What Are Rare Earth Elements and Why Do They Matter?

Rare earth elements (REEs) represent a group of 17 metallic elements that, despite their name, are relatively abundant in the Earth's crust. What makes them "rare" isn't their scarcity but rather the challenging and costly processes required to extract and process them. These elements possess unique magnetic, luminescent, and electrochemical properties that make them irreplaceable in numerous high-tech applications.

The strategic importance of REEs cannot be overstated in today's technology-driven world. From smartphones and laptops to electric vehicles and wind turbines, rare earths are essential components in products that define modern life. Neodymium, dysprosium, and praseodymium, for instance, are critical in creating powerful permanent magnets used in electric motors, hard disk drives, and speakers.

Perhaps most crucially, rare earth elements are vital to national defense systems. They're found in precision-guided munitions, radar systems, night vision equipment, and communications technology. This military application alone makes them strategically significant to any nation's security infrastructure.

China has dominated the global rare earth market for decades, controlling approximately 80% of worldwide processing capacity. This dominance didn't happen by accident—it resulted from deliberate long-term planning dating back to the 1980s when the Chinese government recognized the strategic value of these elements.

"China has enjoyed a huge competitive advantage due to their lower costs and massive capacity," notes industry analysts in a recent South China Morning Post report. This advantage stems from several factors, including less stringent environmental regulations, state subsidies, and significant investments in technological expertise and infrastructure.

The Strategic Importance of Rare Earth Elements

The 17 rare earth elements play a crucial role across multiple sectors of the modern economy. These elements—including neodymium, praseodymium, dysprosium, and terbium—are essential in manufacturing products that power our daily lives and future technologies.

In the renewable energy sector, REEs are indispensable for green energy technologies. Wind turbine generators require neodymium-based permanent magnets, with a single large turbine containing up to a ton of rare earth materials. Similarly, electric vehicle motors rely heavily on these elements—a typical EV uses 1-2 kg of rare earth magnets.

Consumer electronics represent another major application area. Your smartphone contains multiple rare earth elements: neodymium magnets in speakers, europium and terbium for color displays, and cerium for polishing glass screens. Computers, tablets, and other personal devices similarly depend on these materials.

The defense sector's reliance on rare earths may be less visible to consumers but is no less critical. Precision-guided weapons systems, radar technology, sonar systems, and satellite communications all incorporate these elements. For instance, each F-35 fighter jet contains approximately 417 kg of rare earth materials.

Medical technology also benefits from rare earth properties. MRI machines utilize powerful magnets containing gadolinium, while certain rare earths are used in surgical tools, lasers, and diagnostic equipment.

China's Historical Dominance in the Rare Earth Market

China's rise to dominance in the rare earth industry began in the late 1980s and accelerated through the 1990s. The country leveraged its abundant reserves, particularly in Inner Mongolia, along with strategic government planning to become the world's primary supplier.

Several factors contributed to China's market control:

- Lower production costs: Less stringent environmental regulations and lower labor costs allowed for more competitive pricing

- Government investment: Strategic funding for research, extraction, and processing technologies

- Vertical integration: Development of complete supply chains from mining to finished products

- Export quotas: Strategic manipulation of supply to influence global markets

By the early 2000s, China's dominance had led to the closure of most rare earth mining operations in other countries, including the United States' Mountain Pass mine in California, which couldn't compete economically with Chinese suppliers.

The consequences of this market concentration became evident in 2010 when China briefly restricted rare earth exports during a diplomatic dispute with Japan, causing prices to skyrocket. This incident served as an early warning about supply chain vulnerabilities that would later become central to trade tensions.

How Did the US-China Trade War Create a Rare Earth Crisis?

The rare earth sector became a focal point of geopolitical tension following the escalation of trade hostilities between the United States and China. After President Donald Trump's return to office, his administration implemented a series of aggressive tariffs targeting Chinese imports, aiming to address what they viewed as unfair trade practices and reduce America's trade deficit with China.

Beijing's response was calculated and strategic, targeting a sector where American vulnerability was pronounced. "After a US tariff blitz led Beijing to impose export controls on seven rare earth elements," the consequences quickly rippled through American manufacturing sectors, according to reporting by Ralph Jennings in the South China Morning Post (August 2025).

