Strategic Government Investment in Lithium Americas: Understanding the Federal Stake in Critical Mineral Security

What Does the U.S. Government's Stake in Lithium Americas Mean?

The U.S. Department of Energy (DOE) has secured a significant position in America's lithium future through a dual investment strategy: a 5% ownership stake in Lithium Americas corporation alongside a separate 5% stake in the Thacker Pass project joint venture with General Motors. This represents a fundamental shift in how the federal government approaches critical mineral security, moving beyond traditional financing to direct ownership in both corporate and project assets.

The investment marks a milestone in the DOE's loan program for critical minerals, with the first $435 million disbursement coming from a broader $2.26 billion loan package. Financial markets responded enthusiastically, with Lithium Americas shares surging 31% to $7.48 in premarket trading following the announcement.

Unlike conventional government loans, this structure ensures federal interests remain aligned with both corporate governance and specific project outcomes, creating a stronger position for monitoring strategic mineral development.

Key Investment Details

- 5% equity stake in Lithium Americas corporation

- Additional 5% ownership in the Thacker Pass joint venture with GM

- Initial $435 million disbursement from a comprehensive $2.26 billion financing package

- Market valuation impact with 31% share price increase on announcement

- Positioning alongside GM's larger 38% stake in the project

Why Is the Government Taking Direct Ownership in Lithium Projects?

National Security Considerations

The Biden administration has classified lithium as a critical mineral essential for America's energy transition and national defense infrastructure. This designation under Executive Order 14017 (February 2021) acknowledges the strategic importance of securing domestic supply chains for battery materials.

China currently dominates global lithium processing, handling over 75% of raw lithium conversion into battery-grade materials. This concentration creates significant supply chain vulnerabilities that direct government ownership helps address by ensuring priority access during potential supply disruptions.

The federal investment also supports defense applications that rely on advanced battery technologies, from tactical equipment to grid resilience systems critical for national security infrastructure.

Economic Development Objectives

Beyond security concerns, the investment creates a foundation for high-wage mining and processing jobs in Nevada's Humboldt County. These positions offer significant economic multiplier effects in rural areas that have traditionally faced economic development challenges.

The project further establishes domestic battery supply chains essential for automotive manufacturing, supporting the growth of U.S. electric vehicle production while reducing dependence on overseas suppliers subject to geopolitical disruptions.

Importantly, the development of technical expertise in lithium extraction and processing creates intellectual capital that extends beyond this single project to benefit the broader U.S. industrial base.

Market Intervention Rationale

The federal stake addresses fundamental market failures in critical mineral development where private capital alone may prove insufficient. Large-scale lithium projects require patient capital for infrastructure investments with extended timelines that often exceed traditional investment horizons.

This approach balances private sector profit motives with public interest needs, creating stability for downstream manufacturers who depend on reliable lithium supplies for their own production planning. The government's role as minority stakeholder rather than regulator creates market alignment rather than market distortion.

