What Makes Viridis Mining's Colossus Project a Tier-One Rare Earth Resource?

The Colossus project has emerged as a significant player in the global rare earth market following Viridis Mining and Minerals' (ASX: VMM) release of its maiden JORC-compliant ore reserve. Located in Brazil's Poços de Caldas Alkaline Complex, this ionic clay rare earth project represents a strategic asset in the increasingly important rare earth supply chain.

Breaking Down the Maiden JORC Resource Numbers

The recently announced resource estimate confirms impressive metrics that position Colossus as a tier-one asset. The project boasts 201 million tonnes of rare earth resource at 2,640 parts per million (ppm) total rare earth oxides (TREOs), including a significant 740 ppm of mixed rare earth oxides (MREOs) that specifically target the high-value magnet market.

Notably, 100% of this substantial resource falls under the Probable classification according to the 2012 JORC Code, providing a solid foundation for development planning. These numbers support a remarkable 40-year mine life with a processing capacity of 5.0 million tonnes per annum (Mtpa).

The resource quality and quantity position Viridis to potentially become a key supplier in the global rare earth magnet market, which is crucial for technologies ranging from electric vehicles to wind turbines. Understanding various mineral deposit tiers helps contextualize the significance of Colossus as a world-class resource.

Strategic Location in Brazil's Poços de Caldas Alkaline Complex

Colossus benefits tremendously from its strategic location in an established mining hub. The project enjoys access to critical infrastructure already in place, significantly reducing development costs and timeline uncertainties that often plague mining ventures in remote locations.

The region provides Viridis with access to an experienced local mining workforce and a well-developed services ecosystem. This human capital advantage cannot be overstated in an industry where specialized knowledge is essential for operational success.

Further enhancing the project's positioning is the presence of tier-one operators nearby, including Alcoa and Companhia Brasileira de Aluminio. This industrial ecosystem creates synergies and operational efficiencies that would be difficult to replicate in less developed mining regions.

Perhaps most significantly, the project's ionic clay mineralization offers substantial processing advantages over traditional hard rock deposits. Ionic clay deposits typically allow for more cost-effective extraction methods with lower environmental impacts – a critical consideration in today's ESG-focused investment landscape.

How Will the Colossus Project Be Developed?

Viridis has outlined a comprehensive development approach that maximizes the project's economic potential while minimizing operational complexities.

