Red Mountain Lithium Project Delivers Exceptional Drill Results

Astute Metals has announced impressive final assay results from its diamond drilling program at the Red Mountain Lithium Project in Nevada, significantly enhancing the project's potential as a major lithium resource in North America. The latest drilling campaign has delivered multiple high-grade lithium intercepts across an extensive strike length, positioning Red Mountain as an increasingly significant clay-hosted lithium project in the United States.

Breakthrough Drilling Results Expand Mineralization Footprint

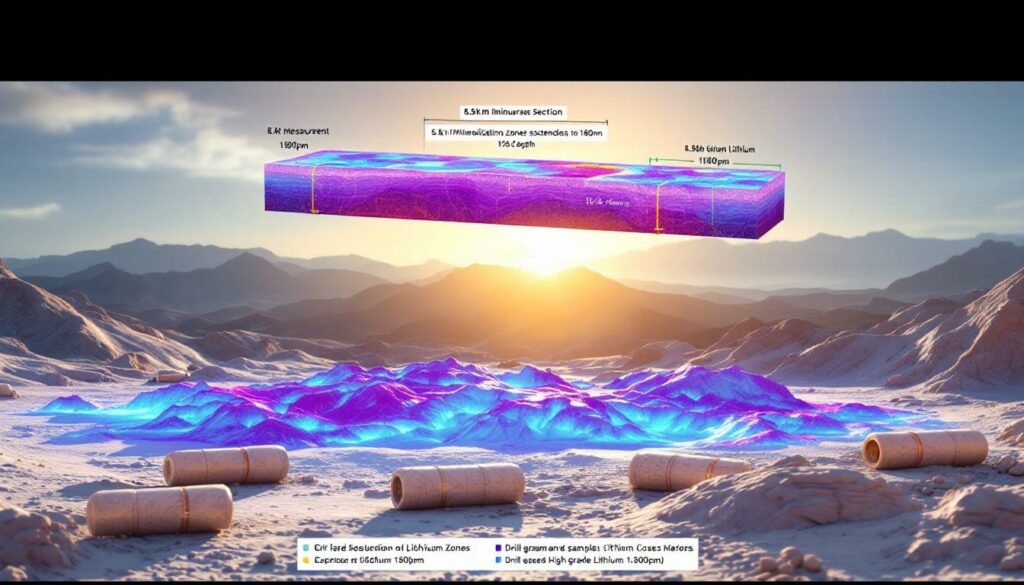

The standout performance came from drill hole RMDD008, which returned six distinct zones of lithium mineralization totaling an impressive 170.4 meters. These results have dramatically expanded the known dimensions of the lithium system at Red Mountain, with mineralization now confirmed across a substantial 5.6-kilometer strike length and to depths exceeding 180 meters.

Dr. Adam Smith, Chief Geologist at Astute, commented: "The consistent high-grade intercepts we're seeing at Red Mountain are exceptional for a clay-hosted lithium project. The extensive mineralization in RMDD008 exceeded our expectations and demonstrates the robust nature of this lithium system."

The drilling campaign revealed multiple high-grade zones exceeding 1,300ppm Li (equivalent to 0.70% Lithium Carbonate Equivalent or LCE), contained within broader mineralized intervals. This grade consistency across significant widths positions Red Mountain favorably among comparable US lithium clay projects.

Notable Mineralized Intercepts Demonstrate Project Potential

The latest drilling program types delivered several noteworthy intercepts that highlight the project's potential:

- 33.8m @ 1,130ppm Li (0.60% LCE) from 34.8m

- Including 10.7m @ 1,320ppm Li (0.70% LCE)

- 62.4m @ 1,210ppm Li (0.64% LCE) from 152.2m

- Including 27.5m @ 1,421ppm Li (0.76% LCE) from 176.7m

These results are particularly significant when considering that many economic lithium clay projects operate in the 800-1,200ppm Li range. The presence of consistent zones exceeding 1,300ppm Li suggests Red Mountain hosts premium-grade mineralization by industry standards.

"What's particularly exciting about these results is not just the grades, but the width and continuity of mineralization we're seeing. These are some of the widest lithium clay intercepts reported in comparable US projects," noted Dr. Smith.

Geological Context Provides Valuable Insights

The majority of lithium mineralization at Red Mountain occurs within clay-rich sedimentary formations, which is typical of lithium clay deposits in the western United States. However, drill hole RMDD004 encountered different geology, intersecting polymictic conglomerate rather than the clay-rich sediments found elsewhere in the project area.

This geological variation has been interpreted as representing a localized alluvial fan formation with limited claystone intervals. Despite this variation, lithium-bearing clays have been observed at surface up-dip from these lower-grade areas, suggesting the potential for additional mineralization beyond the currently drilled areas.

