure

The oil market has begun transitioning from backwardation to contango, signaling a fundamental shift in market sentiment:

- Backwardation (where near-term futures trade higher than longer-dated contracts) has been the dominant market structure throughout 2023-2024, largely due to sanctions-related supply constraints

- This structure is now fading rapidly, with backwardation extending only until February 2026

- The price gap between November and February futures contracts has narrowed to merely 70 cents

- The entire WTI futures curve for 2026 now trades below $60 per barrel—a critical psychological and economic threshold

Physical Market Indicators

While ICE Brent futures demonstrate a similar narrowing backwardation trend, there remains approximately $1 per barrel difference between Dated Brent and ICE Brent. This suggests:

- Some pockets of strength persist in the physical market for November-loading cargoes

- Regional supply-demand imbalances continue to influence short-term pricing

- Immediate physical demand hasn't yet collapsed, despite bearish futures sentiment

Investor Sentiment Metrics

Hedge fund positioning provides clear evidence of deteriorating market sentiment:

| Metric | Current Level | Comparison to Early 2025 |

|---|---|---|

| Net length in WTI futures and options | 29,410 contracts | Only 15% of January 2025 levels |

| Bullish-to-bearish ratio | Near multi-year lows | Down 75% year-to-date |

| Money manager positioning | Increasingly short | Reflecting expectations of further price declines |

This dramatic shift in market positioning indicates that professional investors have substantially reduced their bullish exposure to oil markets, with many actively betting on further price declines ahead.

Why Are U.S. Shale Producers Facing Headwinds?

Economic Breakeven Challenges

The current price environment poses significant challenges for U.S. shale producers:

- Most new shale wells require at least $60-65 per barrel to achieve economic breakeven

- With 2026 futures below this threshold, investment in new drilling becomes increasingly difficult to justify

- Companies face pressure to maintain capital discipline and shareholder returns rather than pursue growth

- Higher interest rates have increased financing costs for capital-intensive shale development

The economic realities are particularly challenging for producers operating in less productive regions or those with higher operational costs. While existing wells with sunk costs will continue producing, the economic barriers to new drilling activity grow more significant with each dollar decline in the futures curve.

Production Outlook Concerns

Industry experts project meaningful production impacts if prices remain suppressed:

- TotalEnergies CEO Patrick Pouyanné estimates U.S. shale output could decline by 200,000-300,000 barrels per day in 2026

- Vitol's Russell Hardy has echoed these concerns, suggesting production growth may stall entirely

- The U.S. Energy Information Administration has already begun revising its production forecasts downward for 2026

- Well productivity in mature basins shows signs of diminishing returns, compounding price challenges

These projections align with historical patterns where sustained low prices eventually lead to production declines as natural well depletion outpaces new drilling activity.

What External Factors Are Amplifying Market Pressures?

U.S.-China Trade Tensions

Renewed trade hostilities between the world's two largest economies are casting a shadow over oil demand prospects:

- The reimposition of 100% import tariffs (effective November 1, 2025) threatens global economic growth

- These tariffs come on top of existing 30% duties, potentially triggering a broader oil price trade war

- Economic slowdown concerns have accelerated bearish sentiment in oil markets

- Chinese demand growth, a key driver of global consumption, faces increasing uncertainty

Historical precedent suggests such US‑China trade tensions could reduce global oil demand growth by 0.2-0.4 million barrels per day if fully implemented and prolonged.

OPEC+ Positioning

OPEC's response to market conditions remains a critical factor:

- The organization has downplayed concerns about a 2026 supply surplus

- OPEC maintains that if production remains at September 2025 levels, markets would still experience a deficit

- Iraq has called for a formal review of its 4.43 million b/d production quota, citing reconstruction needs

- Saudi Arabia continues significant international investments, including a $5.4 billion deal with Algeria's Sonatrach

Internal disagreements within OPEC+ could complicate the group's ability to respond cohesively to market challenges, particularly as individual members face unique economic and political pressures.

How Are Storage Dynamics Influencing the Market?

Contango and Storage Economics

The emerging contango structure creates specific market behaviors:

- Contango incentivizes oil storage, as traders can purchase physical oil now and sell futures contracts at higher prices

- This "cash and carry" trade becomes increasingly profitable as the contango spread widens

- Storage facilities globally are beginning to fill, with floating storage (oil stored on tankers) becoming economically viable

- Rising storage utilization rates typically precede further price weakness

This storage economics dynamic represents one of the fundamental market mechanisms that can accelerate price declines during oversupply conditions.

