Understanding U.S. Sanctions on Iranian Crude Oil Smuggling Networks

The U.S. Treasury Department has significantly expanded its sanctions framework targeting Iranian oil exports in 2025, with a strategic shift toward sophisticated evasion networks that disguise Iranian crude as Iraqi oil. These enhanced measures reflect a comprehensive approach to targeting not just direct exports but the entire ecosystem of intermediaries, blending operations, and maritime logistics that enable sanctions circumvention. The latest U.S. sanctions on Iranian crude scheme represents one of the most comprehensive enforcement actions in recent years.

Key Developments in the 2025 Sanctions Framework

The latest sanctions rollout features several innovative approaches to enforcement, including advanced tracking technologies capable of identifying disguised Iranian crude even after significant blending operations. The Treasury has expanded designations to include third-country facilitators and maritime operators who previously operated with relative impunity.

Regional partnerships have become increasingly important, with neighboring countries coordinating monitoring efforts to track suspicious blending operations at land terminals and offshore facilities. Financial institutions now face enhanced penalties for processing transactions related to these networks, creating additional pressure on the financial side of smuggling operations.

What Makes the Latest Iranian Crude Scheme Unique?

The recently uncovered operation represents one of the most sophisticated oil smuggling networks to date, employing multiple layers of deception that challenge even experienced enforcement agencies. The complexity of this network highlights the evolving cat-and-mouse game between sanctions enforcers and evaders, with important oil price crash insights emerging from this tension.