The targeted nature of China's export controls demonstrated a sophisticated understanding of supply chain vulnerabilities. By restricting specific elements crucial to high-tech manufacturing and defense applications, Beijing maximized economic impact while minimizing self-harm to their own industrial base.

Market reaction was swift and severe. Prices for the restricted elements surged by triple-digit percentages within weeks as manufacturers scrambled to secure supplies. Trading exchanges saw unprecedented volatility as speculators moved in, further exacerbating price fluctuations and supply uncertainty.

The Escalation of Trade Tensions Under Trump's Return to Office

The renewed trade war took shape rapidly in 2025, following a political shift in Washington. Within the first quarter of the year, the Trump administration implemented tariffs on approximately $300 billion worth of Chinese goods, significantly expanding the scope of previous trade actions.

China's retaliatory measures were calculated to maximize leverage. Rather than matching tariff-for-tariff, Beijing strategically targeted critical supply chains, with rare earth elements representing perhaps their most powerful economic weapon.

The seven elements subjected to export controls were selected for maximum impact:

- Neodymium and praseodymium: Essential for manufacturing permanent magnets used in electric vehicles and wind turbines

- Dysprosium and terbium: Critical for high-temperature performance in magnets for defense applications

- Yttrium, europium, and gadolinium: Key elements for electronics, display technology, and medical devices

Industry analysts noted that these specific restrictions reflected a sophisticated understanding of America's industrial vulnerabilities, targeting both civilian manufacturing and defense supply chains.

As tensions escalated through mid-2025, diplomatic channels narrowed. Scheduled economic talks were canceled, and attempts at negotiation yielded little progress as both sides held firm to their positions. The rare earth restrictions became emblematic of the broader economic decoupling underway between the world's two largest economies.

The Vulnerability Exposed in America's Supply Chain

"America's vulnerability was exposed in vivid fashion as a string of blue-chip American companies warned that a lack of magnets could soon disrupt their production," reported the South China Morning Post. This immediate impact revealed the extent of U.S. dependency on Chinese rare earth supplies.

The automotive sector was among the first to experience disruptions. Major American manufacturers issued earnings warnings, citing inability to complete electric vehicle production without reliable access to rare earth magnets. Some production lines faced partial shutdowns within weeks of the export controls taking effect.

Consumer electronics companies scrambled to secure alternative suppliers, but faced limited options and dramatically higher costs. Industry leaders in smartphones, laptops, and home appliances projected significant production delays and price increases for upcoming product releases.

The defense sector confronted particularly serious challenges. Military contractors with ongoing projects faced potential delivery delays for critical systems. Department of Defense officials initiated emergency procurement processes to secure stockpiles of essential materials for priority defense applications.

This crisis exposed structural weaknesses in America's industrial policy. Decades of prioritizing cost efficiency and just-in-time inventory systems had created a manufacturing base with minimal resilience to supply disruptions. The absence of domestic processing capacity meant that even the limited mining operations in the U.S. couldn't translate to finished materials without Chinese processing.

The vulnerability extended beyond direct rare earth shortages. Companies discovered that numerous components sourced from third countries actually contained Chinese-processed rare earths, revealing hidden dependencies throughout complex global supply chains.

