The Evolution of Sibanye-Stillwater Under Neal Froneman

How did Sibanye-Stillwater begin its journey?

Sibanye-Stillwater emerged in 2013 as a spin-off of Gold Fields' South African assets during a turbulent period in South Africa's mining sector. The company's origin story is particularly fascinating, as it wasn't initially planned as a new standalone entity. Neal Froneman, then CEO of Chinese-owned Gold One, had originally set his sights on acquiring just the Driefontein mine from Gold Fields, which had become a non-core asset in Gold Fields' portfolio.

After conducting due diligence, Froneman discovered that acquiring Driefontein alone wouldn't be tax-efficient. When he discussed this with Gold Fields' CEO Nick Holland, Holland revealed he had broader plans to unbundle all of Gold Fields' non-core South African assets. Seeing a strategic opportunity, Froneman volunteered to lead this unbundling process, effectively creating what would become Sibanye-Stillwater.

This birth occurred against the backdrop of extreme labor unrest in South Africa's mining sector. The Association of Mineworkers and Construction Union (AMCU) had recently displaced the National Union of Mineworkers as the dominant union in platinum mining, triggering intense inter-union rivalry. This conflict had recently resulted in the tragic Marikana incident in August 2012, where 34 striking miners were killed by police.

What transformations occurred under Froneman's leadership?

Under Froneman's 12-year tenure, Sibanye-Stillwater underwent a remarkable transformation from a South African gold producer into a diversified global metals conglomerate. This strategic evolution was driven by two key insights: first, the vulnerability of single-commodity businesses to price volatility, and second, the political and operational risks of concentrating assets in South Africa alone.

The company expanded aggressively through strategic acquisitions across multiple sectors:

- Acquired major platinum group metal (PGM) assets in South Africa

- Purchased the Stillwater Mining Company in the United States

- Expanded into battery metals through various investments

- Built a diversified portfolio spanning three continents

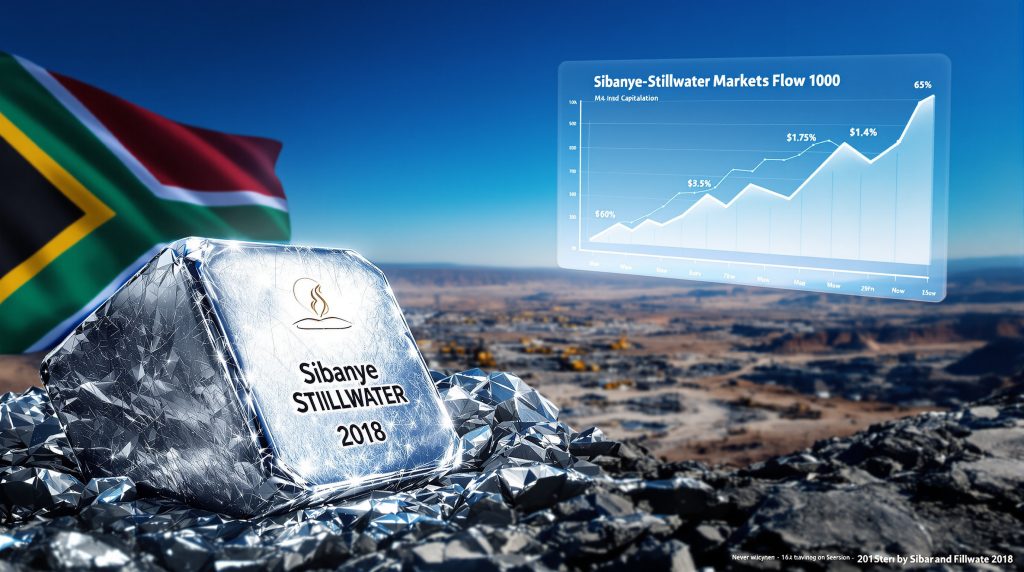

This diversification strategy proved highly successful from a financial perspective. During Froneman's leadership, the company's market capitalization increased approximately eightfold, with over R40 billion returned to shareholders through dividends and other mechanisms.

Beyond financial metrics, the company also implemented significant operational improvements, particularly in safety standards and productivity across its expanding portfolio of assets. These efforts helped the company maintain competitiveness despite operating in challenging jurisdictions. The implementation of mining transformation strategies also positioned the company at the forefront of industry innovation.

How did Froneman approach stakeholder management?