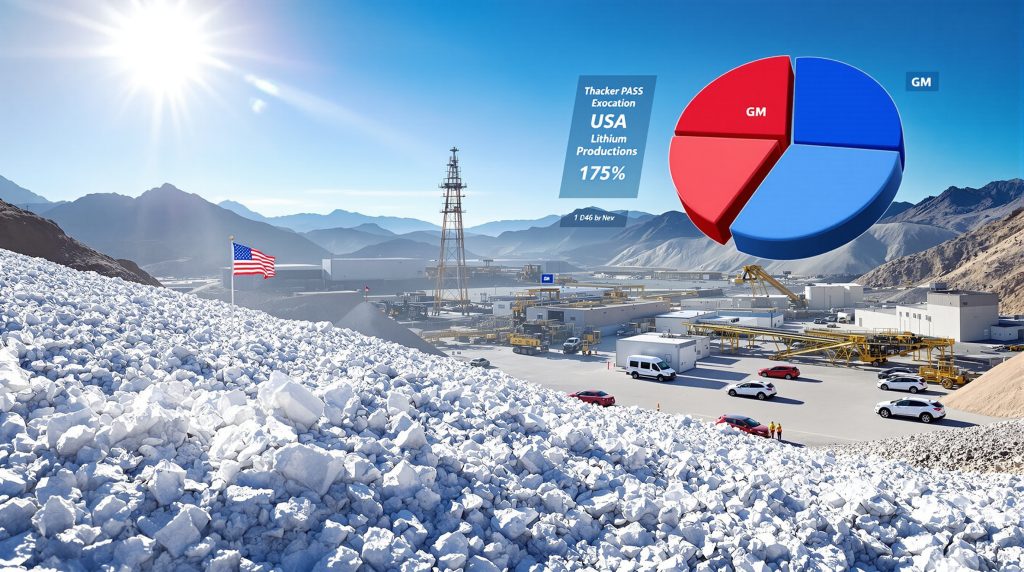

How Does the Thacker Pass Project Transform U.S. Lithium Production?

Project Scale and Significance

Thacker Pass is poised to become the largest lithium source in the Western Hemisphere, with phase one production targeting 40,000 metric tons of battery-quality lithium carbonate annually. This output would support batteries for approximately 800,000 electric vehicles per year—a significant contribution to domestic manufacturing capacity.

The scale represents a massive leap from current U.S. production of less than 5,000 metric tons annually at Albemarle's Silver Peak facility. This eight-fold increase transforms America's position in global lithium markets from minor player to significant producer.

Located entirely within Nevada, the project creates a domestic supply chain hub that minimizes transportation requirements and associated carbon emissions compared to imported materials that typically travel thousands of miles to reach U.S. manufacturers.

Technical and Environmental Considerations

The project utilizes conventional sulfuric acid processing of claystone ore, a well-established extraction method with predictable technical parameters. This approach reduces technology risk compared to novel extraction methods still in development stages.

With an estimated 40+ year mine life, Thacker Pass provides multi-generational production capacity aligned with America's long-term energy transition timeline. The ability to produce battery-grade lithium carbonate directly on-site eliminates dependencies on overseas processing facilities that currently handle most U.S.-mined lithium.

Environmental permitting has been completed despite legal challenges from some stakeholders, with comprehensive mitigation plans addressing water usage in Nevada's arid environment. These plans include closed-loop processing systems that maximize water recycling and minimize consumption in an area where water resources remain precious.

Timeline and Development Status

With the initial $435 million federal funding now secured, construction activities are advancing according to the project's phased development approach. This structured timeline manages capital requirements while aligning capacity expansion with projected growth in electric vehicle battery demand.

The project's strategic implementation coincides with major automotive manufacturers' electrification roadmaps, ensuring supply chain readiness as vehicle production scales. Early-phase operations will establish technical baselines and workforce development pathways for subsequent expansion phases.

What Is General Motors' Role in the Lithium Americas Partnership?

GM's Strategic Investment

General Motors has committed $625 million for a 38% stake in the Thacker Pass project, representing the largest direct automaker investment in U.S. lithium production to date. This substantial financial commitment demonstrates GM's confidence in both project economics and strategic necessity.

The investment secures offtake rights for all lithium from phase one production, giving GM priority access to materials critical for its electric vehicle manufacturing plans. The agreement extends for 20 years with partial offtake rights from phase two production, creating long-term supply chain stability.

This approach differs significantly from traditional purchasing agreements by establishing direct ownership interest with governance rights rather than merely contractual supply relationships. The arrangement gives GM significant influence over production decisions and quality standards.

Supply Chain Integration Strategy

The investment creates a direct connection between lithium source and GM's Ultium battery platform, eliminating multiple intermediaries that typically separate raw material producers from vehicle manufacturers. This vertical integration reduces supply chain vulnerability to market disruptions and trade tensions.

By securing ownership position rather than relying solely on purchasing agreements, GM gains price stability mechanisms that insulate its battery production from volatile commodity market swings. This stability allows for more predictable cost structures and production planning.