Mining Operation Economics and Parameters

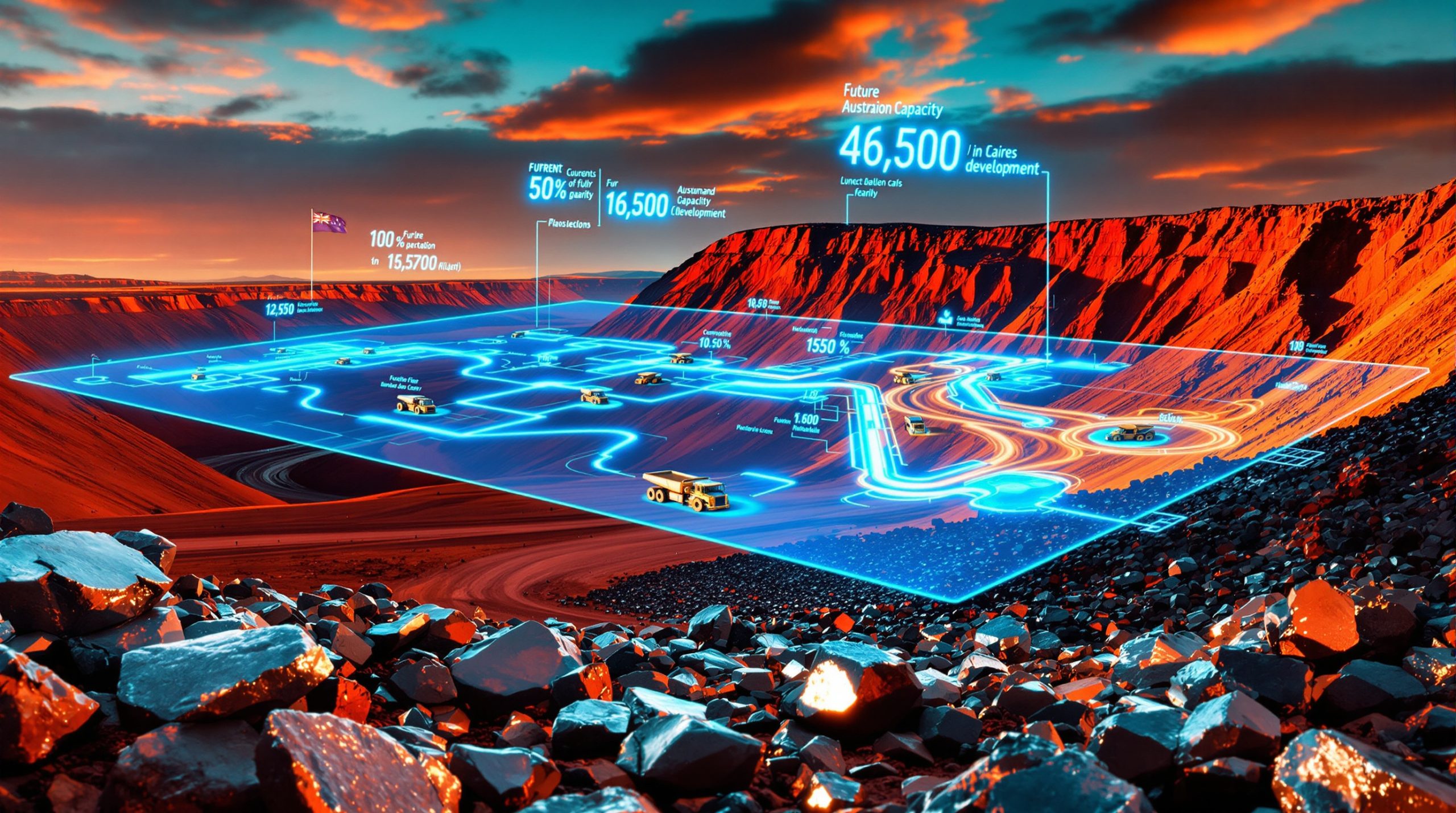

The Colossus project will utilize shallow open-pit mining methodology, minimizing development complexity and reducing upfront capital requirements. This approach is well-suited to the deposit's characteristics and allows for flexible operation as the project evolves.

One of the most compelling aspects of the project is its exceptionally favorable 0.45:1 strip ratio. This means only 0.45 tonnes of waste material must be removed for each tonne of ore – a ratio that dramatically reduces operational costs compared to many mining operations where strip ratios of 2:1 or higher are common.

The mining plan strategically prioritizes magnet rare earth oxides to maximize revenue potential, focusing on the highest-value elements within the deposit. These include neodymium, praseodymium, dysprosium, and terbium – critical minerals essential for permanent magnets used in green technologies.

According to the pre-feasibility study, the project will utilize a centralized production facility processing ore from multiple pit locations. This approach optimizes capital efficiency while maintaining operational flexibility to target the highest-value ore zones throughout the project's lifespan.

Financial Backing and Development Capital

Viridis recently secured $11.5 million through a successful capital raising initiative, which included a cornerstone $5 million commitment from Brazil's JGP Asset Management. This institutional backing represents a significant vote of confidence in the project's viability and the company's execution strategy.

Following the settlement of this placement, Viridis projects a cash position of up to $58.5 million – a substantial treasury that provides financial runway through final investment decision and into early execution phases. This strong financial foundation allows the company to maintain development momentum without immediate additional capital requirements.

The company has also established strategic partnerships with several prominent Brazilian institutions, including ORE Investments (a private equity firm), Régia Capital (financial advisory), BNDES (Brazilian National Bank for Economic and Social Development), and FINEP (federal agency for studies and projects).

These relationships provide Viridis with access to local expertise, potential funding pathways, and enhanced credibility within the Brazilian mining sector. The involvement of BNDES is particularly significant as it indicates potential national strategic interest in the project's success.

