Rio Tinto's Strategic Expansion into Chilean Lithium: The Salares Altoandinos Project

The global demand for lithium continues to surge as electric vehicles and renewable energy storage solutions become increasingly mainstream. In a significant development for the mining industry, Rio Tinto has secured a controlling stake in one of Chile's most promising lithium projects, positioning itself as a key player in the energy transition minerals sector.

What is the Salares Altoandinos Lithium Project?

The Salares Altoandinos project represents a significant lithium brine resource located in Chile's Atacama region, home to some of the world's most productive lithium operations. Unlike hard-rock lithium mining, brine operations extract lithium from mineral-rich underground reservoirs, typically offering lower production costs and different environmental considerations.

Situated in the high-altitude salt flats of northern Chile, this development aims to leverage the region's exceptional natural conditions—intense solar radiation, minimal rainfall, and high evaporation rates—which create ideal conditions for lithium concentration in underground aquifers.

The project is particularly notable for its geological characteristics. The Atacama region's brines typically contain lithium concentrations between 1,000-1,500 parts per million, significantly higher than many competing resources globally, which often range between 200-600 ppm. This higher concentration contributes substantially to the project's classification as a potentially "low-cost" operation.

"The Salares Altoandinos project represents a significant opportunity to develop a large-scale, long-life, low-cost lithium brine resource," stated Sinead Kaufmann, Rio Tinto Minerals CEO, highlighting the strategic importance of this acquisition.

Chile's lithium assets are particularly valuable in the global marketplace, with the country holding approximately 9.2 million tonnes of lithium reserves—second only to Bolivia globally. The country has historically been the world's second-largest lithium producer after Australia, though with fundamentally different extraction methodologies.

How is Rio Tinto Involved in the Chilean Lithium Project?

Rio Tinto's Strategic Partnership with ENAMI

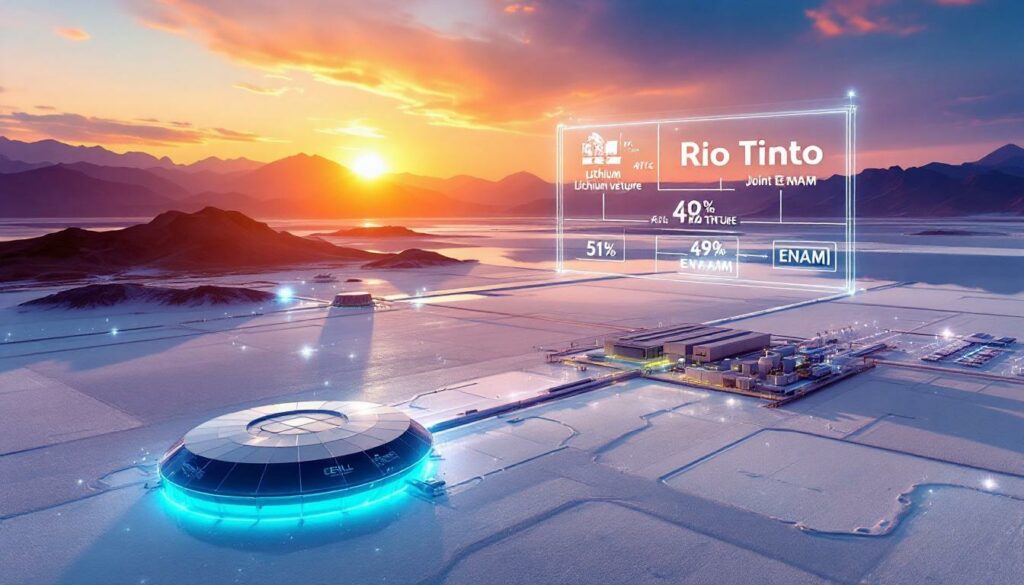

In July 2025, Rio Tinto formalized its entry into Chile's lithium sector by signing a binding agreement with Empresa Nacional de Minería (ENAMI), Chile's state-owned mining company. This partnership follows Chile's strategic approach to lithium development, which balances foreign investment with national interest through joint ventures.

Under the terms of the agreement, Rio Tinto will hold a controlling 51% stake in the Salares Altoandinos project, while ENAMI retains the remaining 49%. This ownership structure reflects Chile's evolving approach to lithium governance—moving away from the strict state control of the past while maintaining significant national participation.

The selection of Rio Tinto as ENAMI's partner came after an extensive competitive process that considered technical capability, financial strength, environmental commitments, and community engagement approaches. This arrangement marks one of the most significant foreign investments in Chile's lithium sector in recent years.

