Understanding Rare Earth Metals and China's Export Controls

Rare earth metals have become a focal point in global geopolitics, with China's recent export controls triggering significant concerns across multiple industries. In April 2025, China added seven rare earth metals to its export control list as a strategic response to U.S. tariffs, highlighting the growing weaponization of these critical materials in international trade disputes. The China mineral export controls have created ripples across global supply chains and financial markets. Despite their name, rare earth metals aren't particularly rare in the Earth's crust, but their concentration in economically viable deposits and the complex processing requirements have enabled China to establish unprecedented market dominance.

These elements are integral to approximately 90% of advanced military systems and 80% of clean energy technologies worldwide, making them indispensable for national security and climate objectives. As one industry analyst noted, "China's dominance in mining and refining transforms rare earths into geopolitical tools" with far-reaching implications for global supply chains.

What Are Rare Earth Metals?

Definition and Properties

Rare earth metals comprise 17 elements in the periodic table, including the 15 lanthanides plus scandium and yttrium. Despite the "rare" designation, many of these elements are actually relatively abundant in the Earth's crust—cerium, for instance, is more common than copper. What makes them challenging to obtain is their geochemical properties, which prevent them from concentrating in easily exploitable ore deposits.

These metals share similar chemical properties, making separation extremely difficult and expensive. Each element possesses unique electron configurations that enable specialized applications across numerous high-tech industries. For example, lanthanum's electron configuration makes it exceptionally valuable as a catalyst in petroleum refining, while cerium's redox properties are essential for automotive catalytic converters.

Importance in Modern Technology

The technological revolution of the 21st century would be impossible without rare earth metals. Their unique electromagnetic properties, luminescence, and catalytic abilities make them irreplaceable in many advanced applications. Neodymium magnets, containing neodymium, praseodymium, and dysprosium, are the strongest permanent magnets available—critical for electric vehicle motors, wind turbine generators, and hard disk drives.

In defense applications, rare earths enable precision-guided weapons, radar systems, and communications equipment. One particularly significant example is yttrium-aluminum-garnet lasers used in missile guidance systems. The clean energy transition likewise depends heavily on these elements, with each megawatt of wind power requiring approximately 600 kg of rare earth materials.

