The Perfect Storm: Global Market Forces and Geopolitical Pressures

Russia's oil sector faces unprecedented challenges in 2025 as global market dynamics and international sanctions create a perfect storm for the country's energy revenue. The combination of persistent low oil prices and increasingly effective Western sanctions has dramatically altered Russia's position in the global energy landscape, forcing major adjustments in both strategy and expectations.

Russian oil giants are reporting dramatic profit declines, with Rosneft seeing a 68% drop in profits for the first half of 2025 compared to the same period in 2024. This financial pressure extends beyond corporate balance sheets to impact government revenues, investment capacity, and long-term development prospects.

What Factors Are Driving Russia's Oil Revenue Decline?

The decline in Russia's oil profits stems from multiple interconnected factors. Global oversupply conditions, shifting demand patterns, and the targeted sanctions regime have collectively undermined the country's energy export earnings. This multi-faceted pressure has exposed vulnerabilities in Russia's petroleum-dependent economy despite efforts to adapt.

According to financial reports, Russia's flagship Urals crude blend traded at an average of just $58 per barrel during the first half of 2025—13% lower than its average for the second half of 2024. This significant price weakness directly translates to reduced export revenues despite relatively stable production volumes.

The Global Oil Market: Oversupply and Price Weakness

The global crude market has been characterized by persistent oversupply conditions throughout 2025, creating significant headwinds for all oil producers, including Russia. OPEC+ decisions to unwind production cuts have exacerbated this situation, flooding markets with additional barrels at a time when demand growth remains uncertain.

Rosneft CEO Igor Sechin has warned that the global oil surplus could reach 2.6 million barrels per day by Q4 2025, potentially extending price weakness well into 2026. This pessimistic outlook reflects broader industry concerns about structural imbalances in the global oil market.

What Price Trends Are Affecting Russian Export Revenue?

Russian oil blends have consistently traded at substantial discounts to international benchmarks throughout 2025. These expanded discounts are a direct result of sanctions pressure, which has forced Russian producers to offer more competitive pricing to secure buyers in a restricted market.

The financial impact on Russia's major oil producers has been substantial, with all major companies reporting significant profit contractions:

| Company | H1 2025 Profit Decline | Primary Factors Cited |

|---|---|---|

| Rosneft | 68% | Global oversupply, sanctions, monetary policy |

| Lukoil | 51% | Price weakness, currency effects |

| Gazprom Neft | 54% | Higher taxes, currency volatility |

These dramatic profit contractions highlight the severity of the current environment for Russian energy companies and suggest that the combined pressure of market forces and sanctions is having its intended effect.

The Impact of Western Sanctions on Russian Oil Exports

How Have Sanctions Altered Russia's Oil Export Patterns?

Western sanctions have fundamentally transformed Russia's oil export geography, forcing a pivot toward Asian markets, particularly India and China. This reorientation has come at a cost, as these new customers have leveraged their position to negotiate deeper discounts, further eroding profit margins for Russian producers.

Despite pressure from the United States, including a 25% additional tariff on Indian imports to the U.S., Indian refiners continue to prioritize discounted Russian crude. According to Reuters reporting, Russian oil exports to India are actually set to increase in September 2025, highlighting the challenges in enforcing secondary sanctions.

What Specific Sanctions Mechanisms Have Proven Most Effective?

The price cap mechanism implemented by G7 nations and the European Union has proven particularly challenging for Russian exporters. This policy limits the price at which Russian oil can be sold internationally while still accessing Western shipping and insurance services. The result has been expanded discounts and increased logistical costs as Russia attempts to circumvent these restrictions.

Industry analysts note that while sanctions haven't completely derailed Russian exports, they have significantly increased the cost of doing business for Russian oil companies, creating a sustained drag on profitability.

Financial Performance of Major Russian Oil Companies

How Severe Are the Profit Declines for Russian Oil Giants?