The partnership facilitates technical collaboration on lithium specifications for optimal battery performance, allowing customization of material properties to match GM's specific battery chemistry requirements. This collaboration creates potential competitive advantages through material optimization impossible in arm's-length supplier relationships.

Negotiation Dynamics with Federal Government

The current structure emerged after significant negotiation between all parties. Government officials initially sought unconditional purchase guarantees from GM regardless of market conditions—a request the automaker resisted as overly restrictive given market uncertainties.

The equity stake solution creates alignment between federal and corporate interests while preserving commercial flexibility necessary for market responsiveness. This three-way partnership model balances government security objectives with private sector operational requirements.

The resulting structure may serve as a template for future critical mineral projects where public interests and private capital must cooperate to achieve strategic objectives beyond what either sector could accomplish independently.

How Does This Investment Compare to Global Lithium Production?

Current Global Production Context

The global lithium landscape remains heavily concentrated, with Australia leading production at approximately 55,000 metric tons annually (46% of global supply), followed by Chile at 39,000 metric tons (23%), and China at 33,000 metric tons (19%). The United States currently produces less than 5,000 metric tons, representing less than 3% of global production.

China's influence extends far beyond its domestic production, processing over 75% of the world's lithium into battery-grade materials regardless of where mining occurs. This processing dominance creates a critical vulnerability in global supply chains that the Thacker Pass project directly addresses.

While raw lithium resources exist in multiple countries, processing capacity remains the primary bottleneck in supply chain resilience. The lithium industry innovations at Thacker Pass with integrated mining and processing capabilities represent a significant step toward reducing this dependency.

Comparative Production Table

| Country | Annual Lithium Production (metric tons) | % of Global Supply | Processing Capacity | Notable Characteristics |

|---|---|---|---|---|

| Australia | ~55,000 | ~46% | Limited domestic | Primarily spodumene hard rock mining |

| Chile | ~39,000 | ~23% | Growing | Brine extraction, low cost but water intensive |

| China | ~33,000 | ~19% | >75% global | Dominant in processing technology |

| Argentina | ~8,700 | ~5% | Limited | Primarily brine operations |

| United States | <5,000 | <3% | Expanding | Thacker Pass will increase by ~800% |

| Other countries | ~6,300 | ~4% | Varies | Emerging producers like Portugal and Canada |

Projected Impact of Thacker Pass

The project's annual production target of 40,000 metric tons would increase U.S. capacity by approximately 800%, significantly altering North American supply dynamics. This production level would place the U.S. among the top global producers, reducing dependence on extended international supply chains.

Beyond pure volume metrics, Thacker Pass introduces integrated processing capabilities that address the critical vulnerability in battery material refining currently dominated by China. This capability creates resilience throughout the battery supply chain rather than simply shifting mining dependencies.

The project's demonstration effect may accelerate additional domestic lithium developments by validating economic models and regulatory pathways. Several other U.S. lithium projects are watching Thacker Pass closely as a bellwether for domestic development viability.

What Challenges Face the Thacker Pass Development?

Technical and Operational Challenges

Scaling lithium extraction from claystone deposits to commercial levels presents technical hurdles different from the brine operations dominant in South America or the hard rock mining common in Australia. The project must validate process efficiency and consistency at industrial scale.

Maintaining consistent battery-grade quality specifications requires sophisticated quality control systems throughout the production process. Even minor deviations from optimal lithium carbonate specifications can impact battery performance and manufacturing yields.

Water management in Nevada's arid environment requires careful resource stewardship through recycling systems and efficiency measures. The project's water rights and usage plans have faced scrutiny from environmental groups concerned about regional hydrology impacts.

Energy usage optimization presents another operational challenge, with processing operations requiring significant power resources. The project's energy strategy includes renewable integration to minimize carbon intensity while maintaining reliability essential for continuous operations.

Financial Considerations

Capital expenditure management during the construction phase remains critical, especially amid inflationary pressures affecting equipment and materials costs. The phased development approach helps manage these risks by spreading investments across longer timeframes.

Operating cost competitiveness against established global producers requires efficiency advantages to offset the higher labour costs of U.S. operations compared to some international competitors. Process automation and technological innovation will play key roles in maintaining competitiveness.