One of the most distinctive aspects of Froneman's leadership was his development of the "Umdoni tree" concept for stakeholder management. This philosophy visualized the company as a tree where:

- The canopy represents various stakeholders (communities, unions, shareholders, employees)

- Each stakeholder group holds equal importance in the ecosystem

- Management's primary role is maintaining balance among competing interests

- No single stakeholder can be allowed to damage others

This approach directly informed how Sibanye-Stillwater navigated complex labor relations in South Africa. Rather than capitulating to union demands or taking an adversarial stance, Froneman believed in "winning the hearts and minds" of employees directly while establishing clear boundaries with unions.

As Froneman explained in a 2025 interview with Miningmx: "The big mining houses had become soft with the unions. They had lost their way. The way to be firm with unions is to win the hearts and minds of your employees."

This stakeholder-balanced approach was particularly evident in how the company addressed the historical trauma associated with the Marikana assets after acquiring Lonmin in 2019. The company actively worked to change the dialogue around Marikana and begin a healing process for a wound that remains sensitive in South Africa's socio-political landscape.

Richard Stewart: The New Leadership Era

Who is Richard Stewart and what is his background?

Richard Stewart represents a new chapter in Sibanye-Stillwater's leadership transition. Appointed as CEO designate and executive director effective March 1, 2025, Stewart will fully assume the CEO role when Froneman retires on September 30, 2025.

Stewart brings a wealth of experience from within the company, having joined Sibanye-Stillwater in 2014. During his tenure, he has held several senior positions, including:

- Chief Regional Officer for Southern Africa

- Chief Operating Officer

- Executive Vice President of Business Development

His deep understanding of the company's operations stems from his hands-on involvement in many of Sibanye-Stillwater's strategic initiatives, particularly in the PGM sector. Stewart has been instrumental in integrating acquired assets and optimizing operations across the company's diverse portfolio.

In terms of leadership style, Stewart presents a notable contrast to Froneman. Where Froneman was known for his direct, sometimes confrontational approach, Stewart is described as more soft-spoken and deliberate in his communication and decision-making processes. This stylistic difference may signal a shift in how the company engages with various stakeholders, particularly in sensitive areas like labor relations and government interactions.

What priorities has Stewart identified for the company?

In his initial communications as incoming CEO, Stewart has outlined several key priorities that will guide his leadership:

- Operational excellence across all assets

- Enhanced financial discipline and capital allocation

- More transparent communication with shareholders

- Restoration of consistent dividend payments

These priorities suggest a shift toward consolidation and optimization rather than the rapid expansion that characterized much of Froneman's tenure. Stewart appears focused on extracting maximum value from the diversified portfolio that Sibanye-Stillwater has built, with particular emphasis on returning to consistent dividend payments—a priority likely to resonate with shareholders.

Stewart's emphasis on financial discipline comes at a critical time for the company, as it navigates volatile commodity markets, particularly in the PGM sector. His operational background may prove valuable in identifying efficiency improvements and cost-reduction opportunities across the company's diverse asset base. Additionally, his focus on critical minerals strategy will be essential for future growth.

How was the succession process managed?

The transition from Froneman to Stewart represents a carefully orchestrated succession plan that demonstrates Sibanye-Stillwater's maturation as an organization:

- An independent committee conducted a rigorous assessment of both internal and external candidates

- Stewart's appointment as CEO designate six months before the formal handover allows for a smooth transition

- The extended transition period enables Stewart to gradually assume public leadership roles

- Froneman remains involved to ensure knowledge transfer and relationship continuity

This structured approach contrasts with the more abrupt leadership changes often seen in the mining industry. The extended transition period allows key stakeholders—including employees, investors, government officials, and community leaders—to adapt to the change while maintaining operational continuity.

Froneman has publicly expressed complete confidence in Stewart and the broader management team, signaling his belief that the company's strategic direction remains sound. This vote of confidence helps reassure investors that the transition represents evolution rather than revolution in the company's approach.

Challenges and Triumphs Under Froneman's Leadership

What significant challenges did Froneman face?

While Froneman's leadership resulted in substantial growth, his tenure was not without significant challenges and setbacks. Among the most notable were:

-

Labor relations: Confrontational relationships with unions, particularly AMCU, led to extended strikes and production disruptions. Froneman characterized AMCU as "an organization which was just a bully" in his approach to industrial relations.

-

Safety incidents: In 2018, the company experienced devastating accidents that claimed 12 lives—seven in a seismic-induced fall-of-ground accident at Driefontein Gold mine in May and five in a heat-related accident at Kloof Gold Mine in June. Froneman characterized these not as system failures but as "a breakdown in values" within the organization.