Russian oil companies are citing multiple factors for their financial struggles, with Rosneft specifically pointing to "lower oil prices, primarily due to the overproduction of oil" as well as "an expansion of discounts on Russian oil due to the tightening of EU and US sanctions restrictions and a significant strengthening of the ruble exchange rate."

This combination of external market pressures and internal monetary policy challenges has created a perfect storm for Russian oil producers, with few obvious solutions in the short term.

What Concerns Have Russian Oil Executives Expressed?

Russian oil executives have voiced increasing alarm about the sustainability of current market conditions. In addition to concerns about global oversupply, they've criticized domestic monetary policy, arguing that high interest rates artificially strengthen the ruble, further disadvantaging exporters.

Interestingly, not all companies are experiencing the same currency effects. While Rosneft cited the strong ruble as a negative factor, Gazprom Neft pointed to ruble weakness as problematic—suggesting that different business models and export-domestic sales mixes create varied currency exposures.

Production Versus Profitability: Russia's Strategic Dilemma

Why Hasn't Russia Cut Production Despite Lower Profits?

Despite plummeting profits, Russian oil companies have maintained or even increased production levels throughout 2025. This seemingly counterintuitive approach reflects both strategic considerations and practical limitations:

-

Market share preservation remains a priority

-

Production cuts would sacrifice volume without guaranteeing price improvements

-

Technical challenges make shutting in and restarting Russian wells particularly difficult

-

Domestic economic considerations favor maintaining employment and activity levels

This volume-over-price strategy suggests that Russian producers are playing a long game, prioritizing market presence over short-term profitability.