Financial Commitment and Technological Contribution

Rio Tinto's commitment to the project is substantial, with the company pledging up to $425 million in combined cash and non-cash contributions to advance development. This investment package includes:

- Direct financial investment for pre-feasibility and feasibility studies

- Technology transfer of proprietary extraction methods

- Technical expertise from Rio Tinto's existing lithium operations

- Environmental management systems and protocols

A particularly significant aspect of Rio Tinto's contribution is its proprietary direct lithium extraction (DLE) technology, which represents a departure from traditional solar evaporation methods historically used in the Atacama region.

Traditional evaporation pond methods require pumping lithium-rich brine into large surface ponds where solar evaporation concentrates the lithium over 12-18 months before harvesting. In contrast, DLE technologies employ ion-exchange or adsorption processes to selectively extract lithium from brines within hours or days, potentially offering:

- Reduced water consumption: Up to 70% less water usage compared to evaporation ponds

- Smaller physical footprint: Significantly less surface disturbance in sensitive desert ecosystems

- Faster production cycles: Weeks versus months for traditional methods

- Higher lithium recovery rates: Potentially 70-90% versus 40-50% for evaporation ponds

The deployment of DLE technology at Salares Altoandinos will be closely watched by the industry as a potential model for more sustainable lithium production in Chile's sensitive desert environment.

Why is This Partnership Significant for Global Lithium Supply?

Strategic Expansion of Rio Tinto's Lithium Portfolio

This Chilean venture represents a critical piece in Rio Tinto's emerging lithium strategy. The company has been methodically building a diverse lithium portfolio across multiple continents and resource types:

- Jadar Project (Serbia): A hard-rock lithium-boron deposit with 2.3 million tonnes of lithium carbonate equivalent

- Rincon Project (Argentina): A lithium brine project in the "lithium triangle" with 11.7 million tonnes of lithium carbonate equivalent

- Salares Altoandinos (Chile): The newest addition, providing access to Chile's world-class brine resources

This three-continent approach diversifies Rio Tinto's lithium assets across both geological types and jurisdictional risks, establishing the company as a potentially major supplier to battery markets in Europe, Asia, and North America.

Positioning in the Critical Minerals Supply Chain

The timing of Rio Tinto's lithium expansion is strategically aligned with exponential growth projections for electric vehicles and grid-scale energy storage. Industry analysts project lithium demand to increase by 400-500% by 2030, with supply struggling to keep pace.

The International Energy Agency forecasts that meeting climate goals could require a 40-fold increase in lithium production by 2040. Against this backdrop, large-scale projects like Salares Altoandinos take on particular significance for global lithium market trends.

By securing access to Chilean lithium, Rio Tinto positions itself within the most cost-competitive segment of global lithium production. The Atacama region's production costs typically range between $3,500-4,500 per tonne of lithium carbonate equivalent—substantially below the global average of $5,000-6,000 per tonne and significantly lower than hard-rock operations which can exceed $7,000 per tonne.

This cost position could prove crucial as the lithium market evolves, potentially allowing Rio Tinto to maintain profitability even during cyclical price downturns that challenge higher-cost producers.

What Was the Selection Process for the Project Partner?

Competitive Negotiation Phase

The selection of Rio Tinto as ENAMI's development partner followed an extensive multi-stage process that began in early 2024. The Chilean government, through ENAMI, invited proposals from global mining and technology companies with demonstrated lithium expertise.

The competitive process attracted several major contenders, including:

- BYD Chile SpA: The Chilean subsidiary of Chinese electric vehicle manufacturer BYD, which sought vertical integration from lithium production to battery manufacturing

- Eramet Chile SA: The Chilean arm of French mining and metallurgy company Eramet, which has lithium operations in Argentina

- POSCO Australia: A subsidiary of the South Korean steel and materials company, which has invested significantly in lithium processing technology

The selection criteria reportedly emphasized several factors beyond simple financial terms, including:

- Environmental management capabilities: Demonstrated systems for minimizing ecological impacts

- Water conservation technologies: Given the Atacama's extreme aridity

- Community engagement track record: History of working with Indigenous communities

- Technical innovation: Particularly in extraction methodologies

- Financial strength: Capacity to support long-term development

Rio Tinto's selection signals Chile's strategic approach to developing its lithium resources with experienced international mining partners while maintaining significant state involvement through ENAMI's 49% stake.

