How Do Political Pressures Influence Federal Reserve Decisions?

Understanding the intricate balance between political dynamics and Federal Reserve (Fed) decision-making is vital to grasp whether current rates will change, especially amid questions like "will Powell and the Fed cut rates in response to Trump's pressure?". The Fed's design as an independent central bank is foundational to its credibility, but history shows political pressures have played a role at crucial moments.

Understanding the Fed's Independence Mandate

The Federal Reserve operates under a congressional mandate for independence, primarily via the Federal Reserve Reform Act of 1977. This independence is meant to insulate monetary policy from direct political influence, allowing the Fed to focus on its dual mandate: achieving maximum employment and maintaining stable prices—often measured by a target 2% inflation rate.

Yet, as noted by Peter Grandich and echoed by numerous economic historians, political leaders have attempted to sway the Fed:

- In 1972, President Nixon famously pushed Chairman Arthur Burns to lower rates ahead of an election, resulting in expansive monetary policy and contributing to the subsequent inflationary crisis.

- Modern central bankers, such as Alan Greenspan and Ben Bernanke, have faced more subtle pressures—public commentary and implied expectations—but typically buffered their independence through transparent communication.

"The fact that he [Powell] remains there is a belief that he has intentions to see out his term." — Peter Grandich

Maintaining this institutional credibility is essential: even perceived capitulation to political wishes can undermine markets' trust in the Fed's objectivity and reliability.

Recent Political Pressure on Rate Decisions

Political rhetoric surrounding interest rates often intensifies during economically sensitive periods or election cycles. Recently, former President Trump has publicly advocated for rate cuts, tying them to economic prosperity and a weaker dollar strategy. His policy inclination is clear: lower borrowing costs to stimulate sectors like housing and automotive, traditionally considered economic growth engines.

- Trump's campaign has repeatedly highlighted concerns about "an overly strong dollar" and the "need for relief for struggling families and businesses."

- Market participants increasingly price in the possibility of rate cuts when such high-profile figures vocalize their preferences, as evidenced by volatility in the Fed funds futures market following Trump's interviews and statements.

Powell, on the other hand, has maintained a deliberate, data-driven tone in public appearances, signaling reluctance to act based on short-term political considerations. Nevertheless, the administration's economic policy goals and pointed commentary have subtly influenced market expectations, if not Fed policy itself.

What Economic Indicators Actually Drive Fed Rate Decisions?

Despite the political pressure, the Federal Reserve relies on a suite of economic indicators to guide its decisions. Understanding what genuinely inspires action versus what simply makes headlines helps predict whether "will Powell and the Fed cut rates in response to Trump's pressure" has merit.

Current Economic Data vs. Rate Cut Justifications

Key economic indicators monitored by the Fed include:

- Employment Figures: As of Q2 2024, the unemployment rate has hovered near multi-decade lows (about 4.0%), but labor force participation remains below pre-pandemic levels—a sign of lingering slack.

- Inflation Metrics: The Consumer Price Index (CPI) and the Fed's preferred Personal Consumption Expenditures (PCE) price index both show inflation above the 2% target, though the pace has decelerated since its 2022 peak.

- Consumer Spending: While consumer spending is robust in the top wealth deciles, there's growing stress among middle- and lower-income cohorts, as evidenced by rising delinquencies in credit cards, auto loans, and mortgages.

- Housing and Automotive Sectors: High borrowing costs have slammed mortgage origination volumes and new vehicle purchases. Auto loan delinquencies reached multi-year highs in early 2024, a direct consequence of elevated rates.

The Dual Economy Challenge

As Peter Grandich frames it, the United States is increasingly a "dual economy," where the majority of prosperity accrues to a tiny fraction of the population:

- The top 10% of households own roughly 86% of American financial assets. [Federal Reserve Survey of Consumer Finances, 2022]

- The middle 40% hold the remaining 14% of assets.

- The bottom 50% own virtually no significant assets and are most sensitive to interest rate swings.

"To them [the struggling bottom 50%], a 2-3% rate cut could mean able to pay electrical bills or mortgage payments." — Peter Grandich

Rate adjustments impact these segments differently:

- Asset owners (top 10%) often benefit from rising equity and real estate values boosted by cheap capital.

- Middle-income families experience mixed fortunes: some benefit from refinancing, others are squeezed by high consumer debt costs.

- Lower half face acute vulnerability: every uptick in rates magnifies the risk of default on auto, mortgage, and credit card loans.

When Will the Fed Likely Cut Rates in 2024?