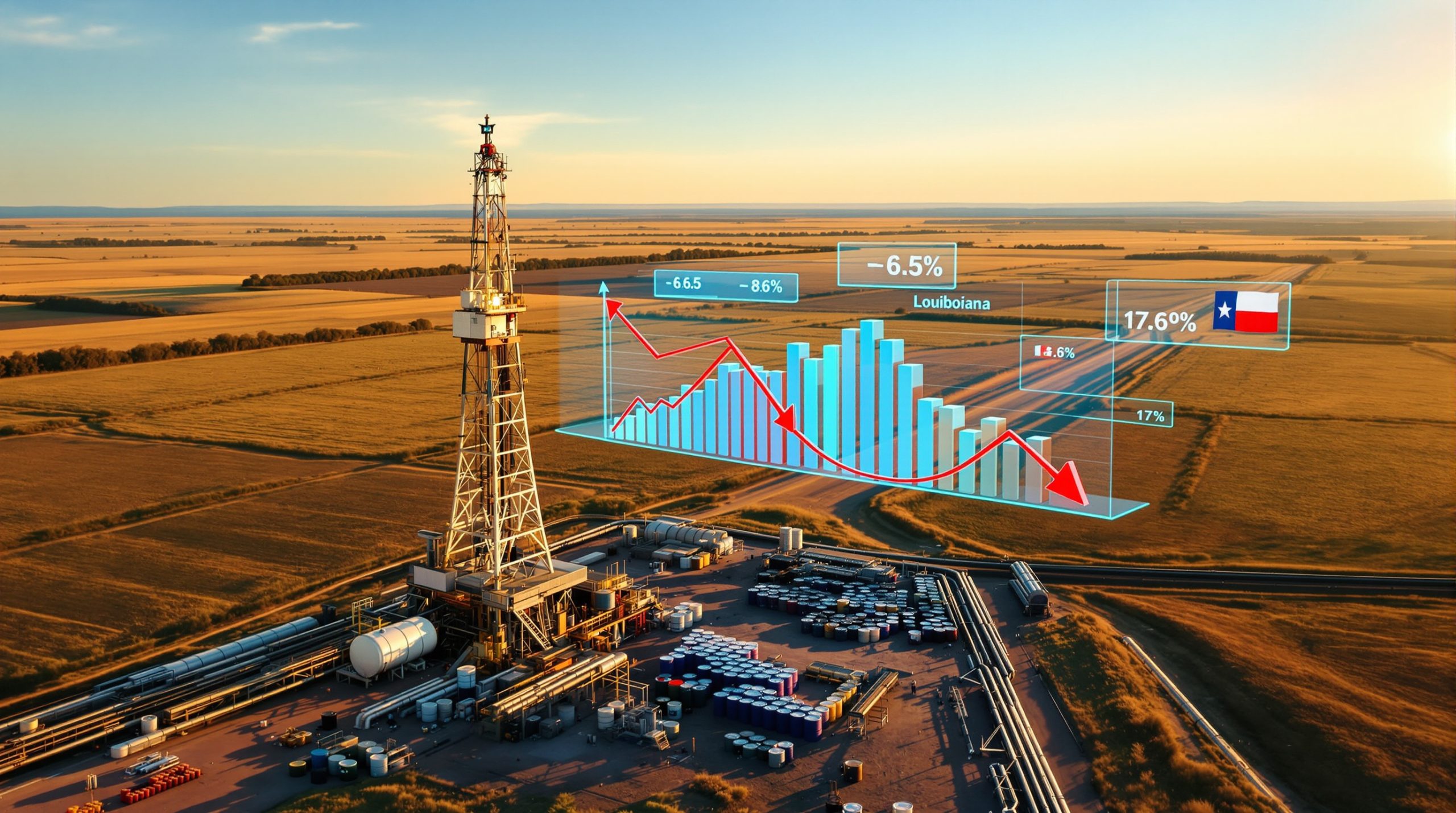

What Production Trends Have Emerged in 2025?

Russian oil output has remained remarkably resilient despite financial pressures. Several major producers have reported production increases in 2025, suggesting that volume strategies are taking precedence over price considerations in the current environment.

This resilience demonstrates the limited effectiveness of sanctions in actually reducing Russian oil production, even as they successfully target profitability and financial returns. Furthermore, analysts predict a potential US oil production decline by late 2025, which could provide some relief to the global oversupply situation.

The Shadow Fleet: Russia's Sanctions Evasion Strategy

How Has Russia Adapted Its Oil Transport Infrastructure?

To circumvent Western shipping restrictions, Russia has developed an extensive "shadow fleet" of aging tankers operating outside traditional insurance and regulatory frameworks. This fleet, consisting primarily of vessels over 15 years old, has enabled continued exports but at significant additional costs and operational risks.

Maritime tracking data suggests this shadow fleet has grown substantially over the past 18 months, allowing Russia to maintain export volumes despite increasingly restrictive sanctions.

What Are the Limitations of the Shadow Fleet Approach?

While the shadow fleet has preserved export volumes, it represents an imperfect and costly solution:

- Higher operational expenses erode already-thin profit margins

- Aging vessels pose increased environmental and safety risks

- Limited capacity constrains Russia's ability to fully redirect export flows

- Insurance and regulatory complications add further complexity and cost

The shadow fleet strategy also creates increased scrutiny from international regulators and maritime authorities, potentially creating additional complications for Russian exporters.

The Currency Factor: Ruble Dynamics and Export Earnings

How Does Russia's Monetary Policy Affect Oil Exporters?

Russia's central bank has maintained elevated interest rates throughout 2025, partly to combat inflation and support the ruble. While this policy helps control domestic price pressures, it creates challenges for exporters who earn in foreign currency but face costs in an artificially strengthened ruble.

This monetary policy dilemma highlights the complex trade-offs facing Russian economic policymakers as they attempt to balance multiple competing priorities during a period of sustained sanctions pressure.

What Currency Effects Have Russian Oil Companies Reported?

Russian oil companies have reported contradictory currency impacts, highlighting the complex interplay between exchange rates and business operations. Companies with different operational profiles experience currency fluctuations differently:

- Export-focused operations suffer when the ruble strengthens

- Domestic-market operations face margin pressure when the ruble weakens

- Companies with significant foreign-denominated debt benefit from a stronger ruble

These varied impacts create additional complexity for both corporate and national economic planning. The situation is further complicated by ongoing oil price trade war dynamics that have emerged in international markets.

