Strategic Divestment Accelerates Youanmi Gold Project Development

Rox Resources Limited (ASX: RXL) has successfully completed the sale of its non-core Mt Fisher and Mt Eureka tenements to High-Tech Minerals Limited (ASX: HTM), securing $1.5 million in cash along with 1 million HTM shares and a 1% Net Smelter Return royalty.

This strategic divestment follows Rox's recent $40 million placement that received strong support from investors, further strengthening the company's financial position as it advances its flagship Youanmi Gold Project toward production.

The sale proceeds will fast-track critical development work at Youanmi, including early infrastructure construction and process plant design, while the company completes its Definitive Feasibility Study (DFS) by the end of 2025.

Strategic Focus: Accelerating the 2.3Moz Youanmi Gold Project

The sale of non-core assets represents a calculated move to concentrate resources on Rox's 100%-owned Youanmi Gold Project, which boasts a substantial 2.3 million ounce gold resource. By divesting these peripheral assets, Rox maintains a strategic focus on its primary value driver while retaining exposure to potential upside through equity ownership and royalty arrangements.

"We are pleased to have finalised the sale of these non-core assets to High-Tech Minerals, further bolstering our balance sheet after our recent A$40 million capital raise, whilst retaining exposure to these assets via ordinary shares in HTM and a 1% royalty," said Phillip Wilding, Managing Director and CEO of Rox Resources.

The proceeds will directly support key development initiatives at Youanmi:

- Construction of mining camp infrastructure for workers

- Advanced design of processing plant equipment

- Parallel work alongside the ongoing Definitive Feasibility Study

Understanding Net Smelter Return Royalties: What Investors Should Know

Net Smelter Return (NSR) royalties represent a percentage of revenue from mineral production paid to the royalty holder after deducting transportation and refining costs. For Rox, the 1% NSR royalty on the divested tenements provides ongoing exposure to any future mining success without operational responsibilities or costs.

Why this matters to investors:

- Creates passive income potential if discoveries are made

- Maintains economic interest without capital expenditure requirements

- Adds a potential long-term revenue stream to complement core operations

- Represents a potential option on future discoveries at the divested properties

NSR royalties are particularly valuable in the mining sector as they provide financial upside with minimal risk, allowing companies like Rox to benefit from discoveries even after selling the underlying assets.

Youanmi: A Historical Producer with Modern Potential

The Youanmi Gold Project represents a compelling redevelopment opportunity with significant historical production and modern resource potential:

| Youanmi Gold Project Metrics | Details |

|---|---|

| Total Mineral Resource | 2.3 million ounces of gold |

| Historical Production | ~667,000 oz at 5.47 g/t Au |

| Project Status | Disturbed site on existing mining leases |

| Infrastructure | Significant existing infrastructure |

| DFS Timeline | Completion by end of 2025 |

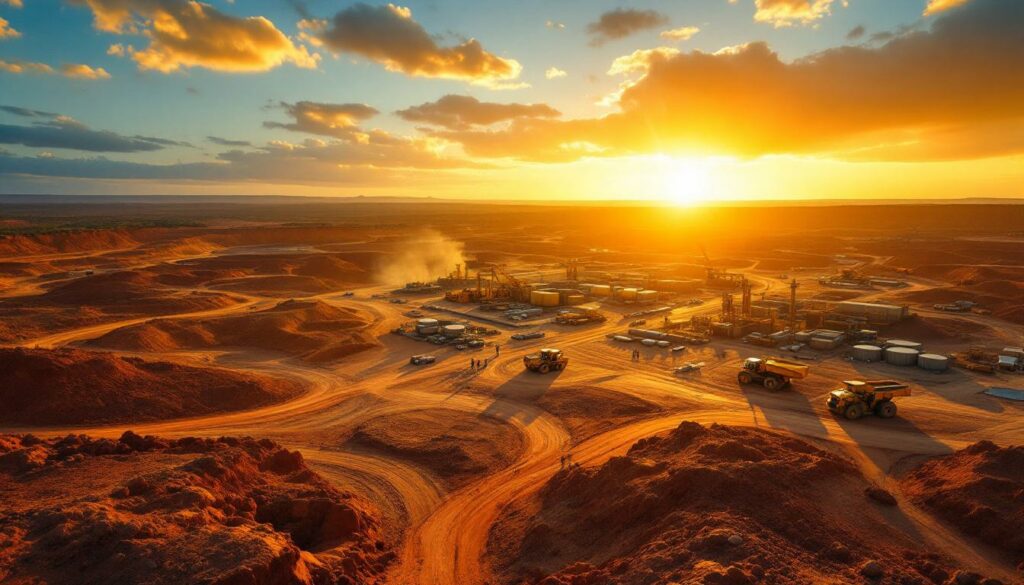

Located approximately 480 kilometres northeast of Perth, Youanmi operated as a high-grade gold mine until its closure in 1997. The project benefits from its classification as a disturbed site on existing mining leases, which significantly streamlines the permitting process compared to greenfield projects.

Pathway to Production: Timeline and Development Strategy

Rox Resources has outlined a clear development strategy for Youanmi Gold Project, with the recent non-core asset sale playing a crucial role in accelerating this timeline:

-

Current Focus (2025):

- Completion of Definitive Feasibility Study by year-end

- Construction of mining camp infrastructure

- Process plant design and engineering

- Early infrastructure works

-

Strategic Advantages:

- Dual-track approach allows simultaneous study work and infrastructure development

- Existing mining leases reduce regulatory hurdles

- Historical site classification streamlines environmental approvals

- Pre-existing infrastructure lowers capital requirements

"Rox is committed to driving value for shareholders as we work towards bringing our Youanmi Project into production swiftly, efficiently and cost-effectively," said Wilding.

Investment Thesis: Why Rox Resources Deserves Attention

Rox Resources presents a compelling investment case based on several key factors:

-

Clear Focus on Value Creation: The divestment of non-core assets demonstrates management's commitment to capital efficiency and focused development of its flagship asset.

-

Strong Financial Position: With over $40 million raised from recent placement plus $1.5 million from the asset sale, Rox is well-funded to advance Youanmi through critical development stages.

-

Resource Quality and Scale: The 2.3 million ounce gold resource provides significant scale, while the historical high-grade production (5.47 g/t Au) indicates quality.

-

Existing Infrastructure Advantage: As a brownfield site with existing infrastructure, Youanmi offers lower development costs and faster pathways to production compared to greenfield projects.

-

Defined Development Timeline: With the DFS scheduled for completion by end-2025 and parallel infrastructure development already underway, investors have clear visibility on project milestones.

-

Strategic Asset Retention: By maintaining exposure to divested assets through shares and royalties, Rox has effectively monetised non-core assets while preserving upside potential.

Why Gold Investors Should Follow Rox Resources

As gold prices remain robust and the sector sees increased investment interest, Rox Resources stands out as a focused gold developer with a clear path to production:

- Advanced-Stage Developer: Positioned between explorers and producers, Rox offers the growth potential of development with reduced discovery risk

- Resource Scale: 2.3 million ounce resource provides meaningful production potential

- Capital Discipline: Strategic divestment demonstrates management's focus on efficient capital allocation

- Defined Timeline: Clear development pathway with DFS completion targeted by end-2025

- Infrastructure Advantage: Existing permits and facilities reduce time and capital required to reach production

For investors seeking exposure to gold development stories with near-term production potential, Rox Resources offers a compelling combination of resource scale, development progress, and strategic focus that positions it well in the Australian gold sector.

Looking to Invest in a Gold Developer With a Clear Path to Production?

Discover why Rox Resources' strategic focus on its 2.3Moz Youanmi Gold Project and robust financial position make it a compelling investment opportunity in the Australian gold sector. With a Definitive Feasibility Study on track for completion by end-2025 and development already underway, now is the time to learn more about this advanced-stage gold developer. Visit Rox Resources' website for comprehensive information about their projects, team, and investment potential.