Why Are Rare Earth Ionic Clay Deposits Increasingly Important?

The global rare earth market is undergoing a significant transformation, with ionic clay deposits like Colossus gaining increased attention for their unique advantages.

Processing Advantages Compared to Hard Rock Resources

Ionic clay rare earth deposits offer several distinct processing advantages that translate directly to improved project economics and reduced environmental impact. Unlike hard rock deposits that require energy-intensive crushing and grinding, ionic clay deposits contain rare earth elements that are loosely bound to clay minerals.

This characteristic typically allows for simpler extraction using ion exchange techniques, resulting in lower chemical consumption and processing complexity. The reduced energy requirements for extraction and concentration translate to both cost savings and a smaller carbon footprint.

The processing advantages extend to environmental considerations as well. Ionic clay deposits generally allow for lower-impact mining methods with reduced waste generation and potentially easier mine reclamation innovation. This alignment with sustainability principles enhances project viability in today's environmentally conscious regulatory landscape.

Perhaps most importantly, ionic clay deposits often enable more cost-effective recovery of critical magnet elements – precisely the high-value rare earths that Viridis is targeting at Colossus.

Global Supply Chain Significance

The development of significant rare earth projects outside traditional producing regions represents an important step in diversifying global supply chains for these critical materials. With rare earth production historically concentrated in a limited number of countries, new sources like Colossus can play a vital role in resource security strategies.

These elements are essential components for renewable energy technologies and advanced electronics – cornerstone industries of the 21st century economy. The growing demand from electric vehicle manufacturers, wind turbine producers, and electronics companies creates strong market fundamentals for well-positioned projects like Colossus.

Brazil's emergence as a potential major rare earth producer could have significant implications for global supply dynamics, offering technology manufacturers an alternative source for these strategic critical minerals. This diversification aligns with the priorities of many governments and corporations seeking to reduce supply chain vulnerabilities.

What Growth Potential Exists Beyond the Current Resource?

While the current resource estimate is impressive in its own right, it may represent just the beginning of Colossus's potential.

Exploration Upside Within Existing Tenements

According to Viridis Managing Director Rafael Moreno, "This reserve covers only a fraction of our landholding, with high-grade zones like Tamoyo yet to be included, underscoring Colossus' immense growth potential and strategic significance as a globally critical source of magnet rare earths."

This statement highlights that the current reserve calculations cover only a portion of the company's total landholding in the region. High-grade zones like Tamoyo have not yet been included in resource calculations, suggesting significant potential for resource expansion through continued exploration programs.

The presence of identified high-grade zones that remain outside current resource calculations represents a meaningful upside opportunity. Successful inclusion of these areas in future resource updates could potentially increase both the total resource size and the average grade – dual factors that would enhance project economics.

This exploration upside positions Colossus as a potentially globally significant rare earth source with room to grow beyond its already substantial defined resource.

Long-Term Strategic Value Proposition

The scale and growth potential of Colossus align perfectly with increasing global demand for critical minerals used in green technologies. As countries worldwide accelerate their transition to renewable energy and electric transportation, secure supplies of magnet rare earths become increasingly strategic.

Brazil's established mining jurisdiction provides operational stability that many competing rare earth projects lack. The country combines robust mining regulations, political stability, and growing government support for critical minerals development – creating favorable conditions for long-term operations.

Perhaps most importantly, Colossus's execution readiness in a world-class mining hub gives it a potential time-to-market advantage over competing projects that face more significant infrastructure or permitting challenges. In critical minerals markets, early movers often secure advantageous offtake arrangements and strategic partnerships.

How Does the Project Compare to Global Competitors?

Understanding Colossus's competitive positioning requires examining both its inherent advantages and its place in the broader rare earth market.

Competitive Positioning in Rare Earth Market

The scale and grade of Colossus place it among notable global rare earth developments. With 201 million tonnes at 2,640 ppm TREOs, the project represents a significant potential source of these critical materials at a time when new supply is actively sought by technology manufacturers and governments alike.