-

Controversial acquisitions: The purchase of Lonmin and its Marikana assets in 2019 connected the company to a site associated with deep historical trauma in South Africa's mining sector. Managing the social and political aspects of this acquisition required careful navigation.

-

Failed deals: The company's attempted acquisition of the Santa Rita nickel mine and Serrote copper mine in Brazil from Appian Capital for approximately $1 billion ended in litigation after Sibanye-Stillwater canceled the transaction following what it described as a "geotechnical event" at Santa Rita. The High Court of England and Wales later ruled the cancellation unjustified, and Appian is seeking $722 million in damages, with a trial scheduled for late 2025.

-

Executive compensation controversy: Froneman's R300 million remuneration package in 2022 sparked criticism, particularly from unions. Froneman defended the package, noting that only one-tenth was cash salary, with the rest being shares linked to long-term company performance.

Despite these challenges, Froneman maintained his characteristically direct approach, rarely backing down from confrontation when he believed the company's interests were at stake.

What were Froneman's notable achievements?

Beyond the financial metrics, Froneman's achievements included several transformative developments for the company:

-

Strategic vision: Successfully transitioning from a single-commodity, South Africa-focused producer to a diversified global company with reduced exposure to any single market or metal price.

-

Safety improvements: Despite the tragic incidents in 2018, the company implemented improved health and safety standards across operations, contributing to industry-wide improvements in South African mining safety.

-

Stakeholder management model: Developing the "Umdoni tree" approach to stakeholder management, which balanced competing interests while ensuring sustainable operations.

-

Marikana healing process: Beginning the difficult process of addressing historical trauma at Marikana following the company's acquisition of Lonmin, demonstrating sensitivity to complex social issues.

In his own assessment of his legacy, Froneman emphasized "value creation" and building "a diversified, globally competitive mining and processing business" capable of competing internationally despite starting as an "underdog" in the global mining industry.

Strategic Direction and Future Outlook

What strategic elements will likely continue under Stewart?

While leadership styles may differ, several core strategic elements established under Froneman are likely to continue under Stewart's leadership:

-

Diversification strategy: The fundamental approach of maintaining exposure across multiple commodities and geographies to mitigate risk will remain central to the company's strategy.

-

Stakeholder-centric management: The "Umdoni tree" philosophy of balancing stakeholder interests will likely continue, though Stewart may implement it with a different style than Froneman's more confrontational approach.

-

Disciplined capital allocation: The focus on generating returns for shareholders while maintaining operational excellence will remain a priority.

-

Safety focus: The emphasis on safety as a core operational value will continue, building on lessons learned from past incidents.

Stewart's background in operations and business development suggests these areas will remain priorities, though his implementation approach may differ from Froneman's more aggressive style.

What new directions might Stewart introduce?

Based on his early communications and background, Stewart may emphasize several new or modified strategic directions:

-

Enhanced financial discipline: A stronger focus on cost control and capital efficiency, particularly in challenging commodity price environments.

-

Renewed focus on shareholder returns: An explicit commitment to restoring consistent dividend payments suggests prioritizing shareholder returns over aggressive growth.

-

More collaborative stakeholder engagement: Stewart's more measured communication style may translate to less confrontational approaches with unions, government, and other stakeholders.

-

Operational optimization: Greater emphasis on extracting maximum value from existing assets rather than pursuing aggressive acquisition strategies.

These shifts would represent an evolution rather than revolution in strategy, adapting to both Stewart's leadership style and changing market conditions while building on the foundation Froneman established.

What industry challenges will the new leadership face?

The incoming leadership team will need to navigate several significant industry-wide challenges:

-

Commodity price volatility: PGM prices in particular have shown significant volatility, requiring flexible operational responses and strong financial management. Recent gold prices analysis indicates potential opportunities in the precious metals sector.

-

Energy and infrastructure constraints: South Africa continues to face electricity supply challenges and infrastructure limitations that impact mining operations.

-

Regulatory environment: Mining regulations continue to evolve across all operating jurisdictions, requiring constant adaptation and engagement with authorities.

-

ESG demands: Increasing investor and societal expectations regarding environmental, social, and governance performance require ongoing attention and investment, particularly in areas like mine reclamation innovations.

-

Technological change: The mining industry is experiencing accelerating technological change, from automation to digitization, requiring strategic investment decisions.

Stewart's success will depend partly on how effectively he navigates these external factors while building on the company's existing strengths and addressing its challenges.

FAQ: Sibanye-Stillwater Leadership Transition

When exactly will Neal Froneman step down?

