The Strategic Importance of Rare Earth Elements

Rare earth elements (REEs) have emerged as critical components in modern technology and national security infrastructure, making them strategically vital resources in today's geopolitical landscape. Their unique properties enable advanced technologies across defense, renewable energy, and high-tech manufacturing sectors. Recent rare earth talks between global powers have highlighted the growing international focus on securing these crucial resources.

The Fundamental Role of Rare Earth Elements in Modern Technology

Rare earth elements possess exceptional magnetic, luminescent, and electrochemical properties that cannot be easily replicated by other materials. Despite their name, most REEs are relatively abundant in the Earth's crust, but economically viable concentrations are scarce. The 17 elements that comprise this group include the 15 lanthanides plus scandium and yttrium, with varying degrees of availability and applications.

These elements are not actually "rare" in terms of abundance in the Earth's crust, but they rarely occur in concentrated deposits that make extraction economically viable. The real challenge lies in their complex metallurgy and the sophisticated processing required to separate individual elements from one another.

Critical Applications Across Strategic Industries

REEs serve as essential components in numerous high-technology applications:

- Permanent magnets: Neodymium, praseodymium, dysprosium, and terbium are crucial for creating the world's strongest permanent magnets used in electric vehicles, wind turbines, and defense systems

- Catalysts: Lanthanum and cerium enable petroleum refining and emissions control in vehicles

- Display technologies: Europium, terbium, and yttrium create vibrant colors in screens and energy-efficient lighting

- Medical applications: Gadolinium revolutionizes MRI contrast agents for advanced diagnostics

- Defense systems: Samarium-cobalt magnets function in extreme temperature environments where other magnets would fail

Energy Fuels CEO Mark Chalmers emphasizes the critical nature of heavy rare earths, noting that "China has a stranglehold on the heavies… heavies are really used to improve resistance to heat issues in permanent electric motors" (Crux Investor, 2025).

These applications represent the backbone of both civilian technology advancement and military capabilities, making secure access to REEs a matter of national strategic importance.

National Security Implications of Rare Earth Supply Chains

Defense Applications Dependent on Rare Earth Elements

Modern defense systems rely heavily on REEs for functionality and performance:

- Precision-guided munitions containing rare earth magnets for guidance systems

- Advanced radar systems utilizing rare earth components for signal processing

- Night vision equipment requiring phosphors made from rare earths for light amplification

- Secure communications equipment with rare earth-based components for signal encryption

- Aircraft and naval vessel guidance systems requiring temperature-resistant magnets

A single F-35 fighter jet contains approximately 420 pounds of rare earth materials across various components. The concentration of these materials in mission-critical systems creates significant vulnerability if supply is disrupted.

The Department of Defense has identified REEs as critical materials essential for national security, highlighting the strategic vulnerability created by supply chain dependencies. This recognition has translated into concrete action, with direct investments in companies like MP Materials to secure domestic supply capabilities.