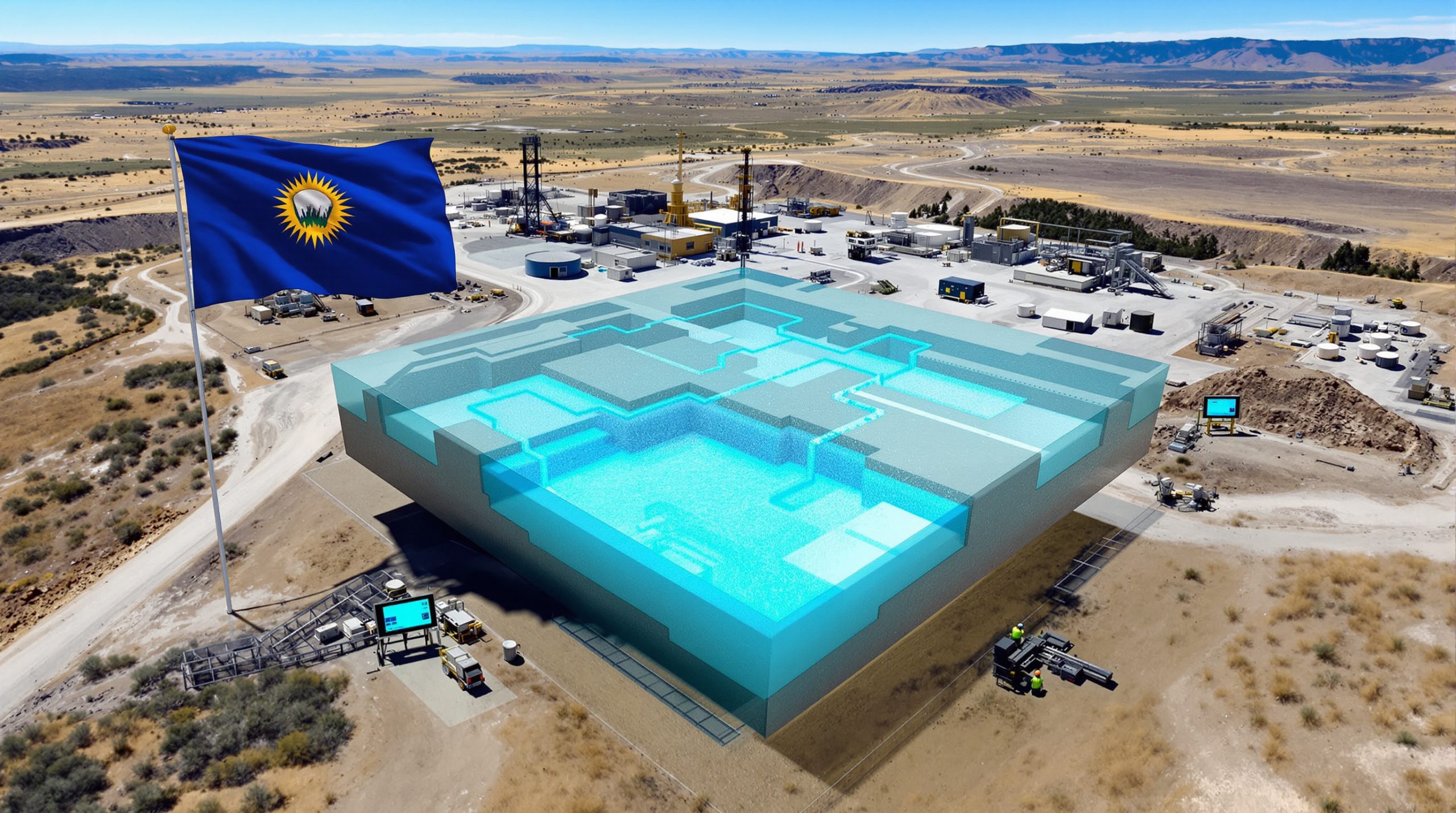

How Is Mountain Pass Mine Leading America's Rare Earth Revival?

The Mountain Pass facility in California's Mojave Desert, operated by MP Materials, stands as a symbol of America's renewed commitment to rare earth production. As "the only operating rare earth mine in the United States," according to the South China Morning Post's reporting, Mountain Pass represents both the challenges and potential of domestic rare earth development.

The mine's history reflects the broader trajectory of America's relationship with rare earth production. Once the world's premier source of rare earths, Mountain Pass ceased operations in the early 2000s as Chinese competition made it economically unviable. After changing ownership multiple times and remaining dormant for years, the mine resumed production in 2018 under MP Materials' management.

Today, Mountain Pass produces approximately 15% of the world's rare earth concentrates, focusing primarily on neodymium and praseodymium. However, the operation still ships most of its concentrated ore to China for separation and processing—a dependency the company is working to eliminate through major infrastructure investments.

MP Materials has committed over $700 million to developing domestic processing capabilities at the Mountain Pass site. These investments aim to create a complete mine-to-magnet supply chain within the United States, addressing a critical gap in America's rare earth ecosystem.