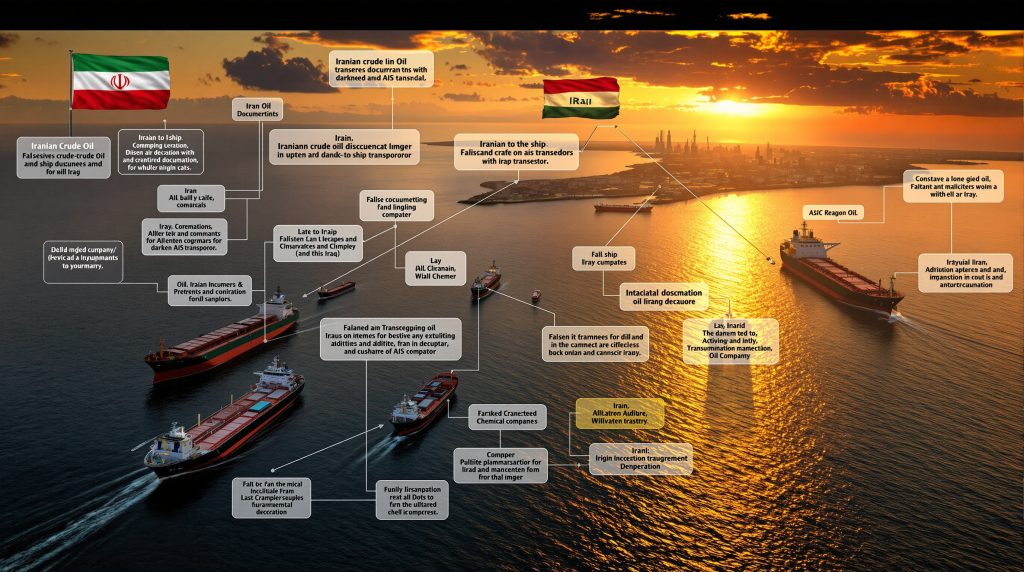

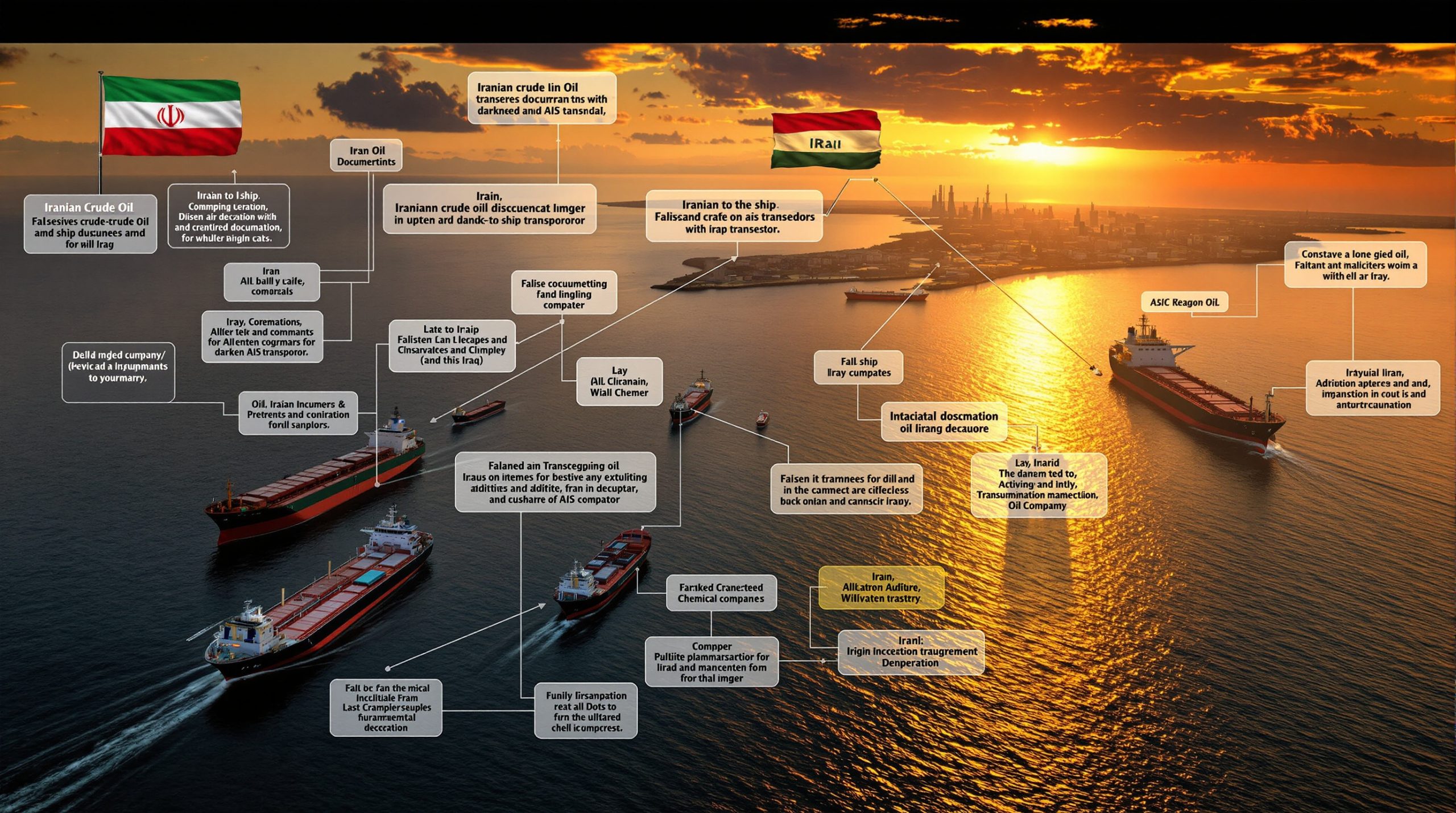

Anatomy of the Disguised Crude Network

Origin Masking: Iranian crude moves through carefully orchestrated channels to Iraqi terminals or offshore blending facilities, where its origin becomes obscured through both physical and documentation manipulation.

Documentation Fraud: The network creates meticulously falsified certificates of origin claiming Iraqi production, complete with fabricated batch numbers, inspection records, and quality assessments that can withstand initial scrutiny.

Blending Operations: Strategic mixing of Iranian and Iraqi crude occurs at precise ratios to alter chemical signatures that might otherwise identify the oil's origin. These sophisticated blending formulas target specific characteristics most commonly tested in verification processes.

Shell Company Structure: The operation employs multi-jurisdictional corporate entities to obscure beneficial ownership, with companies registered in jurisdictions ranging from the Caribbean to Southeast Asia, creating a deliberately confusing ownership trail.

Maritime Deception: Ship-to-ship transfers and AIS manipulation conceal vessel movements, with tankers "going dark" at strategic points to mask loading operations before reappearing with supposedly legitimate cargo.

Who Are the Key Players in the Sanctioned Network?

The U.S. Treasury's Office of Foreign Assets Control (OFAC) has identified several critical entities and individuals who formed the operational backbone of this sanctions evasion network. Their diverse expertise and strategic positioning enabled the operation's effectiveness.