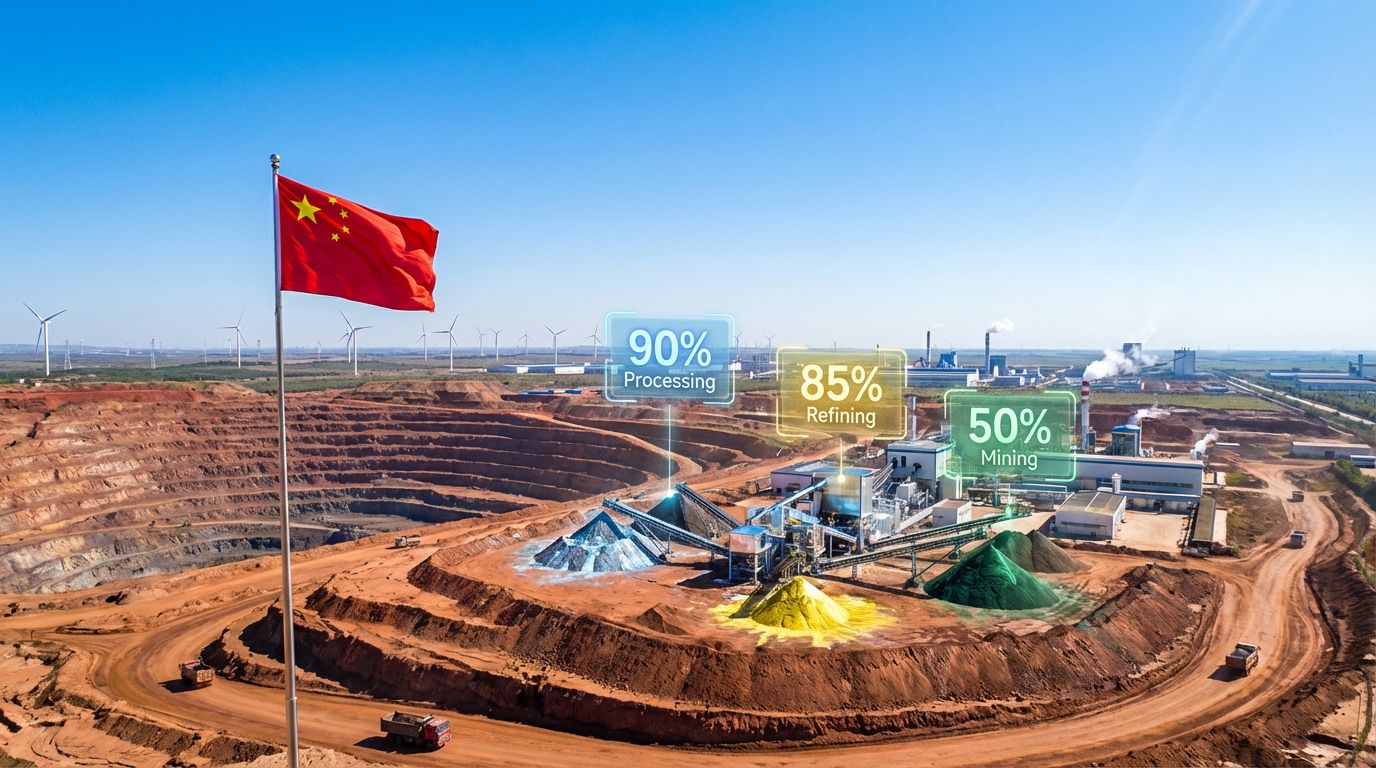

Geopolitical Vulnerabilities in the Supply Chain

The current global supply chain for REEs presents significant strategic concerns:

- Approximately 80% of global rare earth processing capacity remains under Chinese control

- Heavy rare earths (dysprosium, terbium) face particularly severe supply constraints with China maintaining a near-monopoly on production

- Processing capabilities outside China remain limited, creating bottlenecks even when raw materials are available

- Export restrictions have been used as geopolitical leverage in past international disputes

These vulnerabilities have prompted Western governments to classify rare earth elements as strategically critical minerals requiring dedicated supply chain security initiatives. As Chalmers bluntly stated regarding supply shortages: "When there's a shortage… and China imposes restrictions… what does price matter? You need those materials" (Crux Investor, 2025).

Critical Security Insight: The Department of Defense has shifted from viewing rare earths as commodities to classifying them as strategic materials essential for national security, similar to how uranium was treated during the Cold War era.

The Global Race for Rare Earth Resources

China's Dominant Position in the Rare Earth Market

China has systematically developed overwhelming market control through:

- Decades of strategic investment in mining and processing infrastructure

- State-supported research and development in rare earth applications

- Environmental regulations that historically favored Chinese production

- Integration of rare earth supply chains with manufacturing capabilities

- Strategic acquisitions of rare earth assets in other countries

This dominance allows China significant influence over global technology development and manufacturing capabilities that rely on these materials. China's strategy wasn't accidental – it represents a deliberate, long-term plan executed over 30+ years to establish dominance in a critical resource sector.