Global Distribution and Occurrence

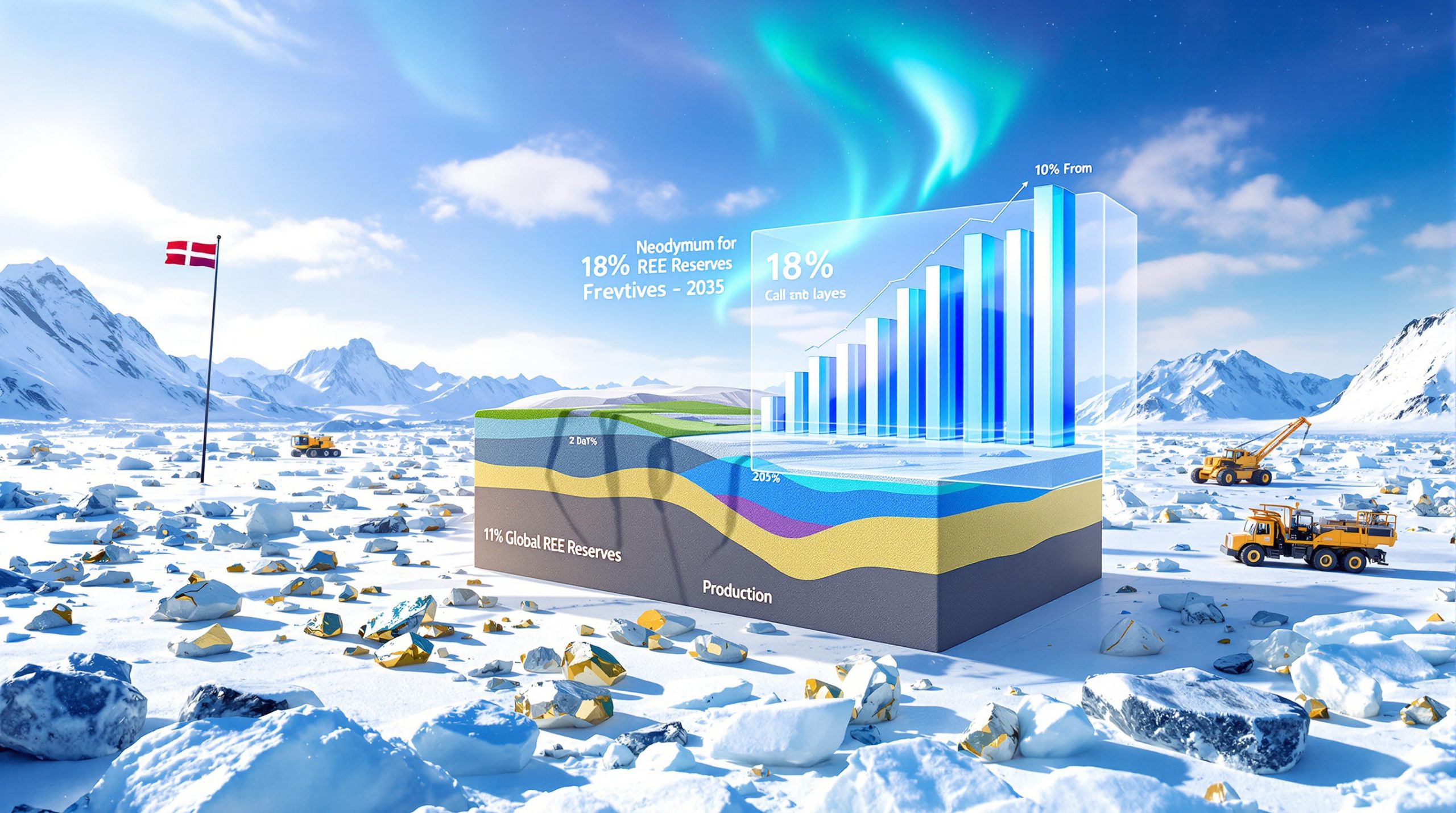

While rare earth deposits exist worldwide, they form under specific geological conditions. The largest deposits occur in China, Vietnam, Brazil, Russia, and the United States. Particularly important are ionic adsorption clay deposits found primarily in southern China, which contain higher concentrations of the heaviest, most valuable rare earth elements.

The Mount Weld deposit in Australia and Mountain Pass in California represent significant non-Chinese resources, but together they account for less than 20% of global production. Brazil's newly discovered Presidente Figueiredo deposit may contain over 8 million tons of rare earth oxides, but development remains years away from commercial viability. According to recent assessments of global rare earth reserves, the geographical distribution of these minerals continues to shape investment strategies worldwide.

China's Dominance in the Rare Earth Market

Mining Capacity and Production Statistics

China's dominance in rare earths begins with its extraordinary mining capacity. The Bayan Obo mine in Inner Mongolia alone produces approximately 45% of global rare earth supply. Overall, Chinese mines extract over 70% of the world's rare earth ores, giving Beijing unparalleled leverage over initial supply.

In 2024, China's rare earth mining quota reached a record 240,000 tonnes, representing a 20% increase over the previous year. This production scale dwarfs all other countries combined, with only Australia's Lynas Corporation and America's MP Materials offering meaningful alternative sources.

Processing and Refining Capabilities

China's most significant advantage lies not in mining but in processing. The country currently refines approximately 92% of global rare earth oxides, controlling the crucial middle stages of the supply chain. This processing dominance persists even when ores are mined elsewhere—Mountain Pass in California ships most of its concentrate to China for separation and processing.

Rare earth processing involves complex chemical procedures requiring specialized knowledge, substantial water resources, and environmental management systems. Chinese facilities have mastered techniques like solvent extraction, ion exchange, and selective precipitation that separate individual elements from mixed concentrates. As one industry analyst emphasized, "Processing expertise, not just mining, cements China's monopoly."

Historical Development of China's Rare Earth Industry

China's rare earth supremacy represents a deliberate, decades-long strategy rather than geological fortune. In the 1980s, Deng Xiaoping famously remarked that "rare earths are to China what oil is to the Middle East," signaling the country's recognition of these elements' strategic value long before Western nations.