Neal Froneman will retire as CEO and executive director of Sibanye-Stillwater effective September 30, 2025, after more than 12 years leading the company since its formation in 2013. The extended transition period, with Richard Stewart appointed as CEO designate on March 1, 2025, is designed to ensure a smooth handover of responsibilities.

How long has Richard Stewart been with Sibanye-Stillwater?

Richard Stewart joined Sibanye-Stillwater in 2014, shortly after the company's formation. Over the past decade, he has held various senior roles including Chief Operating Officer and Executive Vice President of Business Development before being appointed CEO designate in 2025.

What has been Sibanye-Stillwater's financial performance under Froneman?

Under Froneman's leadership, Sibanye-Stillwater's market capitalization increased approximately eightfold from its initial value. The company also returned over R40 billion to shareholders through dividends and other mechanisms during his tenure, despite operating in volatile commodity markets and challenging jurisdictions.

How did Sibanye-Stillwater address safety concerns during Froneman's leadership?

Following tragic accidents in 2018 that claimed 12 lives, Froneman identified these incidents as stemming from "a breakdown in values" rather than system failures. This led to a renewed emphasis on values-based decision-making throughout the organization, with safety considerations elevated to a core organizational value rather than merely a compliance requirement.

What is Sibanye-Stillwater's approach to labor relations?

The company developed a stakeholder-balanced approach symbolized by the "Umdoni tree" concept, where management maintains equilibrium among competing interests. This approach involves direct engagement with employees to win their "hearts and minds" while establishing clear boundaries with unions. This strategy evolved partly in response to the labor unrest that characterized South African mining when the company was formed.

What legal challenges does Sibanye-Stillwater currently face?

The company is involved in ongoing litigation with Appian Capital following its decision to cancel a $1 billion acquisition of Brazilian mining assets (the Santa Rita nickel mine and Serrote copper mine). Appian is seeking $722 million in damages, with the trial scheduled for late 2025. The High Court of England and Wales has already ruled that Sibanye-Stillwater's decision to cancel the transaction was not justified.

The Mining Industry Context

How has South Africa's mining landscape evolved during Froneman's tenure?

South Africa's mining sector has undergone significant transformation since Sibanye-Stillwater's formation in 2013:

-

Labor relations have generally stabilized compared to the volatile period around 2012-2013, when violent confrontations between rival unions were common. While challenges remain, the industry has developed more effective engagement mechanisms.

-

Regulatory frameworks have continued to evolve, with ongoing discussions about revisions to the Mineral and Petroleum Resources Development Act (MPRDA) and mining charter requirements creating both challenges and opportunities.

-

Infrastructure challenges, particularly unreliable electricity supply from state utility Eskom, have intensified, forcing mining companies to invest in alternative energy solutions.

-

Industry consolidation has continued, with fewer but larger players dominating the sector as smaller operations struggle with rising costs and regulatory requirements.

These changes have validated Sibanye-Stillwater's diversification strategy while highlighting the ongoing challenges of operating in the South African context. Understanding South Africa beneficiation trends remains crucial for mining companies operating in the region.

What broader industry trends will influence Stewart's leadership?

Several industry-wide trends will shape the context for Stewart's leadership:

-

Growing ESG emphasis: Environmental, social, and governance considerations are increasingly central to mining company valuations and access to capital, requiring comprehensive strategies and transparent reporting.

-

Technological transformation: The mining industry is undergoing significant technological change, from automation and robotics to artificial intelligence and predictive maintenance, requiring strategic investment decisions.

-

Changing PGM demand patterns: The automotive industry's evolution, particularly the growth of electric vehicles, is reshaping demand patterns for platinum group metals, requiring careful market analysis and portfolio management.

-

Battery metals competition: Increasing global focus on battery metals for energy transition has intensified competition for quality assets in this space, potentially affecting acquisition strategies.

-

Cost pressures: Rising input costs, from energy to labor to regulatory compliance, are squeezing margins across the industry, demanding ongoing efficiency improvements.

Stewart's effectiveness will partly depend on how well he positions Sibanye-Stillwater to address these trends while maintaining the company's competitive advantages in an increasingly complex global mining landscape.

Looking to Gain an Edge in ASX Mining Discoveries?

Discovery Alert's proprietary Discovery IQ model offers real-time notifications on significant ASX mineral discoveries, providing investors with actionable insights before the broader market. Explore how historic discoveries have generated substantial returns by visiting our dedicated discoveries page and begin your 30-day free trial today to position yourself ahead of the market.