What Environmental and Community Considerations are Involved?

Environmental Standards and Community Engagement

The Atacama region presents unique environmental challenges. As one of the driest places on Earth—receiving less than 15mm of rainfall annually in many areas—water usage is the primary environmental concern for lithium operations.

Traditional lithium extraction in the region has faced criticism for its water-intensive nature, with conventional operations using approximately 500,000 liters of water per tonne of lithium carbonate produced. This has raised concerns about impacts on fragile desert ecosystems and Indigenous communities' water access.

"We are committed to the highest environmental standards and to ensuring any potential development is guided by transparent, respectful, and ongoing engagement with local communities in Chile's Atacama region," emphasized Kaufmann, addressing these concerns directly.

Rio Tinto has committed to implementing a comprehensive stakeholder engagement program that includes:

- Regular consultation with the region's Indigenous communities, particularly the Atacameño, Colla, and Licanantay peoples

- Transparent water monitoring programs with community participation

- Local employment and training initiatives

- Community development investments

The company will need to navigate complex relationships with communities that have experienced mixed outcomes from previous lithium developments. Several Indigenous communities have filed legal challenges against existing operations over water rights and environmental impacts, creating a complex social landscape.

Sustainable Lithium Extraction Technology

Rio Tinto's direct lithium extraction technology represents a potential environmental advantage over traditional methods. By reducing both water consumption and surface disturbance, DLE may offer a more sustainable approach to lithium production in this sensitive desert ecosystem.

Key environmental advantages of the DLE approach include:

- Reduced land disturbance: Traditional evaporation pond operations can cover thousands of hectares, while DLE facilities have a much smaller footprint

- Lower freshwater consumption: Some DLE technologies can reduce freshwater needs by up to 70%

- Reduced processing chemicals: Some DLE processes require fewer reagents than traditional methods

- Potential for brine reinjection: Some DLE systems allow for treated brine to be returned to the aquifer, potentially reducing hydrological impacts

However, DLE technologies remain relatively new at commercial scale, and their long-term environmental performance in the Atacama context will require careful monitoring and validation through the development process.

What are the Next Steps for the Salares Altoandinos Project?

Regulatory Approvals and Closing Timeline

Before development activities can begin in earnest, the Rio Tinto-ENAMI partnership must navigate several regulatory milestones:

- Foreign investment approval: Review by Chile's foreign investment promotion agency (InvestChile)

- Antitrust clearance: Approval from Chile's competition authority (FNE)

- Mining property verification: Confirmation of mineral rights by the National Geology and Mining Service (SERNAGEOMIN)

- Initial environmental assessment: Preliminary environmental evaluation before detailed studies

The transaction is expected to close in the first half of 2026, subject to these regulatory approvals and conditions. This timeline suggests that significant development activities could commence in late 2026 or early 2027, though preliminary studies and community engagement work will begin earlier.

Pre-feasibility Study and Development Pathway

Rio Tinto's immediate focus will be conducting a comprehensive pre-feasibility study (PFS) to evaluate the technical and economic viability of the project. This multi-disciplinary assessment typically takes 12-18 months and will examine:

- Resource characterization: Detailed drilling to confirm lithium concentrations and reservoir characteristics

- Extraction technology: Pilot testing of DLE technology in site-specific conditions

- Processing requirements: Determination of optimal processing routes

- Infrastructure needs: Power, water, and transportation requirements

- Environmental baseline: Comprehensive environmental impact assessment

- Community dynamics: Social mapping and engagement framework

- Economic models: Capital and operating cost estimates, production profiles

The results of the PFS will inform decisions about the scale, technology, and development approach for the lithium operation. Based on similar projects, initial production could potentially begin 3-4 years after the completion of feasibility studies, putting potential first production in the 2029-2030 timeframe.

How Does This Project Fit into the Global Lithium Market Context?

Strategic Importance of Chilean Lithium Resources

Chile's position in the global lithium landscape is foundational. The country hosts approximately 25% of the world's lithium reserves, primarily in the Atacama salt flats. These resources are particularly valuable because:

- High lithium concentration: Typically 1,000-1,500 ppm versus global average of 200-600 ppm

- Low impurity levels: Requiring less processing than many competing resources

- Favorable climate conditions: High evaporation rates accelerate concentration

- Existing infrastructure: Established export routes and processing knowledge

The Atacama region has historically produced lithium at among the lowest costs globally, with production costs typically $3,500-4,500 per tonne—significantly below the global average of $5,000-6,000 per tonne and hard-rock operations which can exceed $7,000 per tonne.