America's Only Operating Rare Earth Mine

The Mountain Pass facility occupies a unique position in America's mineral landscape. Located about 15 miles from the California-Nevada border, the mine sits atop one of the richest rare earth deposits in North America. The site contains bastnäsite, a mineral particularly rich in light rare earth elements like cerium, lanthanum, and neodymium.

The facility's current operations represent a remarkable revival story. After its 2002 closure due to environmental concerns and Chinese competition, the site underwent extensive remediation and technological upgrades before reopening. Today's Mountain Pass bears little resemblance to its earlier incarnation, with substantially improved environmental controls and processing efficiency.

MP Materials' current production capacity exceeds 40,000 metric tons of rare earth concentrate annually. This output represents significant progress but still falls short of meeting domestic demand. The company has announced plans to increase production by an additional 25% over the next three years.

The site's workforce has grown to over 300 employees, providing significant economic benefits to surrounding communities. Many of these positions require specialized technical training, creating high-skill job opportunities in a region historically dependent on tourism and gaming.

While Mountain Pass currently produces concentrated ore, MP Materials is implementing a three-stage development plan to expand its capabilities:

- Stage 1: Optimization of mining and concentration (completed)

- Stage 2: Development of separation and processing facilities (in progress)

- Stage 3: Production of finished rare earth magnets (planned)

This expansion strategy aligns with broader national security objectives to reduce dependency on foreign processing and manufacturing.

Technological Innovations at Mountain Pass

The modern Mountain Pass operation bears little resemblance to the facility that closed in 2002. MP Materials has implemented numerous technological innovations to improve efficiency, reduce environmental impact, and enhance competitiveness against Chinese operations.

The company has deployed advanced ore sorting technologies that use optical and X-ray sensors to identify and separate rare earth-bearing minerals from waste rock before processing begins. This reduces the volume of material requiring chemical processing, improving efficiency and reducing environmental impact.

Water management represents another area of significant improvement. The facility now employs a closed-loop water recycling system that recovers and reuses approximately 95% of process water. This technological advancement is particularly important given the mine's desert location and California's recurring water challenges.

Energy efficiency improvements include on-site solar power generation and advanced process control systems that optimize energy usage throughout the operation. These innovations help address one of the traditional cost advantages of Chinese operations—lower energy costs.

The chemical processing systems at Mountain Pass have been redesigned to reduce the use of acids and other reagents while improving rare earth recovery rates. These improvements decrease both operational costs and environmental footprint.

Perhaps most significantly, MP Materials is developing proprietary separation technologies that could potentially overcome China's longstanding technical advantages in rare earth processing. These methods aim to reduce the numerous separation stages traditionally required, potentially slashing processing costs by 35-40%.

The company has also pioneered new approaches to handling the thorium and uranium naturally occurring alongside rare earth deposits. Advanced extraction techniques minimize radioactive waste generation while ensuring regulatory compliance and environmental protection.

What New Projects Are Emerging in the American Rare Earth Sector?

The trade war's escalation has catalyzed unprecedented growth in America's rare earth sector, with multiple new projects moving from planning to implementation. While Mountain Pass represents the current foundation of domestic production, emerging ventures aim to diversify and strengthen the supply chain.

According to the South China Morning Post, USA Rare Earth "launched in 2019 with the goal of reviving America's rare earth magnet supply chain" and is now "raising US$300 million to open three new production lines." This represents just one of several ambitious projects gaining momentum as investment flows into this once-neglected sector.

The emerging projects span the entire value chain—from mining and processing to magnet manufacturing and recycling. This comprehensive approach reflects growing recognition that true supply chain security requires capabilities at every stage of production.

New ventures are geographically diverse, with significant projects developing in Texas, Wyoming, Nebraska, and Alaska. This distribution helps mitigate regional regulatory and resource challenges while creating economic opportunities across multiple states.

Industry observers note that these new entrants typically incorporate more advanced technologies and business models than previous generations of rare earth companies, potentially improving their chances of long-term viability against established Chinese competitors.

USA Rare Earth's Ambitious Expansion Plans

USA Rare Earth represents one of the most ambitious new entrants in America's rare earth revival. Founded in 2019, the company has pursued a vertically integrated strategy aimed at addressing multiple vulnerabilities in the domestic supply chain.

