What Are Solid-State Batteries and Why Are They Revolutionary?

Solid-state batteries represent the next generation of energy storage technology, offering transformative advantages over traditional lithium-ion batteries that currently power most electric vehicles and portable electronics. Unlike conventional batteries that rely on liquid electrolytes, solid-state batteries utilize solid electrolyte materials that fundamentally change how energy is stored and transferred.

At their core, these innovative batteries eliminate the flammable liquid components that have been responsible for thermal runaway and battery fires in conventional systems. This technological shift not only enhances safety but also enables substantial performance improvements that could accelerate electric vehicle adoption worldwide.

Key Advantages of Solid-State Battery Technology

The transition to solid electrolytes unlocks multiple benefits that address longstanding limitations of current battery technology:

-

Enhanced safety profile through elimination of flammable liquid electrolytes, reducing fire risks

-

Significantly longer battery lifespan with improved cycling stability, potentially lasting through thousands more charge cycles

-

Dramatically faster charging capabilities, potentially reducing charge times from hours to minutes

-

Higher energy density allowing for greater range in electric vehicles without increasing battery size or weight

-

Superior thermal stability enabling operation across wider temperature ranges, from extreme cold to high heat conditions

-

Reduced degradation rates leading to more consistent performance throughout the battery's operational life

These advantages combine to create a compelling case for solid-state technology as the future standard for energy storage systems across multiple industries, with automotive applications leading the development charge.

How Are Toyota and Sumitomo Metal Transforming Cathode Materials?

Toyota and Sumitomo Metal Mining have been engaged in strategic joint research since 2021, focusing specifically on one of the most critical components of solid-state battery technology: cathode materials. Their collaborative efforts have yielded a significant breakthrough that addresses a fundamental obstacle to commercialization.

The partnership leverages Sumitomo Metal's expertise in advanced materials science and Toyota's automotive battery requirements to solve specific technical challenges that have hindered solid-state battery development. By combining their respective technological capabilities, the companies have created a solution that potentially accelerates the timeline for bringing solid-state batteries to market.

The Technical Innovation

Their research has produced several key technological advancements:

-

Development of "highly durable cathode material" utilizing Sumitomo Metal's proprietary powder synthesis technology

-

Specific engineering solutions for the persistent problem of cathode degradation during repeated charge-discharge cycles

-

Custom-designed cathode materials optimized specifically for the unique interfaces present in solid-state battery architecture

-

Implementation of advanced material science principles to enhance electrochemical stability at the cathode-electrolyte boundary

-

Creation of cathode materials that maintain structural and chemical integrity over extended operational lifespans

This breakthrough directly addresses one of the most challenging aspects of solid-state battery development—maintaining cathode performance and integrity throughout the battery's operational life when in contact with solid electrolytes rather than liquid ones.

What Makes This Cathode Material Development Significant?

The cathode material breakthrough represents more than just an incremental improvement—it potentially removes a critical barrier to commercial-scale solid-state battery production. The significance extends beyond the technical achievement itself to its implications for the broader electric vehicle market and energy storage industry.

This development tackles one of the fundamental limitations that has kept solid-state batteries from moving beyond laboratory demonstrations to commercial products. By resolving the cathode degradation issue, Toyota and Sumitomo Metal have potentially unlocked a path to practical implementation that was previously blocked by materials science constraints.

Technical Significance

From a technical perspective, the innovation delivers several crucial advantages:

-

Addresses a fundamental limitation in previous solid-state designs by solving the cathode degradation problem

-

Creates more stable and durable interfaces between the cathode material and solid electrolyte

-

Potentially enables higher voltage operation without material breakdown, increasing energy density

-

Contributes to overall system durability and consistent performance across the battery's lifecycle

-

Reduces one of the key failure mechanisms that has limited solid-state battery lifespan in previous designs

Market Significance

From a market perspective, this breakthrough carries equally important implications:

-

Positions Toyota at the forefront of next-generation battery metals investment

-

Establishes Sumitomo Metal Mining as a key supplier in the evolving EV battery supply chain

-

Accelerates the realistic timeline for commercial solid-state battery production

-

Creates potential competitive advantage in the rapidly evolving electric vehicle marketplace

-

May influence industry-wide battery development priorities and investment decisions

The development comes at a critical moment when the automotive industry is increasingly focused on battery technology as the key differentiator in future electric vehicle performance, cost, and consumer acceptance.