The project's ionic clay mineralization offers potential cost advantages over hard rock competitors. While hard rock deposits require energy-intensive crushing, grinding, and complex chemical processing, ionic clay deposits typically allow for more straightforward extraction methods with lower operational costs.

Brazil's location provides geopolitical diversity for supply chains traditionally dominated by a limited number of producing regions. This diversification value may attract strategic investors and customers seeking to reduce concentration risk in their rare earth supply chains.

The proximity to established mining infrastructure significantly reduces capital requirements compared to greenfield projects in remote locations. This advantage can translate to improved project economics and reduced development timeline uncertainties. As evolving mining trends show, such advantages are increasingly important in the competitive global mining landscape.

Key Metrics Table: Colossus Project at a Glance

| Parameter | Value | Significance |

|---|---|---|

| Resource Size | 201 million tonnes | Supports multi-decade operation |

| TREO Grade | 2,640 ppm | Competitive concentration of rare earths |

| MREO Content | 740 ppm | Valuable magnet elements for high-tech applications |

| Strip Ratio | 0.45:1 | Exceptionally low waste-to-ore ratio |

| Processing Capacity | 5.0 Mtpa | Substantial production scale |

| Mine Life | 40+ years | Long-term supply potential |

| Cash Position | $58.5 million (post-placement) | Strong financial foundation for development |

This combination of favorable metrics positions Colossus competitively among global rare earth projects, particularly those targeting the high-value magnet rare earth market segment.

What Are the Next Development Milestones?

As Colossus transitions from exploration to development, several key milestones will define its path to production.

Pathway from PFS to Production

With the maiden resource estimate now complete and a pre-feasibility study in place, Viridis appears well-positioned to advance through the typical mining project development pathway. This would include advancement from pre-feasibility to definitive/bankable feasibility studies, which would further refine technical parameters and economic projections.

Following the completion of technical studies, a final investment decision would represent the formal commitment to project construction. This milestone typically triggers the release of major capital expenditures and the transition from planning to execution.

While specific timelines weren't detailed in the available information, the construction timeline and commissioning schedule would follow industry norms for similar-scale projects, adjusted for the specific characteristics of the Colossus operation and local conditions.

The production ramp-up strategy and target markets would be defined in greater detail as the project approaches completion, with particular focus on securing offtake agreements with end-users of rare earth products.

Critical Success Factors for Project Execution

Several factors will be crucial to Colossus's successful execution. Permitting and regulatory approvals within the Brazilian framework represent important administrative milestones that will influence the overall development timeline.

Securing offtake agreements with end-users of rare earth products will be essential for project financing and risk management. These agreements provide revenue certainty and often form the basis for project financing arrangements.

Optimizing processing technology for ionic clay mineralization represents a technical challenge and opportunity. While ionic clays generally offer processing advantages, achieving optimal recovery rates and product specifications requires careful technology selection and process engineering.

Environmental management and sustainability considerations will be increasingly important, particularly for projects supplying materials to ESG-conscious technology manufacturers. According to recent reporting from The West Australian, Viridis's focus on ionic clay extraction methods with potentially lower environmental impacts may prove advantageous in this regard.

What Do Experts Say About the Colossus Project?

Industry perspectives provide important context for understanding Colossus's potential significance.

Management Perspective on Strategic Importance

Viridis Mining and Minerals unveils maiden rare earth ore reserve at Colossus project in Brazil with Managing Director Rafael Moreno emphasizing the project's "immense growth potential" beyond the current resource boundaries. This confidence suggests internal technical assessments support the view that Colossus represents just the beginning of a potentially much larger resource.

Moreno has specifically highlighted Colossus as a "globally critical source of magnet rare earths," positioning the project in the context of strategic mineral supply chains rather than merely as a commercial mining venture. This framing recognizes the increasing geopolitical significance of rare earth supply.

The management team has expressed confidence in execution readiness within Brazil's established mining jurisdiction. This operational focus suggests the company views development risks as manageable within their existing capabilities and partnerships.