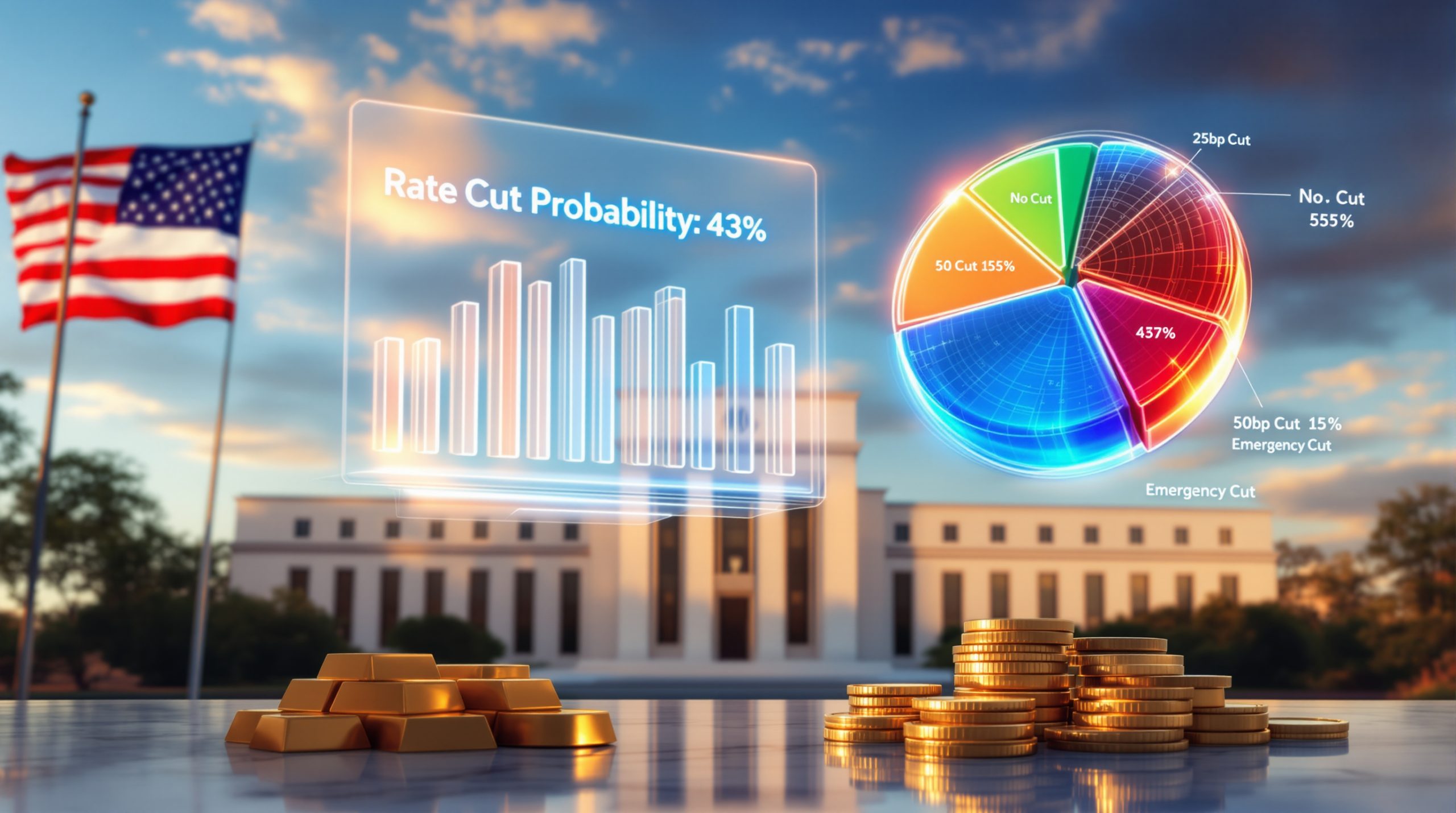

September vs. July Rate Cut Probability

Recent trends and market consensus suggest the Fed is unlikely to lower rates at the July 2024 FOMC meeting. Instead, September has become the more plausible window, barring a major economic shock.

- Fed fund futures currently assign less than a 20% chance of a July cut but above 60% for September, based on CME Group's FedWatch tool as of June 2024.

- The Fed prefers to "telegraph" moves in advance, using speeches and meeting minutes to condition markets. As Grandich notes:

"September is much more likelihood now than it might have been a couple of months [ago]."

Economic data further support a wait-and-see approach:

- Inflation remains stubbornly above target.

- Labor markets are holding steady, but layoffs in rate-sensitive sectors like construction and retail are rising.