What Timeline Can We Expect for Commercial Implementation?

The Toyota-Sumitomo Metal partnership has established clear milestones for bringing their cathode material technology from laboratory to commercial production. Their announced timeline provides the first concrete roadmap for solid-state battery integration into consumer vehicles from a major automotive manufacturer.

Production Timeline

The companies have outlined a staged approach to commercialization:

-

Mass production targeted to begin as early as April 2028, according to Sumitomo Metal's announcement

-

Initial production will prioritize supplying Toyota's manufacturing requirements

-

Subsequent scaling to address broader market demand as production capacity increases

-

Alignment with Toyota's planned electric vehicle launches featuring solid-state batteries in 2027-2028

-

Gradual production capacity expansion based on market response and manufacturing optimization

This timeline suggests that consumers could be driving vehicles powered by these advanced batteries before the end of this decade—a remarkably accelerated schedule compared to previous industry projections.

Development Milestones

Before reaching full production, the partnership must navigate several critical development phases:

-

Continued refinement of cathode material performance and manufacturing consistency

-

Rigorous quality assurance and safety validation processes across thousands of test cycles

-

Cost reduction initiatives to achieve commercial viability compared to conventional batteries

-

Integration testing with other battery components including solid electrolytes and anodes

-

Pilot production lines to validate manufacturing processes before full-scale implementation

While ambitious, this timeline aligns with Toyota's broader electrification strategy and the industry's accelerating shift toward advanced battery technologies.

How Does This Advance Compare to Current Battery Technologies?

The cathode material development by Toyota and Sumitomo Metal represents a significant technological leap compared to the lithium-ion batteries that currently dominate the electric vehicle market. Understanding these comparative advantages helps contextualize why this breakthrough matters to consumers and the automotive industry.

Performance Comparison Table

| Parameter | Conventional Li-ion | Solid-State with New Cathode |

|---|---|---|

| Safety | Uses flammable electrolytes with thermal runaway risk | Non-flammable solid electrolyte with minimal fire risk |

| Charging Speed | Typically 30-60 minutes for 80% charge | Potentially 10-15 minutes for 80% charge |

| Cycle Life | Generally 1,000-2,000 complete cycles | Expected to exceed 3,000+ cycles with new cathode |

| Energy Density | Typically 250-300 Wh/kg | Potential for 400+ Wh/kg with optimized design |

| Temperature Range | Limited performance in extreme temperatures | Wider operational range with less climate sensitivity |

| Manufacturing | Well-established processes, optimized costs | More complex initially, but improving with innovations |

| Environmental Impact | Contains more hazardous materials | Potentially reduced toxic materials in some designs |

This comparative analysis demonstrates why automotive manufacturers are investing billions in solid-state technology—the performance improvements could potentially resolve many of the remaining consumer concerns about electric vehicle adoption.