Global Inventory Trends

Current inventory data reveals concerning trends:

| Storage Location | Current Level | Change vs. 5-Year Average |

|---|---|---|

| U.S. Commercial Crude | Increasing | Above 5-year average |

| Cushing, Oklahoma | Declining | Below minimum operational levels |

| China Strategic Reserves | Expanding | Plans for 11 new storage sites in 2 years |

| Global Floating Storage | Rising | Highest since pandemic era |

China's strategic expansion of storage infrastructure, with plans for 11 new sites within two years, suggests anticipation of continued market volatility and potential supply chain disruptions. This proactive approach to energy security may provide additional demand in the near term but could eventually contribute to increased supply flexibility during future oil price rally periods.

What Does This Mean for Energy Markets in 2026?

Supply-Demand Rebalancing Potential

Despite current bearish sentiment, market fundamentals suggest potential rebalancing mechanisms:

- Lower prices naturally curb production growth, especially in high-cost regions

- Reduced U.S. shale output could remove 200,000-300,000 barrels per day from global supply

- OPEC market influence remains significant, with the organization retaining production flexibility to respond

- Demand typically responds positively to sustained lower prices, particularly in emerging economies

These self-correcting market mechanisms often create the foundation for eventual price recovery, though the timing and magnitude remain uncertain. According to a recent S&P Global analysis, the market is bracing for increased volatility as supply glut fears persist.

Investment Implications

The evolving market structure creates both challenges and opportunities:

- Energy companies with strong balance sheets and low breakeven costs will maintain competitive advantage

- Storage operators and midstream companies may benefit from increased storage demand

- Trading houses with physical storage capacity can capitalize on widening contango spreads

- Producers with effective hedging strategies will demonstrate greater resilience

Investors should carefully assess company-specific exposure to price risks and operational flexibility when evaluating energy sector investments in this challenging environment.

Geopolitical Considerations

Several geopolitical factors could influence market dynamics:

- Ongoing Middle East tensions, including recent Israel-Hamas ceasefire developments

- U.S. policy shifts following the 2024 election

- European energy security concerns as Russian refinery disruptions tighten fuel supplies

- China's strategic petroleum reserve expansion with 11 new storage sites planned

The recent ceasefire agreement between Israel and Hamas suggests potential stabilization of regional conflicts that could impact oil market dynamics, while Russian refinery disruptions following a strike have implications for European fuel supplies. As JP Morgan's commodity analysts note, geopolitical factors continue to create significant price uncertainty.

FAQs About Oil Market Contango and Shale Production

What exactly is contango and why does it matter for oil prices?

Contango occurs when futures prices exceed current spot prices, indicating market expectations of future price increases. This matters because it reflects bearish near-term sentiment, encourages inventory building, and typically signals oversupply conditions. For oil producers, persistent contango often precedes production cuts as companies adjust to market realities.

How does the $60 per barrel threshold impact U.S. shale economics?

The $60 per barrel level represents a critical breakeven threshold for most new shale wells. Below this price, many producers struggle to generate acceptable returns on new drilling investments, particularly in less productive regions. While existing wells with sunk costs continue producing, sustained sub-$60 prices discourage new development and eventually lead to production declines as natural well depletion outpaces new drilling.

Could OPEC+ intervention prevent further price declines?

OPEC+ retains significant production flexibility to respond to market imbalances. The group has demonstrated willingness to adjust output to support price stability, though internal disagreements occasionally complicate consensus. Iraq's recent call for quota review highlights these tensions. While OPEC+ could theoretically cut production further to support prices, their capacity and willingness to absorb market share losses have limits.

How might U.S.-China trade tensions impact oil demand?

Escalating trade tensions between the world's largest economies typically suppress global economic growth and, consequently, oil demand. The announced 100% import tariffs effective November 2025 (beyond existing 30% duties) could significantly impact manufacturing, shipping, and consumer spending. Historical precedent suggests such tensions could reduce global oil demand growth by 0.2-0.4 million barrels per day if fully implemented.

Navigating the Shifting Oil Market Landscape

The oil market stands at a pivotal juncture as contango emerges and U.S. shale faces significant headwinds. With the entire 2026 WTI futures curve trading below crucial breakeven thresholds, producers face difficult investment decisions that could materially impact future supply availability.

While current sentiment appears decidedly bearish, market fundamentals suggest potential rebalancing mechanisms may eventually emerge. Reduced investment in U.S. shale could remove 200,000-300,000 barrels per day from global supply just as demand stabilizes, potentially setting the stage for tighter markets beyond the current bearish outlook.

For market participants, this transitional period presents both challenges and opportunities as traditional energy market dynamics reassert themselves following years of exceptional volatility.

Want To Catch The Next Major Mineral Discovery?

Discover why significant mineral discoveries can generate substantial returns for investors by exploring Discovery Alert's dedicated discoveries page, where our proprietary Discovery IQ model transforms complex mineral data into actionable, real-time alerts that give you a crucial market advantage.