The upcoming U.S. election also complicates timing, as the Fed traditionally avoids major policy shifts just before the vote to sidestep accusations of political favoritism.

FOMC Member Dynamics

The Federal Open Market Committee is composed of the seven Board of Governors, the President of the New York Fed, and four rotating regional presidents. Internal dynamics can sometimes sway decisions:

- Voting patterns reveal a spectrum of hawks (favoring tighter policy) and doves (favoring looser).

- Career considerations play a subtle yet real role, especially in politically charged years. Board members may be reluctant to be seen as either politically compliant or obstructionist.

"There are personal considerations for some Fed board members given the politically charged atmosphere," Grandich observes, highlighting the human factors behind policy outcomes.

How Does Dollar Strength Factor Into Rate Decisions?

The Administration's Dollar Policy

A strong or weak U.S. dollar can profoundly influence the Fed's policy calculus. In the first half of 2024, the dollar experienced its worst six-month performance since the Nixon era (1971–1972), a concern for both policymakers and the business community.

- The administration signaled a preference for a weaker dollar, aiming to boost U.S. exports and ease dollar-denominated debt burdens.

- Peter Grandich emphasized Trump's stance: "A weaker dollar was much more favorable to him."

Dollar Index (DXY) Table: Jan 2024–June 2024

| Date | DXY Index Level | % Change from Jan |

|---|---|---|

| Jan 2, 2024 | 104.3 | 0% |

| Mar 1, 2024 | 102.5 | -1.7% |

| June 28, 2024 | 99.8 | -4.3% |

The sharp drop reflects not only domestic policies but also the shifting sands of global de-dollarization.

Global De-Dollarization Trends

Several forces are challenging the dollar's exclusivity:

- BRICS expansion (Brazil, Russia, India, China, South Africa) has accelerated efforts to establish trade settlement mechanisms outside the U.S. dollar, including via the Shanghai Gold Exchange and various "currency swap" arrangements.

- 2023 marked an increase in trade settled in Chinese yuan and gold-linked contracts, particularly among BRICS and their new partners.

"BRICS did not fold up and die… slowly but surely, [they are] shifting away from the dollar." — Peter Grandich

Such developments pose long-term questions for U.S. monetary flexibility, as persistent de-dollarization could erode demand for U.S. Treasuries and the greenback's preeminence.

What Are the Long-Term Implications of the National Debt on Monetary Policy?

The Growing Debt Service Challenge

America's federal debt has surged to $37 trillion as of 2024, and the Congressional Budget Office (CBO) projects a climb to $50 trillion within eight years. With average interest rates nearing 5%, annual debt servicing costs could soon reach $2.5 trillion—potentially over 40% of projected federal revenues, which have historically peaked around $6 trillion per year.

| Year | Total Federal Debt | Projected Interest Expense (at 5%) | Federal Revenue (Peak) |

|---|---|---|---|

| 2024 | $37 trillion | $1.85 trillion | $6 trillion |

| 2032 | $50 trillion | $2.5 trillion | — |

"Refinancing $9.5 trillion this year… pennies matter." — Peter Grandich

The immediate risk stems from $9.5 trillion due for refinancing this year and a staggering $28 trillion over the next three. Even small shifts in yields can dramatically increase the government's interest costs—crowding out other spending and pressuring lawmakers to seek lower policy rates.

The Short-Term vs. Long-Term Rate Disconnect

While the Fed can adjust short-term interest rates, global bond investors—who influence long-term rates—remain wary of excessive U.S. debt. As a result:

- Short-term rate cuts may not translate into lower long-term borrowing costs if investors demand higher premiums for perceived fiscal risk.

- Foreign participation in U.S. Treasury auctions has been steady but shows signs of faltering, especially among Asian central banks seeking portfolio diversification.

Lessons from Japan's prolonged debt struggles indicate persistent high debt can force monetary policy into difficult, even paradoxical, positions.

How Might Gold Factor Into Future Monetary Policy?

Gold as a Potential Treasury Security Backstop

With uncertainty over fiat currency stability and soaring U.S. debt loads, there is renewed speculation about gold's role in future monetary and fiscal policy:

- Major investment banks (e.g., J.P. Morgan) and independent analysts have revised their gold price forecasts upwards, with some anticipating $4,000–$5,000 per ounce as psychological thresholds if monetary discipline falters or a gold-linked instrument is introduced.

- Western investors, per Grandich, are often late to the party:

"Asian community is instructed to buy gold… they are out there accumulating."

Historical precedents like Italy's short-lived gold-backed Treasury bills in the 1960s demonstrate governments' willingness to tap their gold reserves during fiscal crunches.