The company's CEO, Joshua Ballard, has articulated a vision of comprehensive supply chain development: "We're looking at how we can accelerate… We want to be a major player in this," he told the South China Morning Post. This acceleration comes in response to the dramatically changed market conditions following China's export controls.

USA Rare Earth's $300 million investment plan focuses on three key production lines:

- Mining and concentration: Development of the Round Top deposit in Texas, which contains 16 of the 17 rare earth elements along with critical minerals like lithium

- Separation and processing: Construction of processing facilities to transform concentrated ore into purified rare earth oxides

- Magnet manufacturing: Production of finished neodymium-iron-boron (NdFeB) magnets for end-users

The company's integrated approach is designed to address a critical weakness in the current American supply chain—the absence of commercial-scale rare earth separation facilities. Even domestically mined materials currently require overseas processing, creating a persistent vulnerability.

USA Rare Earth has acquired specialized equipment and intellectual property that provide significant advantages in developing these capabilities. In 2020, the company purchased the only sintered rare earth permanent magnet manufacturing equipment in the Western Hemisphere, previously owned by Hitachi.

The company plans to begin production of magnets by late 2026, with full operational capacity expected by 2028. At full scale, the facilities could satisfy approximately 10% of current U.S. demand for rare earth magnets, representing a significant step toward supply chain resilience.

The Transformation in Investor Sentiment

Perhaps the most dramatic change in America's rare earth sector has been the radical shift in financial markets' perception of these ventures. As recently as early 2025, raising capital for rare earth projects remained extraordinarily challenging despite their strategic importance.

Joshua Ballard candidly described this transformation, noting he "was having a hard time raising capital from Wall Street until a few months ago" but the investment environment "all changed" after trade war escalation, according to the South China Morning Post's reporting.

This shift reflects several factors transforming investor calculations:

- Perceived permanence: Unlike previous trade tensions, the current situation is increasingly viewed as a long-term structural change rather than a temporary dispute

- Price signals: Dramatic increases in rare earth prices have improved project economics, with some elements seeing 200-300% price increases

- Government backing: Enhanced federal support programs reduce perceived investment risk

- National security premium: Investors recognize the strategic importance now attached to these projects beyond pure market economics

Venture capital firms and private equity investors who previously avoided the sector now actively seek opportunities. Several rare earth ventures have successfully completed funding rounds at valuations that would have been unthinkable just months earlier.

Public markets have similarly transformed their approach to rare earth companies. Share prices for the limited number of publicly traded American rare earth companies have surged, with some seeing 400-500% increases following the export restrictions. This market performance has created opportunities for secondary offerings and additional capital raising.

Notably, investment interest extends beyond mining to processing and magnet manufacturing—areas previously considered too risky or capital-intensive for most investors. This comprehensive investment approach improves prospects for developing complete domestic supply chains rather than addressing only isolated segments.

How Is Government Policy Supporting Domestic Rare Earth Development?

The U.S. government has implemented a multi-faceted approach to support domestic rare earth development, recognizing that market forces alone cannot rapidly overcome decades of underinvestment. These initiatives span multiple federal agencies and coordinate with state-level programs to address various aspects of the supply chain challenge.

Policy support operates through several complementary mechanisms. Direct funding provides immediate capital for critical projects, while tax incentives encourage private investment. Regulatory changes aim to streamline development while maintaining environmental protections. Research funding supports innovation to overcome technical hurdles and improve competitiveness.

The Department of Defense plays a particularly important role, as military applications represent both critical needs and potential anchor customers for emerging domestic suppliers. Defence funding has supported several rare earth projects through the defence critical materials strategy and related programs.

These government initiatives signal a significant shift in America's approach to [critical minerals and energy security](https://discov

Ready to Capitalise on the Next Rare Earth Discovery?

Stay ahead in the critical minerals investment landscape with Discovery Alert's proprietary Discovery IQ model, which instantly identifies significant ASX rare earth discoveries and turns complex data into actionable insights. Explore why major mineral discoveries can lead to substantial market returns by visiting Discovery Alert's dedicated discoveries page and begin your 30-day free trial today.