The interest costs on the $2.26 billion federal loan require careful management to ensure project economics remain viable throughout market cycles. The loan's structure includes provisions to align repayment schedules with production ramp-up timelines.

Balancing shareholder returns with strategic objectives creates tension between commercial imperatives and national security priorities. The multi-stakeholder ownership structure helps distribute these pressures across entities with different primary objectives.

Regulatory and Community Factors

Maintaining positive relationships with local communities and stakeholders requires ongoing engagement beyond the initial permitting process. The project's social license to operate depends on delivering promised economic benefits while minimizing negative impacts.

Environmental compliance monitoring creates operational complexity beyond standard mining considerations. The project's extensive permit conditions require sophisticated environmental management systems and transparent reporting mechanisms.

Workforce development for specialised technical roles presents challenges in a region without extensive lithium processing experience. Training programs and educational partnerships will be essential for building the skilled workforce necessary for successful operations.

Infrastructure development beyond the mine site itself includes transportation networks, power delivery systems, and communications infrastructure necessary for modern industrial operations. Coordination with local and state agencies on these developments adds complexity to project timelines.

How Does This Investment Reflect Changing U.S. Industrial Policy?

Evolution of Federal Approach to Critical Minerals

The government's dual stakes in Lithium Americas represent a fundamental shift from passive financing to active ownership in strategic supply chains. This evolution acknowledges that loan programs alone may not secure national interests in critical resource development.

The strategic use of federal loans to secure equity positions creates alignment between government funding and tangible control of resource outcomes. This approach ensures federal interests extend beyond financial returns to encompass actual production decisions.

Coordination between the Department of Energy, Department of Defense, and Commerce Department demonstrates a whole-of-government approach to supply chain security. This coordinated critical minerals strategy represents a more sophisticated industrial policy than previous siloed approaches.

The Defense Production Act authorities activated in 2022 provide additional policy frameworks supporting critical mineral investments. These authorities enable direct federal support for strategic resources beyond traditional funding mechanisms.

Comparison with Other Federal Investments

The Lithium Americas investment follows a similar approach to the government's 15% stake in MP Materials, which operates the only rare earth minerals processing facility in the United States. Both investments target processing capabilities as much as raw material extraction.

Strategic investments in semiconductor manufacturing through Intel and other manufacturers parallel the lithium strategy, focusing on domestic production capacity for components essential to modern technology. These parallel efforts demonstrate a broader industrial policy framework.

The pattern of targeted interventions in supply chain vulnerabilities indicates a deliberate strategy rather than isolated investments. Each intervention addresses specific choke points in strategic material flows essential for both defense and commercial applications.

Unlike previous industrial policies focused primarily on research funding, current approaches emphasize actual production capacity and physical supply chain resilience. This shift represents a more pragmatic approach to industrial security in an era of global competition.

Policy Framework Development

The implementation of Defense Production Act authorities provides legal and administrative frameworks for direct government involvement in strategic industries. These authorities enable federal action beyond traditional market mechanisms when national security requires.

Coordination between multiple federal agencies creates more comprehensive approaches than previous single-agency efforts. This whole-of-government strategy aligns policy tools, funding mechanisms, and regulatory approaches toward common objectives.

The development of long-term US mineral production policy provides continuity beyond political cycles, with implementation spanning multiple budget years and potentially multiple administrations. This approach recognizes that mineral development timelines extend beyond political terms.

Integration with broader industrial policy objectives connects mineral security to manufacturing resilience, workforce development, and technology leadership. This integrated approach creates synergies between previously disconnected policy areas.

What Are the Implications for Global Lithium Markets?

Supply Chain Reconfiguration

The development of Thacker Pass contributes to potential reduction in Chinese processing dominance by establishing significant Western Hemisphere lithium processing capacity. This shift begins to address the 75% Chinese control of global lithium processing that currently creates supply vulnerabilities.