Primary Network Participants

The network centers around a prominent businessman with dual Iraqi and Caribbean citizenship, providing the critical connections between production regions and international markets. His extensive connections in regional banking sectors enabled complex financial arrangements that obscured money flows.

UAE-based blending and trading operations serve as critical nodes, transforming and legitimizing Iranian crude before arranging sales to Asian buyers. These operations maintain sophisticated laboratory facilities to ensure blended products meet specifications that avoid detection.

Maritime logistics companies operating vessels flagged in open registries handle the physical transportation aspects, employing crews with specific instructions on evading monitoring systems and conducting ship-to-ship transfers.

Financial facilitators operating through regional banking systems convert oil revenues through multiple currencies and accounts, making the money trail as difficult to follow as the oil itself.

Technical specialists modify crude specifications to evade testing, employing chemical engineering expertise to ensure the final product bears minimal resemblance to its Iranian origin.

How Does the Oil Disguising Process Work?

The technical process of disguising Iranian crude involves sophisticated methods that go beyond simple paperwork fraud, incorporating actual physical manipulation of the product through chemical and physical processes.

Technical Methods of Crude Disguise

Blending Ratios: Technicians employ specific mixing formulas to alter density and sulfur content – two key identifying characteristics of Iranian crude. The blending occurs with precisely calculated amounts of lighter Iraqi crude to achieve a product that falls within expected parameters.

Chemical Additives: Introduction of specific compounds masks characteristic markers that might otherwise identify Iranian origin in laboratory testing. These additives are carefully selected to be difficult to detect in standard assay procedures.

Testing Evasion: The network develops techniques to circumvent standard assay procedures, including strategic timing of blending operations to ensure any residual identifying characteristics have sufficient time to stabilize before testing.

Documentation Chain: Creation of seemingly legitimate paper trails from wellhead to delivery involves sophisticated forgery operations, with each document in the chain cross-referenced to create a consistent narrative of Iraqi origin.

Digital Footprint Management: Sophisticated IT systems maintain consistent false records across multiple platforms and jurisdictions, ensuring that digital verification processes encounter no discrepancies that might trigger deeper investigation.

What Impact Do These Sanctions Have on Global Oil Markets?

Despite the significant enforcement action, oil markets have shown remarkable resilience, with limited price volatility following the announcement of new sanctions. This stability suggests the market had already priced in the risk of enforcement actions, although detailed oil price movements analysis reveals subtle impacts.

Market Response to Sanctions Enforcement

| Crude Benchmark | Price Movement After Sanctions | Trading Volume Change |

|---|---|---|

| WTI Crude | -1.86% to $64.37 | Moderate increase |

| Brent Crude | -1.66% to $67.99 | Slight increase |

| Murban Crude | -2.03% to $70.51 | Unchanged |

Factors Limiting Market Disruption

Several factors have contributed to the market's measured response to these enforcement actions. Most significantly, markets appear to have already incorporated Iranian sanctions risk into pricing models, limiting surprise-driven volatility.

The sufficient global supply cushion from OPEC+ production capacity provides a buffer against any potential supply disruptions. Most OPEC+ members maintain spare capacity that could quickly replace any Iranian volumes removed from the market.

Market attention remains focused on broader economic indicators affecting demand, including interest rate policies, manufacturing indexes, and consumer spending patterns, which currently exert stronger influence on prices than supply concerns.

There's also a widespread perception among traders that enforcement, while symbolically important, may not significantly reduce actual Iranian export volumes in the medium term as new evasion methods evolve, according to recent reporting from OilPrice.com.

How Are Regional Oil Producers Responding?

The enforcement actions have triggered varied responses from oil producers in the Middle East, particularly those whose legitimate exports might be confused with sanctioned Iranian crude. These producers face both challenges and opportunities in the current environment.

Regional Producer Adaptations

Legitimate producers are implementing enhanced certification and verification systems to clearly differentiate their exports from sanctioned oil. These systems include more rigorous testing protocols and documentation procedures that exceed international standards.

Many regional producers have increased transparency in production and export documentation, providing detailed information about crude characteristics, transportation routes, and ownership chains to remove any ambiguity.

Coordination with international monitoring bodies has intensified, with some producers inviting independent verification of production volumes and export procedures to establish credibility.

