Why Is Silver Becoming a Strategic Investment in 2025?

Silver stands at a fascinating crossroads in 2025, positioned as both a precious metal with monetary value and an industrial metal with expanding technological applications. The dual nature of silver creates unique investment dynamics compared to other commodities and precious metals.

The current market environment presents several compelling factors driving silver's investment potential:

- Supply-demand imbalance: Industrial consumption continues to outpace mining production

- Monetary policy shifts: Central bank activities affecting precious metals valuations

- Technological revolution: Green energy transition creating unprecedented demand

- Economic uncertainty: Investors seeking tangible assets during volatile periods

The Growing Supply-Demand Gap

Industrial demand for silver has transformed dramatically over the past two decades:

| Silver Market Dynamics | 25 Years Ago | 2025 |

|---|---|---|

| Annual Mining Production | 550 million oz | 850 million oz |

| Industrial Demand (% of market) | 35% | 60-70% |

| Supply Deficit Status | Balanced | Structural deficit |

This transformation has created what experts describe as a "natural corner" in the silver market, where industrial consumption alone threatens to absorb available supplies, creating significant price pressure when investment demand increases.

According to the Silver Institute's World Silver Survey, the silver market experienced a deficit of 184.3 million ounces in 2023, marking the fourth consecutive year of supply shortfalls. Industry analysts project this deficit to continue through the foreseeable future, potentially intensifying as industrial applications expand.

How Does Silver Compare to Other Investment Options?

Silver vs. Gold: The Affordability Advantage

While gold and silver share characteristics as precious metals, silver offers distinct advantages:

- Entry point accessibility: At approximately $30-32/oz versus gold's $2,600+/oz, silver allows broader market participation

- Higher volatility potential: Typically experiences larger percentage moves in both directions

- Industrial demand driver: Roughly 60% of silver consumption comes from industrial applications versus 10-15% for gold

- Supply constraints: Silver is predominantly produced as a byproduct of other metal mining operations

Investment Insight: During precious metals bull markets, silver typically outperforms gold in percentage terms during the acceleration phase, as happened in 1979-1980 and 2010-2011.

Historical data confirms this pattern. During the 1979-1980 bull market, silver rose approximately 733% (from $6 to $50) while gold increased 276% (from $226 to $850). Similarly, between 2008 and 2011, silver gained roughly 440% compared to gold's 170% increase.

Silver vs. Traditional Financial Assets

When comparing silver to stocks, bonds, and cash equivalents:

- Tangibility: Physical ownership outside the financial system

- No counterparty risk: Value not dependent on issuer solvency

- Negative correlation: Often moves inversely to broader equity markets

- Inflation protection: Historical preservation of purchasing power

A particularly noteworthy current market anomaly is that both gold and silver are simultaneously reaching record highs—unusual given their typically negative correlation. This situation suggests potential for significant silver market squeeze when these correlations normalize, especially if equity markets experience weakness.

What Are the Primary Silver Investment Vehicles in 2025?

Physical Silver: Direct Ownership

Owning physical silver provides the most straightforward exposure to the metal:

Advantages:

- Complete ownership control

- No counterparty risk

- Privacy benefits

- Immediate access during crises

Considerations:

- Storage and security requirements

- Insurance costs

- Potential premium over spot price

- Liquidity challenges for large quantities

Popular Forms:

- Silver bars: Lower premiums, efficient for larger investments (1oz to 1000oz)

- Silver coins: Government-minted legal tender with higher recognition and liquidity

- Silver rounds: Private mint products with lower premiums than government coins

Government-minted silver coins typically trade at 10-15% premiums over spot price, with American Silver Eagles, Canadian Maple Leafs, and Austrian Philharmonics among the most recognized globally.