Western Hemisphere lithium processing capacity expansion creates more balanced global supply options, reducing risks associated with geographic concentration. This diversification benefits not just the United States but allied nations dependent on lithium for their own energy transition goals.

The project's integration of mining and processing capabilities creates a new model for resource development beyond traditional separation of these activities. This integrated approach reduces transportation requirements and associated carbon emissions while improving supply chain visibility.

New price discovery mechanisms may emerge as more diversified supply sources create alternatives to Chinese-dominated pricing frameworks. Greater transparency in lithium pricing benefits both producers and consumers throughout the battery supply chain.

Market Structure Evolution

Direct producer-consumer relationships through equity stakes represent a structural shift from traditional commodity market dynamics. These direct connections create stability in volatile markets while ensuring priority access during supply constraints.

Reduced reliance on spot market purchases for strategic users provides insulation from short-term price volatility that has plagued lithium markets in recent years. Long-term supply arrangements tied to equity stakes create more predictable cost structures for battery manufacturers.

The development of longer-term contracting structures supported by equity relationships improves planning horizons throughout the supply chain. This stability enables greater investment in manufacturing capacity dependent on reliable lithium supplies.

Integration of government strategic reserves into market dynamics creates new stabilizing mechanisms during supply disruptions. The government's direct stake provides leverage for implementing strategic stockpile policies beyond traditional purchasing programs.

Investment Patterns

The federal-private partnership model may accelerate other domestic lithium projects by providing a blueprint for overcoming financing challenges. Several U.S. lithium projects currently seeking funding are closely watching the Thacker Pass implementation.

Increased investor confidence in U.S. lithium development may emerge from the government's demonstrated commitment to the sector. This confidence could unlock additional private capital for projects previously considered too risky or capital-intensive.

Similar government investments in other critical minerals appear increasingly likely as the strategic minerals approach demonstrates effectiveness. Materials like cobalt, nickel, and rare earth elements face similar supply chain vulnerabilities that could benefit from the same model.

Recalibration of risk assessments for lithium project financing may occur as the government stake reduces perceived political and regulatory risks. This recalibration could improve financing terms for future projects by establishing precedent for successful permitting and development.

What Does This Mean for the Future of Electric Vehicle Manufacturing?

Supply Chain Security

U.S. automakers gain more predictable lithium supply through domestic production integrated with manufacturing needs. This predictability enables more confident production planning for electric vehicle manufacturing investments.

Reduced vulnerability to international trade disruptions insulates U.S. manufacturers from geopolitical tensions that have previously threatened battery material supplies. This resilience creates competitive advantages against manufacturers reliant on more vulnerable supply chains.

More stable input pricing for battery manufacturers results from direct supply relationships rather than spot market exposure. This stability enables more accurate cost projections and potentially more competitive pricing for electric vehicles.

The creation of domestic supply chains from mine to vehicle reduces logistics complexity and associated risks. Shorter transportation distances minimize disruption risks while improving supply chain visibility and environmental performance.

Competitive Positioning

General Motors gains strategic advantage through preferential access to Thacker Pass lithium, potentially creating competitive differentiation in electric vehicle markets. This advantage extends beyond simple cost benefits to include supply reliability during market constraints.

Other automakers face potential pressure to secure similar arrangements as direct lithium access becomes a competitive necessity rather than optional strategy. The GM-Lithium Americas model may establish a new standard for automotive supply chain integration.

Reduced dependence on foreign battery materials creates marketing advantages for "Made in America" electric vehicles. These advantages extend beyond regulatory compliance to consumer preferences for domestic manufacturing.

Alignment with domestic manufacturing incentives in Inflation Reduction Act legislation creates stackable advantages for vehicles using Thacker Pass lithium. These incentives improve economic competitiveness while supporting market development.

Consumer Impact

More stable electric vehicle pricing may result from supply security reducing one source of manufacturing cost volatility. This stability benefits consumers through more predictable pricing and potentially accelerated adoption rates.

Marketing advantages from "Made in America" supply chains appeal to consumers concerned about domestic manufacturing and jobs. These preferences create differentiation opportunities in increasingly competitive electric vehicle markets.