Differentiation strategies to clearly separate legitimate exports from sanctioned oil include marketing campaigns highlighting reliability and compliance records, as well as premium pricing for guaranteed sanction-free products.

Many producers have increased engagement with financial institutions to maintain market access, providing enhanced due diligence information to ensure banking relationships remain unaffected by sanctions concerns.

What Maritime Enforcement Mechanisms Are Being Employed?

The maritime dimension of sanctions enforcement has become increasingly sophisticated, with multiple technologies and international partnerships deployed to track suspicious vessel activities across global shipping lanes.

Advanced Maritime Monitoring Systems

Satellite-based tracking has evolved significantly, with new capabilities to identify dark shipping activities even in congested waterways. Advanced imaging technologies can detect ship-to-ship transfers in previously unmonitored areas.

AI-powered analysis of vessel movement patterns identifies anomalies that might indicate sanctions evasion, such as unusual route changes, unexplained stops, or patterns consistent with ship-to-ship transfers.

International port authority coordination has strengthened suspicious cargo inspection protocols, with enhanced information sharing between previously disconnected port authorities.

Flag registry cooperation for vessel compliance verification has improved, with some open registries implementing enhanced due diligence to protect their reputation and avoid secondary sanctions.

Specialized inspection teams are now being deployed at strategic maritime chokepoints, equipped with advanced testing equipment capable of identifying crude oil characteristics that might reveal Iranian origin.

How Effective Are Oil Sanctions Against Iran Historically?

The history of oil sanctions against Iran offers important context for understanding the potential effectiveness of current enforcement efforts. This historical perspective reveals a pattern of initial impact followed by adaptation that has implications for the broader global energy outlook.

Historical Sanctions Effectiveness Analysis

Pre-JCPOA period (2012-2015): Sanctions achieved approximately 40-50% reduction in exports, representing one of the most successful sanctions campaigns in reducing Iranian oil exports. This period saw Iranian exports fall from approximately 2.5 million barrels per day to 1.1 million.

JCPOA implementation period (2016-2018): Sanctions relief led to export recovery, with exports quickly rebounding to pre-sanctions levels as Iran reestablished market connections and banking relationships.

Maximum pressure campaign (2018-2022): Initially effective but adaptation occurred, with exports initially dropping dramatically before gradually recovering as sophisticated evasion networks developed. By late 2021, Iran had recovered significant export volume despite official sanctions.

Current phase (2023-2025): Results have been mixed, with sophisticated evasion techniques enabling continued exports despite increasing enforcement sophistication. While official exports remain minimal, unofficial channels have maintained significant flow.

The impact on Iranian government revenue has been substantial but not crippling, with budget adjustments and economic diversification partially offsetting reduced oil income. Various economic indicators show strain but not collapse in the Iranian economy.

What Legal Challenges Do International Companies Face?

The complex web of primary and secondary sanctions creates significant compliance challenges for international businesses operating in the energy sector, requiring sophisticated risk management approaches.

Corporate Compliance Considerations

Non-U.S. entities face exposure to secondary sanctions that can effectively cut them off from the U.S. financial system – a risk most international companies cannot afford. This creates de facto compliance requirements even for companies with no U.S. operations.

Enhanced due diligence requirements for crude oil purchases have increased transaction costs and timelines, with companies implementing extensive verification procedures before purchasing from regions with potential Iranian connections.

Regulatory expectations for transaction monitoring have intensified, requiring companies to implement sophisticated systems to track not just their direct counterparties but entire supply chains.

Companies face potential legal liability for inadvertent sanctions violations under strict liability regimes that don't always recognize good faith efforts at compliance. This creates significant risk even for companies with robust compliance programs.

Reputational risks associated with sanctions exposure extend beyond legal penalties, with potential damage to brand value, shareholder confidence, and business relationships that can exceed formal sanctions.

How Might These Sanctions Influence Geopolitical Developments?

The intensification of sanctions enforcement occurs against a backdrop of evolving regional dynamics and international negotiations that shape its broader impact and effectiveness, particularly in light of global market impact considerations.

Geopolitical Implications

Regional diplomatic initiatives may be affected as countries recalibrate their relationships with both Iran and the United States based on sanctions enforcement postures. Countries maintaining economic ties with Iran must carefully balance these relationships against U.S. pressure.