Through the 1990s and 2000s, China leveraged low labor costs, limited environmental regulations, and substantial government subsidies to undercut global competitors. When Western mines like Mountain Pass shut down due to cost pressures and environmental concerns, China consolidated its position further. By requiring foreign companies to establish joint ventures with Chinese partners, the country systematically acquired technical knowledge while building domestic expertise.

Why Are Rare Earth Metals Strategic Resources?

Military and Defense Applications

Modern military systems rely extensively on rare earth components. Fighter aircraft like the F-35 contain approximately 417 kg of rare earth materials in their various systems. Precision-guided munitions depend on rare earth magnets for steering mechanisms, while night vision devices utilize rare earth phosphors.

Naval applications include sonar systems and degaussing equipment for submarines, which rely heavily on rare earth materials. The Pentagon has identified rare earth supply vulnerability as a critical national security concern, with approximately 75% of U.S. defense contractors dependent on Chinese rare earth inputs in their supply chains. This dependency has intensified the critical minerals race between major powers seeking to secure their technological and military infrastructure.

Clean Energy Technology Dependencies

The transition to renewable energy has dramatically increased demand for certain rare earth elements. Each electric vehicle requires approximately 1-2 kg of rare earth materials for its motor magnets. Wind turbines, particularly direct-drive models optimized for offshore use, contain up to 600 kg of rare earth elements per megawatt of generating capacity.

Solar panel production uses smaller quantities but remains dependent on specific rare earths for certain components. Energy storage technologies, including advanced batteries and hydrogen fuel cells, likewise incorporate these materials in critical applications. This clean energy dependency creates a strategic dilemma: carbon reduction goals may require increased reliance on Chinese-controlled materials.

Consumer Electronics Requirements

Smartphones, laptops, and other consumer devices incorporate multiple rare earth components. Each smartphone contains approximately 8-9 different rare earth elements, with neodymium magnets in speakers, dysprosium in vibration motors, and europium and terbium in displays. The miniaturization trend in electronics has actually increased rare earth intensity per device, as these elements enable smaller, more powerful components.

The consumer sector accounts for approximately 40% of global rare earth consumption, making it particularly vulnerable to supply disruptions. As AR/VR technologies and wearable devices proliferate, this dependency continues to grow.

Industrial Manufacturing Necessities

Beyond high-tech applications, rare earths play crucial roles in conventional manufacturing. Cerium oxide serves as a precision polishing compound for glass, including smartphone screens and precision optics. Lanthanum catalysts improve petroleum refining efficiency, while mixed rare earth alloys enhance steel performance.

Industrial magnets, sensors, and specialized ceramics all incorporate rare earth components, affecting sectors from automotive manufacturing to medical equipment production. This widespread industrial reliance creates cascading vulnerabilities throughout global manufacturing supply chains.

The Seven Rare Earth Metals Under Export Control

Scandium: Properties and Applications

Scandium, though often classified with rare earths due to similar properties, is technically a transition metal. Its primary value lies in aluminum alloys, where even small additions (0.2-0.3%) dramatically increase strength while reducing weight. These properties make scandium-aluminum alloys ideal for aerospace applications, including fighter planes and specialized sports equipment.

In solid oxide fuel cells, scandium-stabilized zirconia functions as an exceptional electrolyte material, improving efficiency and operating temperature ranges. Despite these valuable applications, global scandium production remains extremely limited at approximately 15-20 tonnes annually, making it particularly vulnerable to export restrictions.

Yttrium: Critical Uses and Substitutes

Yttrium serves as a critical component in phosphors for LED lighting, display technologies, and laser systems. Yttrium-aluminum-garnet (YAG) crystals form the basis for industrial cutting lasers, surgical tools, and communications equipment. In medical applications, yttrium-90 isotopes are used in certain cancer treatments.

The nuclear industry relies on yttrium for reactor components due to its neutron transparency and heat resistance. While some applications have potential substitutes, areas like laser technology and medical imaging face significant challenges finding alternatives to yttrium, making export controls particularly impactful.

Lanthanum: Industrial Importance

Lanthanum plays a crucial role in fluid catalytic cracking (FCC) catalysts used in petroleum refining, improving efficiency and enabling processing of heavier crude oils. Nickel-metal hydride (NiMH) batteries, though declining in market share, still rely heavily on lanthanum for their cathodes.