Silver ETFs and Funds: Convenient Exposure

Exchange-traded funds and mutual funds offer simplified silver investment:

Advantages:

- Instant liquidity during market hours

- No storage concerns

- Fractional ownership possibilities

- Easily incorporated into existing portfolios

Considerations:

- Management fees erode returns over time

- No physical possession

- Potential tracking errors

- Counterparty and systemic risks

Popular Options:

- Physical-backed ETFs like iShares Silver Trust (SLV) that hold allocated silver

- Equity-based funds investing in silver mining companies

- Leveraged and inverse ETFs for sophisticated strategies

The iShares Silver Trust (SLV), one of the largest silver ETFs, holds approximately 520 million ounces of silver as of October 2024, representing a significant portion of above-ground inventories.

Silver Mining Stocks: Operational Leverage

Investing in companies that extract silver offers amplified exposure:

Advantages:

- Potential dividend income

- Operational leverage to silver prices

- Exposure to company growth beyond silver price movements

- Access through standard brokerage accounts

Considerations:

- Company-specific risks (management, debt, jurisdiction)

- Operational challenges (mining costs, permitting, labor)

- Dilution through equity issuance

- Broader market correlation

Categories:

- Major producers: Established operations with diversified revenue

- Mid-tier producers: Growth-focused companies with existing production

- Junior miners: Exploration and development-stage companies with higher risk/reward

Primary silver miners typically exhibit 2-4x leverage to silver price movements, potentially amplifying returns during bull markets but also increasing downside risk during corrections.

Silver Futures and Options: Advanced Strategies

Derivatives markets provide sophisticated exposure mechanisms:

Advantages:

- Capital efficiency through leverage

- Precise timing strategies

- Hedging capabilities

- Standardized contracts

Considerations:

- Substantial expertise required

- Margin requirements and funding risk

- Time decay for options

- Potential for losses exceeding initial investment

COMEX silver futures represent 5,000 ounces per contract with margin requirements that typically increase during volatile bull markets—a critical consideration for leveraged investors. Understanding silver squeeze strategies is essential for investors utilizing these markets.

What Factors Will Drive Silver Prices in 2025-2026?