Iran's strategic calculus regarding nuclear negotiations could shift depending on the economic impact of these enforcement actions. Historically, economic pressure has both encouraged and discouraged diplomatic engagement at different times.

Iran's relationships with neighboring countries face new tensions as these countries must choose between economic opportunities with Iran and compliance with U.S. sanctions regimes. This creates particular challenges for countries like Iraq that share borders and infrastructure.

The broader Middle East security architecture faces new pressures as sanctions enforcement intersects with regional rivalries and security concerns. Countries must navigate complex trade-offs between economic interests and security alignments.

Major oil consumers like China and India continue developing their own approaches to Iranian oil imports, balancing energy security needs against international relations. Their willingness to challenge or accommodate U.S. sanctions significantly impacts overall effectiveness, as highlighted in recent analysis of sanctions effectiveness.

FAQ: Understanding Iranian Oil Sanctions

What makes Iranian crude identifiable when blended with other oils?

Iranian crude oil has distinct chemical characteristics, including specific sulfur content, API gravity, and trace element compositions that create a unique "fingerprint." Advanced laboratory testing can identify these markers even when diluted through blending. Modern analytical techniques examine molecular structures and isotope ratios that remain detectable despite sophisticated attempts to mask them. While blending operations attempt to obscure these characteristics, completely eliminating all identifiable markers requires extensive processing that often makes the operation economically unfeasible.

How do shipping companies attempt to evade detection?

Shipping companies employ multiple techniques to evade monitoring systems. Beyond turning off AIS transponders (dark shipping), they conduct complex ship-to-ship transfers in international waters where monitoring is limited. Document falsification extends beyond cargo papers to vessel registration, crew documentation, and port call records. Some operations frequently change vessel names, ownership structures, and flag registrations to create confusion in tracking systems. Shell companies serve as registered owners, creating multiple layers of separation between vessels and their actual controllers.

What happens to companies that unknowingly purchase sanctioned Iranian oil?

Companies that unknowingly purchase sanctioned oil face a complex remediation process. While demonstrating appropriate due diligence and cooperation with authorities can mitigate penalties, strict liability principles mean companies can face significant consequences regardless of intent. Remediation typically involves terminating the relationship, enhancing compliance measures, and potentially disgorging profits from the transactions. Repeat incidents face progressively harsher treatment, and claiming ignorance becomes increasingly difficult once enforcement actions become public.

How do financial institutions screen for potential sanctions violations?

Financial institutions employ multi-layered monitoring systems that examine transactions for red flags including sanctioned entities, suspicious payment patterns, unusual shipping routes, and documentation inconsistencies. Advanced analytics flag unusual pricing, volume, or timing elements that might indicate disguised transactions. Enhanced due diligence for high-risk sectors like oil trading involves scrutinizing beneficial ownership structures, verifying physical goods movements, and validating pricing against market benchmarks. Many institutions also employ specialized personnel with regional expertise to identify subtle evasion techniques.

What role do regional neighbors play in enforcing or undermining sanctions?

Regional neighbors adopt varying approaches based on their own strategic interests and relationships. Some actively enforce sanctions through port controls, financial monitoring, and information sharing with international authorities. Others may tacitly facilitate evasion through lax enforcement, providing services to sanctioned networks, or turning a blind eye to suspicious activities within their jurisdictions. This stance often reflects broader geopolitical alignments, economic dependencies, and sometimes religious or cultural affinities. The effectiveness of sanctions significantly depends on these regional cooperation dynamics and potential oil and gas policy shift considerations.

Further Exploration

Readers interested in learning more about global oil markets and sanctions enforcement can explore related educational content at Oilprice.com, which offers regular updates on energy markets, geopolitical developments, and regulatory changes affecting the global oil trade. Understanding the complex interplay between sanctions enforcement, market dynamics, and geopolitical developments requires ongoing attention to this rapidly evolving situation.

Seeking Real-Time Updates on Major Mining Discoveries?

Discover why significant mineral findings can lead to substantial returns by exploring Discovery Alert's dedicated discoveries page, where the proprietary Discovery IQ model delivers immediate alerts on ASX mineral discoveries, transforming complex data into actionable investment opportunities. Start your 30-day free trial today at https://discoveryalert.com.au/discoveries/.