The technical team has noted that this geological understanding will be crucial for resource modeling and future exploration targeting:

| Drill Hole | Lithology | Mineralization Characteristics | Geological Interpretation |

|---|---|---|---|

| RMDD008 | Clay-rich sediments | Six zones totaling 170.4m | Primary lithium-hosting formation |

| RMDD004 | Polymictic conglomerate | Limited mineralization | Localized alluvial fan formation |

| Other holes | Clay-rich sediments | Consistent mineralization | Part of main sedimentary basin |

Red Mountain's Positioning in the US Lithium Landscape

The consistent high-grade intercepts from Red Mountain position the project as an increasingly significant player among US lithium clay projects. The extensive mineralized zones with multiple high-grade cores provide geological advantages that may translate to favorable economics in future development scenarios.

Strategic Importance in North American Supply Chains

Red Mountain's location in Nevada—often referred to as part of the "Lithium Triangle" of the western United States—provides strategic advantages for potential North American supply chain integration. As major automakers and battery manufacturers seek domestic sources of battery materials, projects like Red Mountain may benefit from increased investment and development interest.

Industry analyst Maria Reyes of Battery Materials Research commented: "Nevada clay projects are attracting significant attention as potential domestic sources of lithium. The grade consistency we're seeing at Red Mountain puts it in a competitive position among peers, especially given the increasing premium placed on US-sourced battery materials."

The project's development timeline, with a maiden resource estimate targeted for completion by the end of 2025, aligns with the projected increase in demand for battery-grade lithium refining to support North America's growing electric vehicle manufacturing capacity.

Technical Differentiation in a Competitive Landscape

Several factors distinguish Red Mountain from other lithium clay projects in the region:

- Grade Consistency: Multiple zones maintaining +1,000ppm Li throughout extensive intervals

- Mineralization Width: Some of the widest lithium clay intercepts reported in comparable US projects

- Depth Profile: Mineralization extending from near-surface to depths exceeding 180 meters

- Geological Setting: Clay-hosted lithium in a sedimentary basin environment favorable for potential extraction

These technical advantages could translate to economic benefits as the project advances toward development. Clay-hosted lithium deposits often offer different cost structures and processing requirements compared to traditional brine operations or hard rock (spodumene) mines.

Astute's Forward Strategy at Red Mountain

With the successful completion of this drilling program, Astute Metals is now planning the next phase of exploration and development activities at Red Mountain.

Upcoming Exploration Activities

The company has outlined several key initiatives for the project's advancement:

- Follow-up Drilling: Planning is underway for the next phase of the drilling program, focusing on further defining the resource boundaries and testing additional target areas.

- Resource Definition: Work is centered on supporting a maiden Mineral Resource Estimate, which will provide the first quantification of the project's economic potential.

- Timeline Expectations: The company has targeted completion of the resource estimate by the end of calendar year 2025.

- Technical Studies: Following resource definition, metallurgical and processing investigations will likely commence to determine optimal extraction methods.

Dr. Jennifer Williams, Processing Specialist at Lithium Technologies Consulting, explains: "Clay-hosted lithium deposits require specific processing approaches. Early metallurgical work at projects like Red Mountain will be crucial for determining the most efficient extraction methods and ultimately influencing project economics."

Corporate and Market Implications

Astute Metals (ASX:ASE) continues to establish its position as an emerging player in the North American lithium sector. With a current market capitalization of approximately $12.98 million and trading at 2.1 cents per share (as of the latest market close), the company represents an early-stage opportunity in the lithium exploration sector.

The upcoming resource estimate represents a significant potential value inflection point for the company. Historically, junior mining strategies with successful resource definitions have experienced market revaluations as projects move from exploration to development phases.

"The transition from exploration to resource definition is often where we see significant value creation in junior mining companies," notes investment analyst Thomas Chen. "For Astute, delivering a maiden resource at Red Mountain could represent a crucial catalyst for market revaluation."

Broader Lithium Market Context and Implications

The development of Red Mountain occurs against a backdrop of significant changes in the global lithium market, particularly in North America.

North American Lithium Supply Dynamics

Several factors make Red Mountain's development particularly timely:

- Strategic Importance: There is growing emphasis on domestic lithium sources for battery supply chains, particularly in light of various government initiatives promoting supply chain security.

- Clay-Hosted Resources: The industry is increasingly focusing on clay deposits as alternatives to traditional brine and hard rock sources, driven by their potential for simpler permitting and development pathways.

- Nevada's Emergence: The state is cementing its position as an important hub for lithium exploration and development, supported by existing mining infrastructure and favorable regulations.

- Development Timeline Advantages: Clay projects potentially offer different development pathways than conventional sources, with possibilities for staged production ramp-ups.

These factors combine to create a favorable environment for projects like Red Mountain, particularly as North American battery manufacturing capacity continues to expand.

Market Demand Considerations

The lithium market continues to experience significant growth, driven primarily by demand from electric vehicle and energy storage applications. Industry projections suggest lithium demand could increase by 300-500% by 2030, creating opportunities for new production sources to enter the market.

Key market factors influencing Red Mountain's development potential include:

- Battery Material Requirements: Ongoing growth in lithium demand for EV and energy storage applications

- Supply Chain Security: Increasing emphasis on geographically diverse lithium sources

- Grade Considerations: Projects with consistent mineralization and favorable grades attracting greater attention

- Development Pathways: Exploration success creating foundation for potential future production decisions

Current lithium market insights indicate growing interest in diversified supply sources beyond traditional production centers.