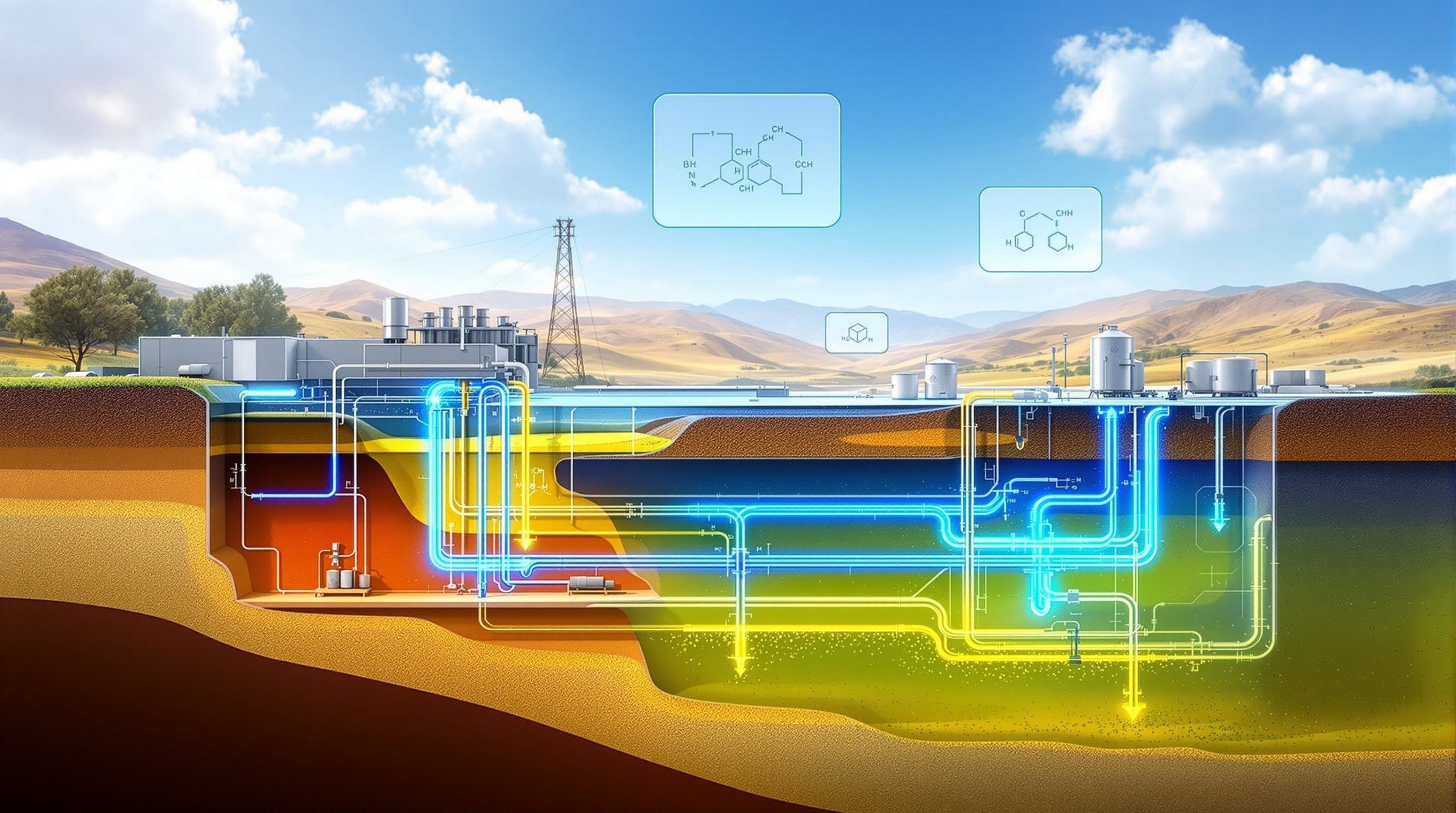

Industrial Demand Revolution

The technological transformation underway creates unprecedented silver consumption:

- Solar energy expansion: Each gigawatt of solar capacity requires approximately 20,000-80,000 ounces of silver

- Electric vehicle growth: Modern EVs contain 25-50 grams of silver compared to 15-28 grams in conventional vehicles

- 5G network buildout: 5G base stations requiring 3-5 times more silver than 4G equivalents

- Medical applications: Silver nanoparticles in antimicrobial treatments growing at 12% CAGR

The International Energy Agency forecasts solar capacity additions of 346 GW in 2024 alone, requiring approximately 130 million ounces of silver—more than 15% of annual mining production. These trends are projected to accelerate through 2030 as global decarbonization efforts intensify.

Monetary Policy Implications

Central bank actions continue to influence precious metals markets:

- Interest rate environment: Lower rates reduce opportunity costs of holding non-yielding assets

- Currency debasement concerns: Expansion of money supply raising inflation expectations

- Central bank diversification: Shifts from traditional reserve currencies to hard assets

- Debt sustainability questions: Growing sovereign debt levels affecting currency confidence

The current landscape features approximately $7 trillion sitting in money market funds seeking alternatives. Even a modest 1% allocation shift from these funds toward silver would represent about two years of global mining supply, potentially creating significant price pressure.

Supply Constraints Reality

The silver production landscape faces significant limitations:

- Mining production plateau: Limited new major discoveries despite higher prices

- Byproduct economics: Approximately 70% of silver comes as byproduct of lead, zinc, and copper mining

- Above-ground inventory depletion: Continued deficits reducing available stockpiles

- Recycling limitations: Silver recycling rates average 20-25% compared to gold's 30-35%

Industry experts project flat silver mining production for at least the next decade while demand continues increasing—creating a structural deficit that could persist for 25 years based on current technology and mining projections. The silver tariffs impact on global supply chains adds another layer of complexity to this situation.

How Should Investors Approach Silver in Their Portfolios?