Industry Outlook for Rare Earth Demand

The broader industry outlook for magnet rare earths remains robust, driven by electrification trends across transportation, energy, and industrial sectors. According to Stockhead's analysis of rare earth resources, electric vehicle production growth and renewable energy deployment create strong fundamental demand for the elements Colossus aims to produce.

Supply chain security concerns continue to increase the strategic value of non-Chinese rare earth sources. With traditional production concentrated in a limited number of regions, new projects in stable jurisdictions like Brazil represent important diversification opportunities for manufacturers.

Brazil's mining sector appears to be positioning for the critical minerals opportunity, with increased government recognition of rare earths' strategic importance. This policy environment could provide supportive conditions for project development.

Long-term price fundamentals generally support the economics of well-positioned rare earth projects, particularly those with favorable processing characteristics and access to established infrastructure – advantages that Colossus appears to possess.

Frequently Asked Questions About the Colossus Project

What makes ionic clay rare earth deposits different from conventional resources?

Ionic clay deposits contain rare earth elements that are loosely bound to clay minerals, typically allowing for simpler extraction using ion exchange techniques rather than the energy-intensive crushing, grinding and chemical processing required for hard rock deposits. This characteristic generally results in lower processing costs and reduced environmental impact.

In conventional hard rock rare earth deposits, the elements are locked within mineral structures that require complex physical and chemical processes to liberate. Ionic clays, by contrast, often allow for more straightforward leaching techniques that can be more cost-effective and environmentally benign.

The processing advantages of ionic clay deposits can translate to lower capital and operating costs, potentially improving project economics relative to hard rock alternatives with similar grades and tonnages.

Why are magnet rare earth elements particularly valuable?

Magnet rare earth elements (including neodymium, praseodymium, dysprosium, and terbium) are essential components in high-performance permanent magnets used in electric vehicles, wind turbines, and various electronic devices, commanding premium prices due to their critical role in green technologies.

These elements enable the creation of magnets with exceptional strength-to-weight ratios, which are essential for the efficient motors used in electric vehicles and wind turbines. As electrification trends accelerate globally, demand for these specific rare earths is growing more rapidly than for other elements in the rare earth group.

The concentration of these specific elements within Colossus's resource (reflected in the 740 ppm MREO content) represents a significant value driver for the project, as these elements typically command higher prices than other rare earths with more limited industrial applications.

How does the strip ratio impact project economics?

The 0.45:1 strip ratio at Colossus means only 0.45 tonnes of waste material must be removed for each tonne of ore, significantly reducing mining costs, energy consumption, and environmental footprint compared to operations with higher ratios.

In practical terms, this favorable ratio directly reduces operating costs throughout the mine life. Less waste material means lower expenses for excavation, haulage, and waste management – all significant cost centers in mining operations.

The environmental benefits are equally important. A lower strip ratio means less ground disturbance, reduced fuel consumption for equipment, and smaller waste storage requirements. These factors can simplify permitting processes and reduce closure costs at the end of mine life.

What advantages does Brazil offer as a rare earth mining jurisdiction?

Brazil combines established mining regulations, experienced workforce, existing infrastructure, and political stability with growing government support for critical minerals development, creating favorable conditions for rare earth projects like Colossus.

The country's long mining history has created a deep pool of technical expertise and service providers that new projects can leverage. This ecosystem reduces execution risk compared to developing operations in regions with limited mining experience.

Brazil's established regulatory framework provides clarity for investors and operators, with well-defined processes for permitting, environmental compliance, and community engagement. This regulatory certainty is particularly valuable for critical minerals projects that may face heightened scrutiny.

The existing infrastructure in the Poços de Caldas Alkaline Complex – including transportation networks, power supply, and nearby industrial facilities – significantly reduces development costs and timeline uncertainties compared to greenfield projects in remote locations.

Interested in Identifying the Next Major Mineral Discovery?

Discover how significant mineral finds like Viridis Mining's Colossus Project can deliver exceptional returns by exploring Discovery Alert's dedicated discoveries page, where our proprietary Discovery IQ model provides real-time alerts on ASX mineral announcements before the broader market recognises their potential. Visit https://discoveryalert.com.au/discoveries/ today to begin your 30-day free trial.