This cost advantage gives Chilean operations significant protection against price volatility, maintaining profitability even during market downturns that challenge higher-cost producers.

Impact on Global Lithium Supply Dynamics

The Salares Altoandinos project enters a rapidly evolving global lithium market characterized by:

- Accelerating demand growth: Projections of 25-30% compound annual growth through 2030

- Supply constraints: Development timelines of 5-7 years for new projects

- Price volatility: Recent cycles of shortage and oversupply

- Geographic concentration: Production dominated by Australia, Chile, China, and Argentina

- Processing bottlenecks: Limited refining capacity outside China

New large-scale projects like Salares Altoandinos will play a crucial role in balancing global supply and demand dynamics. While the project's exact production capacity has not been announced, similar operations in the region produce 30,000-50,000 tonnes of lithium carbonate equivalent annually.

Industry analysts have highlighted a potential global lithium supply gap of 600,000-800,000 tonnes by 2030 if insufficient new projects are developed. Against this backdrop, the success of projects like Salares Altoandinos takes on particular significance for the clean energy transition.

What Does This Mean for Rio Tinto's Business Strategy?

Diversification Beyond Traditional Mining Operations

This lithium expansion represents Rio Tinto's strategic pivot toward future-facing commodities. While the company maintains significant operations in iron ore, aluminum, copper, and other traditional minerals, this diversification into lithium demonstrates its commitment to positioning for the energy transition.

For context, Rio Tinto has historically derived approximately:

- 60% of earnings from iron ore

- 20% from aluminum

- 10% from copper

- 10% from other minerals and metals

The lithium strategy aims to diversify this revenue profile over the coming decade, potentially establishing a significant new earnings stream as EV adoption accelerates globally.

This strategic shift aligns with broader industry trends, as traditional mining companies increasingly target battery metals and other materials essential to decarbonization technologies. By leveraging its mining expertise, capital resources, and global reach, Rio Tinto aims to establish a competitive advantage in the growing lithium sector.

Building a World-Class Lithium Portfolio

The Salares Altoandinos project adds to Rio Tinto's growing lithium interests, which include:

- Jadar (Serbia): A unique lithium-boron deposit with 2.3 million tonnes of lithium carbonate equivalent resources

- Rincon (Argentina): A brine project with 11.7 million tonnes of lithium carbonate equivalent resources, adding to Rio Tinto's portfolio of Argentina lithium brine insights

- Salares Altoandinos (Chile): The newest addition, providing access to Chile's world-class brine resources

This three-continent approach diversifies Rio Tinto's lithium assets across both geological types and jurisdictional risks. The company appears to be pursuing a strategy that balances:

- Resource diversity: Both hard-rock and brine resources

- Geographic distribution: Projects across Europe, South America, and potentially other regions

- Technical innovation: Developing proprietary extraction technologies, including geothermal lithium extraction methods

- Scale advantage: Targeting large, long-life resources

- Integration potential: Possibilities for downstream processing and refining

This multi-faceted approach could position Rio Tinto as a major lithium supplier to battery markets globally, supporting the company's ambition to lead in minerals critical to the energy transition.

Looking Forward: Challenges and Opportunities

The successful development of the Salares Altoandinos project will require Rio Tinto to navigate several challenges specific to lithium development in Chile:

- Water management: Demonstrating responsible water usage in one of the world's driest regions

- Indigenous relations: Building productive relationships with communities that have experienced mixed outcomes from previous mining developments

- Regulatory evolution: Adapting to Chile's evolving regulatory framework for lithium

- Technical implementation: Scaling DLE technology successfully in commercial operations

- Market timing: Positioning production to enter the market during projected supply deficits

Despite these challenges, the project represents a significant opportunity for Rio Tinto to establish itself as a major player in the lithium sector at a time when demand is projected to grow exponentially with the global energy transition.

For investors and industry observers, the Salares Altoandinos development will serve as an important case study in how major mining companies adapt to the changing mineral demands of a decarbonizing global economy. Furthermore

Ready to Get Early Access to Major ASX Mining Discoveries?

Gain the market edge by receiving instant alerts on significant ASX mineral discoveries through Discovery Alert's proprietary Discovery IQ model. Visit our dedicated discoveries page to see how early identification of major discoveries like Rio Tinto's Chilean lithium project can lead to exceptional investment returns.