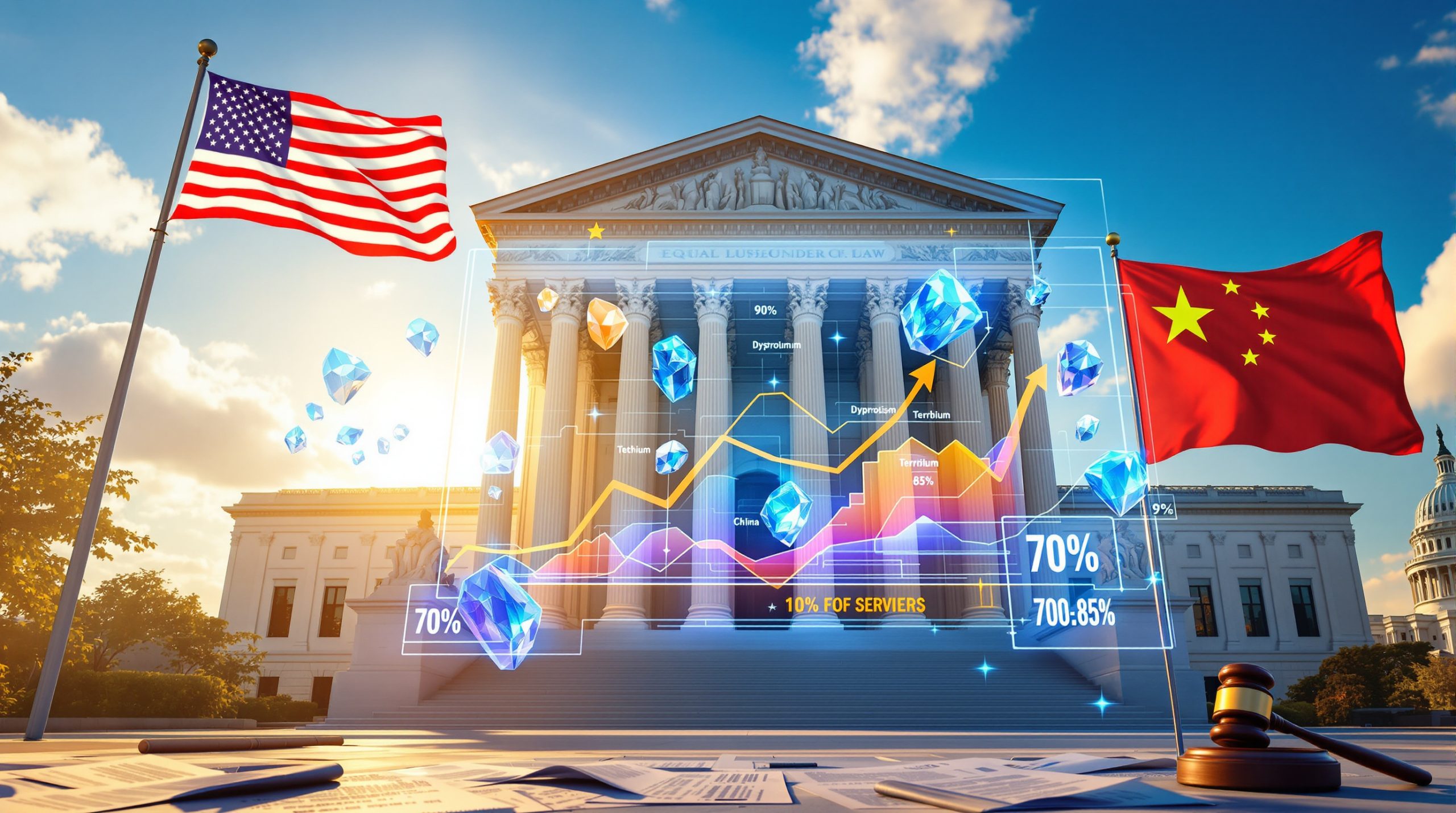

What Challenges Remain for Solid-State Battery Adoption?

Despite the promising cathode material breakthrough, several significant challenges must still be overcome before solid-state batteries can achieve widespread commercial adoption. These barriers span technical, manufacturing, and economic domains.

Remaining Technical Challenges

From a technical perspective, several hurdles remain:

-

Scaling manufacturing processes to maintain consistent quality across millions of batteries

-

Ensuring long-term stability of the solid-state electrolyte-cathode interface under real-world conditions

-

Optimizing ionic conductivity across the entire solid-state system at various temperatures

-

Managing thermal expansion differences between battery materials during charging and operation

-

Developing compatible anodes that maximize the potential of the new cathode materials

-

Creating reliable sealing methods to maintain the integrity of the solid-state structure

Commercial Challenges

The path to market presents equally significant commercial obstacles:

-

Securing sufficient raw material supply chains for specialized battery components

-

Developing manufacturing equipment and processes specifically designed for solid-state production

-

Overcoming initially higher production costs until economies of scale can be achieved

-

Integrating new battery technology with existing automotive production systems

-

Establishing appropriate testing and certification standards for the new technology

-

Educating consumers about the advantages and differences of solid-state technology

Many industry analysts believe that solid-state batteries will initially command a premium price point, gradually becoming more affordable as manufacturing scales and optimizes over time.