Western Responses to Supply Chain Vulnerabilities

Governments outside China have initiated various countermeasures:

- Department of Defense investments in domestic rare earth production capabilities

- Formation of strategic partnerships with allied nations for supply diversification

- Development of recycling technologies to recover rare earths from end-of-life products

- Research into alternative materials that could reduce dependency on certain rare earths

- Stockpiling programs to mitigate short-term supply disruptions

Companies like Energy Fuels are positioning themselves at the forefront of Western supply chain development. As Chalmers notes, "If you want to break dependence on China, you have to start by getting materials from someplace other than China" (Crux Investor, 2025).

Energy Fuels has achieved commercial NDPR (neodymium-praseodymium) oxide production with qualification from major industry partner POSCO, demonstrating concrete progress where many competitors only have plans. Their White Mesa Mill represents the only U.S. facility with operational rare earth separation capabilities. Recent rare earth breakthrough technologies have further redefined the market landscape for Western producers.

These initiatives represent a growing recognition of rare earth elements as strategic resources requiring national-level attention and investment.

Economic Significance of Rare Earth Elements

The Role of REEs in Energy Transition Technologies

Rare earth elements are fundamental to renewable energy development:

- Wind turbine generators require approximately 600kg of rare earth materials per megawatt of capacity

- Electric vehicle motors typically contain 1-2kg of rare earth magnets, primarily neodymium, praseodymium, and dysprosium

- Energy storage systems often incorporate rare earth components for efficiency improvements

- Solar panel manufacturing utilizes various rare earth elements in specialized applications

- Grid infrastructure modernization depends on rare earth-containing technologies for power electronics

The global push toward carbon reduction creates exponential demand growth for these materials, further intensifying their strategic importance. Industry forecasts project rare earth demand for clean energy applications to increase by 300-500% by 2040, creating both enormous challenges and opportunities.

Market Dynamics and Supply-Demand Imbalances

The rare earth market exhibits unique economic characteristics:

- Pricing power concentrated in limited supply sources, particularly for heavy rare earths

- Demand growing at 8-12% annually across most applications

- Supply constraints exacerbated by long development timelines for new projects (typically 5-10 years)

- Processing capabilities representing a more significant bottleneck than raw material availability

- Market distortions created by non-market factors including export restrictions and strategic stockpiling

These dynamics create significant economic opportunities for companies capable of establishing reliable supply chains outside existing channels. For investors, understanding the distinction between light and heavy rare earths is crucial – while light rare earths face growing competition, heavy rare earths like dysprosium and terbium remain in critical shortage with few alternatives in development.

Investment Insight: The most acute supply constraints exist in heavy rare earths (dysprosium, terbium), which command significantly higher prices than light rare earths and face more limited competition from emerging producers.

Technological Challenges in Rare Earth Production

Mining and Extraction Complexities

Rare earth production involves numerous technical challenges:

- Rare earth deposits typically contain multiple elements requiring complex separation

- Radioactive thorium and uranium often occur alongside rare earth elements, requiring specialized handling

- Environmental impacts of traditional extraction methods can be significant

- Processing requires specialized knowledge and equipment not widely available

- Capital intensity of projects creates high barriers to entry

These technical barriers have contributed to supply concentration and create opportunities for companies with demonstrated processing expertise. Energy Fuels has leveraged its 50+ years of experience in handling radioactive materials to process monazite sands containing both uranium and rare earths at its White Mesa Mill – a capability unique in the United States.

Processing and Separation Technologies

The most significant bottleneck in rare earth supply chains occurs in processing:

- Separation of individual rare earth elements requires sophisticated solvent extraction techniques

- Heavy rare earth separation presents particularly complex technical challenges

- Environmental standards for processing facilities vary significantly by jurisdiction

- Scale-up from laboratory to commercial production involves substantial technical risk

- Processing economics depend heavily on the specific rare earth distribution in feed materials

Western companies developing these capabilities face both technical and economic hurdles in establishing competitive operations. Energy Fuels has demonstrated separation capabilities where many competitors only make promises, with its Phase 1 to Phase 2 scale-up representing a manageable 5-7x increase in production capacity.

