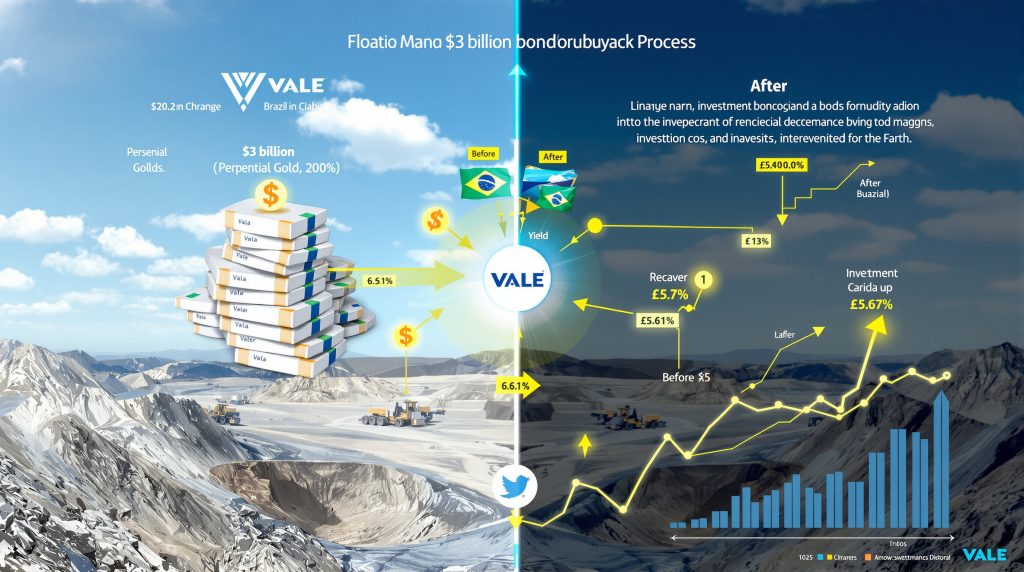

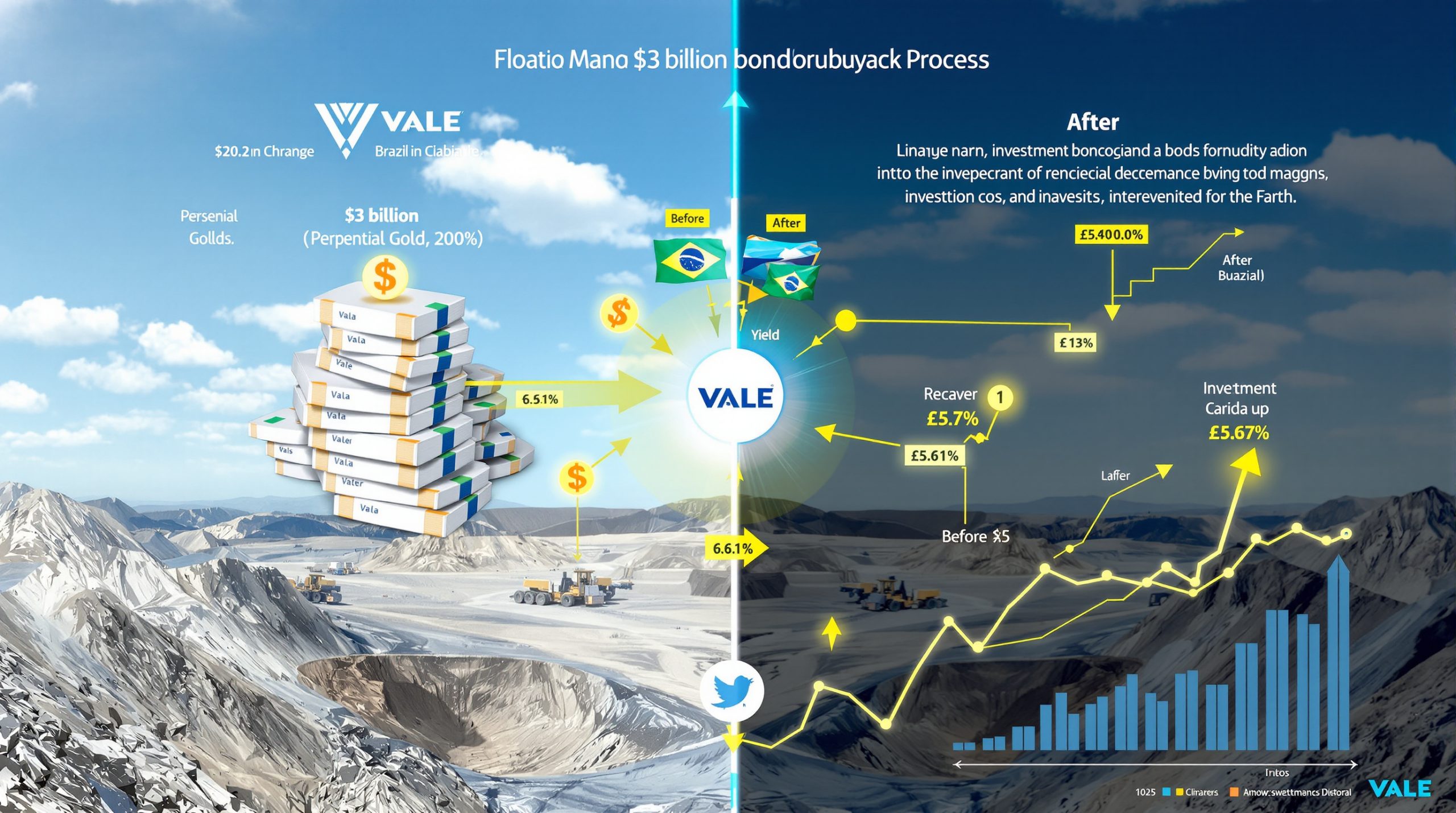

Vale's Strategic $3 Billion Bond Buyback: Financial Implications and Market Impact

Vale SA, the Brazilian mining giant, is undertaking a significant financial maneuver with its plan to buy back up to $3.1 billion in perpetual bonds. This strategic move represents one of the company's most substantial debt restructuring efforts in recent years, targeting unusual securities that date back to its privatization era in the late 1990s.

How Does Vale's Bond Buyback Strategy Work?

Understanding the Unique Perpetual Bonds

These participating debentures represent a distinctive financial instrument in the mining industry. Issued with an original face value of just 0.01 real each in 1997, these securities have become increasingly valuable over time while simultaneously growing more costly for Vale to maintain. Unlike conventional bonds, these securities don't offer a fixed interest rate but instead provide holders with a percentage of the company's revenue from specific operations.

Currently, these bonds yield approximately 13% when calculated in US dollars, making them significantly more expensive than Vale's conventional dollar bonds due in 2054, which yield around 6.1%. This yield differential highlights why the company sees an opportunity for substantial cost savings through this buyback program.

The payout structure is uniquely tied to Vale's commodity production levels, with bondholders receiving 1.8% of net revenue from certain iron ore trends and 2.5% of net revenue from copper and gold production after specific production thresholds are reached. This variable structure means that as Vale's production increases, so do its obligations to these bondholders.

Mechanics of the $3.1 Billion Repurchase Offer