Optical glass manufacturing depends on lanthanum oxide to increase refractive index without discoloration, critical for high-performance camera lenses and fiber optics. This combination of industrial applications makes lanthanum economically significant despite receiving less attention than magnetic rare earths.

Cerium: Technical Applications

Cerium, the most abundant rare earth element, serves as a polishing agent for glass, semiconductor wafers, and gemstones. Its oxide form provides exceptional precision in removing surface imperfections without changing dimensions. Automotive catalytic converters incorporate cerium as an oxygen storage component, improving efficiency and reducing emissions.

UV-blocking applications in glass utilize cerium's ability to absorb ultraviolet light while remaining transparent to visible wavelengths. Though relatively abundant, cerium's inclusion in export controls demonstrates China's strategic approach to controlling even lower-value rare earths.

Neodymium: Magnet Production and Demand

Neodymium forms the basis for NdFeB permanent magnets, the strongest commercially available magnetic material. These magnets enable miniaturization of motors, speakers, and generators while improving efficiency. Electric vehicle drives typically require 1-2 kg of neodymium per vehicle, with demand expected to increase 300% by 2030 as transportation electrifies.

Wind turbine generators represent another major demand source, particularly direct-drive designs that eliminate transmission components. Export restrictions have had immediate market impacts, with neodymium prices reportedly surging 300% following the 2025 controls, forcing manufacturers to activate contingency plans and stockpiles.

Praseodymium: High-Tech Uses

Praseodymium typically works alongside neodymium in magnets, improving temperature stability and coercivity. Praseodymium-doped fiber amplifiers enable 5G telecommunications infrastructure, boosting signal strength over long distances. Special glass utilizing praseodymium provides protection from infrared radiation in environments like steel mills.

In ceramic applications, praseodymium oxide creates a distinctive yellow pigment resistant to extreme temperatures. Though less recognized than neodymium, praseodymium's inclusion in export controls reflects its growing significance in advanced telecommunications and magnet applications.

Dysprosium: Heat Resistance Applications

Dysprosium serves as a critical additive in neodymium magnets intended for high-temperature environments, preventing demagnetization at temperatures up to 200°C. This property makes dysprosium essential for electric vehicle motors, wind turbines, and industrial applications where operating temperatures fluctuate dramatically.

Specialty turbine alloys incorporate dysprosium to maintain strength at temperatures reaching 600°C. Control rod materials in nuclear reactors utilize dysprosium's exceptional neutron absorption capabilities. As one of the heaviest and least abundant rare earths under export control, dysprosium faces particularly severe supply constraints outside China.

How China's Export Controls Work

Legal Framework and Implementation

China's rare earth export controls operate under the Export Control Law of 2020, which established comprehensive mechanisms for restricting outbound shipments of strategic materials. The April 2025 inclusion of seven rare earths expanded the control list to include both raw materials and certain processed forms, representing an escalation from previous quota-based approaches.

The controlling authority, China's Ministry of Commerce, coordinates with customs officials to track shipments and verify compliance. Unlike earlier restrictions focused primarily on raw materials, the 2025 controls extend to certain alloys and compounds containing controlled rare earths, closing previous regulatory loopholes.

Export Licensing Requirements

Companies seeking to export controlled rare earths must navigate a complex licensing process requiring approximately 120 days for approval. Applications must detail end-users, applications, quantities, and contractual arrangements. Authorities evaluate applications based on national security considerations, relationship with destination countries, and strategic priorities.

Foreign entities purchasing Chinese rare earths now face additional documentation requirements, including end-use certificates and periodic verification of appropriate usage. This system creates significant administrative burdens while providing Chinese authorities visibility into foreign supply chains and technological applications.

Quota Systems and Restrictions

Beyond the licensing system, China maintains production and export quotas updated semi-annually based on domestic demand projections and strategic objectives. The quota system prioritizes value-added products over raw materials, encouraging domestic processing industries while limiting foreign access to unprocessed resources.