Reduced carbon footprint through shorter transportation distances aligns with environmental motivations driving many electric vehicle purchases. The ability to demonstrate supply chain sustainability creates additional value for environmentally conscious consumers.

Greater supply chain transparency provides confidence for consumers concerned about ethical and environmental aspects of battery production. This transparency addresses growing consumer interest in understanding the full lifecycle impacts of their vehicle purchases.

FAQs About the Government Stake in Lithium Americas

Why is lithium considered a critical mineral for national security?

Lithium forms the foundation of advanced battery technologies essential for electric vehicles, grid-scale energy storage, and defense applications ranging from portable electronics to tactical systems. Securing domestic lithium supplies reduces vulnerability to foreign supply disruptions while supporting energy independence and military readiness. The material's growing importance across multiple strategic sectors makes it irreplaceable in modern energy and defense systems.

How does the government's 5% stake compare to private investment in the project?

The government's 5% stake represents a strategic minority position rather than controlling interest, positioning federal involvement as supportive rather than directive. General Motors holds a significantly larger 38% stake, making it the primary private investor, while Lithium Americas maintains majority control with 57% ownership. This ownership balance ensures commercial viability remains the primary driver while giving the government sufficient visibility and influence to protect national interests.

Will this investment affect lithium prices for other users?

While GM has secured priority access to phase one production, the overall increase in domestic supply should improve market liquidity and potentially moderate price volatility for all U.S. lithium consumers. The project's substantial scale relative to current domestic production creates broader market benefits beyond just the direct offtake agreements. However, automotive battery applications will likely continue receiving priority allocation given their strategic importance and volume requirements.

How does this investment compare to China's approach to lithium security?

China has pursued a more comprehensive strategy combining domestic production, overseas acquisitions, and processing dominance. Chinese companies control significant lithium assets in Australia, Chile, and Argentina while dominating global processing capacity. The U.S. investment represents a step toward similar strategic thinking but remains smaller in scale than China's global lithium positioning. However, the direct government ownership component demonstrates similar recognition of lithium's strategic importance.

What environmental safeguards will be in place at Thacker Pass?

The project must adhere to stringent environmental standards as conditions of both federal investment and regulatory permitting. These requirements include comprehensive water management systems, habitat protection measures, air quality controls, and detailed reclamation planning. Regular monitoring and reporting requirements exceed regulatory minimums, with oversight from multiple agencies including the Bureau of Land Management and Nevada Division of Environmental Protection. The project's environmental management systems incorporate adaptive management principles to address emerging issues.

Responsible Resource Development for Energy Transition

The U.S. government's dual 5% stakes in Lithium Americas and the Thacker Pass joint venture represent a significant evolution in federal strategy for securing critical minerals. By moving beyond traditional loans to direct equity participation, the government positions itself as an active stakeholder in domestic lithium production while creating a new model for public-private partnerships in strategic industries.

This investment approach balances commercial viability with national security objectives, creating alignment between federal policy, automotive manufacturing needs, and domestic resource development. The success of this model at Thacker Pass could establish a template for similar investments across the critical minerals landscape, potentially transforming how the United States secures materials essential for energy transition and defense applications.

As the largest lithium resource in North America advances toward production, the partnership demonstrates how strategic government investment can catalyze private capital while ensuring public interests remain protected. The collaboration between federal agencies, automotive manufacturers, and mining developers creates a framework for responsible resource development that supports both economic growth and national security.

The transformation of U.S. critical mineral strategy through direct equity stakes represents a fundamental rethinking of government's role in strategic resource development. This approach acknowledges that in an era of global competition for essential materials, passive financing alone cannot secure national interests in supply chains fundamental to both economic prosperity and defense capabilities.

Ready to Gain Early Advantage in Major Mining Discoveries?

Discover the next big ASX mineral discovery before the market with Discovery Alert's proprietary Discovery IQ model, which transforms complex mining data into actionable intelligence for investors. Explore why historic discoveries like De Grey Mining generated substantial returns by visiting the Discovery Alert's discoveries page.