Vale has approved an offer to repurchase the entirety of these participating debentures at a price of 42 reais ($7.89) per unit, representing a premium of approximately 17% over their recent trading price of around 36 reais. With roughly 388.6 million notes currently outstanding according to data from Brazil's capital markets association, the total transaction could reach $3.1 billion if all bondholders choose to participate.

The company has established October 31, 2025, as the deadline for bondholders to accept this offer. This timeline gives investors several weeks to evaluate the proposal and decide whether to cash out at the premium offered or maintain their position in these high-yielding securities.

Why Is Vale Buying Back These Bonds Now?

Triggered Production Thresholds Increasing Costs

The timing of this buyback appears strategically linked to recent production developments. Earlier in 2025, Vale reached an output threshold in its southeastern Brazil operations, which triggered additional payment obligations to bondholders. This milestone effectively increased the cost burden of these securities for the company.

The payment mechanism for these bonds is particularly complex. Revenue is initially calculated in US dollars and then converted to Brazilian reais before distribution to investors. This currency conversion adds another layer of financial complexity and potential cost volatility depending on exchange rate movements between the dollar and real.

Strategic Financial Management Objectives

This buyback represents a significant component of Vale's broader financial management strategy. By eliminating these high-yield securities from its balance sheet, the company can potentially reduce its overall cost of capital and simplify its financial structure. The move aligns with global corporate trends toward optimizing capital raising strategies in anticipation of future market challenges.