International Trade Tensions: Secondary Sanctions and Market Access

How Are Secondary Sanctions Affecting Russian Oil Exports?

The United States has implemented secondary sanctions targeting countries that continue large-scale Russian oil purchases, particularly India. These measures include a 25% additional tariff on Indian imports to the U.S., attempting to discourage Russian oil purchases.

However, their effectiveness remains limited, with Indian refiners continuing to prioritize discounted Russian crude. According to Russian oil giants' financial reports, exports to India are actually set to increase in September despite these tariffs. The implementation of tariffs and investments measures has created additional market uncertainty.

Why Have Secondary Sanctions Failed to Significantly Impact Russian Exports?

Several factors have blunted the impact of secondary sanctions:

-

Price advantages of heavily discounted Russian crude outweigh potential diplomatic costs

-

Alternative markets remain available for refined products derived from Russian oil

-

Complex trading structures obscure the origin of petroleum products

-

Importing nations have developed countermeasures to minimize sanctions exposure

As BNP Paribas analysts noted in August 2025, "The tariffs are part of a broader trade discussion between India and the U.S., and given India's increasing domestic refinery runs amid discounted Russian barrels, we don't see India scuppering its Russian imports in meaningful volumes."

The Outlook: Future Challenges for Russian Oil Revenue

What Price Projections Are Shaping Russian Oil Revenue Expectations?

Market analysts maintain bearish outlooks for oil prices through 2026, with many forecasting Brent crude to remain below $70 per barrel. For Russian grades trading at significant discounts to international benchmarks, this suggests continued pressure on export earnings and corporate profitability.

This pessimistic price outlook compounds the existing challenges facing Russian oil producers, potentially creating a prolonged period of financial stress for the sector. The Trump tariffs impact adds another layer of uncertainty to already volatile markets.

How Might Sanctions Evolution Impact Russian Oil Exports?

The sanctions landscape continues to evolve, with Western nations considering additional measures targeting Russia's energy sector. Potential future restrictions could include:

-

Lowering the price cap threshold for Russian crude

-

Expanding shipping and insurance restrictions

-

Implementing more aggressive secondary sanctions against major buyers

-

Targeting the shadow fleet more directly through enhanced enforcement

The effectiveness of these potential measures would depend on both technical implementation details and the broader geopolitical context, including the willingness of key importing nations to comply.

Structural Challenges for Russia's Oil-Dependent Economy

The combination of persistent low oil prices and increasingly effective international sanctions has created structural challenges for Russia's petroleum sector. While production volumes have remained resilient, the financial foundations of the industry show significant strain, with major producers reporting profit declines exceeding 50%.

Russian oil companies face difficult strategic decisions in the coming years. Maintaining production volumes preserves market share but at the cost of reduced profitability. Yet cutting production offers no guarantee of price improvements while potentially surrendering hard-won export relationships.

The resilience demonstrated thus far will be tested further if current market conditions persist, potentially forcing more fundamental reconsiderations of Russia's energy strategy and economic model. The country's ability to navigate this challenging environment will depend on both global market developments and its capacity to develop effective countermeasures to Western restrictions. Experts following the global recession outlook suggest these challenges may intensify if broader economic headwinds materialize.

Disclaimer: This article contains forward-looking statements and analysis regarding oil markets and geopolitical factors. Future events may differ materially from these projections. Readers should conduct their own research and consider multiple viewpoints when making investment or policy decisions related to the energy sector.

Want to Stay Ahead of Major Market-Moving Discoveries?

Discovery Alert's proprietary Discovery IQ model delivers instant notifications when significant ASX mineral discoveries are announced, giving traders and investors a crucial edge before the broader market reacts. Explore why mineral discoveries can lead to exceptional returns by visiting Discovery Alert's dedicated discoveries page.