As Chalmers notes regarding scale-up risk: "5 to 7:1 scale-up is nothing in commercial plant terms" (Crux Investor, 2025). This relatively modest scale-up ratio compared to industry norms represents lower technical risk for investors and government partners.

The Path Toward Supply Chain Security

Building Domestic Production Capabilities

Creating secure rare earth supply chains requires multi-faceted approaches:

- Development of primary mining operations in politically stable jurisdictions

- Investment in processing facilities capable of producing separated rare earth oxides

- Establishment of metal and alloy production capabilities

- Support for magnet manufacturing and other downstream value-added processing

- Integration with end-use manufacturing to create complete supply chains

This vertical integration approach provides maximum security but requires significant capital investment and technical expertise. Energy Fuels represents a unique example with $250 million in working capital and a $2 billion market capitalization supporting its integration strategy from mining through separation to qualified products.

The company has secured fully permitted resources like the Donald Project in Australia, targeting heavy rare earths including critical dysprosium and terbium. Their multi-feed strategy combines domestic uranium sources with international rare earth concentrates to maximize facility utilization. Many countries are now implementing a dedicated critical minerals strategy to address these supply chain vulnerabilities.

International Cooperation and Strategic Partnerships

Supply chain security can be enhanced through collaborative approaches:

- Formation of international consortiums to develop rare earth resources

- Technology sharing agreements between allied nations

- Coordinated stockpiling programs to mitigate short-term disruptions

- Standardization of environmental and processing requirements

- Joint research initiatives for recycling and alternative materials

These partnerships distribute risk while accelerating development timelines for new supply sources. Energy Fuels has positioned itself for potential government support, with Chalmers noting: "People believe Energy Fuels positioned well for government support" across Washington and Canberra (Crux Investor, 2025). The implementation of an executive order on minerals has further strengthened the policy framework for domestic production.

Regulatory Insight: The qualification of Energy Fuels' NDPR oxide by POSCO represents a critical milestone for regulatory compliance, as customer qualification is often more stringent than government certification requirements.

Future Outlook for Rare Earth Elements

Emerging Technologies Driving Demand Growth

Future applications will likely increase strategic importance:

- Quantum computing technologies requiring specialized rare earth materials for quantum bits

- Advanced robotics with high-efficiency motors and sensors for precision manufacturing

- Next-generation defense systems with enhanced capabilities for multi-domain operations

- Medical technologies utilizing rare earth properties for targeted therapies

- Space exploration and satellite technologies requiring radiation and temperature resistance

These emerging applications create additional pressure on already constrained supply chains. Industry experts project that by 2030, total rare earth demand could exceed current global production capacity by 25-40%, with heavy rare earths facing particularly severe shortages.

Sustainability and Environmental Considerations

The future of rare earth production must address environmental concerns:

- Development of more environmentally responsible extraction methods

- Recycling technologies to recover rare earths from end-of-life products

- Reduction of energy consumption in processing operations

- Management of radioactive byproducts from certain rare earth deposits

- Water conservation in processing operations

Addressing these concerns is essential for establishing socially acceptable production in Western jurisdictions. Companies like Energy Fuels with established environmental management systems for handling radioactive materials have significant advantages in navigating these challenges.

How Are Governments Responding to Rare Earth Supply Challenges?

Policy Initiatives and Strategic Investments

Critical Minerals Legislation and Programs

Governments have implemented various policy frameworks:

- Critical Minerals List designations prioritizing rare earths for strategic attention

- Financial support programs for domestic rare earth development

- Regulatory streamlining for projects deemed strategically important

- Tax incentives for companies developing rare earth capabilities

- Export controls on certain rare earth technologies

These initiatives reflect growing recognition of rare earths as strategic national assets rather than conventional commodities. The Department of Defense has confirmed investments in companies like MP Materials and is evaluating additional opportunities to support domestic production capabilities.

The U.S. has classified rare earths among 50 minerals deemed critical to economic and national security, opening pathways for accelerated permitting and financial support. Similar designations exist in Australia, Canada, and the European Union, creating a coordinated Western response to supply vulnerabilities. Australia has recently established a strategic minerals reserve to further secure these critical resources.