Technical Considerations for Project Advancement

As Red Mountain progresses from exploration to resource definition and beyond, several technical factors will influence its development pathway.

Key Development Considerations

The project team will need to address several critical areas as development advances:

-

Resource Scale: The extent of mineralization across a 5.6km strike length suggests potential for a significant resource, but comprehensive drilling will be required to fully delineate its dimensions.

-

Metallurgical Characteristics: Processing requirements for clay-hosted lithium will be a critical factor in determining project economics. Clay deposits typically require specific leaching and purification processes distinct from brine or hard rock operations.

-

Infrastructure Access: Nevada's established mining infrastructure provides advantages for potential development scenarios, including access to power, transportation, and skilled labor.

-

Water Requirements: Processing needs and water availability will be important considerations in the water-constrained environment of Nevada. Innovative water management solutions may be required.

-

Permitting Pathway: Nevada's regulatory framework will influence the development timeline, though the state has a history of supporting responsible mining development.

Dr. Robert Johnson, mining consultant and former Nevada State Geologist, notes: "Clay-hosted lithium projects in Nevada benefit from the state's established permitting framework. However, water access remains a critical consideration for any processing operation in the region."

Comparative Project Analysis

When benchmarked against other US clay lithium projects, Red Mountain demonstrates several favorable characteristics:

-

Grade Comparison: Red Mountain's reported grades (exceeding 1,300ppm Li in high-grade zones) compare favorably with other US clay lithium projects, many of which operate in the 800-1,200ppm Li range.

-

Scale Potential: The extensive strike length (5.6km) and depth (exceeding 180m) provide a foundation for potential resource growth beyond initial estimates.

-

Development Timeline: While still an early-stage project with significant technical work required, the clear pathway to a maiden resource estimate by end-2025 provides a defined development timeline.

-

Processing Requirements: Clay-hosted lithium typically requires specific extraction and processing solutions, which will be a focus of future technical studies.

The project team is also investigating possible applications of new geothermal lithium extraction technologies that could complement traditional processing methods.

| Project Aspect | Red Mountain Status | Industry Comparison |

|---|---|---|

| Grade | 1,000-1,400ppm Li in key zones | Above average for US clay projects |

| Strike Length | 5.6km confirmed | Extensive by industry standards |

| Depth | Exceeding 180m | Significant vertical extent |

| Development Stage | Pre-resource | Early-stage with defined pathway |

Frequently Asked Questions About Red Mountain

What makes the Red Mountain lithium discovery significant?

The project has demonstrated extensive lithium mineralization across a 5.6km strike length with multiple high-grade zones exceeding 1,300ppm Li. The latest drilling returned over 170 meters of lithium mineralization in a single hole, positioning it as a standout among US lithium clay projects. These grades and widths are considered exceptional for clay-hosted lithium mineralization in North America.

Where is the Red Mountain Lithium Project located?

The project is located in Nevada, USA, a jurisdiction known for mining-friendly regulations and growing importance in the lithium supply chain. Nevada hosts several developing lithium projects and benefits from established mining infrastructure and expertise.

What are the next major milestones for the project?

Astute is planning the next phase of drilling to support a maiden Mineral Resource Estimate, expected by the end of calendar year 2025. This resource definition will be a significant catalyst for the project's advancement and will provide the first quantifiable measurement of the deposit's economic potential.

How does clay-hosted lithium differ from other lithium sources?

Clay-hosted lithium deposits represent an alternative to traditional brine operations and hard rock (spodumene) mines. They typically require specific processing methods but can offer advantages in certain development scenarios, particularly in regions like Nevada. Clay deposits often present near-surface mineralization amenable to open-pit mining methods and may offer simpler permitting pathways compared to some alternative sources.

What is Astute's current market position?

Astute Metals (ASX:ASE) has a market capitalization of approximately $12.98 million and trades at 2.1 cents per share. The company is positioning itself as an emerging player in the North American lithium sector, focusing on the development of the Red Mountain Lithium Project as its flagship asset.

"The extensive strike length and consistent grades we're seeing at Red Mountain provide a solid foundation for resource growth. Our focus now is on systematic exploration to define the full potential of this lithium system," stated Astute Metals' CEO in a recent interview.

As battery material demand continues to grow and North American supply chains develop, projects like Red Mountain represent potential domestic sources of lithium to support the expanding electric vehicle and energy storage markets. The project's advancement will be closely watched by industry observers as Astute works toward its maiden resource estimate in 2025.

Want to Spot the Next Major Mineral Discovery?

Discovery Alert's proprietary Discovery IQ model instantly notifies investors of significant ASX mineral discoveries like Astute Metals' promising Red Mountain lithium results, providing actionable investment insights before the broader market. Visit the Discovery Alert discoveries page to see how major mineral discoveries have historically generated substantial returns for early investors.