Financial analysts note that this transaction could free up substantial cash flow for Vale in the coming years. With the bonds currently yielding around 13% in dollar terms, their elimination would reduce ongoing financial obligations and potentially improve the company's credit metrics and borrowing capacity for future strategic initiatives.

What Are the Market Implications of This Bond Buyback?

Impact on Vale's Financial Position

If successful, this buyback would significantly alter Vale's debt profile and potentially improve its financial flexibility. By replacing these high-cost perpetual bonds with potentially lower-cost conventional debt or using available cash, Vale could achieve meaningful interest savings that directly enhance its bottom line.

The transaction would also simplify Vale's capital structure by removing these legacy instruments with their complex payout mechanisms. This simplification could make the company's financial statements more transparent and easier for investors to evaluate, potentially supporting Vale's equity valuation over time.

Bondholder Considerations and Market Response

For bondholders, Vale's offer presents a clear premium of approximately 17% over recent trading prices. This premium likely reflects Vale's desire to ensure high participation rates and successfully execute the transaction at scale.

The bonds gained increased market liquidity in 2021 after the Brazilian government sold a substantial portion of its holdings as part of former President Jair Bolsonaro's state downsizing agenda. This increased liquidity allowed new investors to enter the market, potentially creating a more diverse bondholder base that Vale must now convince to participate in the buyback.

How Does This Compare to Other Major Debt Buybacks?

Corporate Debt Management Trends

Vale's move reflects a broader trend among major mining companies to optimize their capital structures, particularly as the sector navigates the transition toward critical minerals energy transition. While each company's debt management strategy is unique, there has been an industry-wide focus on balance sheet strength and financial flexibility to weather commodity price volatility.

In the mining sector specifically, companies with exposure to traditional commodities like iron ore have been working to reposition their portfolios and financial structures to support investment in future-focused metals like copper price insights indicate growing demand for metals essential to the energy transition. Vale's debt optimization could be viewed as part of this broader strategic repositioning.

Sovereign Debt Buyback Context

While corporate and sovereign debt management strategies differ substantially in their objectives, both share the common goal of reducing long-term financial obligations when favorable opportunities arise. The scale of Vale's potential $3.1 billion transaction makes it comparable to some sovereign debt operations in smaller emerging economies.

A key difference, however, is that corporate buybacks like Vale's are typically funded through operating cash flows or new debt issuance, while sovereign buybacks often involve more complex considerations around foreign exchange reserves and monetary policy.

What Does This Reveal About Vale's Future Strategy?

Investment Focus on Energy Transition Metals

Vale's efforts to optimize its financial structure may signal preparation for increased investment in critical minerals essential for the energy transition. As one of the world's largest nickel producers, Vale is already positioned to benefit from growing demand for battery materials and may be creating financial flexibility to expand this positioning.

The company's focus on reducing fixed financial obligations could indicate plans to increase capital allocation to growth projects, particularly in nickel and copper, which are expected to play crucial roles in global electrification efforts. By freeing up cash flow previously dedicated to these high-yield bonds, Vale could accelerate investments in these strategic areas.

Financial Flexibility for Strategic Initiatives

Beyond specific commodity investments, the bond buyback should enhance Vale's overall financial flexibility. This improved position could support various strategic initiatives, from potential acquisitions to increased shareholder returns through dividends or share repurchases.

The mining industry continues to emphasize balance sheet strength following lessons from previous downturns. Vale's proactive debt management suggests the company is preparing for potential market volatility while ensuring it maintains the capacity to pursue growth opportunities as they arise.

How Should Investors Interpret This Financial Move?

Valuation Impact Assessment

From a valuation perspective, investors should consider both the short-term costs and long-term benefits of this transaction. While the premium offered to bondholders represents an immediate expense, the elimination of these high-yield obligations could enhance Vale's earnings over time through reduced interest expenses.

The impact on enterprise value calculations will depend on how efficiently Vale deploys the capital freed up by reducing these debt service obligations. If the company can reinvest at returns exceeding its cost of capital, the transaction should ultimately enhance shareholder value.

Investment Thesis Considerations

This buyback may signal management's confidence in Vale's future cash flow generation capacity. By committing to eliminate these perpetual bonds, the company is effectively expressing a view that its equity returns will exceed the cost of these securities over the long term.