Allocation Strategies

Determining the appropriate silver exposure depends on individual circumstances:

- Conservative approach: 2-5% of total portfolio for diversification benefits

- Moderate approach: 5-10% allocation for meaningful impact during precious metals strength

- Aggressive approach: 10-20% for investors with strong conviction in silver's potential

Modern portfolio theory suggests that even modest precious metals allocations can improve risk-adjusted returns through diversification benefits. Yale University's endowment model historically maintained a 5-10% allocation to real assets, including precious metals.

Entry Point Considerations

Timing silver investments requires understanding market dynamics:

- Dollar-cost averaging: Systematic purchases to reduce timing risk

- Technical analysis: Using chart patterns and indicators to identify favorable entry points

- Ratio analysis: Evaluating silver relative to gold and other assets for relative value

- Sentiment indicators: Contrarian approach when market sentiment reaches extremes

Studies show that dollar-cost averaging can be particularly effective for volatile assets like silver, reducing timing risk while building positions over time. For more detailed information on timing, investors can refer to how to invest in silver guidelines.

Risk Management Techniques

Protecting capital while maintaining exposure:

- Position sizing: Limiting allocation to appropriate percentage of portfolio

- Stop-loss strategies: Predetermined exit points to limit downside

- Diversification within metals: Combining silver with gold and other precious metals

- Rebalancing discipline: Periodically adjusting allocations as prices change

Quarterly rebalancing has proven optimal for precious metals allocation maintenance, allowing investors to systematically "buy low and sell high" as different asset classes perform independently. Understanding the gold-silver ratio insights can be particularly valuable when implementing this strategy.

What Are the Potential Risks to Silver Investments?

Market Volatility Considerations

Silver's price action can be extreme:

- Historical precedent: Previous bull markets have seen 30-50% corrections within longer-term uptrends

- Leverage impact: Margin requirement increases during volatile periods affecting futures markets

- Liquidity constraints: Market depth issues during extreme movements

- Correlation shifts: Changing relationships with other asset classes during market stress

The 2011 silver market demonstrates this volatility, when prices fell from $49 to $26 (47% decline) within months despite the continuing longer-term bull market.

Regulatory and Political Factors

Government actions can significantly impact silver markets:

- Tax treatment changes: Potential modifications to capital gains or collectibles taxation

- Trading restrictions: Possible limits on position sizes or market participation

- Environmental regulations: Increasing costs and constraints on mining operations

- Strategic metal designations: Government stockpiling or export restrictions

Physical silver is often taxed as a collectible (28% maximum rate in the US) versus the 15-20% long-term capital gains rate applicable to most ETFs—an important consideration for taxable investors. For more information about investing in physical silver, you can explore Perth Mint investment options.

Technological Disruption Possibilities

Innovation could affect silver's industrial demand profile:

- Thrifting trends: Manufacturers reducing silver content per unit

- Substitution risk: Alternative materials replacing silver in certain applications

- Recycling advances: Improved recovery technologies increasing secondary supply

- Process innovations: New manufacturing techniques requiring less silver

Electronics manufacturers have already reduced silver content per device by 15-20% over the past decade through miniaturization and thrifting, though the overall number of devices has increased substantially.

How to Evaluate Silver Investment Quality?

Physical Silver Authentication

Ensuring genuine products when purchasing physical silver:

- Reputable dealers: Established companies like APMEX, JM Bullion, and SD Bullion with BBB ratings

- Verification tools: Magnetic tests, dimensional checks, and specific gravity measurements

- Assay certifications: Professional verification of purity and weight

- Anti-counterfeiting features: Security elements in government-minted products

Professional testing identifies fake silver in approximately 2-5% of secondary market transactions, underscoring the importance of purchasing from established dealers.

Mining Company Due Diligence

Key metrics when evaluating silver mining investments:

- All-in sustaining costs (AISC): Comprehensive measure of production expenses

- Reserve quality and quantity: Proven and probable resources in the ground

- Jurisdiction risk assessment: Political stability and mining regulations

- Management track record: Previous success in developing and operating mines

- Balance sheet strength: Debt levels and cash position relative to development needs

All-in sustaining costs for primary silver miners typically range $12-18/oz, providing significant margins at current silver prices and potential for expanding profitability if prices rise further.