Global Central Bank Gold Acquisition Patterns

Central banks have been net buyers of gold for several consecutive years:

- According to World Gold Council (WGC) data, central bank gold purchasing reached a decade high in 2023, with China, India, and Turkey leading the charge.

- This trend reflects a strategic diversification away from dollar-denominated assets and a hedge against geopolitical and fiscal uncertainty.

| Year | Central Bank Purchases (tons) | Notable Buyers |

|---|---|---|

| 2022 | 1,136 | China, Turkey, India |

| 2023 | 1,082 | China, Russia, Singapore |

Their actions reinforce the perception of gold as a robust backstop for both national and global monetary systems, potentially reducing reliance on traditional reserve currencies such as the USD.

FAQ: Federal Reserve Independence and Rate Decisions

Can the President Directly Order the Federal Reserve to Cut Rates?

- No. The Federal Reserve Act of 1913 and its amendments ensure legal independence. The President can appoint governors (with Senate approval) and designate the Chair from among them, but cannot unilaterally order policy changes.

- Historical precedents show indirect pressure—such as public comments or private meetings—sometimes prompt policy shifts, evidenced by the Nixon-Burns episode (1972) and more recently, Trump's pressure on the Fed directed at Powell.

How Do Rate Cuts Affect Different Economic Segments?

- Mortgage Holders & Homebuyers: Benefit from reduced borrowing costs and refinancing opportunities.

- Credit Card/Auto Loan Consumers: Lower rates translate to some relief on new variable-rate loan products, but fixed-rate and nonprime borrowers see limited short-term impact.

- Savers and Fixed-Income Retirees: Reduced returns on savings and annuities, potentially forcing riskier investment behavior.

- Investors: Equity and property values typically benefit from lower rates due to increased leverage and capital flows.

What Signals Indicate the Fed's Next Likely Move?

- Key Economic Indicators: Monthly unemployment reports, CPI/PCE inflation releases, and retail sales figures.

- FOMC Member Speeches: Shifts in rhetoric by influential members (e.g., Powell, New York Fed President) can signal impending moves.

- Market Pricing: Fed funds futures, Treasury yields, and swap spreads reflect collective bets on the Fed's path.

How Might International Factors Influence Fed Decisions?

- Interest Rate Differentials: As other central banks move rates, the Fed must balance competitiveness and capital flows.

- Currency Markets: Dollar strength or weakness impacts exports, imports, and multinational corporate earnings.

- Coordination: Occasional policy alignment among G7 or G20 central banks, especially during crises.

Conclusion: Balancing Independence, Economics, and Political Reality

The Fed's Credibility Challenge

Navigating the intersection of economic imperatives, global expectations, and aggressive political outreach requires finesse from Powell and his colleagues. Surrendering independence could undermine the very stability the Fed seeks to preserve, yet overtly ignoring political realities risks being seen as aloof or detached.

"Fed has its own political choices… Powell's challenge against Trump tariff implications." — Peter Grandich

Transparent communication and a firm grounding in the Fed's mandate are the best tools to maintain credibility and investor confidence in turbulent times.

Forward Outlook for Monetary Policy

- 2024-2025 Rate Trajectory: Barring a severe downturn, expect a potential rate cut by September, with a cautious approach as the Fed juggles inflation, jobs, political optics, and US economy tariffs & debt.

- Long-Term Rates and Federal Financing: Long-term yields may remain stubbornly high due to fiscal concerns, limiting the Fed's ability to stimulate with short-term cuts.

- Structural Challenges: Ultimately, resolving the dual economy, reigning in the deficit, and restoring housing affordability will require concerted fiscal, regulatory, and private-sector action—beyond what monetary policy alone can achieve.

Disclaimer: Monetary policy forecasts and opinions are inherently uncertain. All economic statistics reflect best available data as of June 2024. For more information on Federal Reserve decisions and their implications, consult official Federal Reserve publications, Congressional Budget Office reports, and the World Gold Council.

Further Exploration:

Readers interested in learning more about Federal Reserve policy decisions and political influences on monetary policy can also explore related educational content, such as the YouTube interview with Peter Grandich discussing Fed policy, interest rates, and gold price analysis and the potential US‑China trade impact on monetary policy.

Wondering How to Profit from Major Mineral Discoveries?

Discovery Alert's proprietary Discovery IQ model delivers instant notifications on significant ASX mineral discoveries, transforming complex data into actionable investment opportunities for both short-term traders and long-term investors. Visit the Discovery Alert discoveries page to understand how major mineral discoveries have historically generated substantial returns and begin your 30-day free trial today.