Who Are the Key Players in the Solid-State Battery Race?

The development by Toyota and Sumitomo Metal positions them among the leaders in solid-state battery technology, but they face competition from numerous other major industry players making significant investments in this space. The competitive landscape includes automakers, specialized battery startups, and established materials companies.

Major Automotive and Battery Companies in Solid-State Development

The race to commercialize solid-state batteries includes several major competitors:

-

Toyota-Sumitomo Metal partnership focusing on advanced cathode materials with 2027-2028 target launch

-

Volkswagen-backed QuantumScape developing ceramic separators with plans to source materials from Corning

-

BMW's partnership with Solid Power focused on sulfide-based solid electrolytes for high-energy-density cells

-

Nissan's research efforts on oxide-based solid-state technology integrated with their EV platform

-

Chinese manufacturers including CATL and BYD developing proprietary solid-state solutions for domestic and international markets

-

Ford and Stellantis investing in solid-state startups to secure future technology access

-

Samsung SDI and LG Energy Solution adapting their battery expertise to solid-state technology

This competitive environment is driving rapid innovation, with each company pursuing somewhat different technical approaches to solve the challenges of solid-state implementation.

How Will This Technology Impact Electric Vehicle Adoption?

The successful commercialization of solid-state batteries with advanced cathode materials could significantly accelerate electric vehicle adoption by addressing several key consumer concerns that have limited market growth. The technology promises improvements in precisely the areas that have caused consumer hesitation about transitioning from internal combustion vehicles.

Potential EV Market Impacts

The cathode material breakthrough could transform the EV landscape through:

-

Extended driving ranges potentially exceeding 500-600 km on a single charge, eliminating range anxiety

-

Reduced charging times from hours to potentially 10-15 minutes, comparable to refueling a conventional vehicle

-

Longer battery warranties becoming possible with the improved durability of new cathode materials

-

Enhanced safety profile appealing to consumers concerned about battery fire risks

-

Improved cold-weather performance expanding EV practicality in northern climates

-

Lower lifetime ownership costs through battery longevity and reduced replacement needs

-

Potential for smaller, lighter battery packs that improve vehicle dynamics and efficiency

These benefits directly address the most frequently cited barriers to EV adoption in consumer surveys, potentially transforming market growth trajectories as the technology becomes widely available.

What Other Applications Could Benefit from This Technology?

While automotive applications drive most solid-state battery development, the cathode material advancements pioneered by Toyota and Sumitomo Metal could benefit numerous other sectors that require high-performance energy storage. The technology's combination of safety, energy density, and longevity makes it attractive across multiple industries.

Potential Applications Beyond Automotive

The technology could find applications in:

-

Grid-scale energy storage systems providing longer duration backup power with reduced fire risk

-

Advanced robotics and automation requiring high-density, long-lasting power sources

-

Aerospace and aviation applications where weight reduction and safety are paramount

-

Portable electronics with dramatically extended battery life and faster charging

-

Medical devices requiring safe, long-lasting power sources for implantable technologies

-

Military and defense systems benefiting from improved energy density and durability

-

Marine applications where battery safety and longevity in harsh environments are critical

-

Wearable technology enabling smaller devices with longer operating times

Many of these sectors have unique requirements that conventional lithium-ion batteries struggle to meet, creating significant market opportunities for solid-state technology with advanced cathode materials.

What Does Toyota's Broader Battery Strategy Reveal?

Toyota's partnership with Sumitomo Metal on cathode materials represents just one element of their comprehensive approach to next-generation battery technology. The company's strategy reveals a multi-faceted effort to secure technological leadership in the transition to electrified transportation.