What Are Expert Projections for Silver in 2025-2026?

Price Target Scenarios

Market analysts present varying outlooks based on different assumptions:

Conservative Case:

- Silver maintaining $35-45 range

- Modest industrial demand growth

- Limited monetary demand

- Gradual supply response to higher prices

Base Case:

- Silver reaching $60-80 range

- Strong industrial demand continuation

- Moderate investment interest

- Persistent supply constraints

Bullish Case:

- Silver exceeding $100

- Accelerating industrial consumption

- Significant investment demand surge

- Minimal supply response capability

The acceleration phase concept suggests that "90% of the move comes in the last 10% of the time"—a pattern observed in previous precious metals bull markets where the largest percentage gains occurred during the final stages.

Potential Catalysts for Price Acceleration

Events that could trigger rapid silver price movements:

- Financial system stress: Banking or sovereign debt concerns driving safe-haven demand

- Currency confidence crisis: Major reserve currency volatility increasing precious metals appeal

- Supply disruption: Production challenges in key mining regions

- Investment demand surge: Mainstream recognition of structural supply deficits

The timeframe for potential acceleration is estimated at approximately 18 months, with price movements potentially compressing into this relatively short period after years of accumulation.

FAQ: Common Silver Investment Questions

What is the ideal form of silver for new investors?

For beginners, government-minted silver coins (American Eagles, Canadian Maple Leafs, Australian Kangaroos) offer the best combination of liquidity, recognition, and modest premium over spot price. As investment size increases, transitioning to 10oz and 100oz bars improves cost efficiency.

How does silver perform during economic recessions?

Silver typically experiences initial weakness during deflationary shocks as industrial demand concerns dominate, followed by strength as monetary stimulus measures are implemented. This pattern was evident in both 2008-2011 and 2020-2021.

What storage solutions work best for physical silver?

Options include:

- Home safes (practical for smaller quantities)

- Bank safe deposit boxes (moderate security with limitations)

- Private vault facilities (professional security with ownership privacy)

- Allocated storage programs (professional management with ownership verification)

Professional vault storage typically costs 0.5-1.5% annually, providing insurance coverage and professional security for larger holdings.

How is silver taxed compared to other investments?

Tax treatment varies by jurisdiction, but in many countries, physical silver is subject to:

- Sales/VAT taxes on purchase (with notable exemptions)

- Capital gains taxes on sale (often at collectibles rates rather than standard investment rates)

- Potential dealer reporting requirements for certain transaction sizes

Is silver mining environmentally sustainable?

The environmental impact varies significantly by mining method and regulatory environment. Modern operations increasingly implement:

- Water recycling systems

- Energy efficiency measures

- Tailings management best practices

- Land reclamation programs

Conclusion: Silver's Unique Position in 2025's Investment Landscape

Silver occupies a distinctive space in today's investment universe, combining precious metal safe-haven characteristics with critical industrial metal applications. The convergence of structural supply deficits, expanding technological demand, and macroeconomic uncertainty creates compelling silver investment opportunities.

The metal's relatively small market size compared to gold or major financial assets means that even modest shifts in investment allocation can generate significant price movements. This characteristic makes silver particularly attractive during periods of financial system stress or inflation concerns.

Whether approached as wealth insurance, portfolio diversification, or growth opportunity, silver merits consideration within a comprehensive investment strategy. By understanding its unique properties, market dynamics, and investment vehicles, investors can make informed decisions about incorporating silver exposure appropriate to their financial goals and risk tolerance.

Ready to Catch the Next Major Silver Discovery?

Don't miss out on the next high-performing silver stock – Discovery Alert's proprietary Discovery IQ model instantly notifies investors about significant ASX silver discoveries, turning complex mineral data into actionable investment opportunities. Explore why major mineral discoveries can lead to exceptional returns by visiting our dedicated discoveries page.