Direct Government Investment in Supply Chain Development

Beyond policy frameworks, direct investment has accelerated:

- Department of Defense funding for rare earth separation facilities

- Government loan guarantees for processing plant construction

- Public-private partnerships for technology development

- Strategic stockpile purchases creating demand certainty

- Research grants for recycling and alternative materials

These investments provide crucial early-stage support for developing capabilities outside established supply chains. Energy Fuels is positioned to potentially benefit from such support, leveraging its demonstrated capabilities in rare earth separation and handling of radioactive materials.

Technical Insight: Energy Fuels' White Mesa Mill holds the only active license in the United States for processing monazite sands containing both rare earths and radioactive elements, providing a significant regulatory advantage measured in years compared to new entrants.

The Role of Private Industry in Rare Earth Security

Commercial Viability Versus Strategic Necessity

Private sector participation faces complex considerations:

- Economic challenges of competing with established producers

- Strategic value that may exceed conventional return metrics

- Long development timelines requiring patient capital

- Technical risks in scaling new processing approaches

- Market uncertainties affecting investment decisions

Companies pursuing rare earth development must balance commercial considerations with strategic positioning for potential government support. As Chalmers emphasizes regarding Energy Fuels' approach: "We're not building a promotion… We're building a company with capacity, cost structures, and infrastructure" (Crux Investor, 2025).

This focus on operational execution rather than mere promotion distinguishes serious contenders from speculative entrants in the rare earth space.

Vertical Integration Strategies

Leading companies are pursuing integration across the value chain:

- Securing multiple feed sources to ensure consistent mill loading

- Developing flexible processing capabilities for various rare earth materials

- Establishing relationships with end-users to create stable demand

- Building technical expertise applicable across multiple project types

- Creating operational synergies between related critical minerals

This approach maximizes strategic value while creating multiple revenue opportunities. Energy Fuels exemplifies this strategy with its campaign processing model at White Mesa Mill, allowing flexible switching between uranium and rare earth processing based on market conditions and strategic priorities.

FAQ: Understanding Rare Earth Elements and Their Strategic Importance

What are the most critical rare earth elements for national security?

The most strategically vital rare earth elements include neodymium, praseodymium, dysprosium, and terbium, which are essential for high-performance permanent magnets used in defense systems, renewable energy technologies, and advanced manufacturing. Heavy rare earths (dysprosium and terbium) present particular strategic concern due to their extreme supply concentration and limited substitutability in critical applications.

China maintains near-total control of heavy rare earth production, with dysprosium and terbium facing the most severe supply constraints. These elements are essential for enhancing magnet performance at high temperatures, making them irreplaceable in advanced defense and energy applications.

How does rare earth production impact the environment?

Rare earth production can create significant environmental challenges, including:

- Potential radioactive waste from thorium and uranium associated with some deposits

- Chemical-intensive separation processes requiring careful waste management

- Land disturbance from mining operations

- Water usage in processing operations

- Energy consumption throughout the production chain

Modern operations increasingly implement advanced environmental controls, recycling systems, and waste management practices to mitigate these impacts. Companies with experience handling radioactive materials, like Energy Fuels, bring valuable expertise to managing these environmental challenges responsibly.

The environmental footprint varies significantly based on deposit type and processing method. Ion-adsorption clay deposits typically have lower radioactivity but may involve more extensive land disturbance, while hard-rock deposits like monazite contain higher levels of radioactive elements but can be processed with smaller physical footprints.

Can recycling help address rare earth supply constraints?

Recycling represents a growing opportunity for supplementing primary rare earth production. Current technologies can recover rare earths from permanent magnets, phosphors, and certain electronic components, though economic viability varies by application. The Department of Defense and other agencies are

Want to Spot the Next Major ASX Discovery Before the Market?

Discovery Alert's proprietary Discovery IQ model instantly notifies investors of significant mineral discoveries on the ASX, turning complex data into actionable insights for both short-term traders and long-term investors. Explore why major mineral discoveries can lead to substantial returns by visiting our dedicated discoveries page and begin your 30-day free trial today.