Toyota's Strategic Battery Initiatives

The company is pursuing a diversified approach that includes:

-

Parallel partnership with Idemitsu Kosan specifically focused on lithium sulfide development for solid-state electrolytes

-

Investment in multiple battery chemistries beyond solid-state, including advanced lithium-ion and other alternatives

-

Vertical integration approach to secure critical parts of the battery supply chain

-

Balanced strategy between hybrid and full-electric vehicle technologies during the transition period

-

Strategic partnerships across the battery value chain from raw materials to recycling

-

Research into manufacturing processes specific to solid-state battery production at scale

-

Pilot production facilities to validate technologies before full commercial implementation

This comprehensive strategy positions Toyota to adapt to changing market conditions and technological developments while maintaining a focus on their solid-state battery timeline.

FAQ: Toyota and Sumitomo Metal's Solid-State Battery Development

When will Toyota launch vehicles with solid-state batteries?

Toyota aims to introduce electric vehicles equipped with all-solid-state batteries between 2027 and 2028, aligning with Sumitomo Metal's production timeline for the new cathode materials. This represents one of the most concrete timelines for solid-state battery implementation from any major automaker.

How do solid-state batteries differ from conventional lithium-ion batteries?

Solid-state batteries replace the liquid electrolyte found in conventional lithium-ion batteries with a solid material, offering potential improvements in safety by eliminating flammable components. They also provide higher energy density, faster charging capability, longer lifespan, and improved performance across wider temperature ranges.

What specific contribution is Sumitomo Metal making to the partnership?

Sumitomo Metal Mining is leveraging its proprietary powder synthesis technology to develop highly durable cathode materials specifically engineered for solid-state battery applications. Their expertise addresses the critical problem of cathode material degradation during repeated charging and discharging cycles in solid-state environments.

Will solid-state batteries completely replace conventional lithium-ion batteries?

While solid-state technology offers significant advantages, the transition will likely be gradual. Conventional lithium-ion batteries will continue to serve many applications while solid-state technology matures and manufacturing scales. The two technologies will likely coexist in the market for many years, with solid-state initially focusing on premium applications where its advantages justify higher costs.

What makes cathode material development particularly important for solid-state batteries?

Cathode materials in solid-state batteries must maintain structural integrity and electrochemical performance despite the different interface dynamics compared to liquid electrolyte systems. The cathode-solid electrolyte interface is particularly challenging to maintain over thousands of charging cycles, making durable cathode materials critical for overall battery performance and longevity.

How will solid-state batteries affect electric vehicle pricing?

Initially, solid-state batteries will likely increase the cost of electric vehicles that incorporate them, positioning them in premium vehicle segments. As manufacturing scales and processes improve, costs should gradually decrease, eventually making the technology more accessible across broader vehicle categories. The higher durability and longer lifespan may offset initial cost differences through improved total cost of ownership.

Further Exploration of Solid-State Battery Technology

Solid-state battery technology represents a rapidly evolving field with significant implications for energy storage across multiple industries. The breakthrough in cathode materials by Toyota and Sumitomo Metal marks an important milestone in this development journey, but many aspects of the technology continue to advance through ongoing research worldwide.

The commercialization of these advanced batteries will likely proceed through several stages, with initial applications in premium vehicles before expanding to broader market segments as manufacturing scales and costs decrease. This technological evolution promises to address many of the remaining limitations of current EV trends and mining while creating new possibilities for energy storage across numerous applications.

As development continues, the competition between different technical approaches and manufacturing methods will likely accelerate innovation, potentially bringing these batteries to market even faster than currently projected timelines suggest. Furthermore, these advancements could revolutionize the lithium refinery insights and battery recycling breakthrough sectors, as well as enabling more effective closed-loop recycling systems for sustainable battery production.

Want to Capitalise on the Next Battery Technology Breakthrough?

Stay ahead of game-changing developments like solid-state batteries with Discovery Alert's proprietary Discovery IQ model, delivering real-time notifications when ASX-listed companies announce significant mineral discoveries or technological breakthroughs. Visit the Discovery Alert discoveries page to understand how major mineral discoveries can lead to extraordinary investment returns.