For investors evaluating Vale, this transaction may represent a positive indicator regarding management's focus on shareholder value creation through disciplined capital allocation and financial optimization. However, the ultimate success of this strategy will depend on how effectively Vale redeploys resources toward productive assets in its portfolio, particularly in a time when gold market analysis shows increased investor interest in precious metals as a hedge against inflation.

What Are the Technical Aspects of These Unusual Securities?

Participating Debenture Structure Explained

These participating debentures represent a relatively uncommon financial instrument in today's markets. Unlike traditional bonds that offer fixed interest payments, these securities entitle holders to a percentage of Vale's revenue from specific operations, making them something of a hybrid between debt and equity.

The revenue-sharing mechanism is particularly complex, with payouts triggered by production thresholds and calculated based on a percentage of net revenue – 1.8% for iron ore and 2.5% for copper and gold. This variable payout structure means the effective yield to bondholders fluctuates based on Vale's production volumes and commodity prices.

Historical Context and Liquidity Profile

The origins of these bonds trace back to Vale's privatization process in 1997, when they were issued with a face value of just 0.01 real each. Over time, they have appreciated significantly in value, reflecting both Vale's growth as a company and the unique rights these securities convey to their holders.

A significant milestone in the market for these bonds occurred in 2021 when the Brazilian government sold a substantial portion of its holdings as part of former President Jair Bolsonaro's state downsizing agenda. This transaction increased market liquidity for the securities and brought in new investors, potentially diversifying the bondholder base that Vale must now convince to participate in its buyback offer.

FAQ: Vale's $3 Billion Bond Buyback

What happens if not all bondholders accept the offer?

If participation in the buyback is less than 100%, Vale would continue to have obligations to the remaining bondholders. The company would need to continue making revenue-share payments based on the original terms of the bonds for any securities not tendered in the offer.

In such a scenario, Vale might consider additional strategies to address the remaining bonds in the future, potentially through subsequent tender offers or open market repurchases. The company would need to evaluate whether the benefits of eliminating the remaining bonds justify offering an even higher premium in future buyback attempts.

How does this buyback affect Vale's dividend capacity?

By reducing ongoing financial obligations associated with these high-yield perpetual bonds, the buyback could potentially increase Vale's distributable cash flow available for dividends. This would depend on the company's overall capital allocation strategy and priorities between reinvestment in operations, debt reduction, and shareholder returns.

Vale's approach to dividends would likely continue to be influenced by its commodity price outlook, planned capital expenditures, and broader financial policy. However, all else being equal, reduced debt service requirements would create more flexibility for potential dividend increases over time.

What are the tax implications for bondholders?

Bondholders would likely face varying tax considerations depending on their jurisdiction, acquisition cost basis, and holding period for the securities. In many tax systems, the difference between the purchase price and the buyback price would be treated as a capital gain, subject to applicable capital gains tax rates.

Brazilian investors might face different tax treatment compared to international holders, potentially influencing participation rates across different investor segments. Tax considerations could be particularly complex for long-term holders who acquired these securities at much lower prices years ago.

Strategic Significance of Vale's Debt Management

Long-term Financial Positioning

Vale's bond buyback represents a significant step in optimizing its capital structure and reducing legacy financial obligations. By eliminating these high-yield perpetual securities, the company can potentially lower its overall cost of capital and enhance financial flexibility to pursue strategic growth initiatives.

The transaction aligns with Vale's likely objective to maintain a strong balance sheet while positioning itself for future opportunities in critical minerals essential for the energy transition. By simplifying its capital structure and reducing fixed obligations, Vale enhances its ability to navigate commodity price volatility and market uncertainty.

Market Signals and Industry Trends

This transaction may signal growing confidence among major mining companies about their future cash generation capacity. By proactively addressing legacy financial instruments, Vale demonstrates a forward-looking approach to capital management that other resource companies might consider emulating.

For the broader mining industry, this buyback highlights the continuing importance of financial optimization alongside operational excellence. As mining companies navigate the evolving landscape of energy transition and changing commodity demand patterns, financial flexibility remains a crucial competitive advantage in pursuing strategic opportunities.

Want to Invest in the Next Major Mineral Discovery?

Discovery Alert's proprietary Discovery IQ model instantly alerts investors to significant ASX mineral discoveries, transforming complex data into actionable investment opportunities. Discover why major mineral finds can lead to substantial returns by exploring our dedicated discoveries page and begin your 30-day free trial today.