Quota allocations increasingly favor companies participating in the national rare earth industry consolidation program, accelerating the formation of state-controlled giants with enhanced pricing power. Historical precedent suggests quota assignments may incorporate political considerations, with companies serving priority industrial sectors receiving preferential access.

Enforcement Mechanisms

Enforcement involves multiple agencies, including customs authorities, the Ministry of Commerce, and provincial resource departments. Penalties for violations include substantial fines, revocation of export privileges, and potential criminal charges for serious infractions. Tracking technologies and enhanced inspection procedures at ports have strengthened enforcement capabilities.

China has established specialized rare earth material verification laboratories at major ports to detect attempts to misclassify controlled materials. The 2023 gallium export restrictions demonstrated China's willingness to rapidly implement and strictly enforce controls on strategic minerals, providing a precedent for rare earth enforcement approaches.

What Are the Geopolitical Implications?

US-China Trade Tensions

The rare earth export controls directly respond to escalating trade tensions, particularly U.S. semiconductor restrictions and tariffs on Chinese goods. By targeting materials critical to U.S. defense and clean energy objectives, China has created leverage in ongoing trade negotiations while demonstrating its willingness to employ resource diplomacy.

Pentagon officials have characterized the restrictions as "concerning but anticipated," acknowledging that defense planning has incorporated rare earth vulnerability assessments since at least 2019. Congressional hearings following the announcement focused on accelerating domestic capabilities, with proposed legislation to expand tax incentives for rare earth production and processing.

Global Supply Chain Vulnerabilities

The controls expose fundamental vulnerabilities in global manufacturing networks, where Chinese processing dominates even for materials mined elsewhere. Companies across multiple sectors face difficult decisions between accepting higher prices, developing alternative suppliers at significant cost, or redesigning products to reduce rare earth dependency. Understanding global commodities insights has become crucial for businesses navigating these challenging supply chain disruptions.

Supply chain consultants report that approximately 60% of affected companies lacked viable contingency plans before the announcement, despite years of warnings. The most severe impacts affect companies requiring high-purity individual elements rather than mixed rare earth products, as separation capabilities remain particularly concentrated in China.

National Security Concerns

Defense departments worldwide classify rare earth supply security as a critical vulnerability, with approximately 75% of U.S. defense contractors dependent on Chinese inputs somewhere in their supply chains. According to a 2025 Pentagon report, "Decoupling rare earth supply chains could take 8–10 years" even with accelerated investment and regulatory support.

Weapons systems development timelines now incorporate material security assessments, with some programs reportedly exploring alternative technologies to reduce dependency on the most vulnerable elements. Intelligence agencies have expanded monitoring of China's rare earth production and policy signals, elevating these materials to strategic intelligence priorities.

Technology Development Impacts

Emerging technologies face particular challenges from export controls, as research and development typically requires small quantities of diverse materials before commercialization. Quantum computing, advanced battery chemistry, and next-generation semiconductor projects report delays due to material access uncertainties.

University research programs express concerns about academic collaboration impacts, as material transfer restrictions complicate international partnerships. Some technology companies have established strategic rare earth reserves for research purposes, while others deliberately avoid rare earth-dependent designs despite potential performance trade-offs.

How Are Countries Responding to China's Control?

US Strategic Initiatives

The United States has implemented a multi-faceted response centered on the Critical Minerals Security Act, which provides $2 billion in funding for domestic production, processing capabilities, and stockpiling initiatives. Tax incentives for rare earth recycling and production have been expanded, while Defense Production Act authorities now encompass rare earth supply chain development.

The Mountain Pass mine in California has received federal support to establish domestic processing capabilities, though reaching commercial scale remains several years distant. Research funding has increased for alternative technologies and substitution strategies, particularly through ARPA-E programs focused on reducing rare earth intensity in energy applications.

European Union Policy Approaches

The European Raw Materials Alliance has accelerated its action plan, focusing on partnerships with non-Chinese suppliers and investments in processing infrastructure. Member states have

Want to Stay Ahead of Major Mineral Discoveries?

Don't miss the next big mining opportunity on the ASX. Discover how Discovery Alert's proprietary Discovery IQ model provides instant notifications on significant mineral discoveries, giving you actionable investment insights before the broader market reacts. Explore our discoveries page today to see how major mineral findings can deliver substantial returns.